Top 3 Protocol-Owned Liquidity Tokens

Alchemix (ALCX)

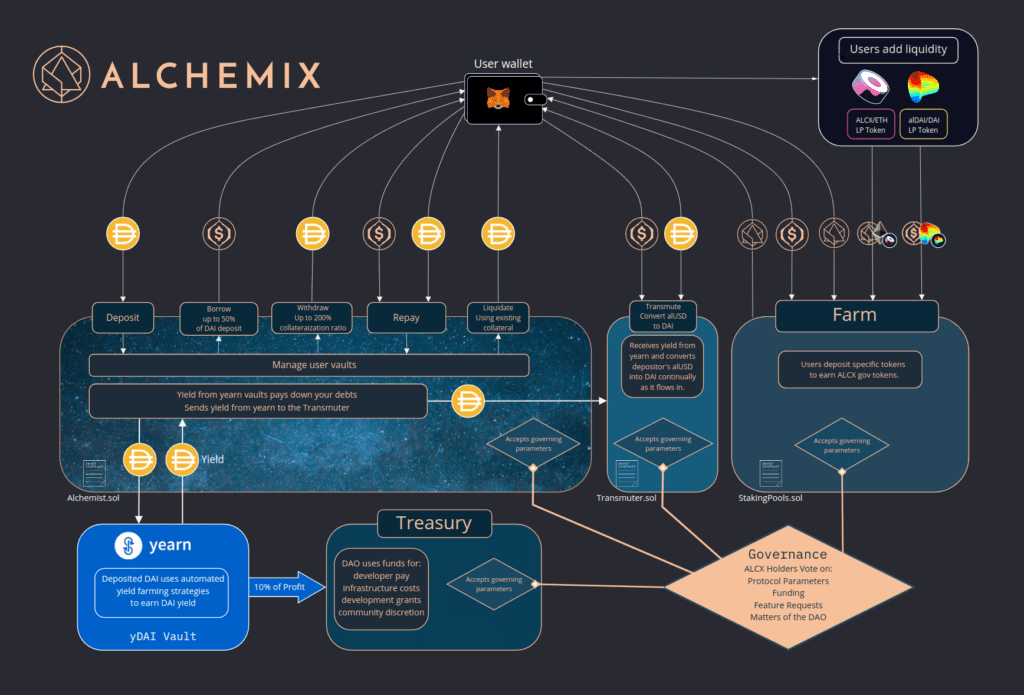

A platform for creating yield-backed synthetic tokens, Alchemix is also a decentralised autonomous organisation (DAO) that intends to facilitate the development of projects within the Alchemix ecosystem and the wider Ethereum ecosystem.

Alchemix’s platform makes it possible for users to receive advances on their yield farming by way of a synthetic token that typically is representative of a fungible claim on underlying collateral within the protocol. The prerequisite is that the synthetic token to be minted, be it an ERC20 token or stablecoin, is required to already have a pre-existing on-chain yield generating mechanism on lending markets such as AAVE or Compound or indeed vault-like products such as yvDAI or aLINK vaults.

The Alchemix team’s first synthetic token (alUSD) will be targeted at stablecoins and the protocol will initially only support DAI. The Alchemix decentralised application (DApp) is comprised of:

-

Vaults – these serve to generate yield advances much like lending platforms such as AAVE and MakerDAO (DAI is the first type that the protocol will accept).

-

Transmuter – makes it possible for users to stake synthetic assets which over time can be converted into their base assets. For example, a user can transmute their alUSD back into DAI 1-to-1 in Alchemix if they wish to or they can trade it on decentralized markets such as Curve Finance or SushiSwap.

-

Staking & Liquidity Provision – 80% of ALCX block rewards are distributed to holders of ALCX token who stake tokens in the staking pools contract and receive rewards.

-

Treasury – Alchemix DAO works in such a way that sustains it through the receipt of income from the Alchemix protocol. A portion of the yield earned goes into the treasury from which payments to developers, auditors and staff working on the protocol are paid.

In order for a user to mint the synthetic stablecoin alUSD, they’d need to deposit DAI in order to tokenize future yield, which if earned by collateral from Yearn Finance, repays the advance over time automatically. A user can choose their high yield strategies to repay debt without worrying about the risk of being liquidated.

If a user so wishes, they can then transmute their alUSD back into DAI 1-to-1 or they can trade it on decentralized markets such as Curve Finance or SushiSwap.

ALCX tokens can be traded on crypto exchanges including FTX, Coinbase, OKEx, Binance, HitBTC, among others.

Spell Token (SPELL)

Described as a spell book that makes it possible for users to mint Magic Internet Money (MIM) which is a pegged stablecoin, Abracadabra.money is a lending platform that makes it possible for users to borrow funds using interest bearing tokens as collateral. The way Abracadabra works is simple, a user deposits collateral then a debt allocation (interest included) gets assigned to the borrower. MIM tokens are then deposited into the wallet of the borrower and the user is able to take their MIM whenever convenient for them to do so. All a borrower needs to do in order to regain their collateral is to simply repay the debt plus interest. MIM tokens can be minted on Ethereum by multisig holders.

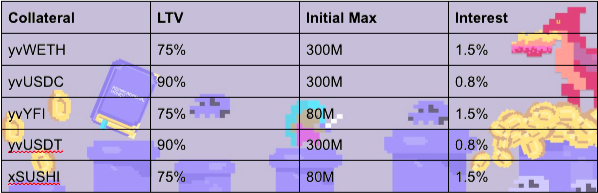

A couple of factors influence the amount of MIM a user can get i.e. the loan to value ratio (LTV) and the initial maximum MIM allocation to that collateral. Only following collateralization can the tokens be injected into circulation. There’s hope that they may be bridged to other blockchains in the future.

Abracadabra.money has a platform token called SPELL. Users of the platform are able to provide collateral in the form of different interest bearing crypto assets including xSUSHI, yvYFI, yvUSDT, yvUSDC, and more. SPELL tokens can also be staked for sSPELL which can be used for fee-sharing and voting.

The main use case of SPELL tokens is to incentivise ecosystem participants. The token also provides holders with voting rights when they stake the tokens. The unique value proposition of Abracadabra is that unlike assets such as yVaults which have locked-in capital, with Abracadabra users have an opportunity to use the capital. Holders of interest-bearing tokens such as xSUSHI (Staked SUSHI); yvWETH (WETH v2 Yearn Vault); yvUSDC (USDC v2 Yearn Vault); yvYFI (YFI v2 Yearn Vault); and yvUSDT (USDT v2 Yearn Vault) can use the assets as collateral to mint Magic Internet Money (MIM).

The idea is that since MIM is backed by interest-bearing tokens, the collateral value is always increasing. However, there are risks associated including the risk of liquidation which takes place when the value of the collateral drops to a predetermined point that is established once the user opens their debt position. If such an event occurs, a third-party has a choice to either pay-off the debt in exchange for the borrower’s collateral with a liquidation fee also included. A cool feature on Abracadabra is that each collateral has an independent market on the platform meaning that a user has a choice of which assets they are prepared to take the risk with. Smart contract bugs or other vulnerabilities are also risks a user needs to consider.

SPELL tokens can be traded on exchanges such as FTX, OKEx, Coinbase, Bybit, and others.

Olympus (OHM)

Founded by Zeus, Apollo, Unbanksy, and Wartul which could be a group or an individual running multiple anonymous accounts and now being run as a decentralised autonomous organisation, Olympus is an algorithmic currency protocol which intends on becoming a stable digital currency. The protocol utilises reserve assets such as the stablecoin DAI in order to manage its price while maintaining a floating price that’s driven by the market.

Olympus is operated by a decentralised autonomous organisation through smart contracts. The protocol comes with a treasury that mints and sells OHM tokens which are the native currency of Olympus. OHM tokens can be found on crypto exchanges such as Gate.io and Uniswap (V3), among others.

Check out our deep dive into Olympus here.