A decentralized autonomous organization (DAO) can be described as a type of entity whose decisions are made through the vote of its members electronically using computer code. Essentially, the hard coded rules of the system define the actions that organization takes. DAOs are sometimes referred to as decentralized autonomous corporations (DACs).

The rules governing how the DAO operates are encoded as a computer program that is controlled by the organization’s members, transparent and not determined by a central authority. DAOs utilize blockchain technology for keeping track of transactional records. A DAO is administered through a governance token which means that those who own that token have voting rights and can submit proposals for the DAO to vote on. The top 3 most popular DAO tokens by market capitalization are:

Uniswap (UNI)

Uniswap is an automated market maker and decentralized trading protocol that facilitates the automated trading of decentralized finance (DeFi) digital assets. Uniswap provides a solution to the problem of liquidity and aims to make it possible for users to trade tokens in an automated and decentralized fashion.

Source: Uniswap

The Uniswap protocol incentivizes activity by limiting risk and lowering costs for participants all the while eliminating the need to identify users through KYC. On Uniswap, any user is able to create a liquidity pool for any pair of tokens.

In 2020, Uniswap introduced the UNI governance token which was distributed to platform users with the objective to turn the Uniswap into a community-owned protocol that is truly decentralized in its operations. UNI tokens help govern the Uniswap protocol. UNI is an ERC-20 token issued on the Ethereum blockchain and the maximum supply of UNI tokens is capped at 1 billion units. UNI tokens are available for trading on exchanges such as Coinbase, Binance, OKEx, and Bithumb.

Aave (AAVE)

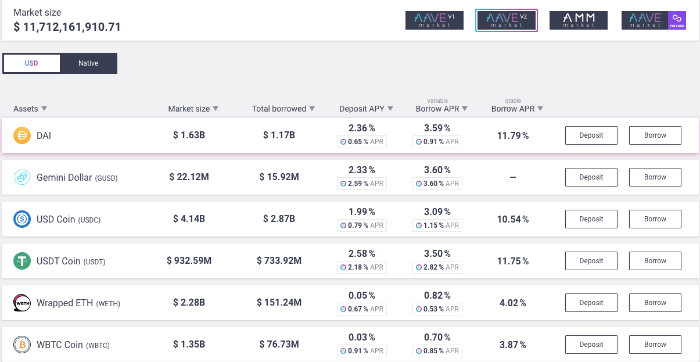

Aave is an open-source, decentralized lending protocol and non-custodial money market platform built on Ethereum. Similar to how Uniswap functions, Aave also utilizes smart contracts to remove intermediaries between lenders and borrowers thereby operating in a decentralized manner. Lenders on Aave can earn interest when they deposit digital assets into liquidity pools. Borrowers pay interest on amounts lent by liquidity providers. Aave’s automated functions include determining the lending rates and matching lenders to borrowers.

Source: Aave

To manage debt in its system, Aave utilizes a system of over-collateralization and liquidations. When a user deposits tokens to Aave, they are essentially providing liquidity to Aave’s token pools. This is meant to trigger the automatic minting of aTokens which are ERC-20 tokens pegged 1:1 to the value of the underlying asset.

Each aToken is generally based on a particular crypto asset which means that the aTokens are in fact a claim to the liquidity that the user has provided. This means that for instance, if a user deposits Ethereum (ETH) to Aave, they will essentially mint aETH tokens. If they deposit DAI to Aave it then means that they mint aDAI tokens. Depending on the lending supply and borrowing demand for the respective underlying assets, aETH and aDAI will typically earn different interest rates depending on the lending supply and borrowing demand.

The tokens earn interest in real-time directly in the user’s wallet which typically will fluctuate depending on the borrowing demand and the liquidity supply. Holding aTokens provides a user with the opportunity to earn interest on deposited assets continuously. Holders of aTokens are also entitled to a percentage of the fees which are accrued from the flash loans or uncollateralized loan option mechanism.

It is important to note that, the more an asset is utilized, it tends to mean that the higher the interest rate and the higher the risk. If the utilization rate nears 100%, there’s a possibility of an illiquidity scenario due to the system being under-collateralized since the value of collateral would have effectively become inadequate to cover the debts or users’ need to withdraw their collateral.

Aave DAO is governed and operated by AAVE token holders who vote on changes to the protocol. AAVE is an ERC-20 token that is designed to be deflationary and with a circulation that is correlated to the total value locked on Aave. Tokens are generally burned when the protocol gathers fees. AAVE tokens can be traded on many exchanges including FTX, Huobi and Binance.

Maker (MKR)

MakerDAO is a decentralized governance community that manages the generation of Dai which is a decentralized stablecoin or collateral-backed crypto asset with a value that is soft-pegged to the US Dollar.

Source: MakerDAO

Through a governance mechanism within the Maker Protocol, holders of MKR – the governance token of the MakerDAO and Maker Protocol – are endowed with voting rights over the development of the protocol. Holders of MKR can vote on certain aspects of running the protocol such as the addition of new collateral asset types or make changes to the risk parameters of existing ones. They can also vote on protocol upgrades.

The Maker Protocol is one of the most used DApps on Ethereum and consists of a set of smart contracts that make the minting of Dai possible. Users can generate Dai through a process of depositing collateral assets into Maker Vaults. The Dai are backed by a surplus of collateral assets. This means that the value of the collateral is higher than that of the Dai debt. Dai transactions can be viewed publicly on the Ethereum blockchain and the tokens can be stored in supported digital wallets. MKR tokens can be traded on Uniswap, Coinbase, Binance, OKEx and other exchanges.