Smart Ways to Generate Passive Income with Bitcoin

Bitcoin’s recent surge following the Trump presidential news underscores its status as a leading risk-on asset. With BTC rallying 26% in a single week, the asset has entered a new phase of institutional adoption and broader market validation. Wall Street is diving in, with ETF inflows surpassing $1 billion in days, global liquidity rising, and even sovereign nations integrating BTC into their treasuries.

For retail investors, Bitcoin’s role as digital gold is undisputed. It has overtaken silver in market cap and is only a 10x leap from challenging gold. But with BTC sitting idle in wallets, a question arises: What can you do with your BTC?

While holding is often the safest bet, there’s a growing ecosystem of opportunities to put your BTC to work. Below, we delve into seven cutting-edge strategies for generating yield and enhancing your Bitcoin’s utility.

1. BTC Staking: Unlocking Yield from Digital Gold

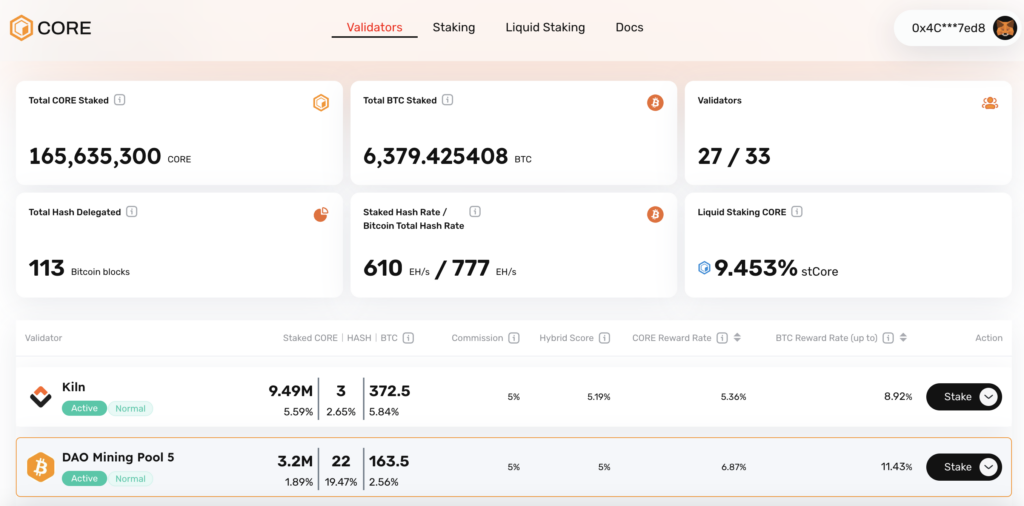

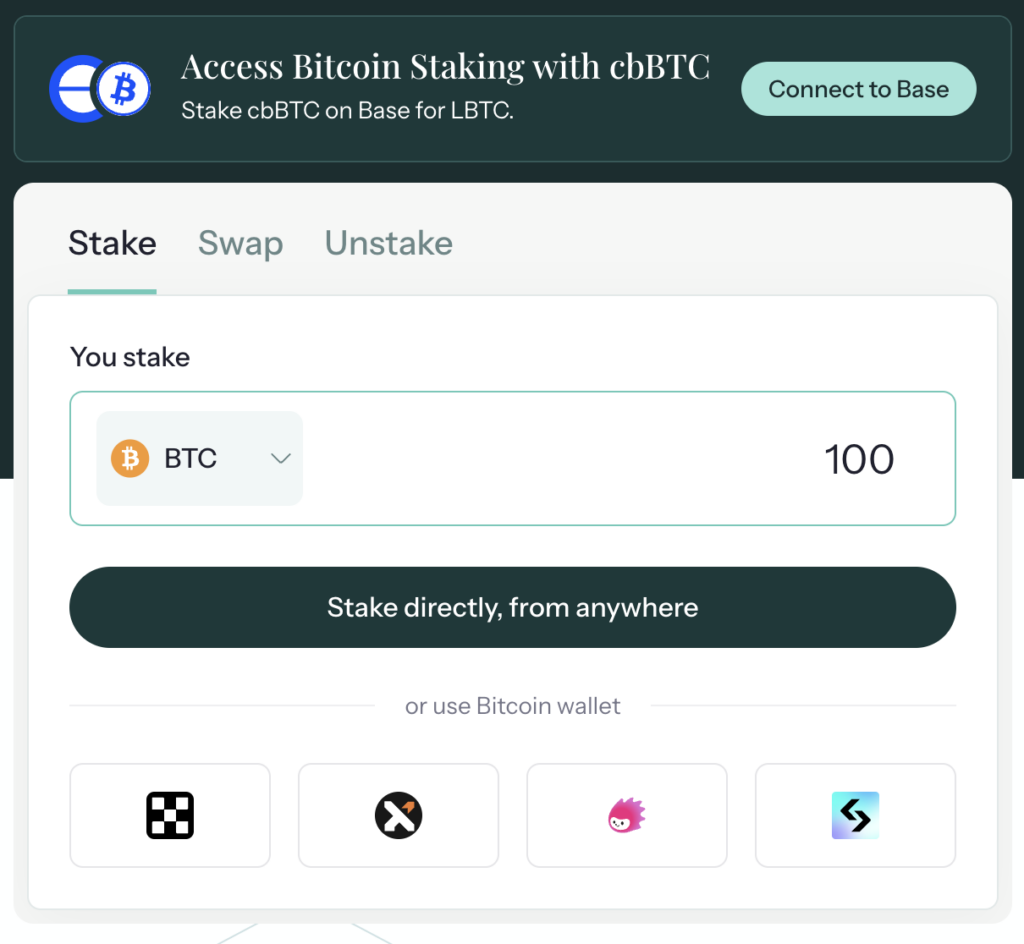

Though Bitcoin is a Proof-of-Work asset, innovative protocols now enable BTC staking to secure networks. Platforms like Core and Botanix offer BTC staking options, while liquid staking protocols such as Lombard and pSTAKE have introduced tokenized BTC derivatives (e.g., LBTC, EBTC).

These derivatives can be leveraged across DeFi to earn sustainable double-digit APYs.

These derivatives can be leveraged across DeFi to earn sustainable double-digit APYs. 💡 Key Insight: Liquid staking not only generates yield but also offers liquidity, enabling you to utilize your BTC in additional DeFi strategies.

💡 Key Insight: Liquid staking not only generates yield but also offers liquidity, enabling you to utilize your BTC in additional DeFi strategies.

2. BTC Restaking: Amplifying Security for Additional Rewards

Restaking, popularized by Ethereum’s EigenLayer, is now available for Bitcoin through networks like Babylon. By leveraging Bitcoin’s economic security, restaking allows protocols to secure their ecosystems without building new infrastructure. Babylon‘s model incentivizes restakers with potential airdrops and speculative rewards.

💡 Key Insight: Restaking combines yield potential with a speculative edge, making it attractive for long-term BTC holders who can stomach higher risk.

3. BTC Lending: Passive Income Meets Liquidity Access

BTC lending through platforms like AAVE enables you to earn interest while maintaining liquidity. Borrowers pay for the privilege of accessing capital against collateral, creating a straightforward avenue for generating yield.

💡 Key Insight: BTC lending is a low-effort, reliable way to earn yield, ideal for risk-averse investors.

4. BTC Liquidity Providing (LPing): Earning Fees in DeFi Markets

BTC itself may not be directly DeFi-compatible, but wrapped versions (e.g., wBTC) allow you to provide liquidity on decentralized exchanges like Uniswap and Curve. By facilitating trades, you earn a share of transaction fees. Using correlated pools like BTC-BTC reduces impermanent loss risks.

💡 Key Insight: LPing offers a practical way to earn fees, especially when paired with protocols like Pendle for enhanced strategies.

5. PT Tokens: Fixed Income and Yield Amplification

Protocols like Pendle tokenize future yields, enabling you to buy BTC at a discount through PT tokens. These assets can then be used in other protocols to multiply your yield or hedge against market volatility.

💡 Key Insight: PT tokens offer a blend of fixed income and yield optimization, appealing to those who value predictability and diversification.

6. Option Strategies: Generating Premium Through Covered Calls

Options trading, especially selling covered calls, is a proven income strategy. By selling out-of-the-money (OTM) calls on your BTC, you collect premiums while retaining your BTC exposure. For example:

- Bob buys 5 BTC.

- Bob sells 5 OTM BTC call options and earns a premium.

If BTC’s price remains below the strike price, Bob keeps the premium as yield.

💡 Key Insight: Platforms like Cega and Derive simplify options trading, making this strategy accessible even to retail investors.

7. Perpetual/Derivative Liquidity: Profiting from Market Speculation

Perpetual exchanges, such as GMX, offer opportunities to provide liquidity and earn fees. Single-sided liquidity options minimize impermanent loss while maintaining exposure to BTC. For high-frequency traders, perpetuals provide additional avenues for leveraging market activity.

💡 Key Insight: Liquidity provision on perpetual markets caters to experienced investors seeking higher yields with manageable risks.

Navigating the Risks

While the potential for yield is enticing, it’s crucial to understand the risks:

- Blockchain Risks: Vulnerabilities in the underlying chain.

- Smart Contract Risks: Code exploits or bugs.

- Depeg Risks: Wrapped BTC losing parity with BTC.

- Collateral Risks: Market downturns affecting collateralized positions.

- Slashing Risks: Losses from protocol penalties in restaking scenarios.

Actionable Advice: Always diversify across strategies to mitigate concentrated risks and maintain a portion of your BTC in cold storage for ultimate security.

Macro Takeaway: The Evolving BTC Ecosystem

Bitcoin is no longer a static “buy-and-hold” asset. Its integration into the broader DeFi landscape has unlocked unprecedented opportunities for yield generation and financial innovation. Whether you’re staking, lending, or exploring derivatives, these strategies allow you to actively participate in the Bitcoin economy while building wealth.

💡 Closing Thought: By making your Bitcoin work for you, you not only maximize its potential but also position yourself at the forefront of financial innovation. The next decade will belong to those who leverage assets intelligently – be among them.