How Crypto Futures Move the Spot Market

Why Derivatives Move the Market

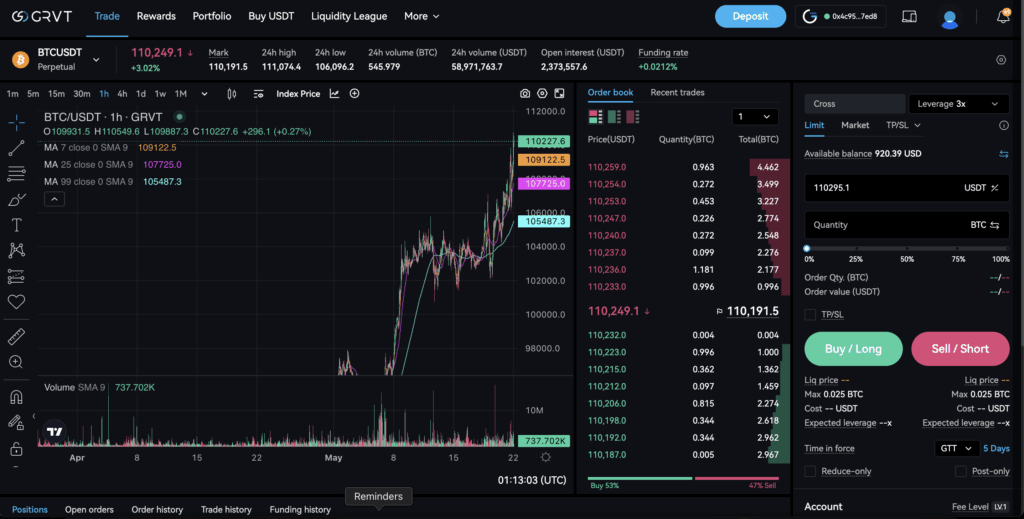

Crypto markets are famously volatile, but what many don’t realize is that much of that volatility doesn’t originate in spot markets – it’s driven by derivatives. Futures contracts, perpetual swaps, and options often set the pace for price action. In this guide, we’ll break down the feedback loop between futures and spot markets, and how traders on platforms like GRVT, Binance, Bybit, and Blofin can learn to decode that hidden influence.

What Are Derivatives? (And Why They Matter to Spot Traders)

Derivatives are financial contracts that derive their value from an underlying asset – in this case, crypto like BTC or ETH.

Types That Affect Spot:

-

Perpetual Futures (Bybit, Bitunix): No expiry, price closely tracks spot but often with funding rate distortions.

-

Quarterly Futures (Binance, Blofin): Expiry-based contracts used for large-scale hedging.

-

Options (Polynomial, Lyra): Add implied volatility expectations into pricing, indirectly influencing market momentum.

These derivatives allow traders to speculate with leverage, meaning outsized positions influence price movement without the capital needed in spot markets.

The Feedback Loop: Spot <-> Derivatives

Let’s decode how this loop works:

-

Traders Open Longs in Futures → Price of the perp pushes up.

-

Spot Market Arbitrageurs → Buy spot to sell perp (or vice versa) → Move spot price to meet perp.

-

Funding Rate Adjusts → Encourages counter-positioning.

-

Open Interest Expands → More exposure = higher liquidation risk.

-

Liquidation Events → Create cascading effects in both markets.

Result: Derivatives lead, spot follows – especially in short time frames.

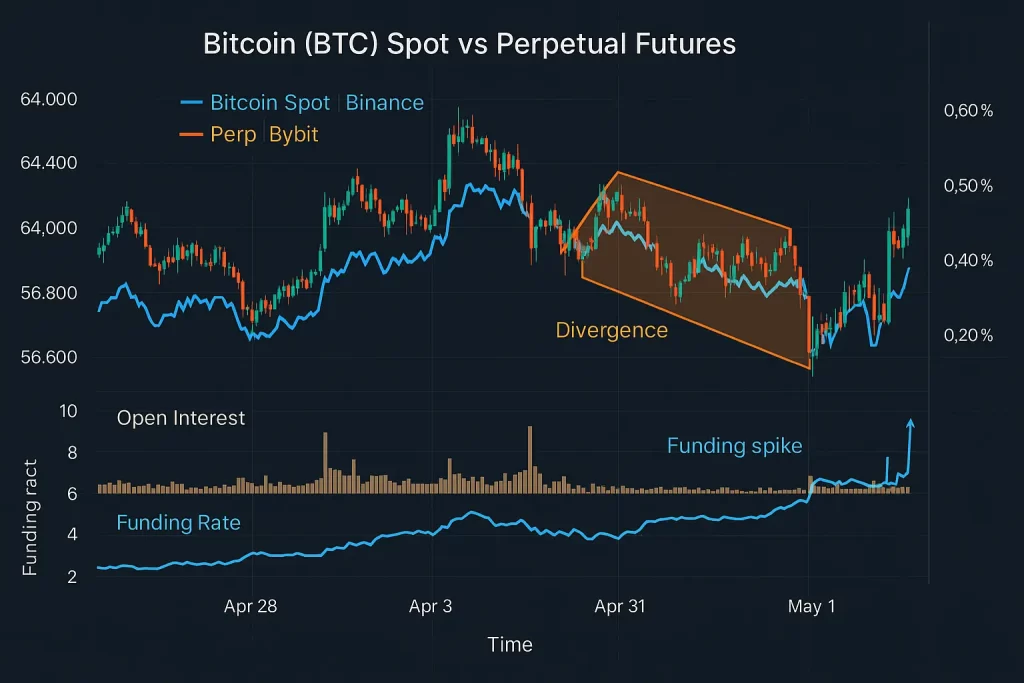

Spot-Perp Divergence on Binance & Bybit

In March 2024, BTC on Bybit’s perpetual futures spiked 1.5% above Binance spot – a common divergence during high-leverage environments.

-

Bybit Perp Premium: +1.5%

-

Spot Catch-Up: Within 3 minutes, Binance spot adjusted +1.3%

-

Why? Arbitrage bots and directional traders closed the gap.

Lesson: Spot traders ignoring perp premiums are trading blind.

How to Track This in Real Time

Recommended Tools:

| Tool | Feature | Best Use |

|---|---|---|

| Coinalyze | Perp vs Spot divergence charts | Trend confirmation |

| HyroTrader | Order book overlays | Detect whale moves |

| Binance Futures Data | Open interest, funding | Liquidity stress signals |

| Blofin’s Terminal | Basis & macro overlays | Institutional positioning |

Spot-Focused Indicators You Can Extract from Derivatives

-

Funding Rate Extremes: Predict counter moves.

-

Perp Premiums: Early signal for spot breakouts.

-

OI Spikes + Price Drop: Watch for forced liquidations → buying opportunity.

Risks of Overreliance on Derivatives Signals

-

False Divergences in low liquidity environments

-

Spoofing by large traders can manipulate order books

-

Funding baiting: When whales inflate funding to trap retail traders

Spot vs Perp Divergence Snapshot

Interpreting divergence zones = key to smarter spot entries.

Pro Tips for Spot Traders Using Derivatives Data

-

Use futures as confirmation, not signal.

-

Wait for spot follow-through before placing orders.

-

Study funding rates as risk appetite proxies.

-

Watch liquidation maps on gTrade for sniper entries.

Trade Smarter, Not Harder

Derivatives drive price action. Whether you’re a beginner stacking sats on Binance or an advanced trader using GRVT’s hybrid infrastructure, understanding this feedback loop will elevate your edge. Futures markets are no longer a side arena — they’re the main show.

“Trade the spot. Follow the perp.”