Delta Exchange (Crypto Derivatives Platform) Review

What is Delta Exchange?

Delta Exchange offers spot, calendar spreads, interest rate swaps and leverage. The exchange is described as a traders-first, crypto derivatives platform that offers a reliable way for users to trade futures on Bitcoin (BTC), Ether (ETH), Ripple (XRP) and other altcoins. According to Delta Exchange their strengths are mainly that their platform offers 24/7/365 liquidity, up to 20x leverage, fast execution trades, low fees and enterprise-grade security. The team’s vision is to serve both retail and institutional traders by building a very liquid and trusted global cryptocurrency derivatives exchange. Some of Delta’s competitors include BitMEX, Deribit and FTX.

The project was conceived in 2017 and founded in 2018, Delta Exchange is operated by Bit Protocol LLC, a company incorporated in St Vincent and the Grenadines. Bit Protocol is wholly owned as a subsidiary of Protocol Labs Pte Ltd, a company that is incorporated in Singapore. Delta Exchange is a centralized exchange. You can find out more about their management team here. The exchange has solid support from investors that include AAVE, Kyber Network, CoinFund and others:

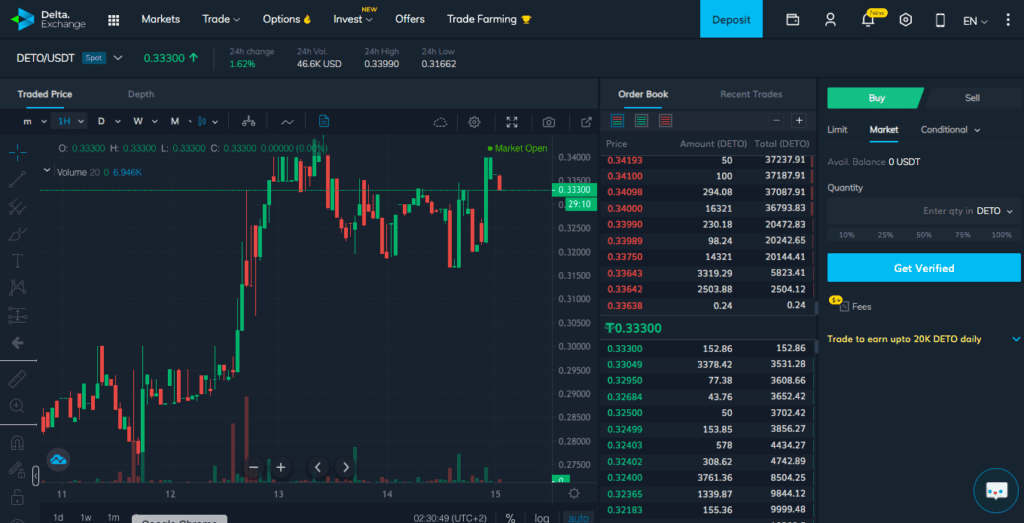

Users have access to multiple trading panels on the exchange including chart, order book or recent trades, order submission and open orders & position panels. In order for a user to place a trade, they simply need to select the type of contract of interest. Futures contracts on Delta are margined and settled in either BTC or USDT. Users of Delta can simply use the currency converter tool to change BTC to USDT if they intend on trading a USDT settled contract. They can then specify the number of contracts that they are considering buying or selling and choose the type of order (e.g. limit or market) and then placing the order.

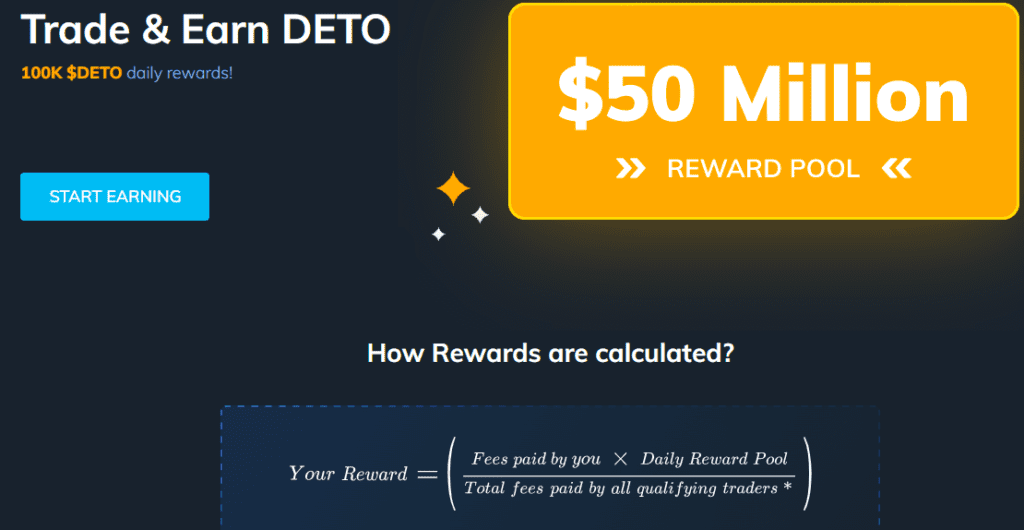

Delta Exchange has its own native ecosystem token with the ticker DETO. It is essentially an ERC-20 utility and rewards token intended on powering the Delta Exchange. DETO is currently an untracked listing on Coinmarketcap but on Coingecko it is trading in ranges above US0.30 at the time of writing. DETO is expected to be integrated across the value chain of the exchange. DETO also utilizes market-making pools for liquidity and enables:

- Staking and Exchange Utility – DETO can be used to pay for trading fees and can also be used as margin. Delta offers staking and reasonable lock-up periods.

- Liquidity Mining (AMM) – currently available on single currency pools (BTC and USDT). More are expected to be added in due course.

- Robo-Trading – users have the potential to earn yield and DETO tokens through investing in trading strategy pools.

- Buybacks – part of the tokenomics of DETO is that Delta Exchange will use a part of the fees earned on the exchange to buy back DETO.

- Minimum Support Price (MSP) – Delta Exchange is intending on accepting DETO tokens for >= $0.10 as trading fees.

- Trade Farming – crypto traders are able to earn DETO proportional to their trading volumes on Delta Exchange.

What’s Great About Delta Exchange?

- Great educational content on futures trading.

- Delta Exchange has a pretty good affiliate program. Users simply need to share their referral links and invite friends to Sign up on Delta Exchange. Referred users get a 10% discount on trading fees for six months. The discount will apply on all contracts. For referring people to Delta, you receive 15% of the trading fees that the people you refer pay for the first year and a 10% lifetime referral fee.

- The exchange seems to prioritize security. You can check out the prizes for their bug bounty program.

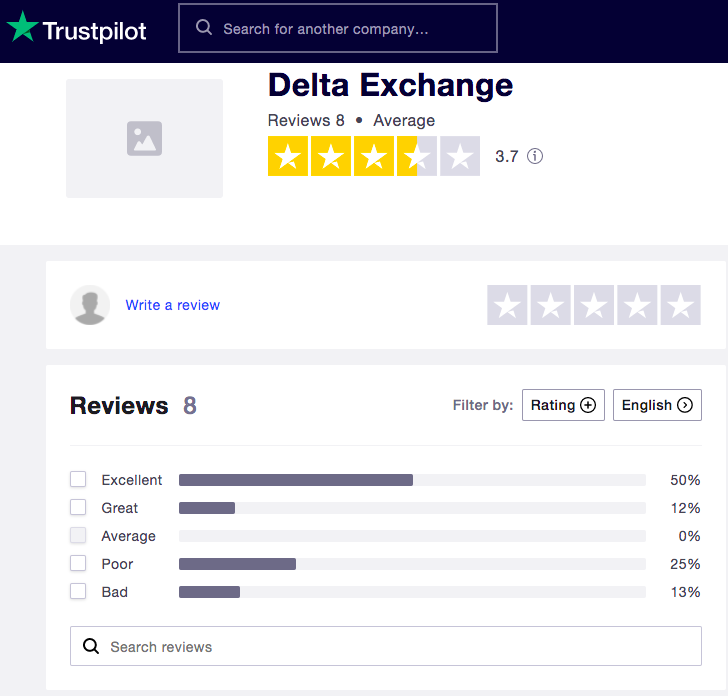

- Delta has some decent reviews on platforms such as TrustPilot.

Delta Exchange also runs an over-the-counter (OTC) trading desk that is aimed at facilitating high volume trades in futures and perpetual contracts on digital assets supported on the exchange. Delta acts as an OTC liquidity provider. The OTC desk serves institutional investors, miners, and individual pro traders. Delta Exchange also has a dedicated chat room for OTC trading. Find out more.

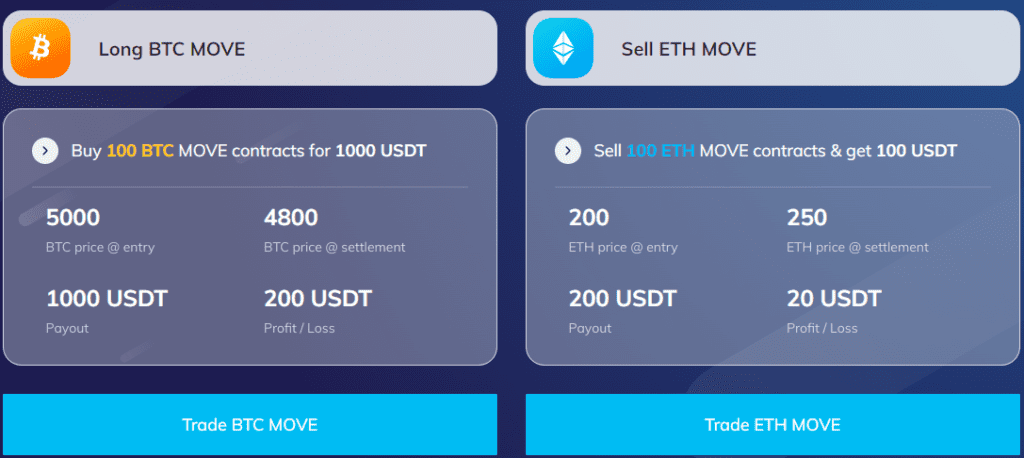

- Delta Exchange offers MOVE Options which are used to speculate on the volatility of the underlying cryptocurrencies. Delta also offers Bitcoin (BTC) Futures, BNB Futures, Litecoin (LTC) Futures, Ethereum (ETH) Futures, Ripple (XRP) Futures, Stellar (XLM) Futures, Tezos (XTZ) Futures, Basic Attention Token (BAT) Futures Bitcoin Cash SV (BSV) Futures, ATOM Futures, Ravencoin Futures and LINK Futures.

- Delta has around 10 markets for perpetuals i.e. BTC – USD Perpetual, BNB – BTC Perpetual, XTZ – BTC Perpetual, XLM – BTC Perpetual, ATOM – BTC Perpetual, LINK – BTC Perpetual, ETH – BTC Perpetual, ALGO – USDT perpetual, KAVA – USDT perpetual, and BAND – USDT Perpetual.

What’s Not So Great About Delta Exchange?

- Users located in, or citizens or residents of the US (including Puerto Rico, the U.S. Virgin Islands), St Vincent and the Grenadines, Iran, North Korea, Syria, and other countries cannot trade on the platform.

- To some the fact that you have to KYC in order to use the platform is not attractive but again this is to comply with basic laws in many of the jurisdictions that the exchange is allowed to operate in and to try and prevent fraud and money laundering.

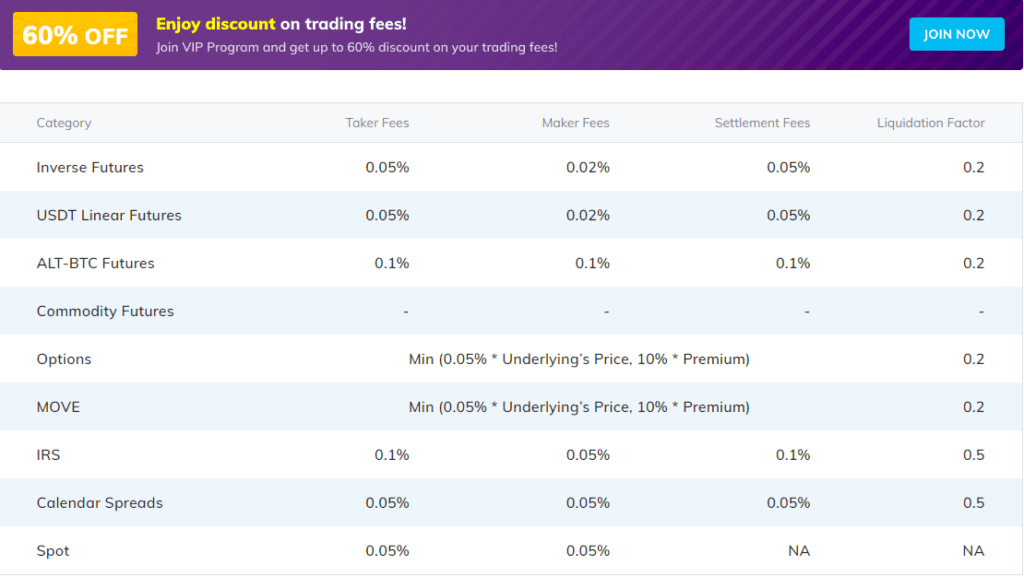

Delta Exchange Platform Fees

When a trader receives a rebate that is called a negative fee. At the time of settlement, settlement fees apply to all open contracts. The notional size of a position determines trading fees charged for options contracts. Trading fees are however capped at 10% of the premium of that option. As far as liquidated positions that Delta Exchange happens to close at a price better than the bankruptcy price, Maintenance Margin multiplied by Liquidation factor is added to the Insurance Fund. Any leftover position margin is then returned to the trader.

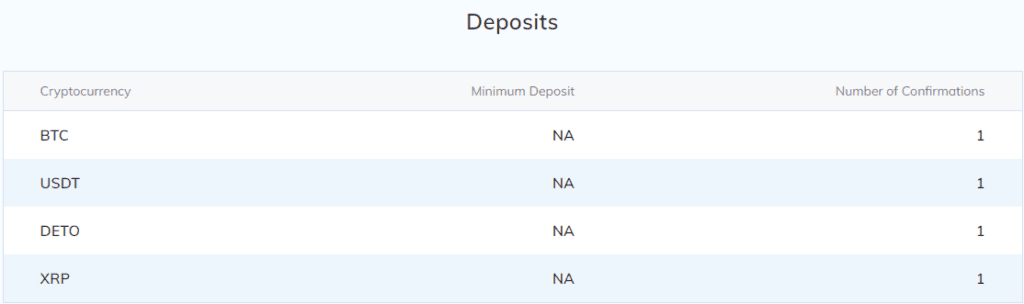

Deposit Limits

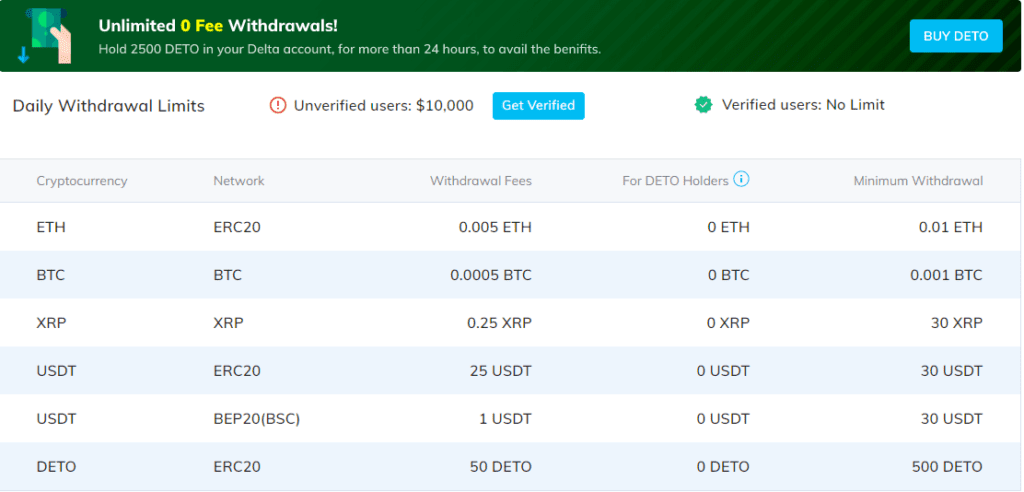

Withdrawal Limits & Fees

Delta Exchange operates an advanced platform with decent volumes. Currently it is doing on average around US$250 million in daily volume which is significantly lower than competitors such as BitMEX which are doing around four times that. However, the platform’s interface is user-friendly, the product offering is innovative and the platform seems secure with no major reported security breaches to date.

Derivatives trading is a risky affair and it is recommended that traders be fully equipped with the proper know-how in order to avoid making costly mistakes due to the nature of using leverage when trading. Delta Exchange is competitive in its offering, pricing, liquidity, etc. It therefore appears that the exchange has potential to grow even larger over time as long as it continues to be reliable. Always do your own further research.