Trader Joe Review

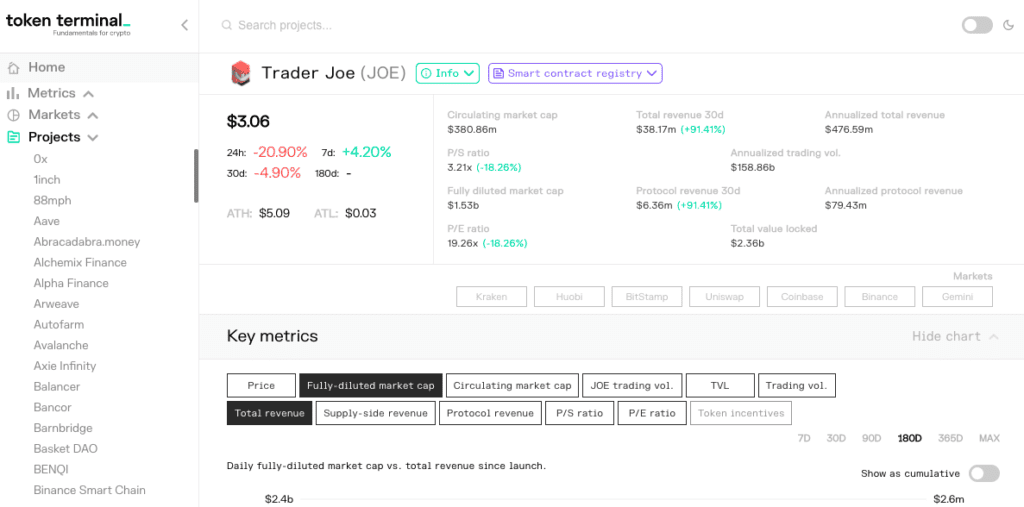

Described as a platform that offers decentralized trading on Avalanche and is essentially a one-stop shop which gives users access to trading, liquidity mining, yield farming, lending, and staking, etc.

0xMurloc and Cryptofish are the monikers of the founders of Trader Joe. The platform is geared towards DeFi with a focus on servicing participants in the Avalanche blockchain ecosystem.

It is estimated that over $4bn in assets have already been exchanged on the platform and currently is doing upwards of $800 million in daily trading volume according to Coinmarketcap.

The platform was launched with support from investors including Defiance Capital, GBV and Mechanism Capital. Other VC and angel investors who strategically invested include Coin98 Ventures, Not3Lau Capital, Three Arrows Capital, Delphi Digital, Avalanche Foundation and Stani Kulechov who is the founder of Aave. Avalaunch and Yield Yak from the Avalanche community apparently also supported the development of Trader Joe.

Trading

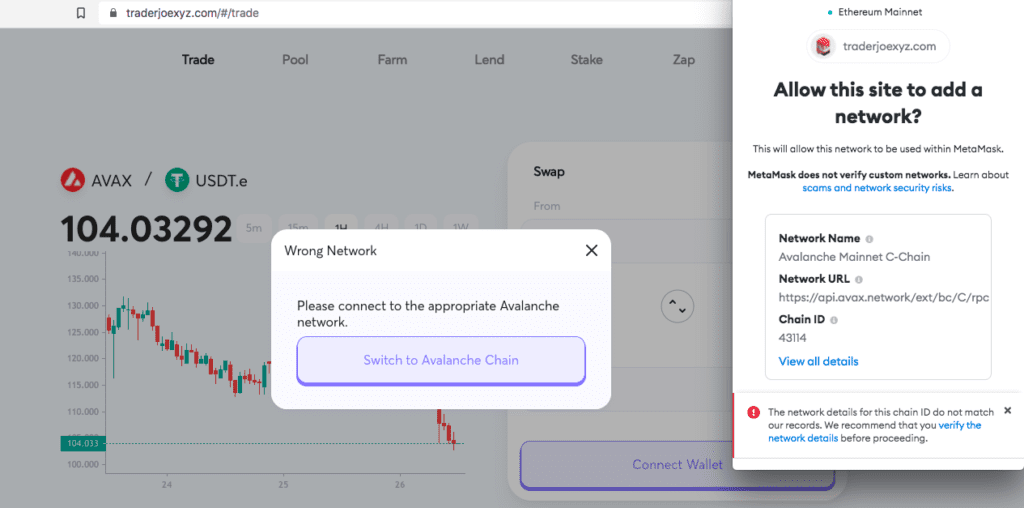

To trade tokens on Trader Joe, simply go to the trading page and unlock your Avalanche wallet. You will need to connect to the platform with Metamask and choose the Avalanche network.

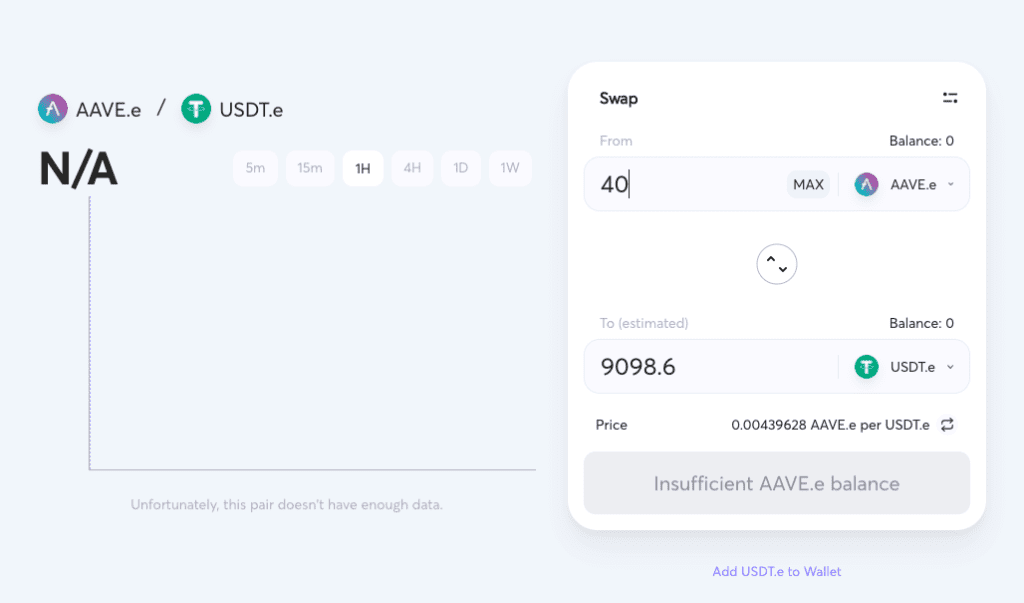

Once you’re connected you can then select the tokens that you wish to trade for instance Aave/USDT and enter the amounts that you would like to trade. From there you can confirm your swap and approve the transaction. Once the transaction has been processed you can check its status in Avax Explorer.

Yield Farming

Trader Joe first launched its automatic market maker and yield farm features which were reportedly audited by HashEx. Based on the highlighted vulnerabilities which included the issues related to the ability to allocate all emissions to the team, the development team decided to launch MasterChefJoeV2 behind a 12 hour time lock that apparently is meant to limit the maximum distribution to the team to 20%.

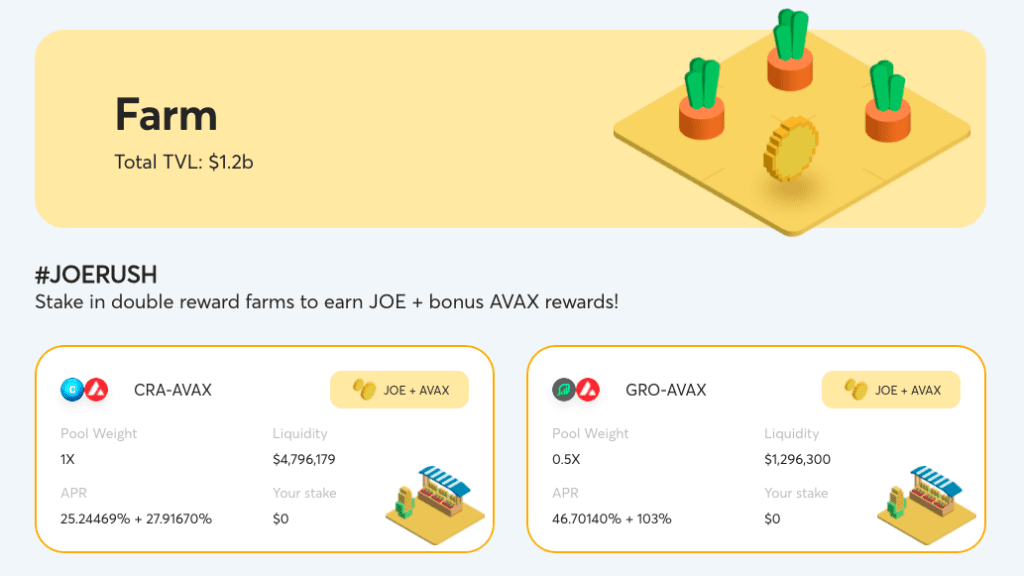

Farming on Trader Joe is attractive to many users because the process is as simple as depositing liquidity pool tokens into a farm to earn extra yield that is rewarded in JOE tokens.

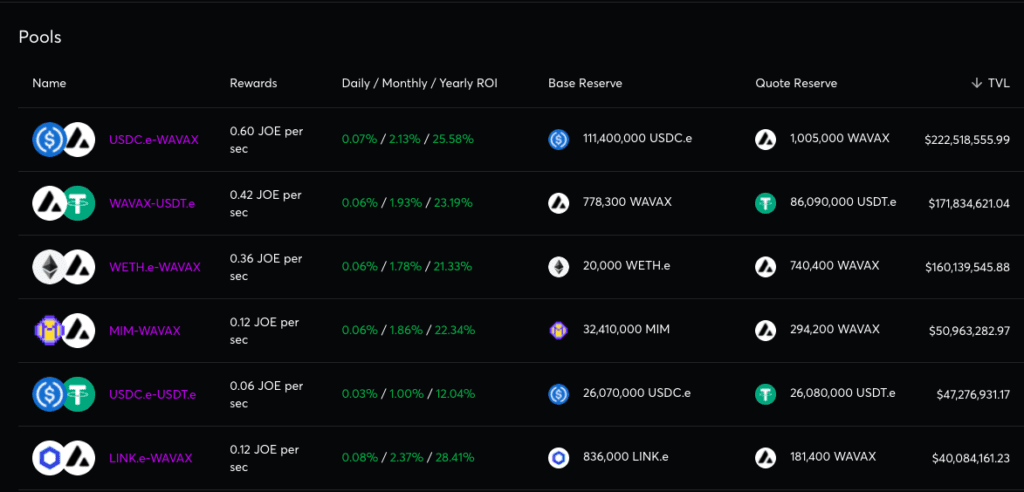

A user needs to connect and make sure they confirm the wallet they want to use and from there they can easily navigate to the Pools page where they will be able to search for the liquidity pool that they wish to enter into and then they can proceed to the Farm page and select the farm they entered in the pool.

From there, a user can manage the farm and they can view Farm details including the Liquidity, Pool Weight & APR. Once a user enters the amount of liquidity provider tokens (LP) they wish to deposit, they can confirm the transaction in their wallet and start earning JOE token rewards from the farm.

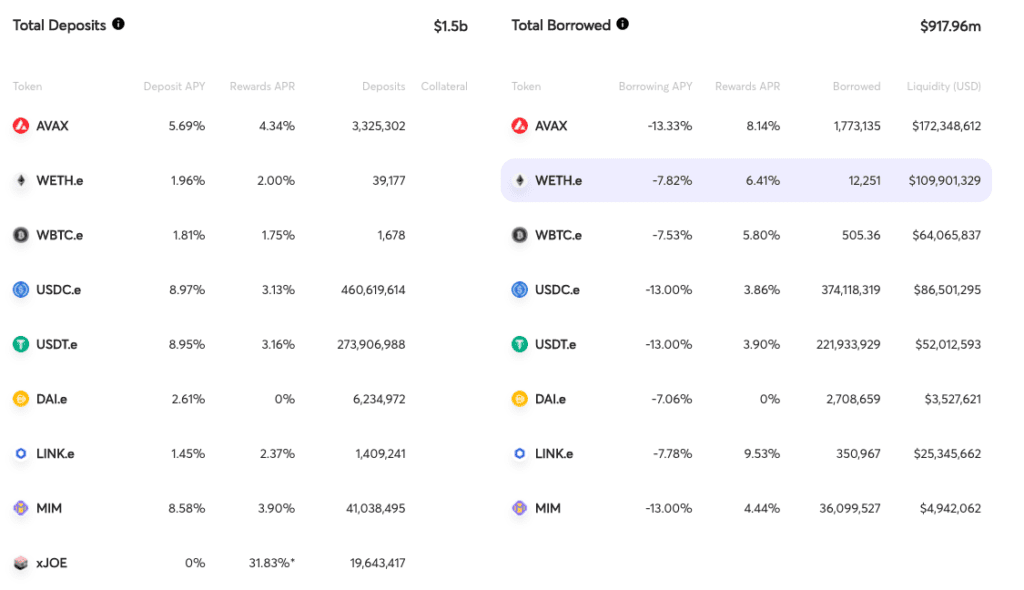

Lending

Trader Joe also has a lending protocol called Banker Joe which has also been audited by Paladin and HashEx. It is a lending protocol that is based on the Compound and some say even CREAM protocol but with support for long-tail assets. Banker Joe is effectively a decentralized lending protocol built onto the Trader Joe platform.

The platform intends to offer non-custodial leveraged trading by combining the DEX with the lending protocol.

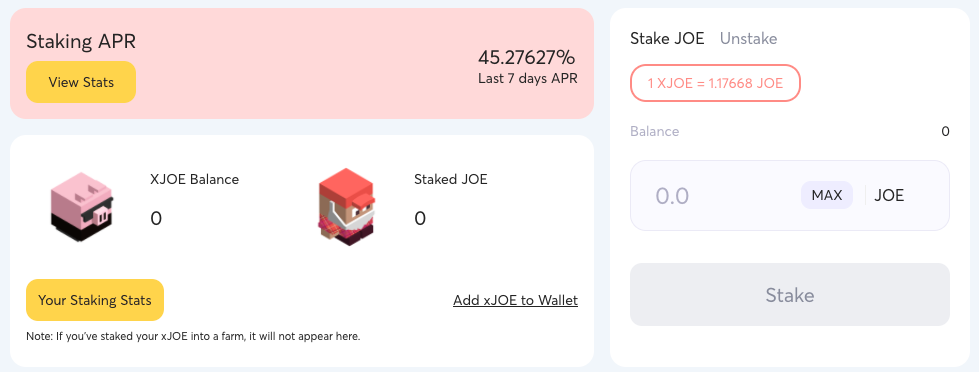

Staking

On the platform users can also stake JOE tokens to earn xJOE in order to maximise yield without the risk of exposure to impermanent loss. According to Trader Joe, there’s a 0.05% fee that is charged and sent to the xJOE pool for every swap on JOE and there are buybacks every 24hrs which means a user’s xJOE keeps compounding. When JOE tokens tokens go up in value it maximises profits for stakers.

When a user decides to unstake, they receive all the JOE tokens that they originally deposited and any additional earnings from fees. The idea is that a user ends up getting more JOE than what you started with by staking.

Zap

Trader Joe’s Zap feature helps users save on gas fees when creating a liquidity pool. To get started all you need is the token you wish to swap and AVAX tokens for fees. Typically when you want to provide liquidity you need to perform three transactions. 1) Swap the token you want 2) Swap for the other token 3) Creating the liquidity pool. With Zap on Trader Joe the process is simplified by enabling users to Zap directly from one of their supported tokens to one of their LP pairs.