How to Use Crypto and AI to Build Wealth in 2025

Imagine earning while you sleep as AI agents automate your crypto investments, optimize yields, and even create value-generating digital assets. This isn’t just a pipe dream; it’s the new reality of passive income in the digital age.

If you’re intrigued by the idea of combining AI and crypto to grow your wealth, this guide will introduce the most promising strategies, tools, and platforms to get started.

1. Yield Optimization with AI-Powered DeFi Tools

Decentralized Finance (DeFi) has already revolutionized how we think about financial services, and AI is taking it one step further. AI-powered tools are being used to:

- Automate Yield Farming: AI agents can analyze and predict the best liquidity pools to stake your tokens, maximizing annual percentage yields (APY) while reducing risk.

- Optimize Lending and Borrowing: AI bots monitor DeFi lending platforms like Aave or Compound, moving funds to platforms with the best rates.

- Real-Time Rebalancing: By constantly scanning the market, AI agents can rebalance your portfolio, moving funds to where they’ll generate the most return.

💡 Example: Tools like Yearn.Finance now integrate AI algorithms to suggest optimized vaults for yield farming, allowing users to sit back and let the algorithms work.

2. Staking with AI Agents

Crypto staking allows you to earn rewards by locking up your cryptocurrency in a proof-of-stake (PoS) network. AI tools simplify and optimize this process:

- Portfolio Analysis: AI agents recommend which coins to stake based on risk, lock-up periods, and expected rewards.

- Automated Staking Strategies: Platforms powered by AI can automatically delegate your tokens to validators with the highest performance, boosting your staking rewards.

💡 Example: Projects like Lido and RocketPool use AI to optimize validator selection and ensure higher reliability for Ethereum staking.

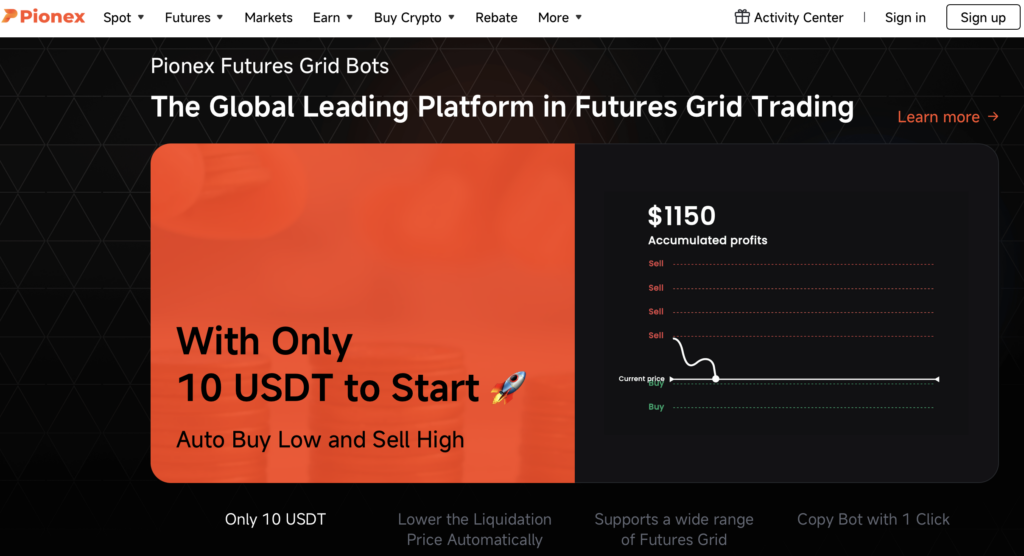

3. Automated Crypto Trading

AI bots are redefining how individuals approach crypto trading. Unlike traditional traders, these bots don’t sleep – they analyze data 24/7 to execute profitable trades. Here’s how they help:

- Market Sentiment Analysis: AI scans social media and news platforms to gauge market sentiment and anticipate price movements.

- Predictive Analytics: Machine learning models predict price trends based on historical data and real-time market conditions.

- Scalping and Arbitrage: Bots take advantage of minor price differences across exchanges, performing hundreds of micro-trades per day to generate profits.

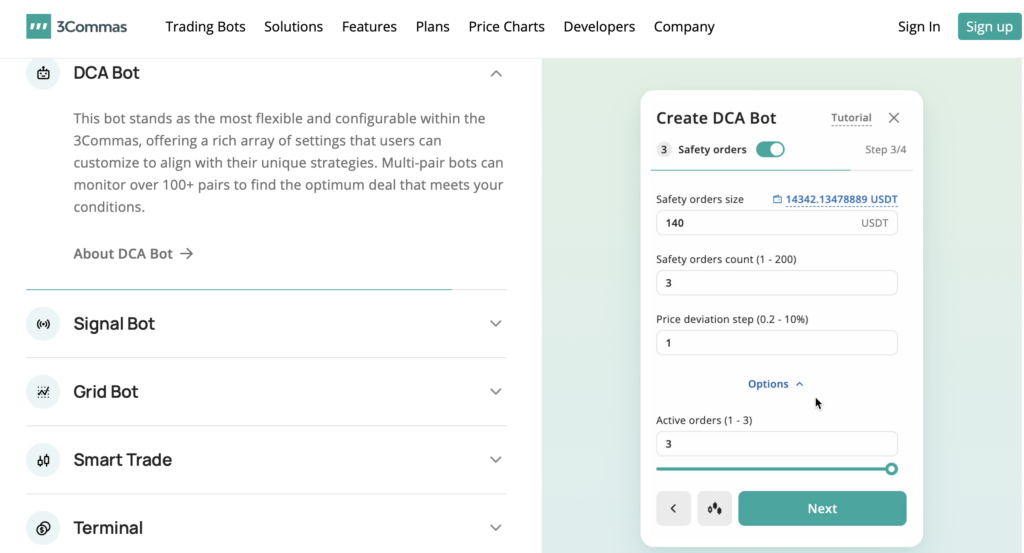

💡 Example: Tools like 3Commas and Pionex offer beginner-friendly AI trading bots capable of executing sophisticated strategies with minimal manual input.

4. Passive Income from AI-Created NFTs

Non-fungible tokens (NFTs) have opened up a new world of digital ownership. AI can now assist in generating unique, high-value digital art or assets:

- AI-Generated Content: Platforms like Artbreeder or NightCafe use AI algorithms to create stunning digital art that can be tokenized as NFTs and sold on marketplaces like OpenSea.

- Fractional Ownership: By leveraging fractionalization platforms, you can earn passive income from NFTs by sharing ownership with other investors.

- Dynamic NFTs: AI can create NFTs that evolve over time, increasing their uniqueness and potentially their market value.

💡 Example: Beeple’s success in selling digital art for millions underscores the potential of combining creativity, AI, and blockchain.

5. Renting Digital Assets in the Metaverse

The rise of metaverse platforms like Decentraland and The Sandbox is unlocking new opportunities for passive income:

- Virtual Real Estate Rentals: AI algorithms identify prime locations to purchase digital land, which can then be rented to businesses or creators.

- AI-Powered Experiences: You can use AI to create immersive experiences or digital storefronts in the metaverse, attracting visitors and generating revenue.

💡 Example: Metaverse landowners are earning thousands by leasing virtual plots for concerts, events, or branded experiences.

6. AI-Powered Tokenized Agent Economies

AI agents are increasingly being tokenized, enabling them to act as revenue-generating assets. By holding or deploying these tokenized agents, you can earn passive income through:

- Initial Agent Offerings (IAOs): Similar to token launches, IAOs allow you to invest in AI agents that perform specific tasks, such as market research or social media management.

- Revenue-Sharing Models: Token holders may earn a portion of the agent’s revenue from tasks like content creation, data analysis, or trading.

- Agent Deployment Fees: As the owner of an AI agent, you can charge fees for its deployment or usage in various applications.

💡 Example: Virtuals Protocol and ai16z DAO are pioneers in creating tokenized agents for crypto markets, with returns linked to their operational success.

7. Decentralized AI Funds

AI-driven Decentralized Autonomous Organizations (DAOs) are enabling users to pool funds and benefit from AI-driven investments:

- AI-Led Hedge Funds: These DAOs use AI to analyze market trends and execute trades, distributing profits to token holders.

- Democratized Venture Capital: By contributing to AI-driven investment DAOs, you can gain exposure to high-potential crypto projects selected by AI.

💡 Example: ai16z DAO employs an AI agent to manage its $10M AUM portfolio, potentially redefining the venture capital space.

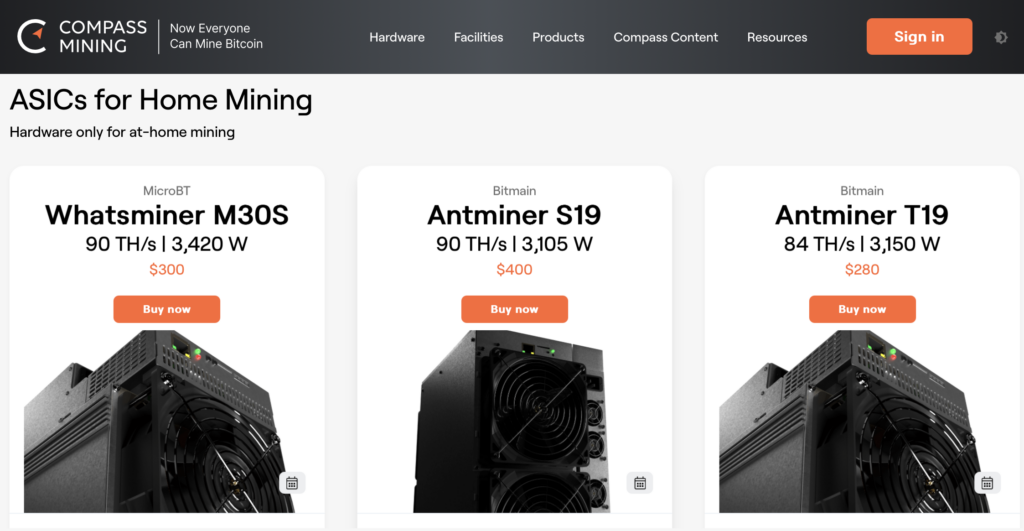

8. Mining 2.0: AI and Green Crypto Mining

Traditional crypto mining is energy-intensive and becoming less accessible. AI is now helping miners:

- Optimize Energy Usage: AI algorithms predict the cheapest energy times, reducing mining costs.

- Green Mining Initiatives: Some platforms use AI to connect miners with renewable energy sources, ensuring sustainable practices.

- Mining Pools: AI selects the most profitable pools and adjusts your participation in real-time.

💡 Example: AI-powered mining rigs by Compass Mining are revolutionizing crypto mining efficiency.

9. Creating AI-Powered dApps

For those with technical expertise, building AI-powered decentralized applications (dApps) can provide long-term revenue streams:

- Subscription Models: Charge users for premium features or access to AI-powered tools.

- Marketplace Revenue: Earn commissions by hosting user-generated content or services.

- Revenue-Sharing Protocols: Use smart contracts to automate income distribution from dApp activities.

💡 Example: Projects like Fetch.ai are creating decentralized marketplaces for AI services, paving the way for innovative applications.

The Future of Passive Income with AI and Crypto

The intersection of AI and crypto is a game-changer for wealth generation. These tools don’t just automate – they optimize and elevate your income potential. As AI continues to evolve, expect more sophisticated platforms and opportunities to emerge.

Whether you’re a crypto veteran or a curious beginner, leveraging AI tools to earn passive income is a smart move in this age of technological innovation. Start exploring, start automating, and watch your portfolio grow – one AI-driven decision at a time. 🌐🚀