FMFW Crypto Exchange Review

Registered in Saint Kitts and Nevis and formerly Bitcoin.com Exchange, the name FMFW which stands for ‘Free the Money, Free the World’ came into effect as part of a rebrand of the exchange which took place at the end of September 2021. As part of the rebranding, Bitcoin.com Exchange changed its domain and brand identity. The exchange has been operational since 2019 and is said to have over 1.2 million users, 100 million transactions and the exchange does hundreds of millions of dollars in trading volumes.

There are not a lot of public details surrounding the nature of the rebrand in terms of the reasons why the company has decided to not host the exchange on what could be the most valuable domain in the entire cryptocurrency space. Could it possibly have something to do with the ongoing saga between the BTC, BCH, and BSV camps? Earlier in the year, it was reported Bitcoin.org was ordered to remove the Bitcoin Whitepaper by a UK court in a judgement favouring Craig Wright who is currently in the middle of a nearly $70 billion court case to do with Satoshi Nakamoto’s more than 1 million Bitcoins. Maybe time will reveal the reason why they decided to change from Bitcoin.com Exchange to FMFW. Check out our review of Bitcoin.com Exchange here before it rebranded to FMFW.

Positives

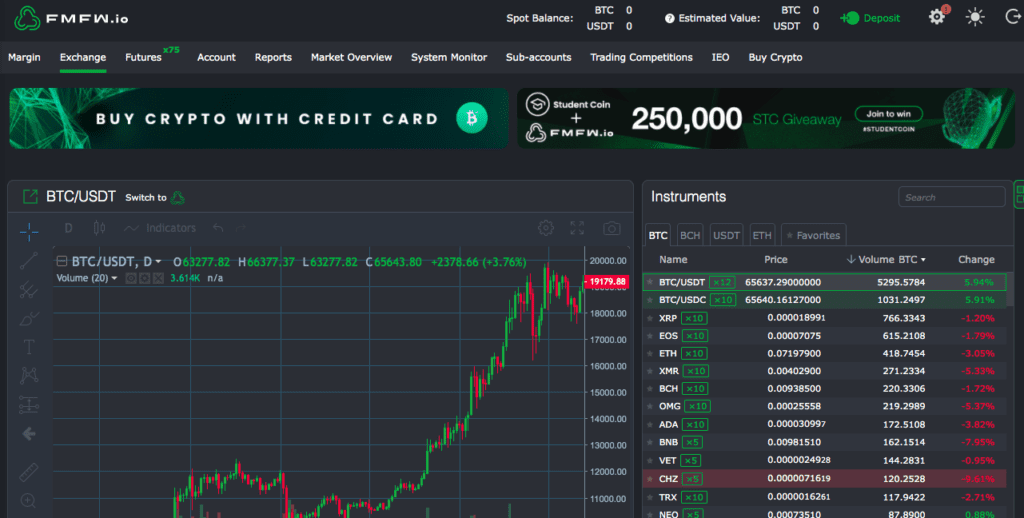

- Can find a wide range of crypto assets on the exchange including BCH, BTC, ETH, XRP, NEO, ADA, BNB, SOL, XLM, MATIC and many others.

- Traders can access the REST & Streaming API version 3.0 which is meant to provide programmatic access to FMFW.io’s next generation trading engine.

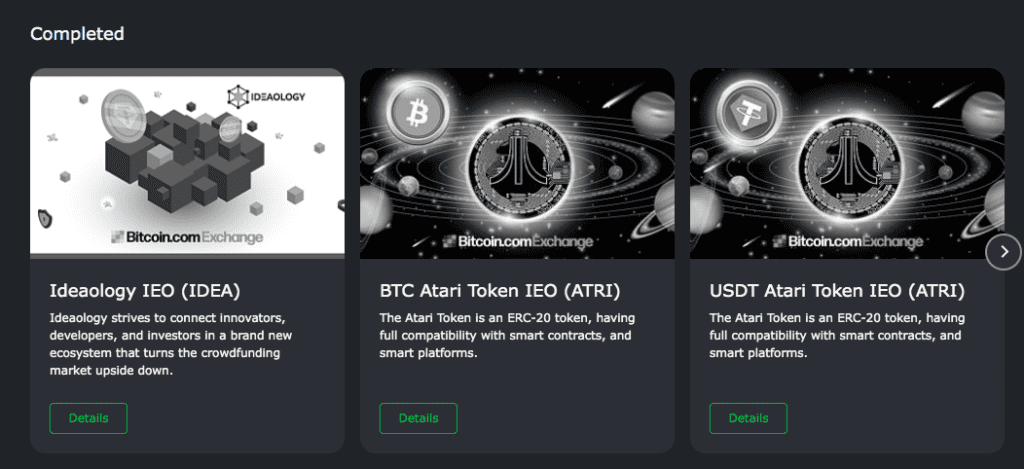

- The exchange is popular for initial exchange offerings (IEOs).

- High withdrawal limits for Individual Pro trader accounts: 100 BTC daily with no monthly limits.

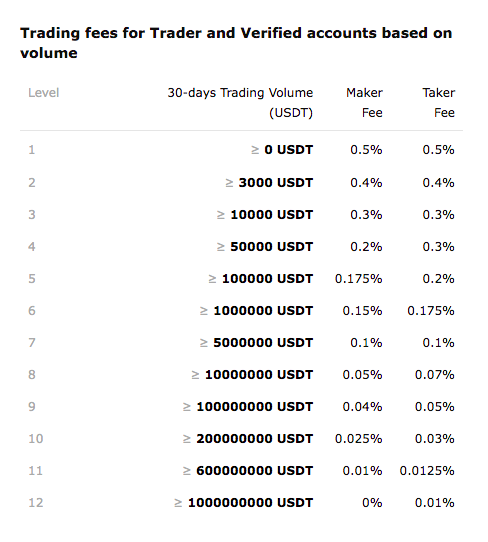

- FMFW.io employs a ‘maker-taker’ model for fees in order to maximize liquidity and narrow the spread on markets, plus to incentivize market-makers.

- The exchange uses a dynamic fee structure which means that the more a user trades, the less fees they pay.

- Trading fees are determined based on the user’s 30-day trading volume in Tether (USDT).

- The exchange offers margin trading which provides traders with the opportunity to open Long and Short positions on a variety of cryptocurrencies by up to 10x leverage. Leverage trading is available for 29 markets. Users can use 10x leverage on BCH/USDT, BTC/USDT, ETH/USDT, XRP/USDT, ETH/BTC, BCH/BTC, XRP/BTC TRX/USDT, LTC/USDT, EOS/USDT, XMR/USDT, ETC/USDT, ADA/USDT, TRX/BTC, LTC/BTC, ETC/BTC, ADA/BTC, XMR/BTC, and EOS/BTC. 5x leverage is available on ZEC/USDT, DASH/USDT, VET/USDT, DOGE/ USDT, XLM/USDT, ZEC/BTC, DASH/BTC, XLM/BTC, DOGE/ BTC, VET/BTC.

Margin Trading Fees

In order to keep your margin position open on FMFW, a user will be required to pay a small interest rate daily. This applies regardless of if the user is shorting or going long on an asset. The rates are:

Name | Ticker | Daily Interest Rate |

Tether | USDT | 0.099% |

Bitcoin | BTC | 0.024% |

Ethereum | ETH | 0.027% |

Ripple | XRP | 0.027% |

Bitcoin Cash | BCH | 0.018% |

EOS | EOS | 0.021% |

TRON | TRX | 0.039% |

Cardano | ADA | 0.042% |

Litecoin | LTC | 0.021% |

Zcash | Zec | 0.030% |

Stellar | XLM | 0.021% |

Monero | XMR | 0.081% |

NEO | NEO | 0.021% |

VeChain | VET | 0.021% |

QTUM | QTUM | 0.021% |

Binance Coin | BNB | 0.021% |

Chiliz | CHZ | 0.021% |

Maker | MKR | 0.021% |

FTX Token | FTT | 0.021% |

Verge | XVG | 0.021% |

Chainlink | LINK | 0.021% |

Basic Attention Token | BAT | 0.021% |

NEM | XEM | 0.042% |

Negatives

- Users from the USA, Iran, North Korea, Syria, China, Venezuela, and many other nations cannot use the platform. Some of FMFW’s products are not available in certain regions and jurisdictions including Australia, Germany, Hong Kong, Italy, Japan, Netherlands, United Kingdom, etc.

- Withdrawals are limited – individual: $25,000 daily, $100,000 monthly.

- KYC may be required to pass KYC checks in order to withdraw even if the amount is below the said limits to stay compliant with AML/CFT obligations.

- FMFW is still not considered a high volume exchange the likes of KuCoin, OKEx, Bittrex, Coinbase, Gemini, Kraken, FTX and other much larger exchanges which offer a lot more products as well.