ZigZag Decentralized Exchange Review

What are ZK-Rollups?

ZK-Rollups are a Layer-2 scaling solution for blockchains like Ethereum that aim to increase the network’s transaction throughput and reduce fees while maintaining a high level of security and decentralization. The “ZK” in ZK-Rollups stands for “Zero-Knowledge,” which refers to a type of cryptographic proof known as Zero-Knowledge Proofs.

In ZK-Rollups, multiple transactions are bundled or “rolled up” into a single proof, which is then submitted to the main chain (Layer-1). This proof contains information about the new state of the accounts involved in the transactions without revealing any sensitive data. By compressing multiple transactions into one proof, ZK-Rollups greatly reduce the amount of data that needs to be stored and processed on the main chain, thereby increasing its capacity and reducing transaction fees.

The main advantages of ZK-Rollups include:

- Scalability: By bundling transactions together, ZK-Rollups can significantly increase the transaction throughput of a blockchain, allowing for thousands of transactions per second (tps) compared to the limited tps on Layer-1.

- Security: ZK-Rollups inherit the security of the underlying main chain (e.g., Ethereum) because the rollup proofs are submitted and verified on Layer-1.

- Decentralization: ZK-Rollups maintain the decentralized nature of the main chain, as they do not rely on centralized operators or validators to process transactions.

- Low fees: By reducing the amount of data that needs to be stored and processed on the main chain, ZK-Rollups can significantly reduce transaction fees for users.

- Fast finality: Transactions in ZK-Rollups can be settled quickly, often within seconds, providing a better user experience compared to slower Layer-1 transaction times.

Overall, ZK-Rollups offer a promising solution for addressing the scalability challenges faced by blockchains like Ethereum while preserving security and decentralization.

What is ZigZag Exchange?

ZigZag is a decentralized, peer-to-peer, non-custodial exchange leveraging ZK-Rollups to power its order book. This groundbreaking technology allows users to trade rapidly and securely with minimal fees. Additionally, they can access price quotes comparable to centralized exchanges for trades of all sizes!

ZigZag aims to develop a decentralized exchange that emulates the user experience of existing centralized exchanges while offering the advantages of a non-custodial system and excellent liquidity.

Why trade on ZigZag Exchange?

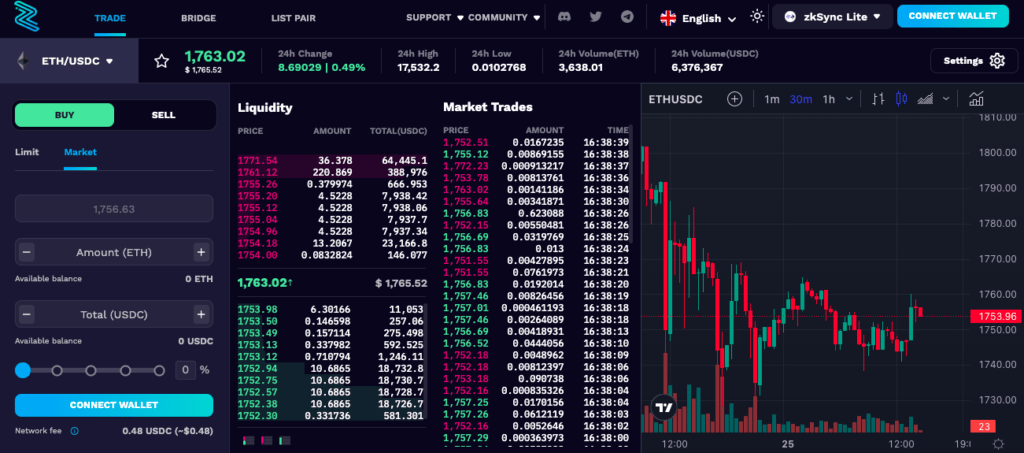

The order book DEX is crafted to resemble the user experience of a centralized exchange, providing a familiar and straightforward interface for traders accustomed to that type of platform.

Users can trade directly from their wallets without needing to deposit or withdraw funds, maintaining complete control over their assets.

The price quotes available on Zig Zag are the most competitive on-chain, as market makers obtain price feeds from centralized exchanges and relay them to Zig Zag’s order books.

ZigZag Exchange is the first decentralized exchange built on an open ZK-Rollup chain (zkSync 1.0). Zig Zag represents the first successful mass adoption of a ZK-Rollup, contributing to its well-established name and reputation.

As zkSync 1.0 is not zkEVM, its infrastructure has certain limitations. With zkSync 2.0 (zkEVM), Zig Zag will offer users additional features and advantages, such as liquidity pools.

A preview of ZigZag’s zkSync 2.0 DEX is now live on the Arbitrum mainnet.

How can I start using ZigZag Exchange?

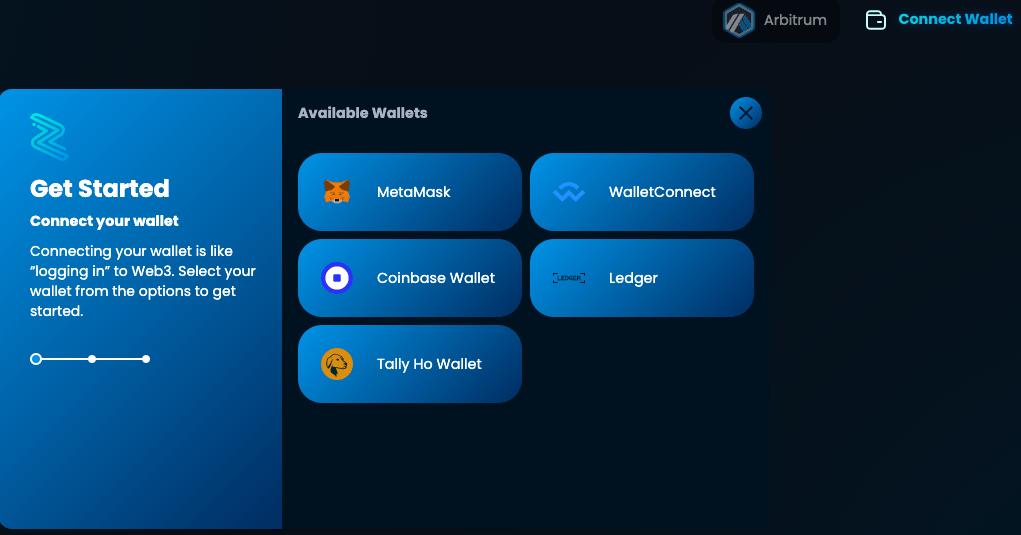

To get started, first connect your web3 wallet.

Once connected, it is simple and straightforward to use the platform.

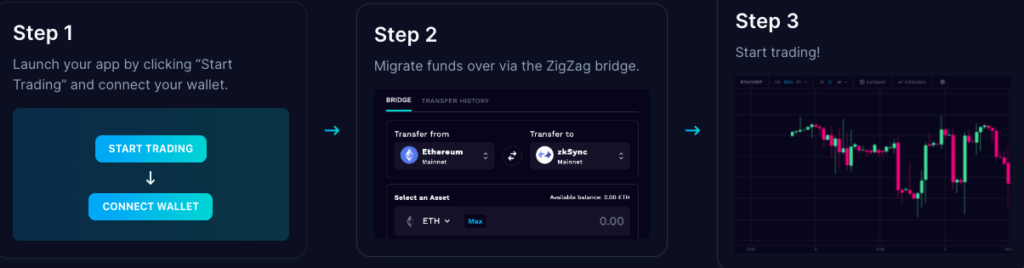

To start, simply click “Start Trading” at the top of the page, and connect your Web3-wallet to the application. For zkSync 1.0 you will need to bridge funds from Ethereum activate your account with a one-time transaction, of roughly $0.50.

If you want to use ZigZag Exchange on zkSync, you will first need to bridge your funds from Ethereum Layer 1 to zkSync Layer 2. After that, a one-time activation fee is required by zkSync’s design to activate your account. You’re then ready to start trading on ZigZag.

- Go to trade.zigzag.exchange/bridge, switch your wallet network to Ethereum, connect your wallet and sign the message to access your account.

- Fill in the amount you want to transfer from L1 to L2, click on transfer for ETH or approve+transfer for any ERC-20. If you choose ETH, you can bridge to L2 right away. If you choose any ERC-20, you’ll first need to approve the token before being able to transfer.

- Confirm the transaction in your wallet and wait until your funds are bridged to zkSync.

- Once your funds have arrived, sign zkSync’s one-time activation fee and start trading at https://trade.zigzag.exchange/

Check your account and transaction details:

- Balances: go to trade.zigzag.exchange and click the ‘Balances’ tab next to ‘Orders’ and ‘Fills’

- On zkscan.io go to Transaction details: zkscan.io. Another option is to visit wallet.zksync.io/account

You can also use the official bridge: https://lite.zksync.io/

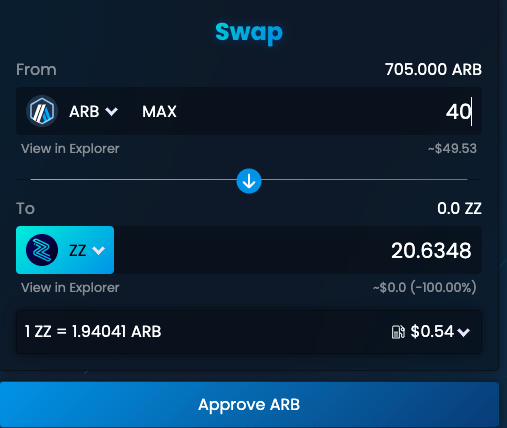

ZigZag Exchange Swaps on Arbitrum

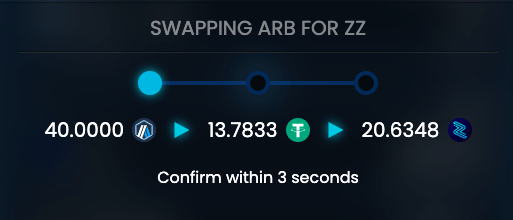

You can also use https://swap.zigzag.exchange/ to swap on the exchange using the Arbitrum network.

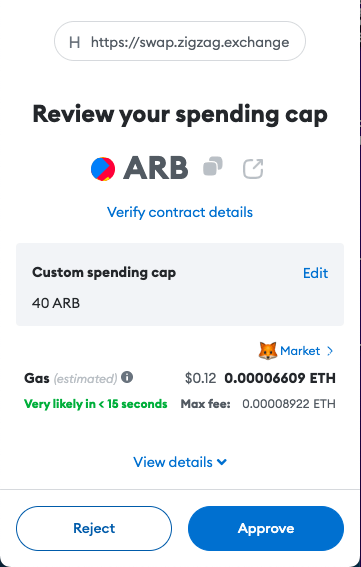

You’ll be required to set a spending cap via your wallet.

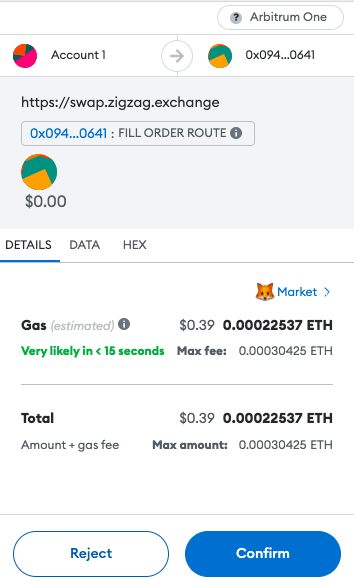

You’ll need to pay the gas fee.

Once you confirm then your swap will be completed.

Order Book

Using a P2P system, users can trade against each other with a familiar order book model that mirrors the experience of centralized exchanges. Unlike AMM-style DEXs, market makers supplying liquidity via limit orders do not necessarily experience impermanent loss. Placing or canceling an order consumes no gas since the process occurs off-chain. However, when an order matches with another user’s order, an on-chain swap transaction takes place.

Competitive Pricing

ZigZag offers outstanding quotes to all users through its order book model. Users can leverage real-time price feeds from leading CEXs and on-chain oracle feeds like Chainlink and Uniswap, which market makers use to place resting orders on the protocol’s order books.

Decentralized Protocol

ZigZag is dedicated to establishing a completely community-owned decentralized exchange and has made significant progress towards achieving this objective. All code is publicly available on GitHub, and independent experts routinely audit smart contracts. There is no need to deposit or withdraw funds from your wallet with the protocol, enabling trustless, non-custodial transactions.

ZK-Rollups

ZigZag capitalizes on ZK-Rollup technology. By employing this technology, users enjoy near-zero swap fees and almost instant transactions.

ZK-Rollups enhance Ethereum’s scalability. These Layer-2 solutions enable numerous off-chain transactions to be bundled and recorded on-chain while still benefiting from optimal decentralization and security from Ethereum’s mainnet.

This results in extremely high throughput, faster transaction times, and lower fees compared to individual on-chain transactions, leading to a capital-efficient order book.

ZZ Token

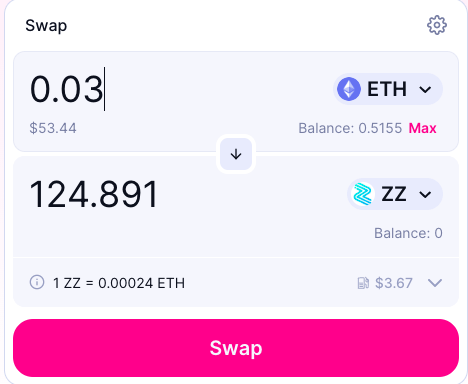

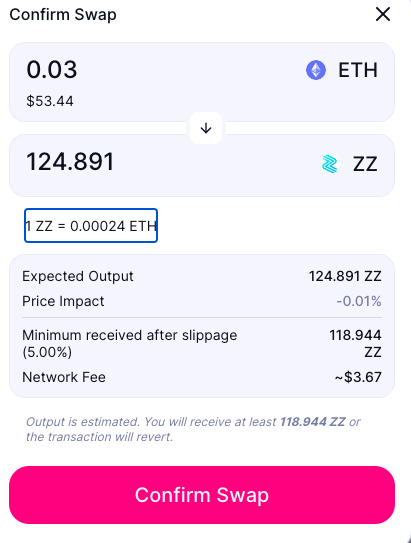

To purchase ZZ tokens. Go to Uniswap.

A convenient way to acquire ZZ tokens is to swap from ETH for example.

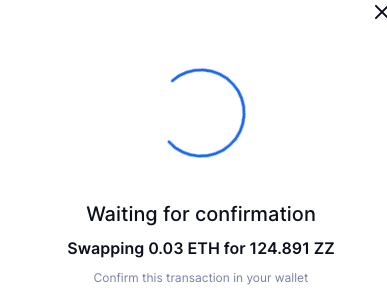

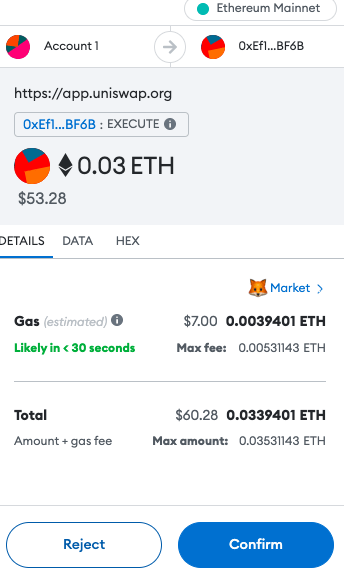

Simply pay the network fees and confirm the swap.

Once confirmed, you can add the token to your web3 wallet.

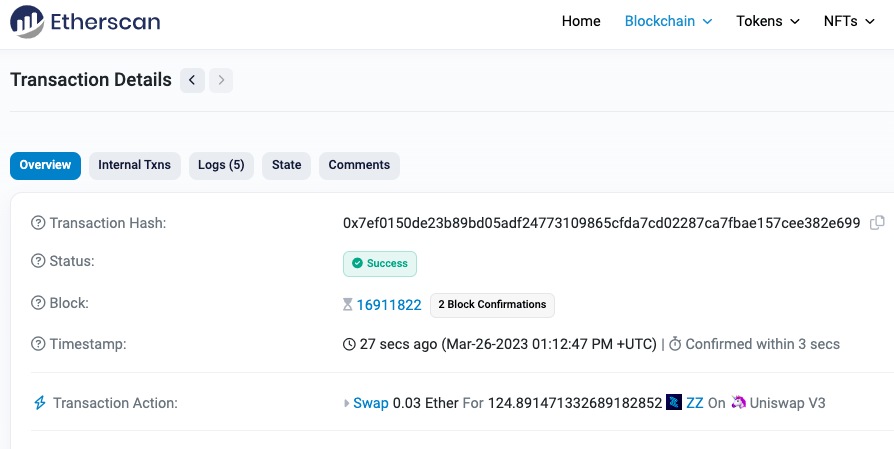

You can confirm if the transaction has been processed on Etherscan.

In addition, you can also check your wallet.

ZigZag is a decentralised P2P order book exchange powered by Zero-Knowledge Technology that shows good potential. Time will tell how the ecosystem continues to evolve.