Top 5 Crypto Tokens in the Solana Ecosystem

Work on the Solana project began as early as 2017, even though the open source project – which is working towards implementing a new permissionless blockchain to provide decentralized finance (DeFi) solutions – was only launched in March 2020. The project is maintained by the Solana Foundation which is based in Geneva, Switzerland. Some of the notable founding persons of the Solana team are Anatoly Yakovenko (a former Qualcomm and Dropbox engineer) and Greg Fitzgerald (also ex-Qualcomm engineer).

The Solana protocol is designed to spur on the creation of decentralized apps (DApps). The developing team and community are hoping to bring about the scalability needed in the crypto ecosystem for dapps to find wider user adoption and market development by introducing proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain. The Solana blockchain can process 50k transactions per second. According to the team, Solana is designed to keep fees low for scaled applications that accomodate many users, even in the billions.

Source: Solana.com

1) Solana (SOL token)

The SOL token powers the Solana blockchain. According to Solana, as of December 2020, the total supply was 488,597,775 and circulating supply was 46,265,521. At the time, about 1 SOL per day was spent by validators in vote transaction fees. These tokens would be burnt and removed from supply. Since its inception, an estimated ~40,000 SOL are said to have been burnt and removed from the circulating and total supply as a result of vote transaction fees. Solana has a Token Swap Program that allows simple trading of token pairs without a centralized limit order book.

Source: Solana

Between April and December 2020, the SOL token had been listed on most major exchanges including Binance which launched with three trading pairs: SOL/BTC, SOL/BNB, and SOL/BUSD. SOL also got listings on BitMax, FTX, Huobi and many other cryptocurrency exchanges. Holders of SOL tokens can store tokens using non-custodial web wallets from SolFlare.com and sollet.io, or using MathWallet’s browser extension and web wallet interface which supports wallet addresses for sending and receiving SOL and SPL tokens.

2) Terra (LUNA token)

A blockchain protocol that utilizes fiat-pegged stablecoins to power price-stable global payments systems, Terra’s stablecoin proposition is that it offers instant settlements, low fees and seamless cross-border exchange. Founded by Daniel Shin and Do Kwon, the development of Terra started in early 2018 and the mainnet launched at the beginning of the second quarter of 2019. According to sources, Shin was also founder & CEO of TicketMonster, an e-commerce platform based in South Korea. Shin also founded Fast Track Asia, a company-builder that was responsible for establishing reputable brands such as the office sharing platform Five and FoodFly (later acquired by Yogiyo).

Source: Terra

The Terra blockchain uses a proof-of-stake consensus algorithm based on Tendermint. Token holders of LUNA are able to stake their tokens as collateral in order that they can be involved in the validation of transactions, consequently being rewarded in proportion to the amount of LUNA that they choose to stake. Luna token holders also have the option to delegate others to validate transactions on their behalf, thereby sharing in any revenue that is subsequently generated through the staking.

Terra offers a range of stablecoins pegged to the U.S. Dollar, the IMF’s Special Drawing Rights basket of currencies, South Korean Won, and Mongolian Tugrik. LUNA is the native token for the Terra ecosystem and its primary utility is for the purposes of bringing stability to the price of the protocol’s stablecoins. Holders of LUNA tokens are also conferred rights to submit and vote on protocol governance proposals.

Terra supposedly maintains its 1-1 peg through an algorithm which adjusts stablecoin supply automatically based on demand. LUNA holders are incentivized to swap LUNA and stablecoins at exchange rates that are profitable and as needed, in order to expand or contract the stablecoin supply so that it is in line with demand. Terra is live on Ethereum and Solana. In April 2020, Solana announced a new high-speed token bridge with Solana. LUNA tokens can be found on numerous digital currency exchanges including KuCoin, Bitfinex, Binance, Huobi, Bittrex and many more.

3) Waves (WAVES token)

Founded by Alexander Ivanov (aka Sasha Ivanov) a Ukrainian-born scientist, Waves was launched in 2016 through an initial coin offering (ICO). It was one of the first projects to utilize what went on to become a widely used method of crowdfunding to support the development of blockchain-based projects.

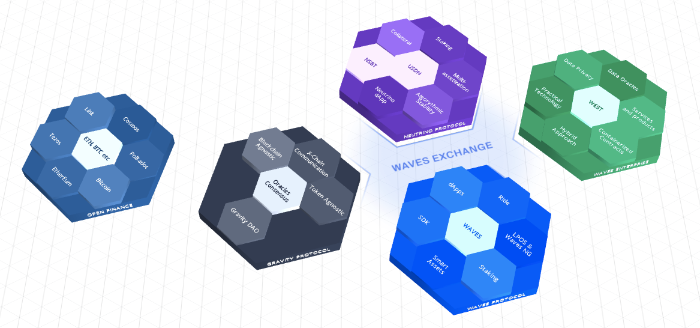

Source: Waves

Waves supports smart contract and DApp development and several products have already been released on the WAVES blockchain such as Gravity which is simply a cross-chain and oracle network. Neutrino, is a DeFi platform also operates using Waves and the Waves DEX is their competing decentralized digital asset exchange platform. In October 2020, Waves announced its integration of Solana into Gravity meaning that the Solana network would be made available for data transfers between Gravity’s network participants.

Waves’ native token also has the ticker symbol WAVES. Initially the token supply was capped at 100 million tokens, however, in 2019, the max supply cap was removed. WAVES is utilized for standard payments such as block rewards. WAVES tokens can be found on exchanges such as Kraken and OKEx, and many other digital currency exchange platforms.

4) Arweave (AR token)

Founded by Sam Williams and William Jones, Arweave is a decentralized storage network the likes of IPFS, Sia, Storj, FileCoin, and Swarm. In January 2020, Arweave launched a decentralized autonomous organization. Some of the project’s backers include Andreessen Horowitz, Union Square Ventures and Coinbase Ventures.

The blockweave which is essentially a set of blocks that contain data, linking to multiple previous blocks from the network is the core technology powering Arweave. This data structure apparently makes it possible for the network to enforce conditions that require miners to provide ‘Proof of Access’ (PoA) to old data before they are able to add new blocks.

Arweave network miners are incentivized to replicate important or valuable data that is stored within the network by being rewarded in AR tokens. According to Arweave, when data is added to the network, a user is charged a ‘principle’ upfront, on which ‘interest’ in the form of storage purchasing power is then subsequently accrued. Over time, interest on that once-off upfront payment is given to those users providing hard drive space. Arweave protects the long-term viability of the network’s endowment by using very modest estimates for storage pricing.

Source: Arweave

Arweave has a maximum token supply of 66 million AR according to Arweave’s yellow paper. 55 million of those AR tokens are said to have been minted in June 2018 when the blockweave’s genesis block was created. The project made it public that an additional 11 million AR would be added to the supply in a gradual manner as block rewards.

A token pre-sale event was held in August 2017 and public sales were completed in May 2018 and June 2018 respectively. Some of the exchanges where AR tokens are traded include Huobi Global, FTX, MXC.COM, among several others.

According to Solana, the team partnered with Arweave in order to provide a decentralised permanent data storage solution of ledger data, making sure that the data would always be retrievable when and when required. Arweave in December 2020 announced the creation of SOLAR Bridge, a connection between Solana and Arweave made possible by Bering Waters, a Hong Kong based investment group with interests in Arweave.

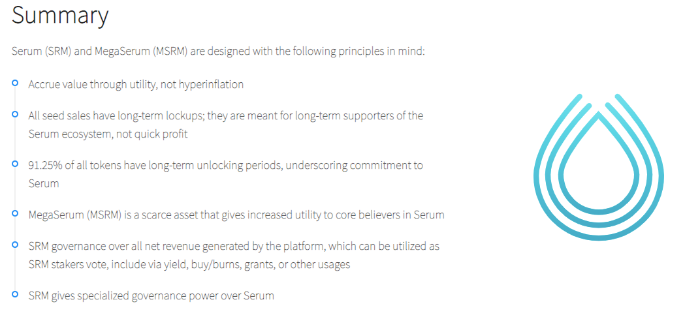

5) Serum (SRM token)

The Serum Project was co-founded by Sam Bankman-Fried, the current CEO of crypto derivatives exchange FTX and a co-founder of the quantitative trading firm Alameda Research quantitative trading firm.

Serum was created with the intention of eliminating some of the vulnerabilities plaguing the DeFi space as a result of incomplete decentralization. Serum is said to be fully decentralized, operating on a non-custodial exchange with cross-chain trading support and no know your customer (KYC) requirements.

The Serum decentralized exchange is meant to provide high speed and low transaction costs to DeFi. Serum claims to have lower transaction costs than any other DEX averaging $0.00001 per transaction. Built on the Solana blockchain, Serum is considered permissionless.

Source: Serum

Serum offers a decentralized automated full limit order book which provides crypto traders with total control over every one of their orders. Due to its Ethereum and Solana integration, Serum is much faster, more efficient and interoperable with the Ethereum-based ERC20 token standard. Cross-chain contracts that are physically settled make it possible to achieve relatively easy margin positions in DeFi on synthetic assets. SerumBTC for example, is a model for creating Solana-based or ERC20 tokens for Bitcoin (BTC) whereas SerumUSD is a model for creating a decentralized USD-pegged stablecoin.

The SRM is a utility token used within the Serum ecosystem. Its cross-chain swap protocol makes it possible for users to exchange assets between blockchains trustlessly. Staking rewards issued in SRM tokens are distributed on the basis of the performance of nodes. It’s also possible for users to stake towards another node.

According to Coinmarketcap, Serum has a circulating supply of 50 million SRM, a total supply of 161 million and a maximum supply of 10 billion. Serum (SRM) is available on a number of exchanges including Binance, OKEx and several other cryptocurrency exchanges.