OpenLeverage Money Market Review

What is OpenLeverage?

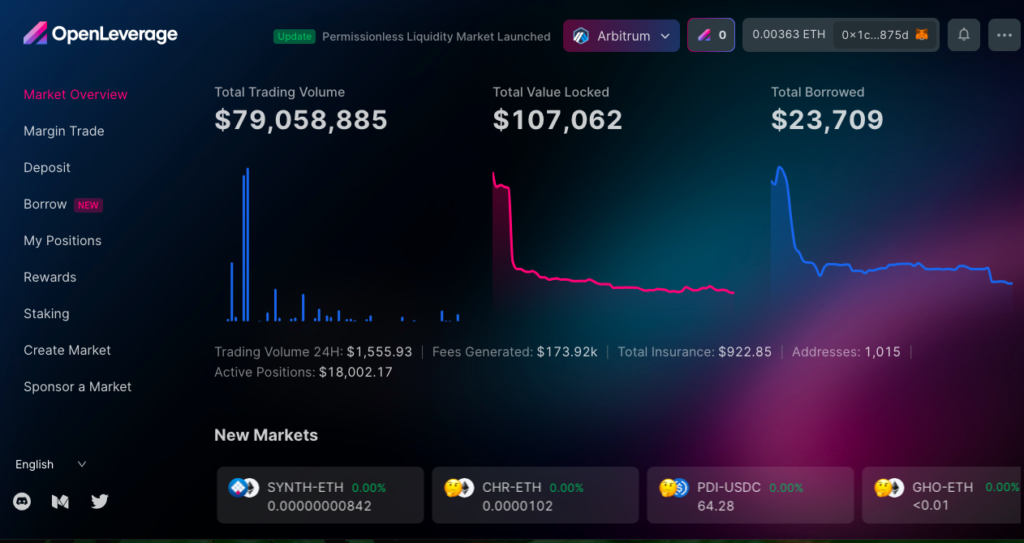

OpenLeverage is a breakthrough in the crypto trading arena as a permissionless lending margin trading protocol.

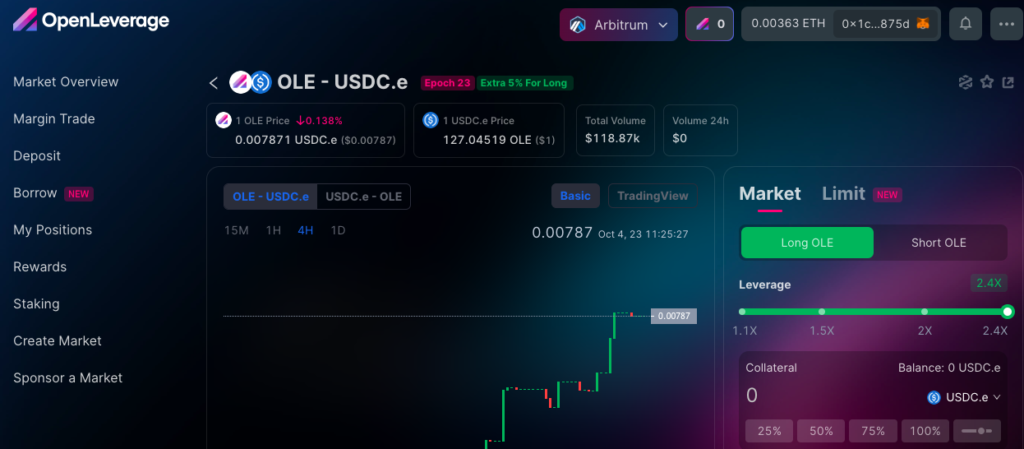

This revolutionary platform allows traders and other applications to long or short on any trading pair on Decentralized Exchanges (DEXs) with unparalleled efficiency and security.

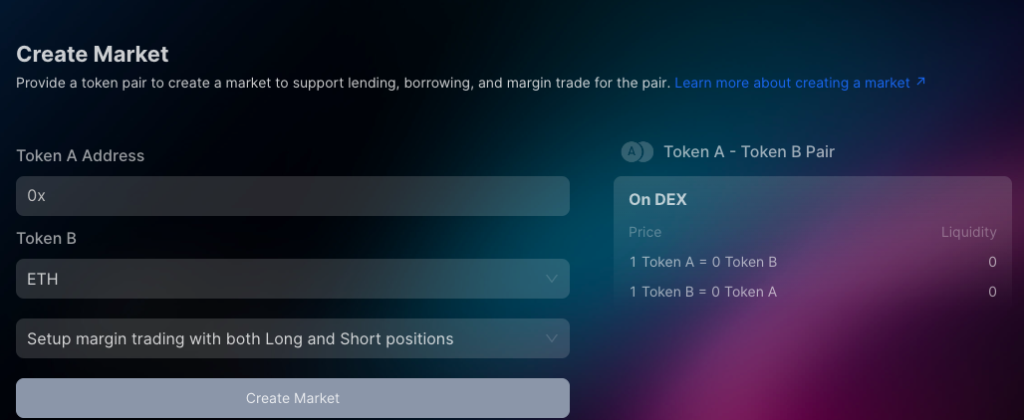

OpenLeverage is spearheading the push towards a fully permissionless decentralized margin trading landscape. This means traders can now create a margin trading market for any pair, completely doing away with the need for permissions.

Moreover, with its focus set on the long run, OpenLeverage is looking to shape a decentralized crypto securities service catering to both retail and institutional clients. This service includes decentralized lending, derivatives trading, and asset management infrastructure, all while integrating seamlessly with the global DeFi ecosystem.

Key Features of OpenLeverage

-

Direct connection with the most liquid decentralized markets such as Uniswap, PancakeSwap, SushiSwap, and others for margin trading.

-

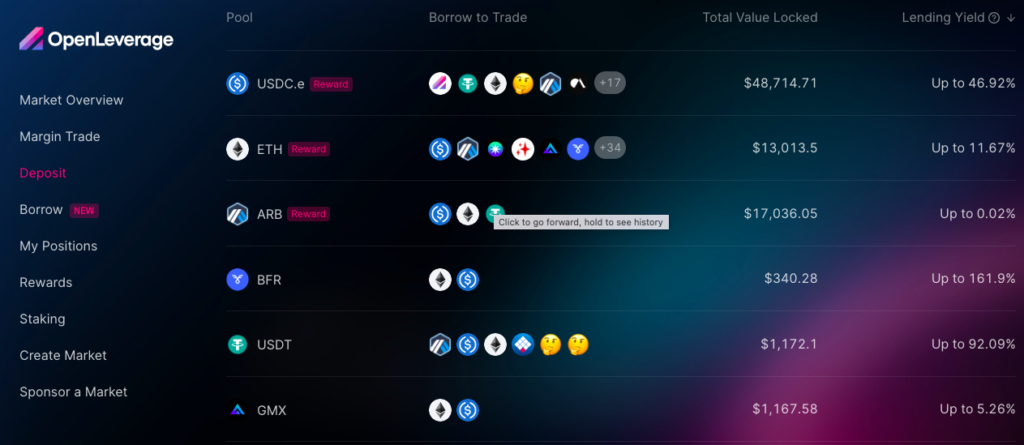

Innovative Risk Isolation Lending Pools feature with separated pools for each pair.

-

Real-time AMM Price-based risk calculations for collateral ratios.

-

Use of OnDemand Oracle and TWAP prices from DEXs to prevent price manipulations.

-

LToken & OLE Token systems provide unique incentives and reward mechanisms.

-

An intuitive and user-friendly UI design ensures optimal user experience.

What Makes OpenLeverage Unique?

-

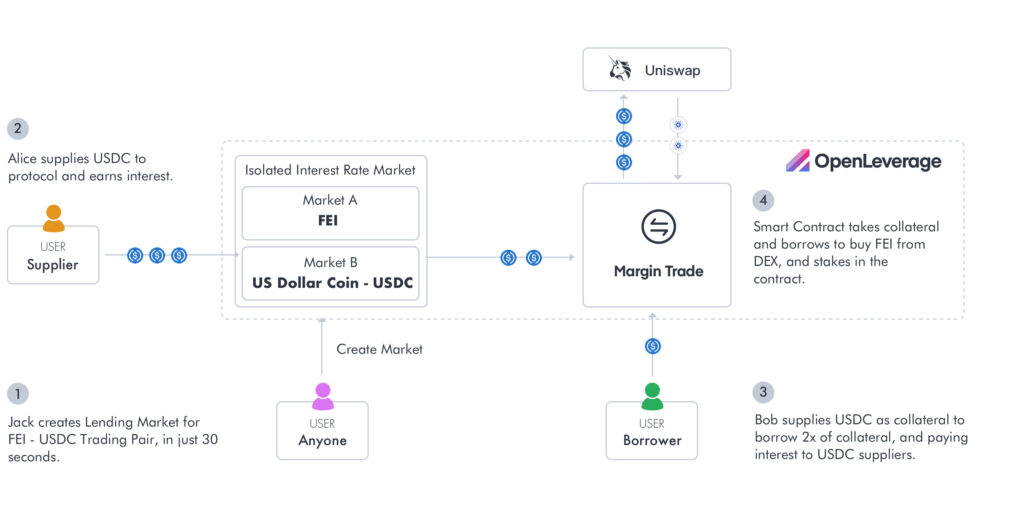

OpenLeverage offers a platform where any individual can create lending pools for available trading pairs on a DEX.

-

Higher yield opportunities for lenders.

-

Simplified borrowing and leverage trading with one-click transactions.

-

Open integration options for projects to boost leverage trading on specific pairs.

-

Reward opportunities for liquidators upon triggering liquidations.

- OpenLeverage has a good ecosystem of partners and supporters.

Decentralized Margin Trading Explained

While margin trading has long been a method of trading assets using third-party funds, OpenLeverage brings a decentralized twist to it. Unlike traditional centralized platforms where intermediaries provide borrowed funds, OpenLeverage sources these funds from anonymous users within the ecosystem, offering them interest based on market demand for margin funds.

The platform operates transparently with smart contracts that ensure safety and adherence to set conditions. The smart contracts have been audited to give users some assurance of the credibility of their product.

What is OLE Token?

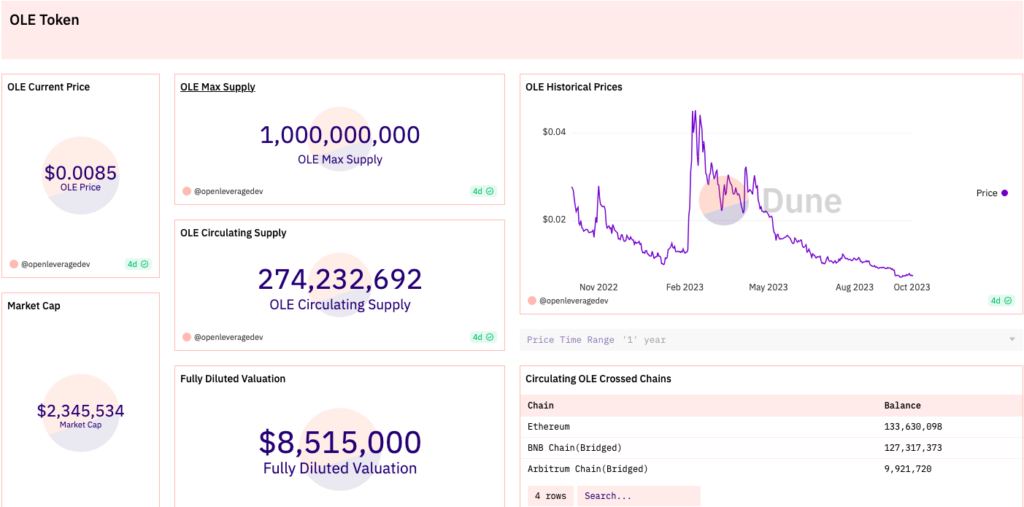

OLE serves as the native token of the platform, and it’s vital for shared community ownership and incentives within the protocol. It’s minted during various activities, such as trading and staking, and is available on Ethereum and accessible via Multichain. You can trade OLE tokens on exchanges such as Bitget, MEXC, KuCoin, Gate, etc.

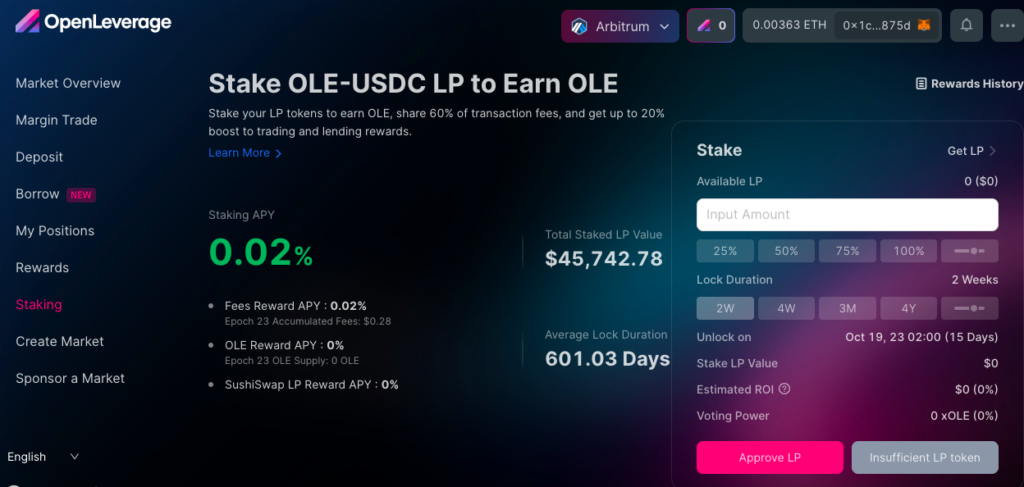

Staking and xOLE

xOLE emerges as the governance token for OpenLeverage. Its design encourages liquidity provisioning for OLE, aligning token holders with the protocol’s long-term interests.

Governance and Incentive Distribution

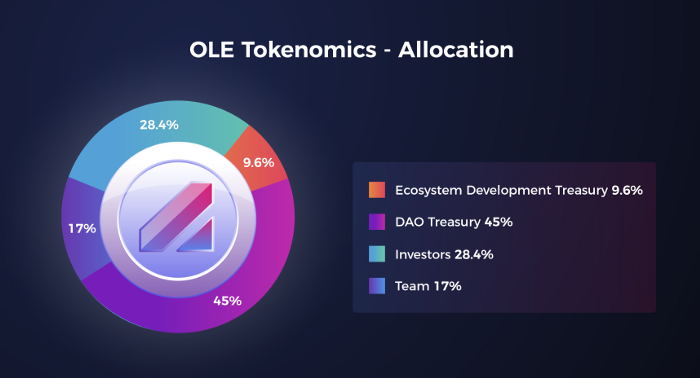

OpenLeverage’s governance model involves xOLE holders in epoch voting rounds, determining rewards for token pairs. With up to 47% of the total OLE supply allocated to the OpenLeverage DAO fund, continuous liquidity incentives are ensured.

Trading, Lending, and Borrowing Rewards

OpenLeverage’s reward distribution model incentivizes market liquidity and trading volume. Both traders and lenders can earn $OLE rewards based on their participation. The platform has also introduced a unique reward system for traders that ensures genuine trades and discourages exploitative activities.

Conclusion

OpenLeverage‘s platform offers a fresh and decentralized approach to margin trading. With its innovative features and commitment to decentralization, it’s setting new standards for crypto trading. For those involved in the DeFi space or considering diving in, OpenLeverage presents a promising prospect worth exploring.