Top 10 Crypto Arbitrage Bots

The world of crypto trading is fast-paced, with prices fluctuating in milliseconds. Arbitrage – profiting from price differences across exchanges – has become an essential strategy for savvy traders. In 2024, crypto arbitrage bots offer unprecedented ease and efficiency, making it possible to automate trades and capture fleeting profit opportunities. Here’s an in-depth look at the top arbitrage bots of 2024, designed to streamline your crypto trading.

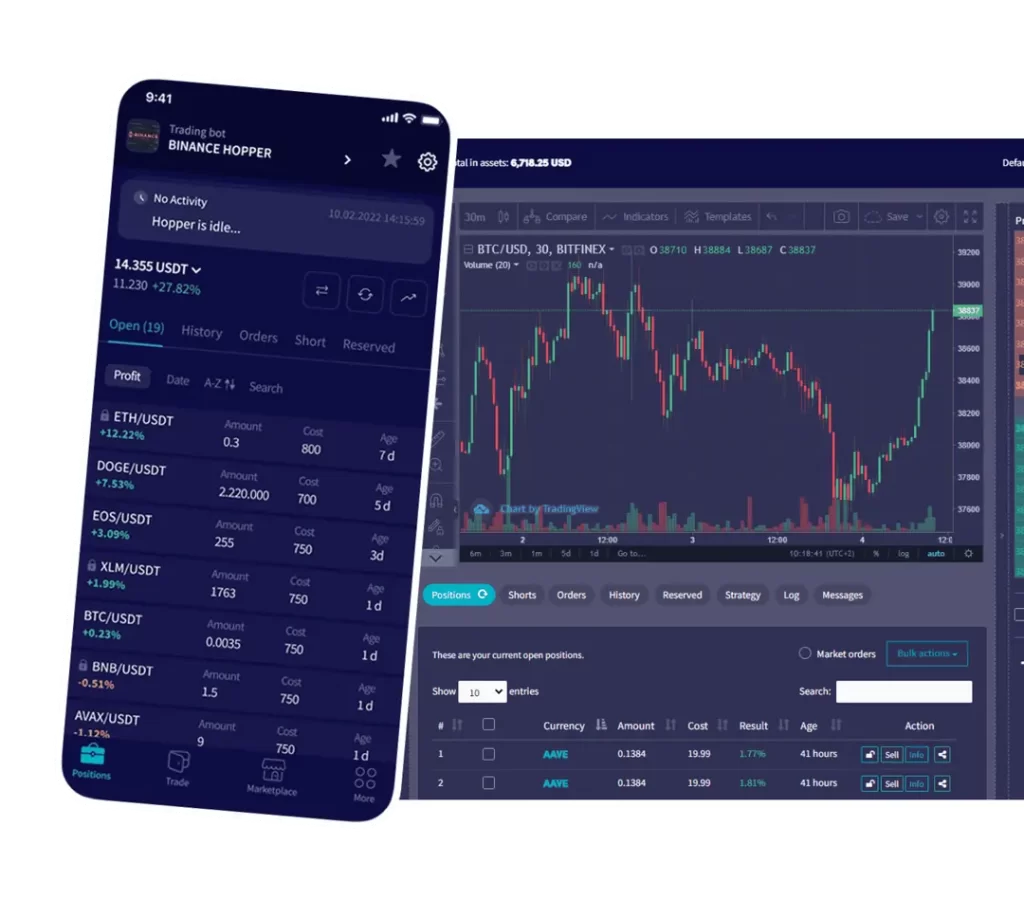

1. Cryptohopper

Cryptohopper is a powerful tool suitable for both beginners and seasoned traders. It stands out for its user-friendly interface and vast library of technical indicators, enabling users to tailor strategies according to market conditions. New traders can practice risk-free through paper trading, allowing them to test strategies without real funds.

- Features: AI-enhanced bots, cross-exchange arbitrage, and social trading.

- Pricing: Free version; Paid plans start at $19/month.

- Platform: Windows

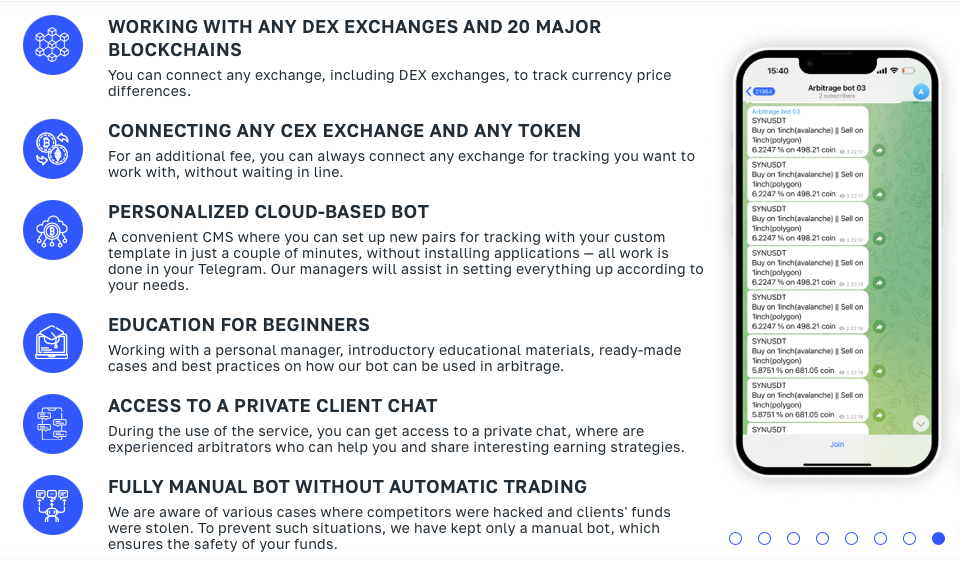

2. ArbitrageScanner.io

ArbitrageScanner.io excels in tracking price spreads across both centralized (CEX) and decentralized exchanges (DEX), providing traders with rapid alerts and access to manual bot operations, reducing security risks. The platform supports spot and futures arbitrage, enabling users to maximize returns on low-risk strategies.

- Features: Real-time spread alerts, manual bot, cross-blockchain tracking.

- Pricing: Free version; Paid plans start at $69/month.

- Platform: Web browser

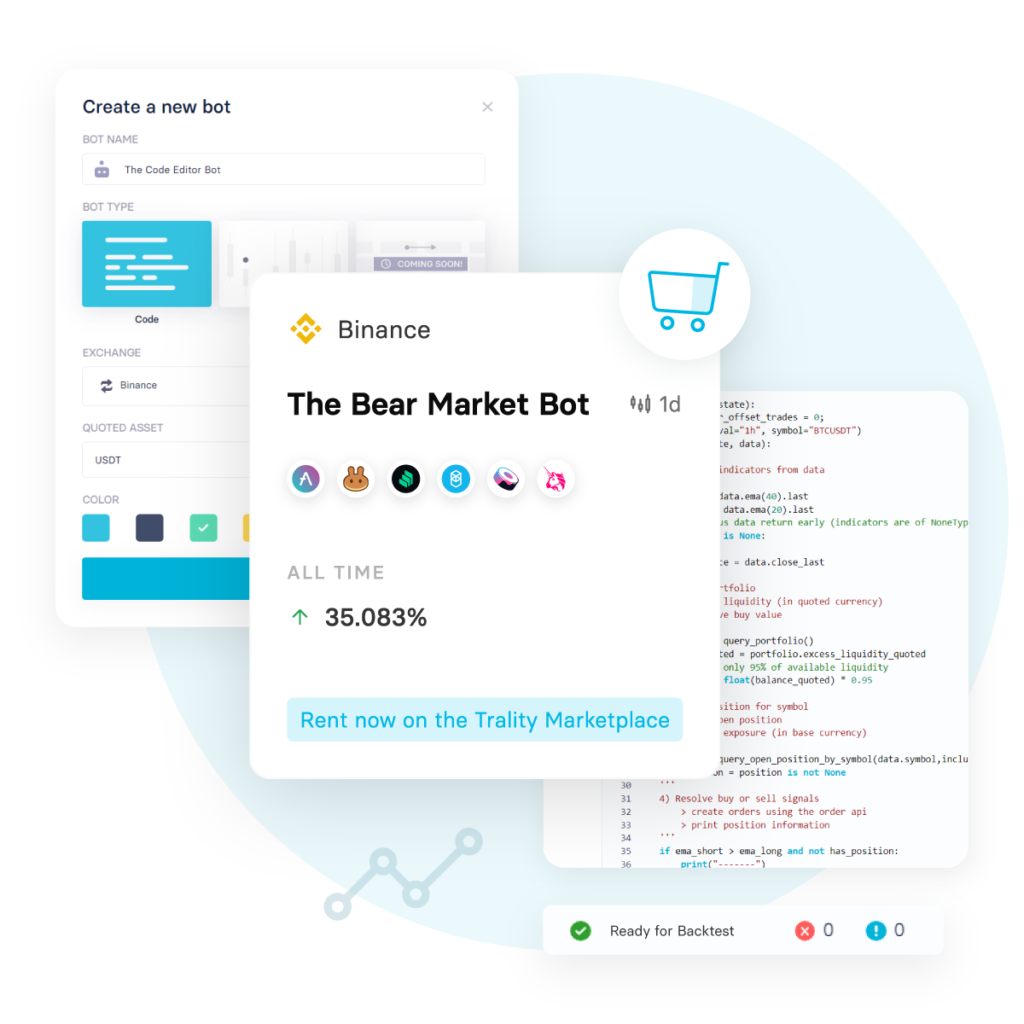

3. Traility

For those interested in coding their own bots, Traility offers an advanced code editor along with a marketplace to share, sell, or rent trading algorithms. Traility supports margin trading, which can be advantageous for experienced traders looking to maximize returns.

- Features: Code editor, bot optimizer, marketplace for strategies.

- Pricing: Free version; Paid plans start at €9.99/month.

- Platform: Windows

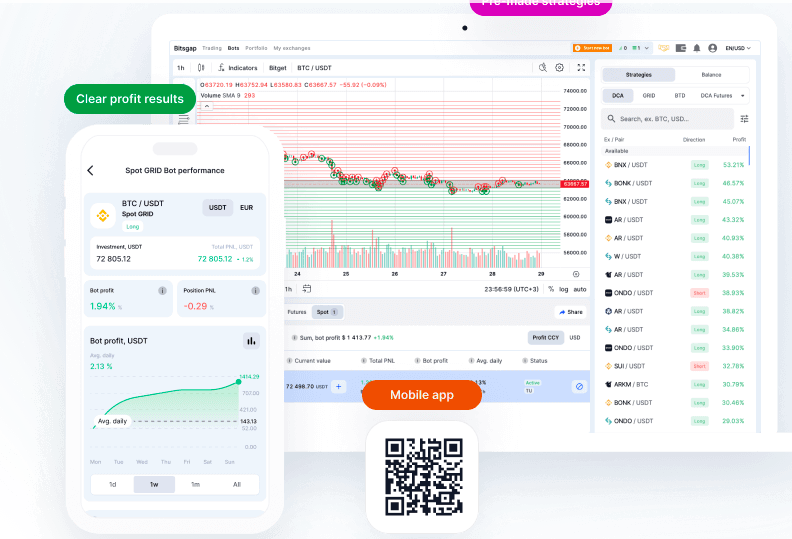

4. Bitsgap

Bitsgap is ideal for traders looking for a versatile platform that integrates multiple order types. It offers support for both GRID and DCA (Dollar Cost Averaging) strategies. With TradingView integration, Bitsgap allows users to manage their portfolios in real-time.

- Features: TradingView integration, smart orders, automatic portfolio management.

- Pricing: Free version; Paid plans start at $29/month.

- Platform: Windows, Android, Mac

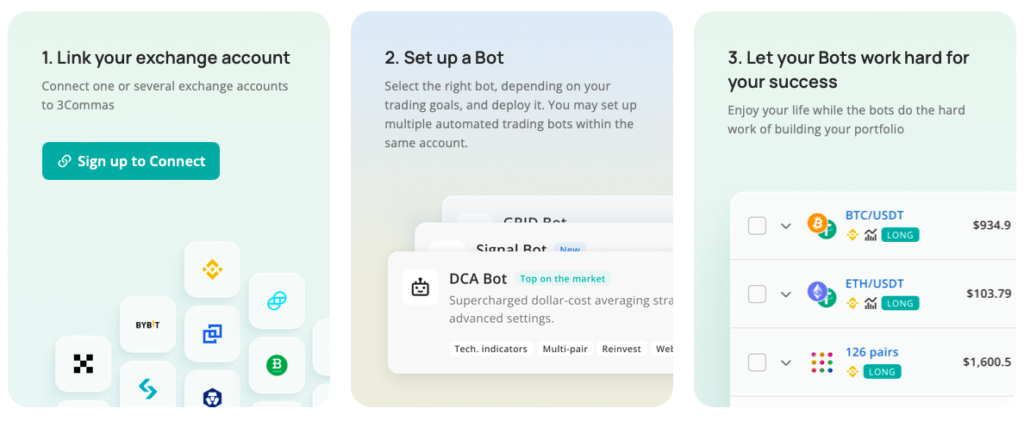

5. 3Commas

3Commas combines an extensive set of pre-configured trading algorithms with customizable bots, making it a suitable choice for professionals. It’s known for its advanced charting tools and copy trading features, helping users replicate successful strategies.

- Features: Copy trading, advanced charting, bot integration.

- Pricing: Free version; Paid plans start at $29/month.

- Platform: Windows

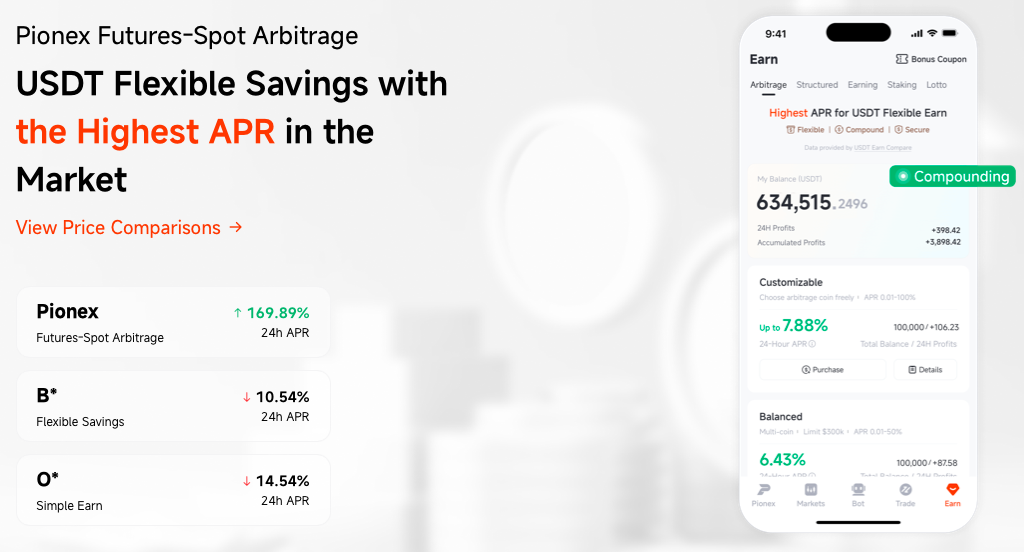

6. Pionex

With over 12 unique bots, Pionex offers a free, integrated trading platform designed specifically for arbitrage. Its “Smart Trade” function automatically adjusts stop-loss and take-profit levels, enhancing trading strategy efficiency.

- Features: AI strategy, grid trading, automated take-profit and stop-loss adjustments.

- Pricing: Free with 0.05% trading fees.

- Platform: Android, iPhone

7. Kryll

Kryll is designed for those who prefer a visual approach to building trading strategies. With drag-and-drop functionality, users can create advanced trading setups without coding knowledge. It also offers a marketplace to rent and sell strategies.

- Features: Visual strategy editor, historical data access, community marketplace.

- Pricing: Free version available; other fees vary.

- Platform: Android, iPhone

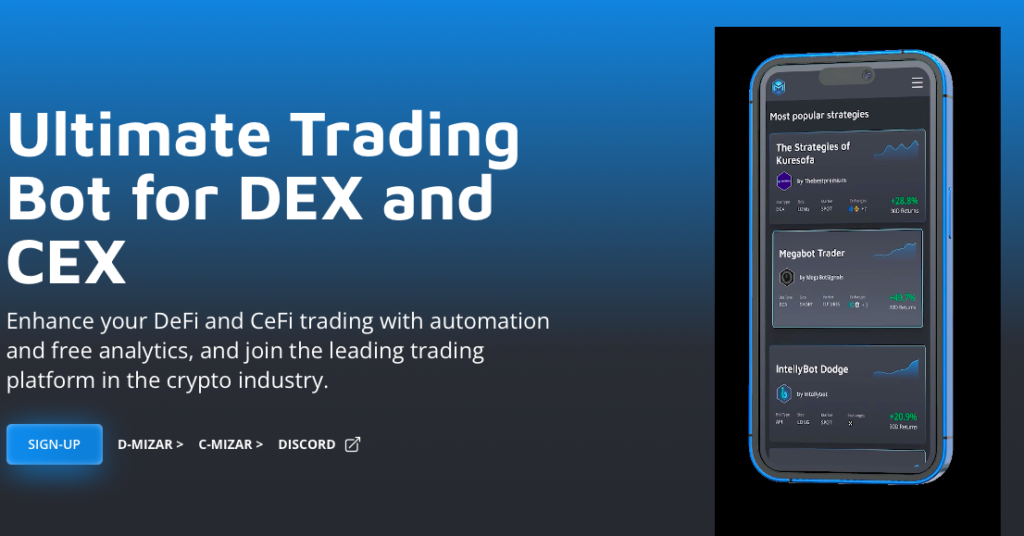

8. Mizar

Specializing in triangular arbitrage, Mizar uses smart order execution to capitalize on discrepancies between three different cryptocurrencies. Its real-time data enhances trade speed, and it supports copy trading for additional flexibility.

- Features: Triangular arbitrage, smart order execution, real-time market data.

- Pricing: Free version available; 0.5% trading fee.

- Platform: Windows

9. Wundertrading

A cloud-based platform, Wundertrading lets you access your bots from any device with an internet connection. It offers DCA, Grid, and futures bots along with automated portfolio management features for comprehensive trade tracking.

- Features: Fiat-compatible arbitrage, DCA, Grid bots, portfolio management.

- Pricing: Free version; Paid plans start at $9.95/month.

- Platform: Windows

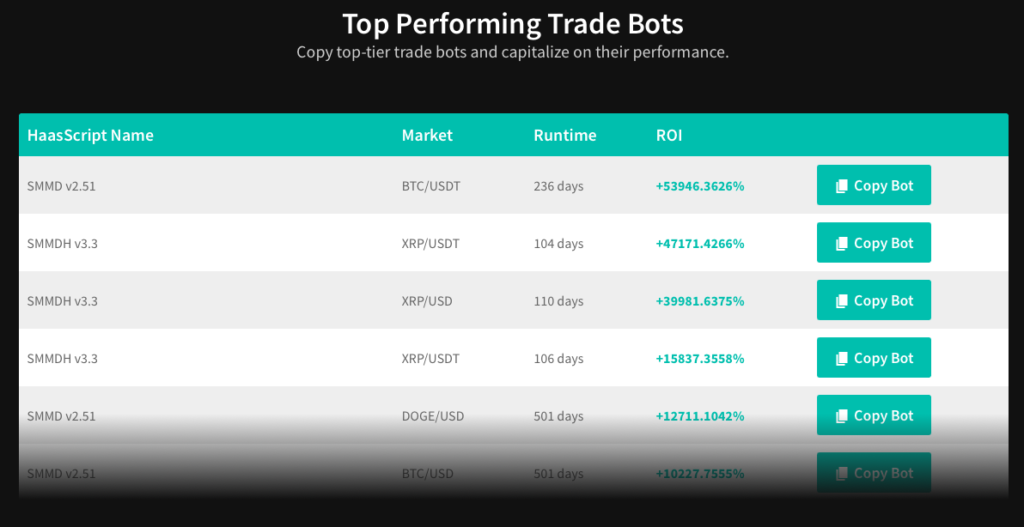

10. HaasOnline

HaasOnline’s backtesting and strategy modification tools make it an excellent choice for those who prefer a hands-on approach. It supports multiple arbitrage types, including statistical and triangular arbitrage, and offers reliable paper trading functionality.

- Features: Advanced backtesting, customizable bots, email support.

- Pricing: Free version; Paid plans start at $9/month.

- Platform: Windows, Android, Mac

Types of Crypto Arbitrage Bots

- Convergence Arbitrage Bots: Capitalize on price convergence across assets.

- Triangular Arbitrage Bots: Exploit price differences among three crypto assets.

- Statistical Arbitrage Bots: Use historical data to identify profitable anomalies.

- Decentralized Arbitrage Bots: Operate on DEXs using smart contracts.

- Spatial Arbitrage Bots: Target geographic price disparities across exchanges.

How to Choose the Right Arbitrage Bot

- Security: Look for strong encryption and API management.

- Performance: Choose bots with a proven track record and backtesting features.

- Supported Markets: Ensure your bot covers the exchanges you trade on.

- Fees: Factor in monthly fees or transaction-based costs.

- Ease of Use: Platforms like Cryptohopper and Pionex are known for user-friendly interfaces.

Conclusion

Crypto arbitrage bots offer substantial opportunities for traders to automate and optimize their strategies in volatile markets. While tools like Cryptohopper and Pionex are perfect for beginners, platforms like HaasOnline and ArbitrageScanner.io cater to more advanced traders. With the right bot, you can capture profitable trades faster and with greater precision than ever before.