Shell Protocol Review 2023

What is Shell Protocol?

Shell Protocol is an assembly of EVM-based smart contracts situated on Arbitrum One. Unlike other DeFi protocols which depend on large, single-purpose smart contracts, Shell serves as a hub for a modular ecosystem of services. Its architecture simplifies the bundling of multiple smart contracts or the development of new ones and allows users to batch numerous services in a single transaction.

Renowned for streamlining DeFi for both users and developers, Shell is a public asset that will be overseen by the forthcoming Shell DAO.

What are Shells?

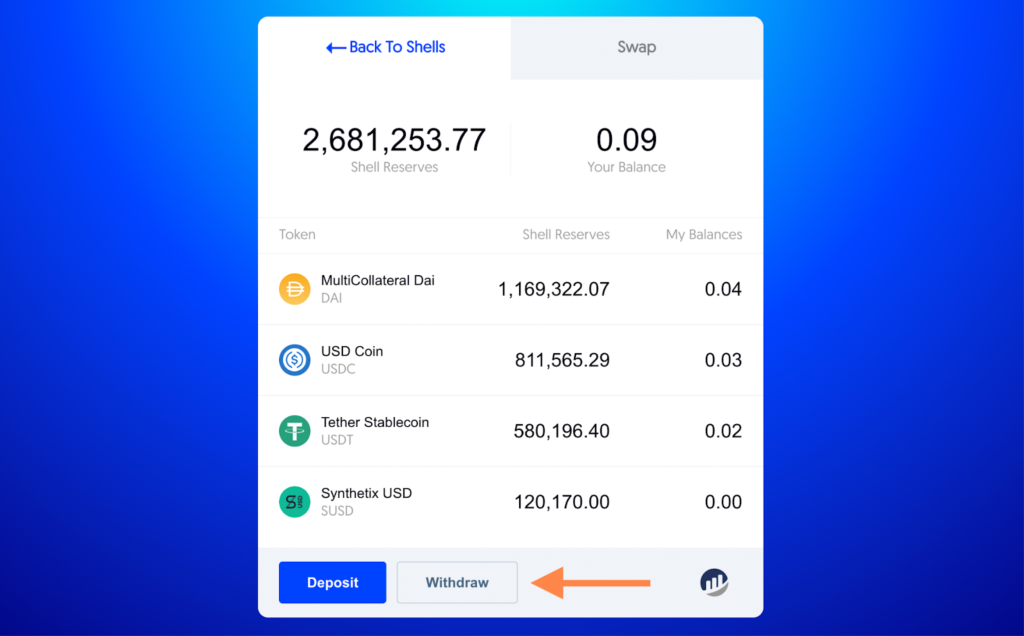

Stablecoins placed in pools are provided by liquidity providers. To monitor these contributions, the pool issues shares, or “shells”, to those depositing tokens. To extract their tokens, providers exchange their shells. Shells encapsulate the pool’s underlying assets, similar to how a living shell houses an organism.

Shells offer three main advantages over non-active stablecoins:

- Liquidity

- Risk spreading

- Yield

Shells essentially symbolize tokenized liquidity pools, thereby possessing the liquidity used for swaps. Stablecoins in the pool can be directly transformed into shells, and vice versa, making shells intrinsically liquid assets.

Shells provide more than just an efficient liquidity source. They represent diversified asset portfolios, reducing the risk of holding shells compared to holding a single stablecoin. Additionally, the liquidity pool can generate passive income for shell holders by providing liquidity to the wider market. Each swap generates a fee for the pool, which directly increases the value of the shells, generating passive income, making shells yield-generating assets.

Considering that shells are diversified, inherently liquid, and yield-bearing, they potentially could become the most optimal store of crypto asset value. It’s also easier to manage a single shell than multiple stablecoins. Currently, there’s no crypto equivalent to the safest and most liquid interest-bearing assets in traditional finance, such as US Treasuries.

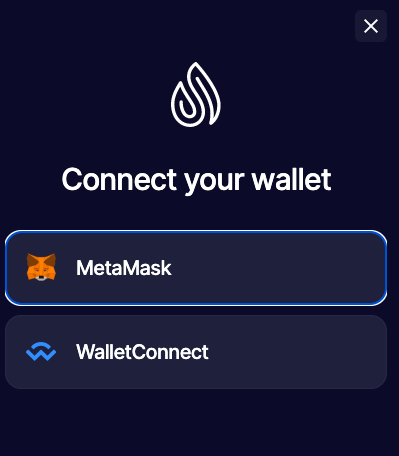

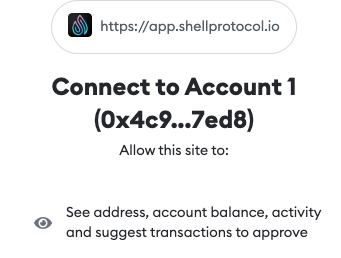

To get started with Shell, you need to connect your web3 wallet e.g. MetaMask.

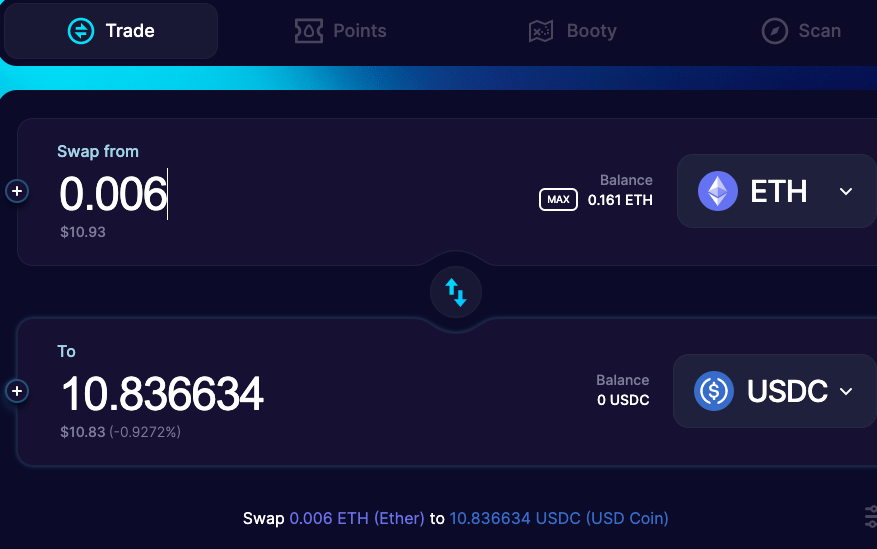

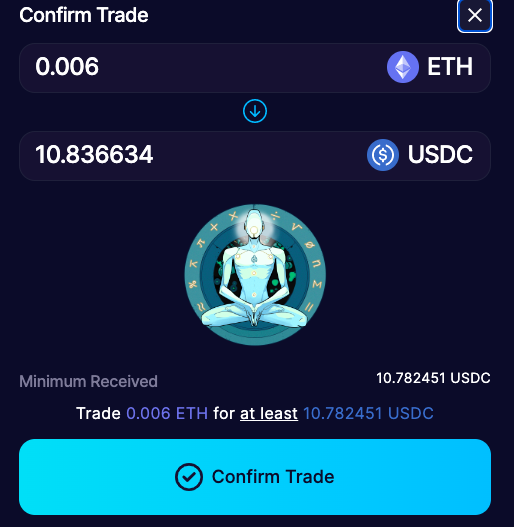

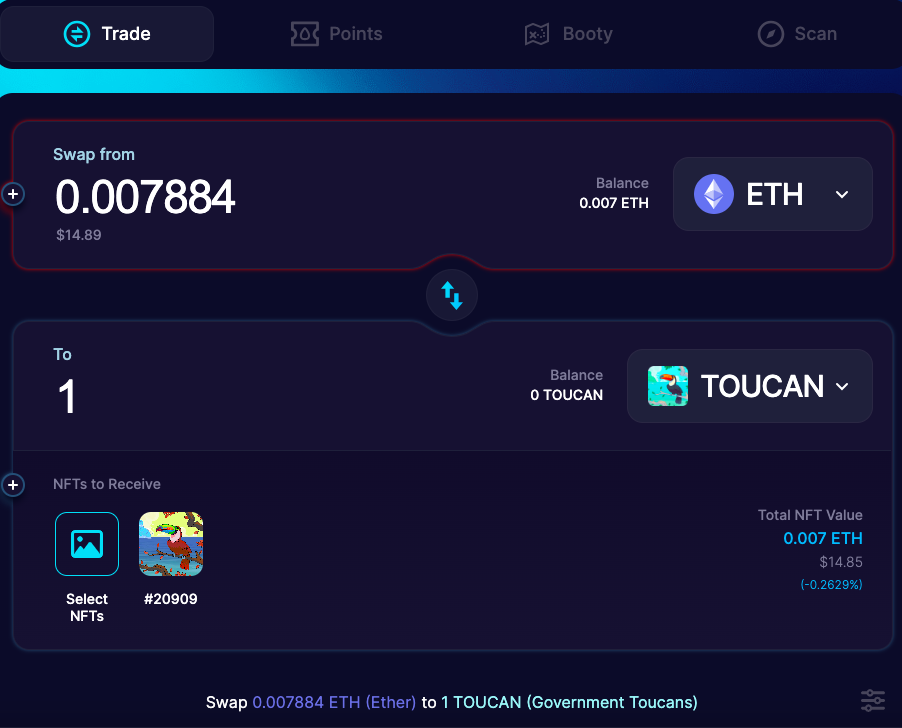

Once connected, you can proceed to swap an asset e.g. ETH for USDC.

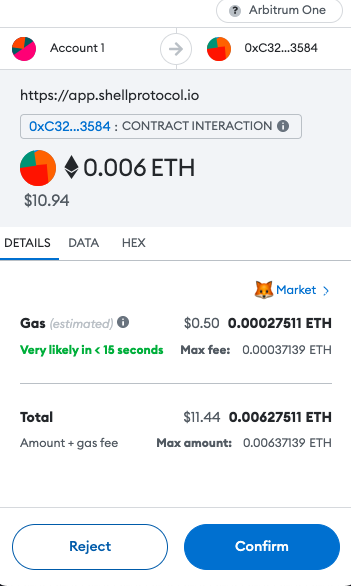

You can then proceed to pay the gas fees to facilitate your transaction.

Once you’ve agreed to pay the network fee, you can then confirm your intended transaction or trade.

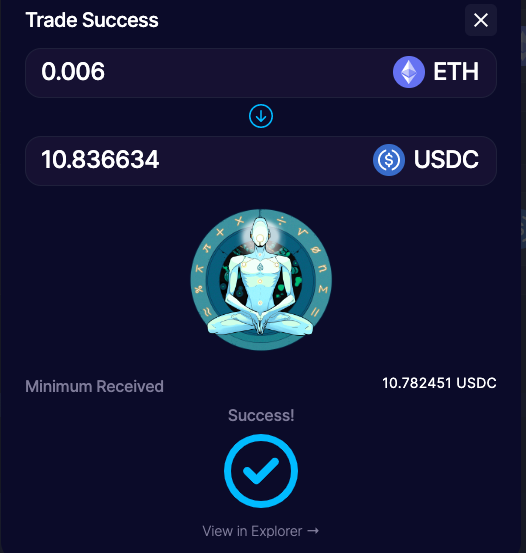

You’ll be able to get confirmation that your trade has been approved once it is processed.

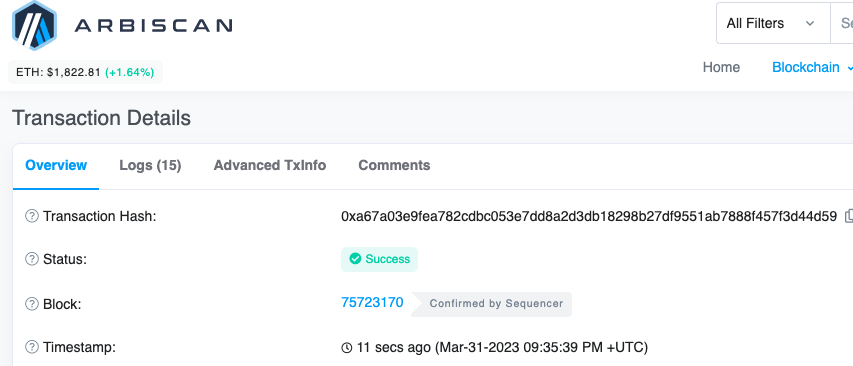

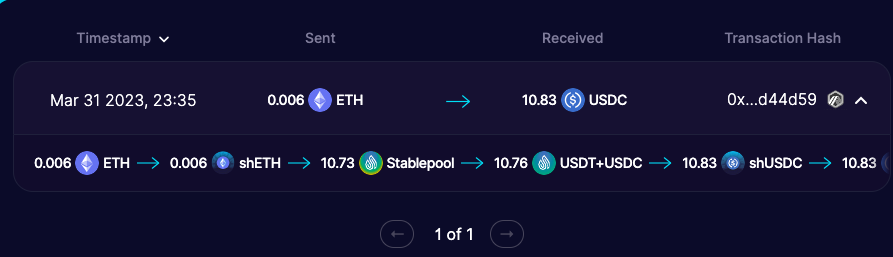

You can also verify the transaction on-chain via the block explorer. Since Shell Protocol is deployed on the Arbitrum network, you can verify the transaction via ArbiScan.

You will also be able to see the transactional information on your dashboard.

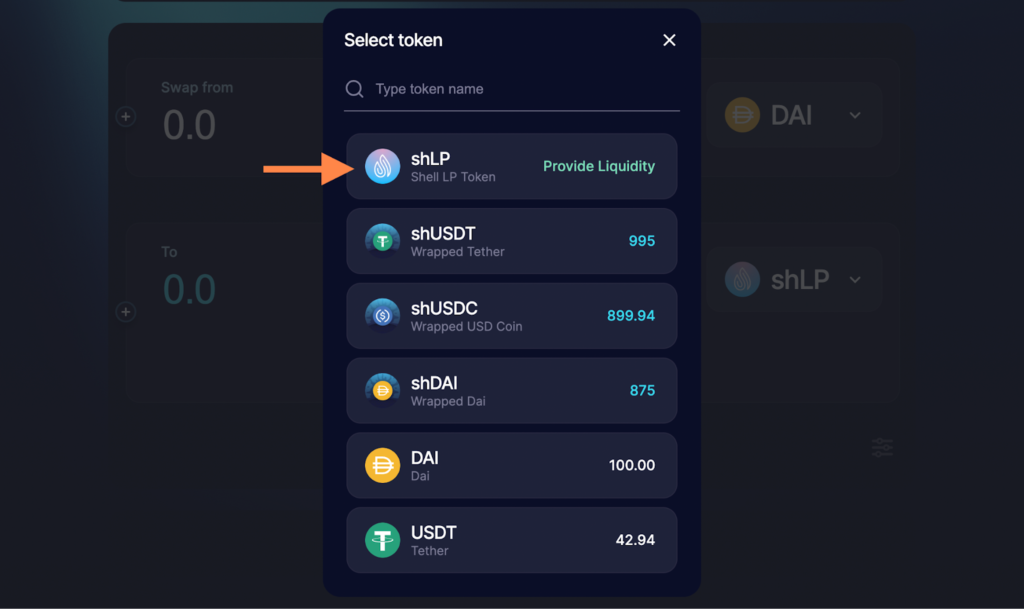

To earn Shell Points, you can wrap tokens/provide liquidity using the Trade screen.

Why choose the Shell Protocol?

Shell Protocol enables you to atomically merge any set of transactions, such as LPing, lending/borrowing, or executing multi-token and NFT swaps, while significantly reducing gas fees.

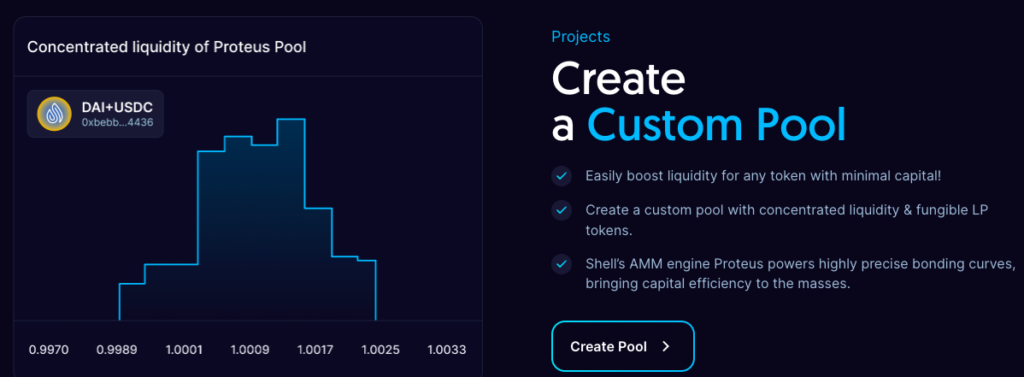

Proteus, Shell’s native AMM engine, allows you to use or create custom pools with concentrated liquidity and fungible LP tokens, significantly enhancing the precision of the bonding curve. Well-constructed curves capture significantly more trade volume than their competitors.

Shell is the platform for streamlined, modular DeFi contracts. Its design reduces code complexity for builders and enhances user experience.

Shell Protocol Architecture Overview

Shell Protocol comprises two primary components: The Ocean: a communal accounting system that simplifies the composition of DeFi primitives. Proteus: an AMM engine capable of accurately replicating any bonding curve shape while utilizing fungible LP tokens.

History of Shell v1 (Retired)

In October 2020, Shell Protocol introduced its inaugural AMM pools on the Ethereum mainnet, known as Shell v1. These represented a novel solution to specific problems, providing deep liquidity and (predictively) broken peg protection for like-value tokens (like stablecoin-stablecoin or wrapped BTC-wrapped BTC).

Regrettably, Shell v1 was singular in providing broken peg protection, which might have allowed more protocols to mitigate damage during the significant stablecoin crash of 2021 had it been more prevalent.

Shell v1 was a visionary product in many ways, and it also harbored the aspiration for a composable liquidity network, an ambition now realized by its v2 successor (simply known as Shell Protocol). Consequently, after nearly two years of active operation, Shell v1 has smoothly transitioned into retirement.

Shell Protocol’s Value Proposition

The Shell Protocol’s mission is to establish an internet monetary system utilizing stablecoins as foundational elements. Its initial launch offers a liquidity pool tailored for optimized stablecoin-to-stablecoin exchanges, featuring weights, significant liquidity, protections against broken pegs, and fluctuating fees.

Moreover, it can directly provide liquidity between stablecoin derivatives, like cTokens (cTokens are the primary means of interacting with the Compound Protocol) and aTokens (aTokens are tokens minted and burnt upon supply and withdraw of assets to an Aave market).

Shell Protocol aims to construct a framework for adaptable bonding curves that can adjust to new applications and market fluctuations. The shares given to liquidity providers are referred to as “shells”, symbolizing their function as a holder for the pool’s value, mirroring the role of living shells as protectors of the creatures within them. These shells are inherently liquid, help spread risk, and generate earnings. They have the potential to become the primary method of value storage and transaction.

Designing the optimal protocol for shells

Assuming shells become the standard method of value exchange and storage (i.e., “money”), what would such a system look like? Despite being pegged to the same numeraire, stablecoins have substantial differences, like varying risk profiles, regulatory limits, geographic distributions, and so on. For instance, some stablecoins, like USD Coin or Paxos, are backed by fiat currency in audited bank accounts. Others, like Tether, keep their fiat reserves in unaudited accounts.

Stablecoins issued by Maker and Synthetix are backed by cryptocurrency. Terra had a stablecoin whose peg was backed by future transaction fee-generated cash flows, but this concept was proven faulty. The variety of stablecoins is bound to increase over time. As more users adopt stablecoins, they’ll become increasingly diverse. Early DeFi adopters are risk-tolerant, but this will change with mainstream users.

It’s unlikely that the entire world will use the same stablecoin shell, considering the various stablecoins that could be included in a shell, the varying weights of reserve assets, and the pool’s potential risk levels. A single shell that meets everyone’s needs is impossible. The market will likely see thousands of pools and shells. Additionally, market conditions are very unpredictable. A pool design that works well in stable markets might not perform well in volatile ones.

Therefore, a protocol for creating shells should be highly adjustable to adapt to the variety of stablecoins and market conditions. The Shell Protocol, in its first iteration, focuses on creating a framework for highly adaptable core logic. By tweaking parameters, the pool’s behavior can be substantially modified.

As Shell is an open-source protocol, anyone technically can deploy a pool without needing approval. But due to the protocol’s novelty, independent deployments won’t be initially endorsed or supported until the project matures. Ultimately, it will be easier for individuals to configure, deploy, and operate their own pools.

Shell Protocol Use Cases

The Shell Protocol’s most evident application is serving as a liquidity source for DeFi traders and a yield source for liquidity providers. Given that liquidity induces trade volume, liquidity providers are the primary concern initially. As Shell possesses dynamic fees and safeguards against a broken stablecoin peg, it can potentially generate higher yield with less risk compared to incumbent stablecoin AMMs that lack these protections and only offer a fixed fee. Shell pools can also adapt dynamically to market fluctuations.

However, the real benefit for liquidity providers in Shell lies in the model’s adaptability. For instance, stablecoin reserves can hold specific weights in the pool, a feature unique among other stablecoin AMMs. Hence, stablecoins with relatively low volume, such as SUSD, can have a smaller weight compared to high volume ones like Tether. This exact structure is evident in the first Shell pool, with SUSD having a 10% allocation and Tether a 30% allocation.

Stimulating liquidity for new stablecoins

Weights can also be used inversely to stimulate liquidity for new stablecoins. A pool can be created with a 50% target weight assigned to the new stablecoin. This pool can then gain liquidity mining incentives from the new stablecoin’s parent protocol. In an evenly weighted pool, liquidity incentives would be dispersed among all other stablecoins, while an overweight pool would generate more liquidity for each dollar of subsidy.

Liquidity between stablecoin derivatives

Shell’s utility isn’t restricted to facilitating liquidity between stablecoins, staking derivatives, or bitcoin on Ethereum. Shell can also offer liquidity between lending pools and smart yield protocols like Compound, Aave, and yEarn. For instance, a direct swap between cUSDC and aUSDT could occur in one transaction without requiring a Zap. This flexibility also extends to the pool’s reserves. Stablecoins can be deposited into yEarn, earning additional yield on top of trading fees from the AMM. The design allows for more integrations without altering the pool. For security reasons, once a pool is deployed, new integrations won’t be added to it. However, as pool governance becomes decentralized, this constraint can be eased.

Settlement currency for DeFi protocols

The protocol offers more than just liquidity and yield. Shell tokens can directly serve as an exchange medium for other DeFi protocols. Remember that shells can be converted into stablecoin reserves and vice versa. For instance, if you’re a decentralized options exchange like Opyn, your market has to settle in a stablecoin. Ideally, the exchange can accept numerous stablecoins without fragmenting liquidity.

Instead of settling through a single stablecoin, trades can settle in shell tokens. Let’s say Alice has sold a put option to Bob. Alice wants to settle the option in DAI, while Bob prefers USDC. At the smart contract level, the option can settle in shells. If Bob exercises the option, the shells are converted to USDC. If the option is not exercised, the shells are converted to DAI and returned to Alice.

Given that shells can convert between lending pools and other stablecoin derivatives, DeFi protocols can accept a wide range of assets on their platform without the need for additional integrations. Furthermore, they can establish their own pool with parameters tailored to their needs. Utilizing other stablecoin AMMs this way is highly risky if they lack protections against a broken peg. Without these safeguards, a single broken peg could deplete the entire pool, leading to a collapse of any other associated decentralized exchange.