ApeX DEX Review 2024

What is ApeX Protocol?

ApeX Pro operates as a non-custodial trading platform, offering limitless cross-margined perpetual contracts to its metacommunity within a novel social trading framework. This platform is positioned to provide unfettered access to the perpetual swaps market through its order book model, upholding commitments to speed, efficiency, security, and transparency concerning the assets of traders.

The DEX is multi chain and available on different blockchain networks including Arbitrum, BSC, Polygon, Optimism, Ethereum, Avalanche and more!

How to Trade Perpetual Swaps on ApeX DEX

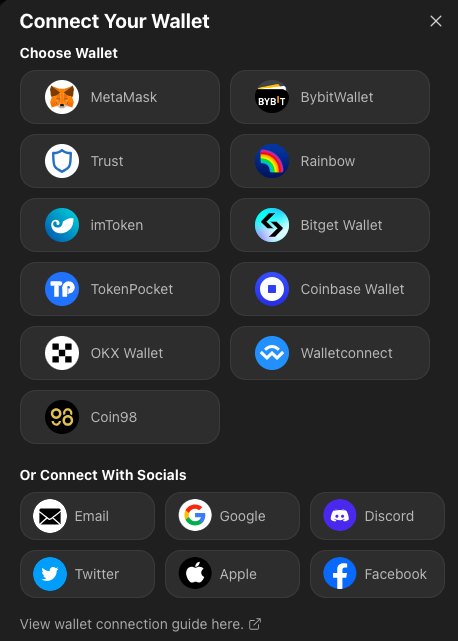

Connect your web3 wallet.

There are any available options as far as wallet options. For this demonstration, we’ll be using MetaMask.

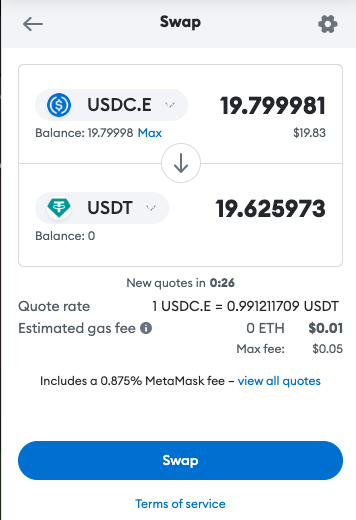

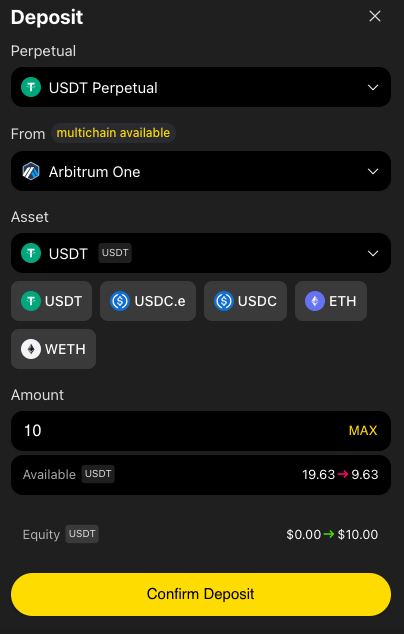

I’ll be using the Arbitrum network to trade USDT-Perp contracts.

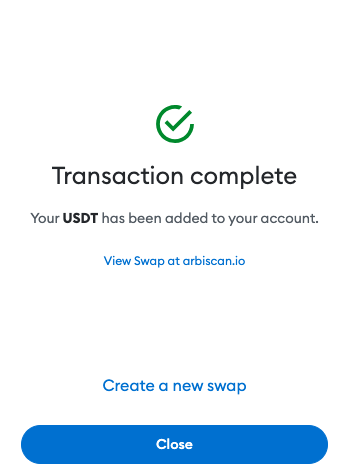

First, I’ll swap some USDC on Arbitrum to USDT in my MetaMask wallet.

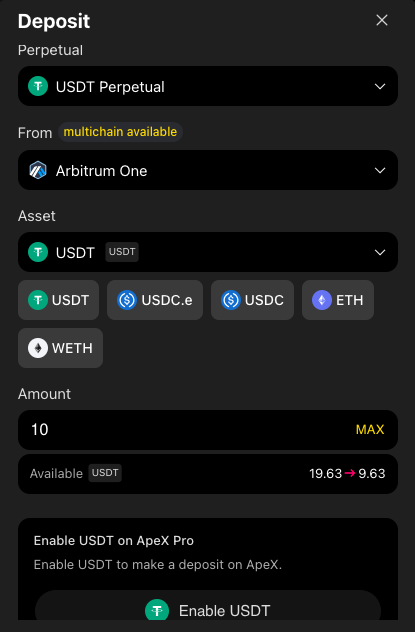

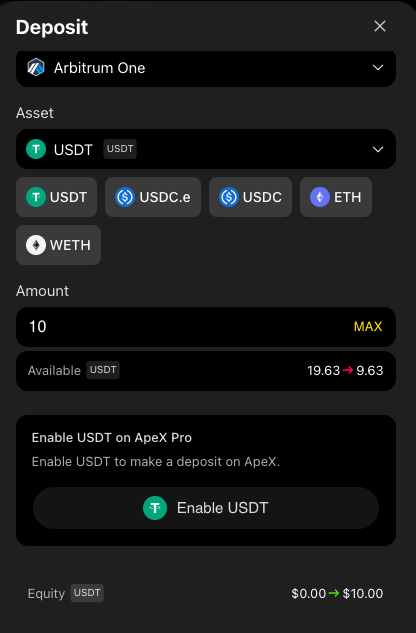

Now I have some USDT in my wallet which I will now deposit to ApeX DEX.

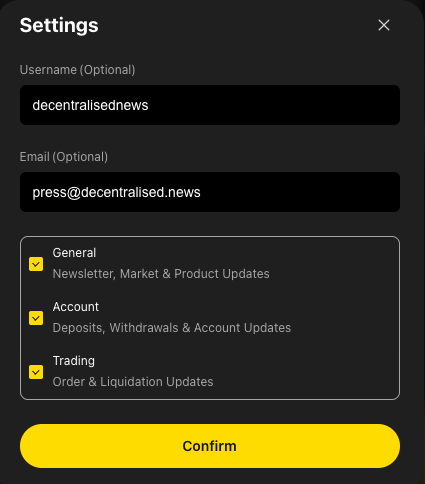

I will also turn on my email notification so that I’m in the loop with important updates about my trades.

Now, I’ve enabled USDT deposits to ApeX.

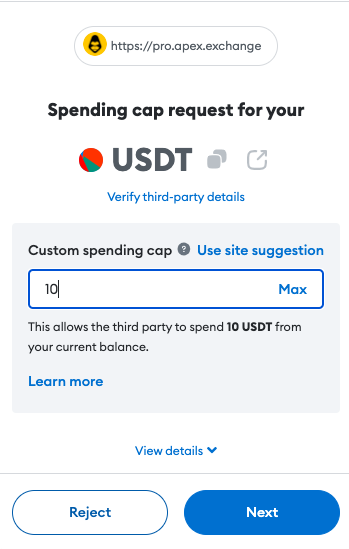

You can set your spending cap.

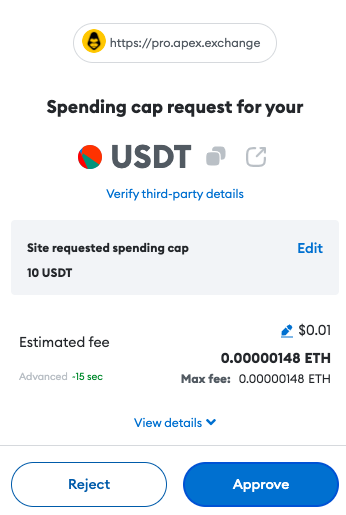

Pay the gas fee.

Confirm the deposit.

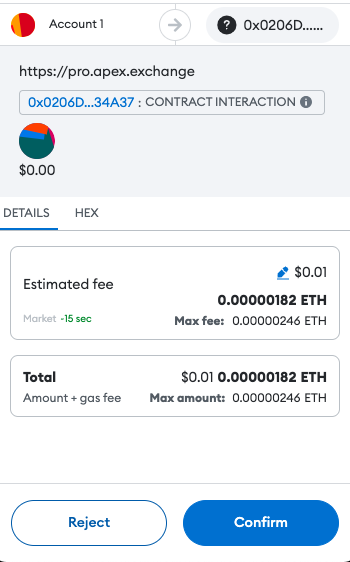

Pay the gas fee.

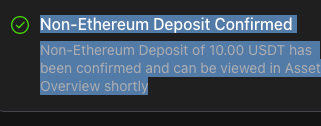

The deposit will now be confirmed.

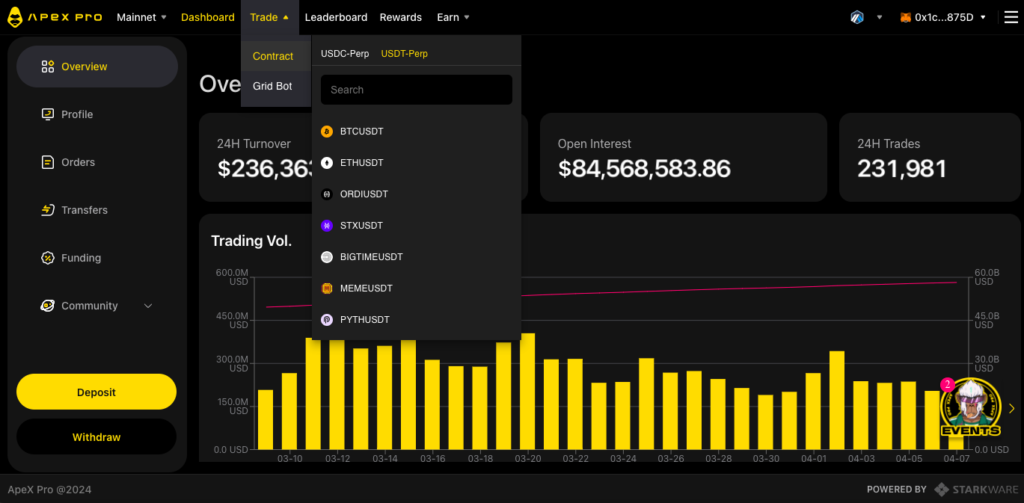

Now that we have some funds to try out the platform, we’ll choose the USDT-Perp option as we intended to.

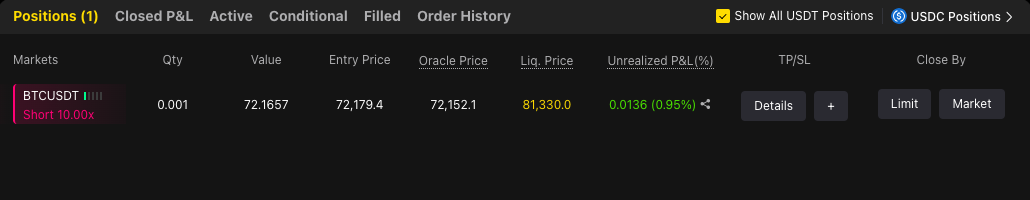

When trading perp contracts, you can choose to LONG or SHORT the asset pair of your choice. You can also decide the amount of leverage to use for your position depending on the margin requirements and also choose whether you wish to execute a market or limit order.

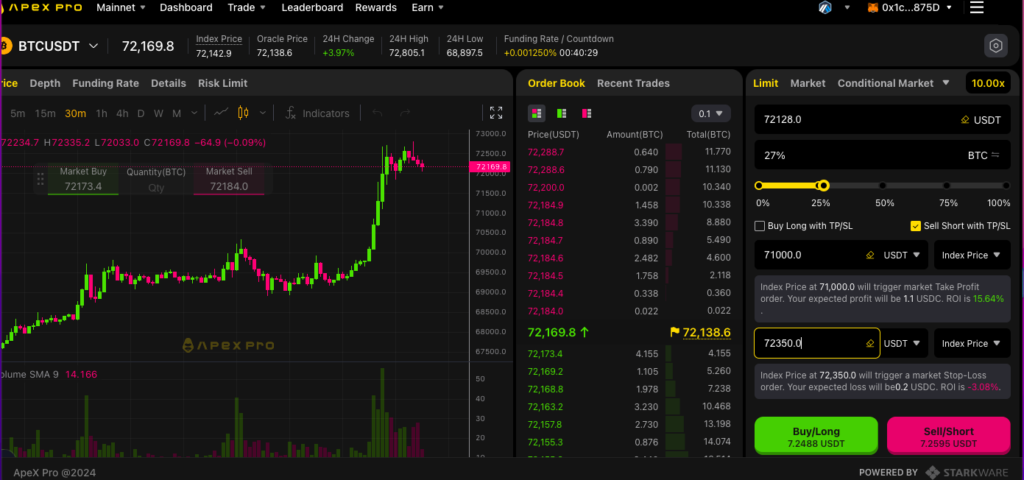

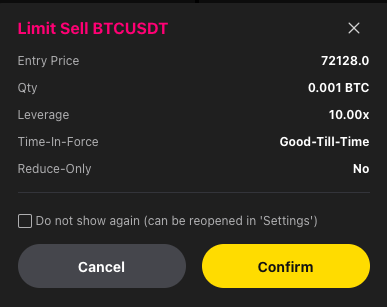

For this demonstration, we are going to sell SHORT the BTC/USDT pair as a limit order.

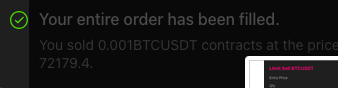

You’ll be notified when your order fills.

ApeX offers USDT cross-margined futures. Perpetual contracts offered by ApeX Pro include USDC and USDT collateralized options, with no expiration date, leveraging Layer 2 capabilities for data integrity, EVM compatibility, and fund security. This ensures low fees, advanced pricing, faster transactions, and significant leverage, encapsulating a secure trading environment.

Notably, ApeX Pro accounts comprise two distinct cross-margin accounts for USDC and USDT, each supporting perpetual contracts tied exclusively to their respective stablecoins.

Cross-margin trading on ApeX Pro allows traders to manage multiple perpetual contract markets within a single margin account, enhancing capital efficiency and user experience. Deposits of any asset are converted to USDC/USDT collateral, enabling market access within the same account.

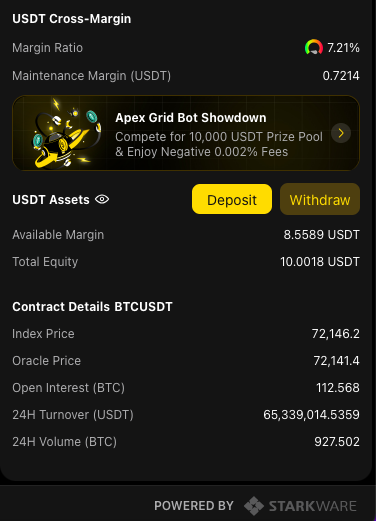

What’s great about ApeX is the transparency of your position information. You can clearly see the margin available, your total equity in addition to the open interest, etc.

What’s great about ApeX is the transparency of your position information. You can clearly see the margin available, your total equity in addition to the open interest, etc.

Regarding margin, profit, and loss calculations for USDC/USDT perpetual contracts, these are conducted in the respective currencies, mitigating the need for hedging against non-stablecoin cryptocurrency risks. The P&L chart is linear, such that a price movement of 100 USDC/USDT results in a corresponding P&L change.

Open interest and leverage considerations reflect that while centralized exchanges may offer leverage up to 100x, ApeX Pro provides up to 50x leverage on selected contracts, prioritizing a safe and trusted trading environment. The platform also enables manual leverage adjustments for each contract.

You can also see your open positions on the dashboard.

ApeX Protocol’s Key Features

ApeX Pro‘s adoption of the order book model merges the security and transparency typically seen in decentralized exchanges (DEXs) with the speed and ease of use characteristic of centralized exchanges (CEXs). This model effectively narrows the divide for users accustomed to trading with order books on a permissionless platform.

Key offerings include maximum security, achieved through on-chain data integrity. Privacy is further enhanced by the protocol upgrade, increasing ApeX Pro’s capacity for trade settlement while securing transaction validations without compromising traders’ privacy.

Other benefits include lower fees, higher leverage up to 50x with instant settlement, thereby facilitating amplified earnings with reduced starting capital. Multi-chain support is also a cornerstone, accommodating ETH, ERC-20 tokens, and those from EVM-compatible chains with cross-chain deposits and withdrawals.

Fees on Apex DEX

ApeX Pro employs a maker-taker fee structure for trade fees, distinguishing between maker orders that enhance liquidity and taker orders that immediately execute, thus affecting liquidity. Maker fees are set at 0.02% and taker fees at 0.05%, with plans to introduce a tiered trading fee structure for additional cost savings.

Order cancellations on open orders incur no fees, emphasizing that charges apply only upon order fulfillment. Furthermore, the execution of trades on Layer 2 negates the necessity of gas fees, underlining ApeX Pro’s commitment to cost efficiency and user satisfaction.

Funding Fees

Funding is a fee exchanged between traders holding long or short positions to ensure that the trading price aligns closely with the spot market price of the underlying asset.

Funding fees are transferred between holders of long and short positions every 1 hour.

It is important to note that the funding rate will experience real-time fluctuations every hour. When the funding rate settles as positive, holders of long positions are required to pay funding fees to those holding short positions. Conversely, if the funding rate is negative at settlement, holders of short positions will compensate those with long positions.

Only those traders who maintain positions at the time of the funding settlement are obligated to either pay or receive funding fees. Traders without any positions at the time of funding fee settlement will not be subjected to these fees.

The value of a trader’s position at the exact timestamp of funding settlement will determine the amount of funding fees to be paid or received.

2024 Rewards & Incentives

Trade-to-Earn Mechanism on ApeX

Trade-to-Earn offers participants an opportunity to earn rewards through their trading activities on ApeX. This mechanism rewards participants based on the volume of their trades: the more they trade, the more rewards they accumulate.

This initiative is structured as a 52-week program, divided into several rounds, allowing participants multiple opportunities to enhance their earnings. Participants are encouraged to engage in trading on any USDT contracts offered by ApeX to start earning rewards.

A brief history for newcomers: In November 2022, coinciding with the launch of ApeX Pro, the first Trade-to-Earn event was unveiled. This initiative attracted over 53,000 participants who earned rewards from their trading activities throughout the year. Preparations are now underway to expand this initiative, aiming to include even more traders in the forthcoming round.

Updates for Trade-to-Earn Round 2 This Year

For the second iteration of Trade-to-Earn this year, several enhancements have been introduced:

Introduction of the New $BANANA Token

The second round of Trade-to-Earn will feature the new $BANANA token on the Ethereum network. With a minted total of 10,000,000 $APEX tokens locked over a 12-month period and an initial redeem rate of 0.001, reward tokens are set to be automatically distributed bi-weekly among ApeXers trading USDT perpetual contracts on ApeX Pro.

Expanded Rewards Pool and Airdrop Opportunities

This year’s iteration promises an expanded rewards pool, offering additional excitement and incentive for ApeXers through potential airdrop opportunities. Beyond $BANANA rewards, traders will have the chance to earn rewards in tokens from partner projects. These allocations will depend on the traders’ overall Trade-to-Earn score and specific criteria related to the partner projects, details of which will be disclosed alongside the launch of these new prize pools and airdrop events. This initiative allows traders to multiply their rewards, potentially earning in various tokens beyond $BANANA.

Maximizing Rewards in Three Steps

-

Swap: Traders can swap $BANANA for USDT using the $BANANA-USDT pool at any point during the 52-week period.

-

Add Liquidity: By adding $BANANA and USDT to the $BANANA-USDT Pool, traders receive LP Tokens. The holding of LP Tokens during an epoch influences a trader’s Average LP Token Holdings, a significant determinant in the final distribution of $BANANA rewards at each epoch’s conclusion. A higher number of LP tokens increases the potential for receiving more $BANANA rewards.

-

Hold and Redeem: Long-term holders of $BANANA will have the opportunity to redeem $APEX governance tokens on a pro-rata basis after the event period, at the conclusion of the 52 weeks. The redemption rate will be determined by the quantity of $BANANA burnt in the Buy & Burn Pool at the event’s end.

Smart Liquidity Pool (SLP) on ApeX DEX

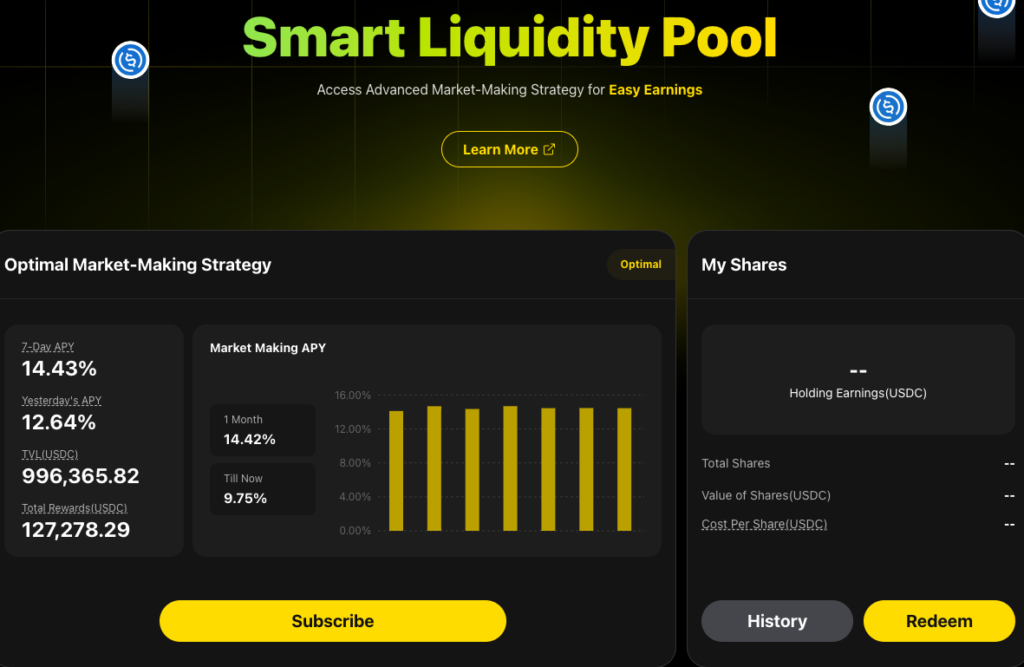

The Smart Liquidity Pool (SLP) stands as a pioneering market-making liquidity pool in the DeFi space, offering users a chance to assume the role of professional market makers. This opportunity comes with the potential for substantial profits, boasting an impressive return to risk ratio through the use of data-driven signals and position management systems.

Diverging from the standard market-making strategies and vault options available in the market, the Smart Liquidity Pool excels in executing a high volume of spread trades. It employs advanced signals and risk management tactics to sidestep adverse positions, setting a new standard for liquidity provision.

The pool’s highlights encompass:

- Enabling traders to access sophisticated market-making strategies by allocating their USDC funds to the pool.

- Utilizing automated trading algorithms that capitalize on fleeting market opportunities at any time.

- Implementing stringent security protocols to safeguard ApeXers’ assets against online threats.

- Enhancing the liquidity on the ApeX Pro trading platform, thereby deepening the order book and minimizing slippage for its users.

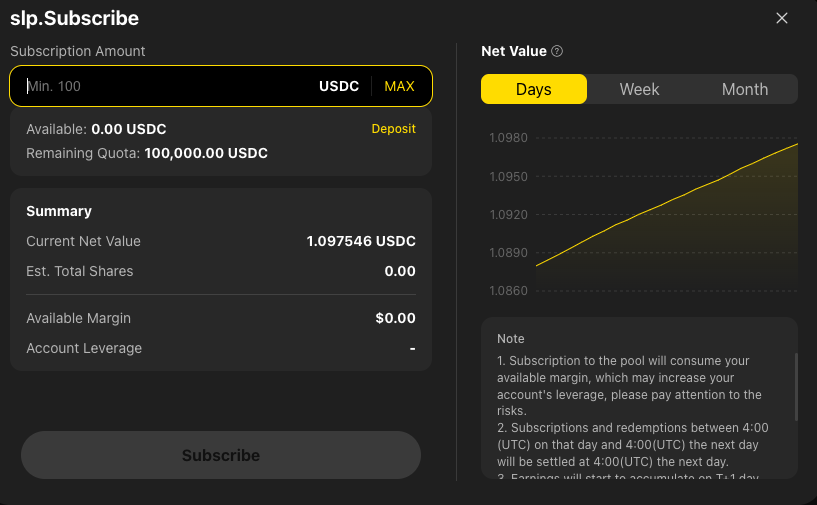

Accessing the Smart Liquidity Pool

Users are invited to deposit a minimum of 100 USDC into the Smart Liquidity Pool to partake in the profits derived from market-making activities. The pool promises a secure, transparent, and automated avenue for achieving higher yields on deposited assets.

The Total Value Locked (TVL) in the pool is the aggregate of USDC allocated by participants plus the profits garnered through the market-making strategy.

The Total Pool Shares are determined by dividing the TVL by the value of a single share, calculated before the market-making strategy commences profit generation.

Subscribing to the Pool

The value of a share is established by dividing the TVL by the total pool shares. A user’s share in the pool is then calculated based on their deposited amount in USDC, divided by the share value at the time of deposit.

Following a subscription, participants can view their total pool shares and commence yield accumulation.

Withdrawing from the Pool

The total amount receivable upon withdrawal is computed by multiplying a user’s pool shares by the share value at withdrawal. The yield is the product of the difference in share value at deposit and withdrawal times the user’s pool shares.

Participants select the quantity of pool shares to withdraw, with the total yield depending on the share value exchange rate at withdrawal time.

Yield Calculation

The pool’s subscription is settled daily, with the yield calculated on a daily basis and automatically reinvested, leading to compounded returns. The minimum lockup period for deposited USDC is one day, allowing for next-day earnings settlement at 4 AM UTC, after which withdrawal of earnings in USDC is permitted.

Yield, as displayed for each pool, is benchmarked against real yield calculations and benefits from automatic compounding for enhanced returns.

To initiate, participants must transfer funds from their wallet to their ApeX Pro account, noting that no fees apply for either subscription to or withdrawal from the Smart Liquidity Pool.

Apex DEX Staking Program: Revenue Sharing Incentives

The practice of staking has gained substantial traction within decentralized finance (DeFi) realms, serving as a conduit for community members to engage with and reap benefits from a platform’s ecosystem actively.

To reward community members for their contributions to the ecosystem, the ApeX Protocol introduced its Staking Program on January 10, 2023. This program supports $APEX and $esAPEX pools on both Ethereum and Arbitrum networks. It allows participants, referred to as ApeXers, to earn additional weekly income in USDC by distributing a portion of the ApeX Protocol’s revenue, which is primarily derived from trading fees on ApeX Pro.

An important update for participants is the transition to Staking 3.0, scheduled to commence on March 7, 2024, at 10AM UTC. Those involved in Staking 2.0 will have a one-month window following the launch to migrate their stakes without the time factor of their staked positions dropping to zero. Beginning March 4, 2024, the time factor will diminish daily through a linear reduction mechanism, eventually reaching zero. Participants are advised to migrate their Original Staked Positions from Staking 2.0 to Staking 3.0 promptly upon its activation and select their preferred Lock-Up terms for the newly established Locked Staked Positions.

Key Features of the Staking Program

-

Flexibility in Staking Terms: The program does not impose fixed staking durations, enabling participants to stake and unstake at their discretion. However, the returns on staking are directly proportional to the duration of the stake, encouraging participants to strategize their staking duration for optimal returns.

-

Inclusivity for All Traders: The program is designed to cater to traders of all practices and preferences, allowing them to earn effortlessly simply by staking their esAPEX and/or APEX tokens.

Comprehensive Reward Calculation: Beyond considering the volume of staked assets, the staking rewards formula also accounts for daily trading activity on ApeX Pro. This inclusive approach aims to amplify the overall gains for participants by acknowledging their engagement across the platform’s ecosystem.