Why Bitcoin’s Bull Market May Defy Historical Patterns

Cryptocurrencies, led by Bitcoin, have historically exhibited four-year price cycles characterized by dramatic peaks and valleys. These cycles have been driven by a combination of supply shocks, market sentiment, and speculative fervor. However, as crypto matures into a mainstream asset class, market behavior is beginning to diverge from historical norms. With the advent of regulatory clarity, institutional adoption, and the introduction of spot Bitcoin and Ether ETFs, the crypto market could be poised for a new era, where cycles flatten and fundamentals take precedence.

The Evolution of Bitcoin Cycles

Bitcoin’s past price cycles were defined by rapid growth and sharp corrections. The first two cycles saw prices skyrocket over 500x from their lows, followed by two cycles with more modest, but still significant, 20x to 100x gains. The ongoing cycle, which began after Bitcoin’s 2022 low of $16,000, has seen a comparatively restrained 6x return. While some interpret this as diminishing returns, it also signals a maturing market where speculative bubbles are less pronounced.

A key feature of these cycles has been the Bitcoin halving events, which occur approximately every four years and reduce the issuance of new coins. These halvings have historically triggered supply shocks, driving prices upward. However, as Bitcoin adoption widens and market liquidity deepens, the impact of halving events may diminish, paving the way for more stable growth trends.

Current Indicators: A Mid-Cycle Bull Market

On-chain metrics suggest Bitcoin is in the intermediate stage of its current cycle. The Market Value to Realized Value (MVRV) ratio, currently at 2.6, remains below the peak levels of prior cycles, signaling potential for further price appreciation. Similarly, the HODL Waves indicator, which tracks on-chain activity, shows that only 54% of Bitcoin’s free float supply has moved in the past year—below the 60% threshold observed in past bull markets.

Bitcoin miner behavior provides additional clues. The Miner Cap to Thermocap (MCTC) ratio, a measure of miners’ profitability, sits at 6, well below the historical cycle peaks of 10. This suggests miners are not yet under pressure to sell their holdings, reducing downward price pressure.

Beyond Bitcoin: Altcoins and Broader Market Trends

While Bitcoin dominates crypto market narratives, the broader market reveals additional insights. Historically, Bitcoin’s market dominance has declined two years into bull markets, as investors rotate into altcoins seeking higher returns. This pattern is repeating in the current cycle, with Bitcoin dominance waning as capital flows into altcoins.

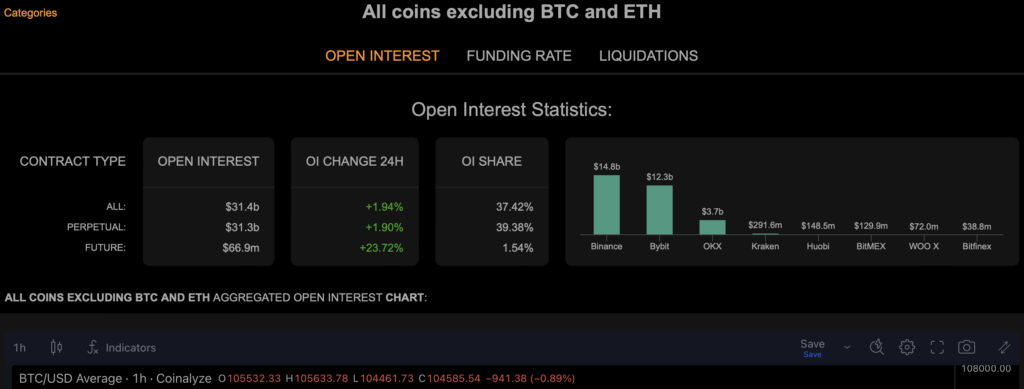

Perpetual futures markets offer further evidence of speculative activity. Altcoin open interest reached a staggering $54 billion before a wave of liquidations reduced speculative positioning. Despite this pullback, open interest remains elevated, signaling a market still in its growth phase rather than nearing exhaustion.

Positive funding rates for altcoin perpetual futures further highlight sustained investor appetite for leverage, though they remain below the speculative peaks of previous cycles. These metrics suggest the crypto market has room to grow, even as speculative activity remains relatively tempered.

Institutional Tailwinds: Spot ETFs and Regulatory Clarity

The approval of spot Bitcoin and Ether ETFs in the U.S. marks a pivotal moment for crypto adoption. These products have attracted over $36 billion in net capital inflows, broadening access to digital assets and embedding them in traditional portfolios. Institutional investors, historically hesitant due to regulatory uncertainty, now view crypto as a legitimate asset class.

Regulatory developments, particularly in the U.S., are likely to accelerate this trend. A Congress more aligned with clear crypto oversight could solidify the industry’s position in the global financial system, ensuring a steady flow of institutional capital. These dynamics reduce the likelihood of sharp cyclical downturns, replacing them with more sustained growth trajectories.

Macro Factors: The Broader Market Context

Crypto markets do not exist in isolation. Broader macroeconomic conditions, including central bank policies, global liquidity, and risk sentiment, play a critical role in shaping market trends. Bitcoin’s correlation with risk assets like equities suggests that a favorable macro backdrop – such as easing inflation and dovish central bank policies – could extend the bull market.

Moreover, Bitcoin’s role as a digital commodity with finite supply enhances its appeal in an environment of fiscal uncertainty and growing interest in alternative stores of value. The ongoing geopolitical realignments and monetary policy experiments in major economies may further boost demand for decentralized assets.

Predictions for 2025 and Beyond

The current crypto market landscape suggests a break from the historical four-year cycle paradigm. As on-chain indicators remain below peak levels, and institutional adoption drives steady capital inflows, the bull market is likely to extend well into 2025. However, several risks remain:

- Regulatory Overreach: While regulatory clarity is a net positive, overly restrictive measures could stifle innovation and dampen market enthusiasm.

- Macroeconomic Shocks: A sudden shift in global liquidity or risk sentiment could trigger a market correction.

- Speculative Excess: A rapid buildup of speculative positions, particularly in altcoins, could lead to localized blow-offs.

Nonetheless, the crypto market is evolving toward a more sustainable growth model. As fundamentals such as application adoption and institutional involvement take center stage, Bitcoin and its peers are well-positioned to transcend their early speculative cycles.

Conclusion

The crypto market is at a crossroads. While echoes of past cycles remain, the asset class is maturing, driven by structural factors that favor long-term growth over short-term volatility. By leveraging on-chain metrics, monitoring macro trends, and understanding the dynamics of institutional capital, investors can navigate this evolving landscape with confidence. The era of predictable four-year cycles may be ending, but the future of crypto as a transformative asset class is just beginning.