Top 10 Crypto Copy Trading Platforms 2025

Copy trading has revolutionized the cryptocurrency landscape, enabling investors to mirror the strategies of seasoned traders. This approach democratizes access to sophisticated trading tactics, making it ideal for both novices and experienced investors.

1. Tapbit

Tapbit distinguishes itself with its innovative Zero Slippage Copy Trading feature, ensuring followers execute trades at the exact prices as the traders they emulate. This advancement addresses the common issue of slippage, enhancing profitability for users. Tapbit’s rigorous trader screening process evaluates trading behavior, risk management, and market adaptability, ensuring users have access to top-tier trading strategies.

Additionally, Tapbit holds multiple licenses, including the MSB fiat currency business license and the NFA general financial license, underscoring its commitment to security and compliance.

2. eToro

eToro is renowned for its user-friendly interface and robust social trading community. It offers a wide array of cryptocurrencies and provides detailed performance metrics for traders, aiding users in making informed decisions. However, users should be aware of inactivity fees and higher withdrawal charges.

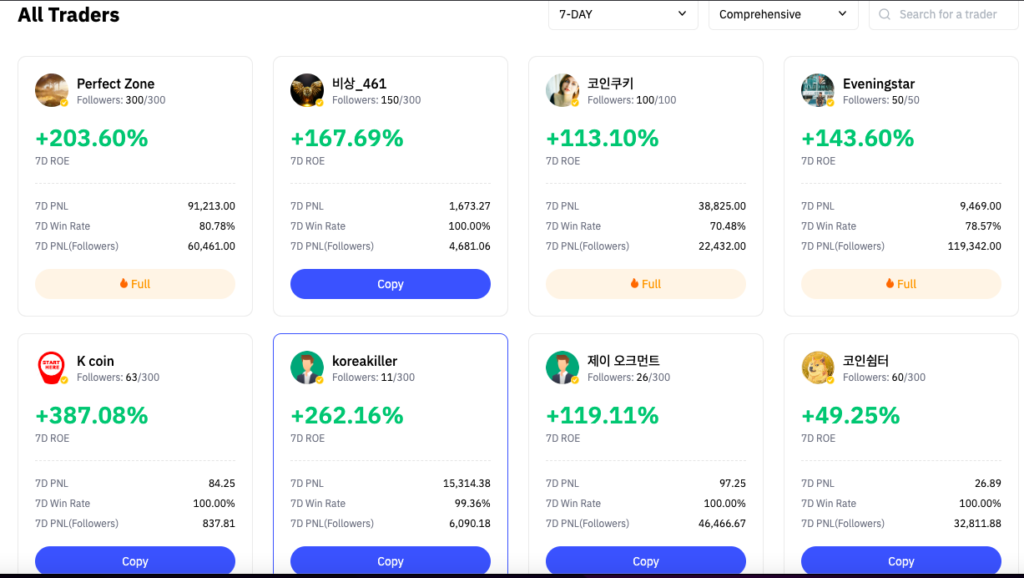

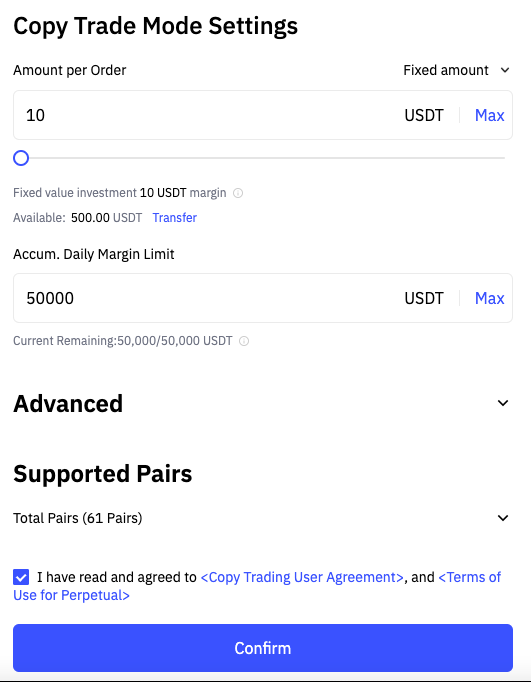

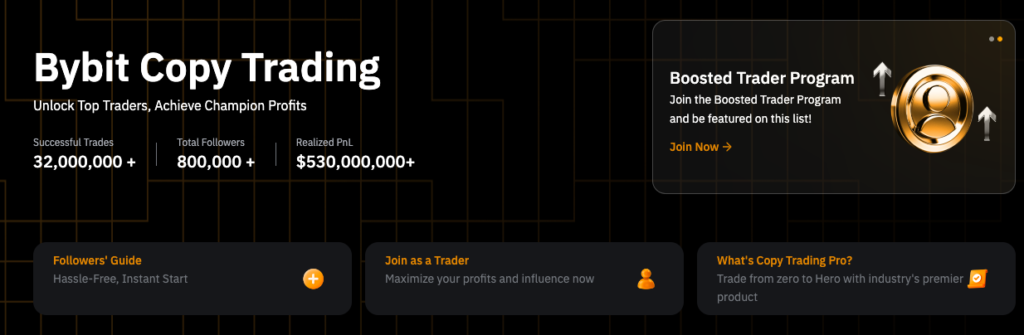

3. Bybit

Bybit caters to both novice and seasoned traders with its intuitive platform and up to 100x leverage. The platform offers customizable preferences and fund allocation options, along with sign-up bonuses. It’s important to note that Bybit is not available for U.S. residents, and fees can accumulate over time.

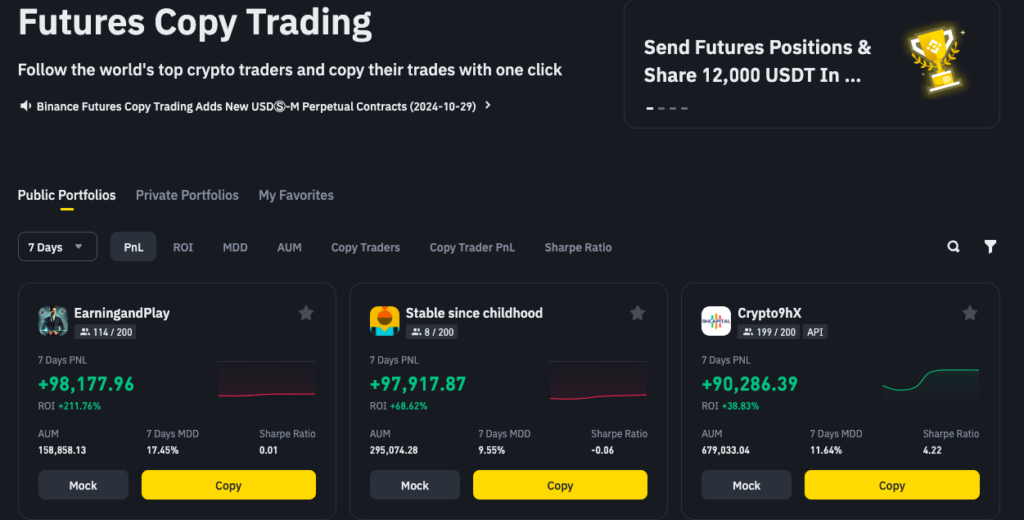

4. Binance

As one of the world’s largest cryptocurrency exchanges, Binance provides high liquidity and a global presence. Its copy trading feature allows users to replicate the strategies of experienced traders. However, some products may be limited depending on your location, and fees for smaller traders can be relatively high.

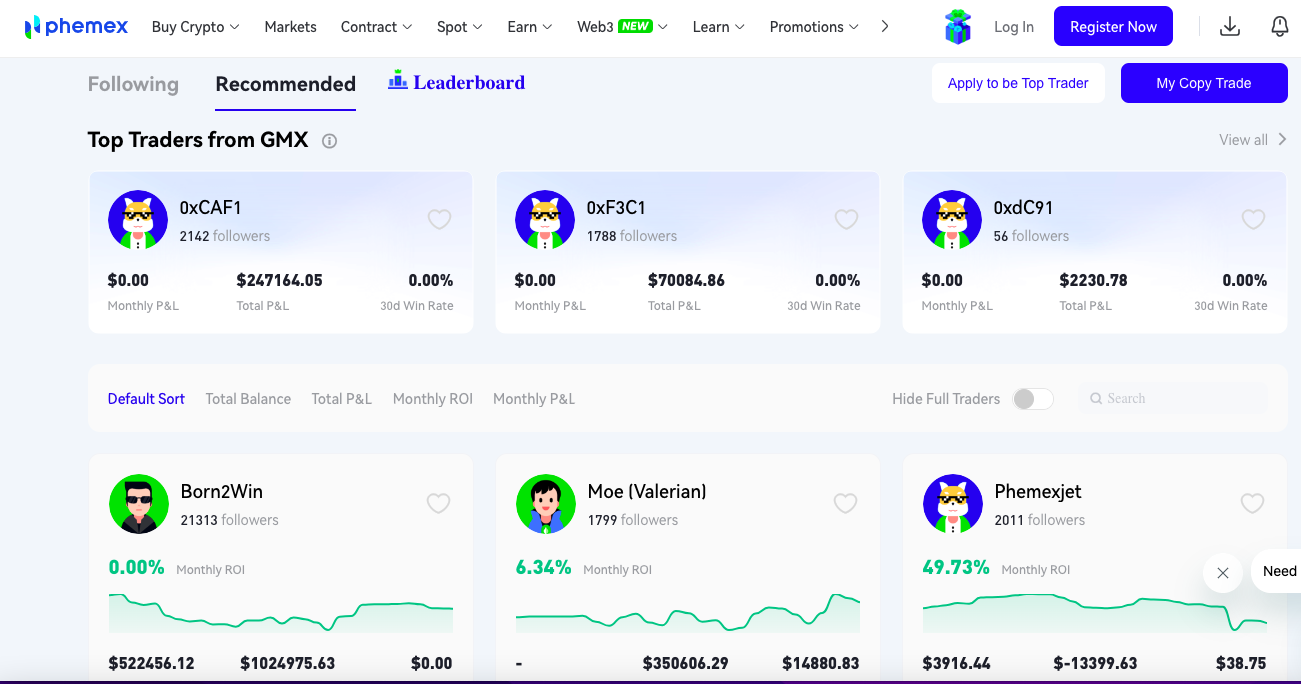

5. Phemex

Phemex is known for its advanced copy trading features and intuitive interface. It offers customizable copy order criteria and detailed performance metrics for traders. Users should be aware that withdrawal fees may apply, and there is a mandatory minimum withdrawal amount.

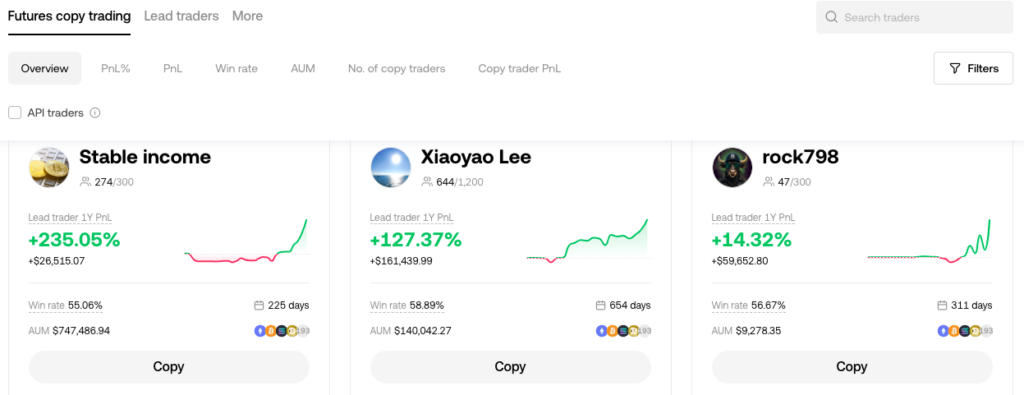

6. OKX

Formerly OKEx, OKX offers a user-friendly interface suitable for beginners and supports a broad assortment of coins and trading pairs. It provides low fees and the ability to filter traders by AUM capacity. However, it is not available for U.S. residents, and there are increasing KYC processes for users worldwide.

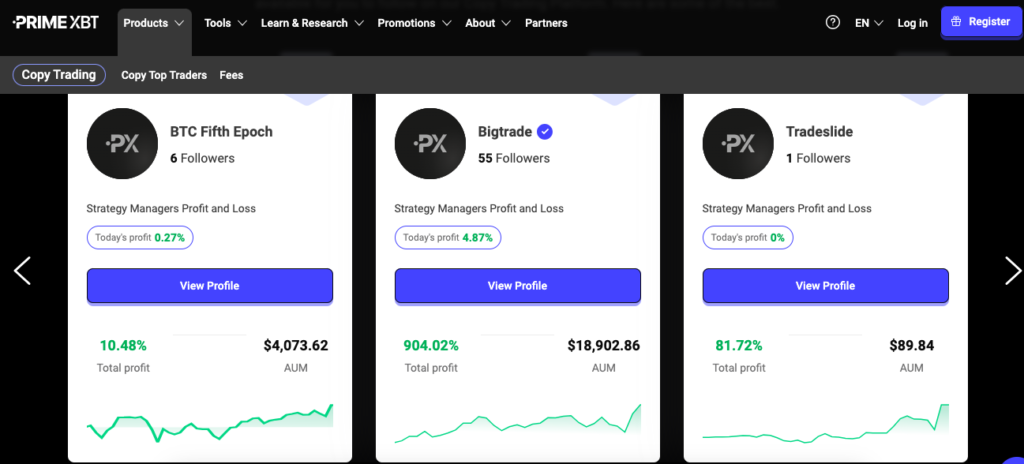

7. PrimeXBT

PrimeXBT combines a social trading platform with a crypto exchange, offering margin trading and copy trading services. It provides a demo account for practice and low fees, with the potential for high-profit sharing for traders. However, it may not be suitable for beginners, and geographical restrictions may apply.

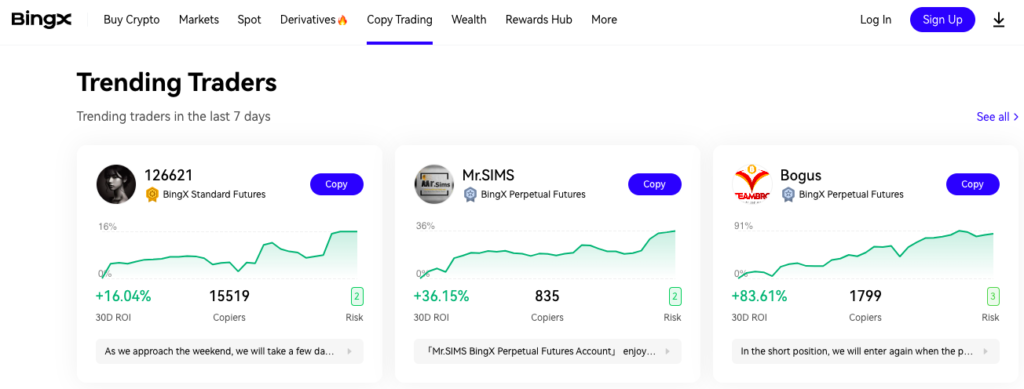

8. BingX

BingX offers a straightforward and flexible copy trading feature, fostering a community of traders for sharing ideas and strategies. It provides an active social trading community, an easy-to-use interface, and demo accounts available for practice. Users should be aware of higher transaction fees, and it is not available for U.S. residents.

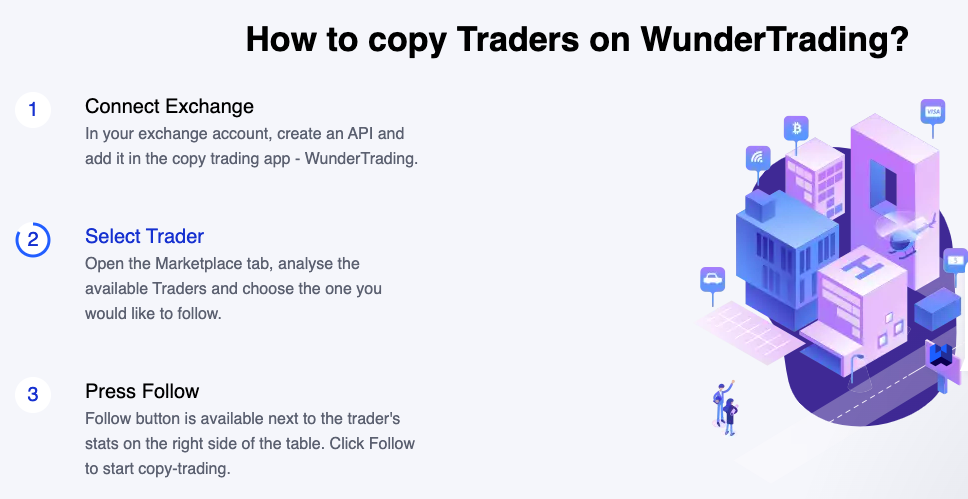

Wundertrading focuses on creating a community of traders, fostering collaboration, and providing educational resources. It offers strong emphasis on building a social trading community, collaboration and learning opportunities, and access to educational resources and tools. However, it has a growing user base but still relatively small, and includes weaker traders among all traders.

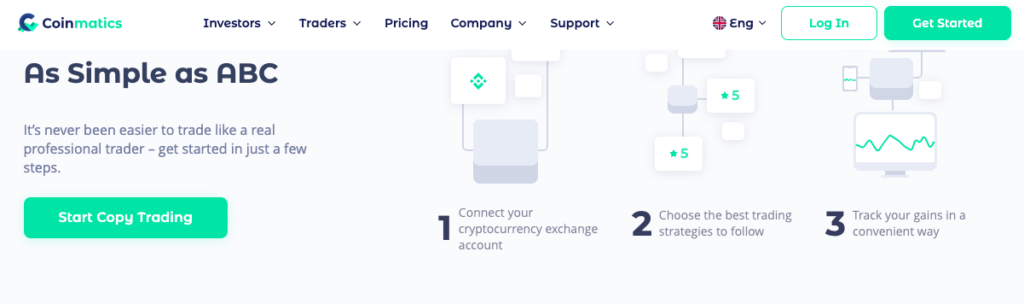

10. Coinmatics

Coinmatics is an automatic copy trading platform that allows users to copy the trading operations of profitable traders based on their preferences. It offers promotions for free plans often available, fast technical support, and a user-friendly interface. However, it has higher commission for traders, a minimum $50 USDT deposit required, and supports only three exchanges.

When selecting a copy trading platform, consider factors such as user interface, fee structure, available assets, and the platform’s regulatory compliance. Each platform offers unique features tailored to different trading preferences and risk tolerances.