Premia Decentralized Options Marketplace Review

What is Premia? DeFi Options Platform Explained

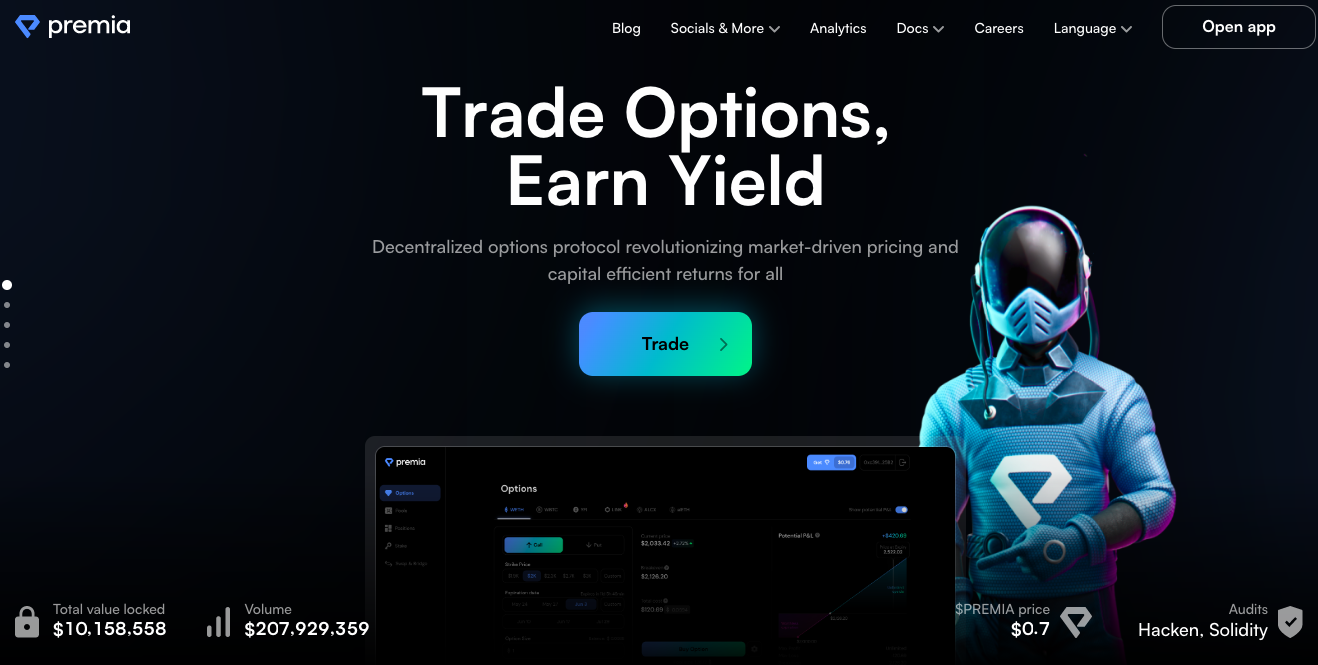

Premia’s automated options market is bringing peer-to-pool trading and capital efficiency to DeFi options. Premia is a decentralized options marketplace which operates via the domain https://premia.finance/ owned by Defy Network Services Limited, registered in Cyprus. The front-end to the decentralized Premia ecosystem that Defy controls is separate from the smart contracts that are executed on the platform and the entity, in essence, has no control to update or alter any of the smart contracts that may be interacted with on the platform.

As an automated options market, Premia offers decentralized options based on a pool-to-peer architecture to the market, kind of similar to how Uniswap or SushiSwap work but with a focus on options.

Premia is a collection of DeFi Smart Contracts on the Ethereum blockchain that are utilized for the delivery of financial instruments-as-a-service to users. What makes Premia an innovative platform is that it introduces a liquidity sensitive pricing model with built-in market adjustment mechanisms. Initially, Premia looked to deliver functionality that makes it possible for users to underwrite financial contracts that are traditionally referred to as American Style, physically settled, Covered Call and Put Options.

What distinguishes Premia’s offering is exactly its focus on providing American options which can be exercised any time before expiration, as opposed to European options that can only be exercised at expiration. One could suppose that the ‘increased opportunity’ they offer is why they are more desired by traders than the European options.

Effectively, the Premia Options Minter can simply write options contracts for any token that is denominated in DAI, ETH, or WBTC. The Premia ecosystem and platform is powered by the PREMIA token, which is the native ecosystem token that makes it possible for users to stake to earn rewards.

Premia Options Explained Simply

Premia options offer the holder the rights but not the obligation to buy or sell the underlying token by a specified date. The options are ERC-1155 tokens which Premia chooses to utilize for the securitization of covered options contracts. This means that the token collateral is effectively locked up with the smart contract until either early cancellation, exercise, or expiration – that is if it is not sold. Essentially, the Premia Options Minter was devised in such a way that is meant to be able to write Options for any token denominated in either DAI/WETH/WBTC.

The ERC1155 token standard is conventionally used for transferable and fungible artworks or in-game assets because it facilitates single smart contract minting of numerous tokens with varying degrees of specifications. It also allows for many unique tokens such as options to be created from the same smart contract, while also making it possible for each contract to hold unique parameters or identifications that are specifically tailored to the distinct options contracts.

What makes options on Premia interesting is that they represent the same number of tokens unlike traditional stock option contracts that usually represent 100 shares of the underlying stock. For instance, a 100 ETH call option essentially represents the right to purchase 100 ETH at the option’s strike price and by the option’s maturity date. Every option comes with a token token pair for example ETH/DAI, then an option type i.e.either a call or put, and then a strike price which is generally the price at which the option can be exercised, plus a maturity date which represents the expiration date of the option.

To use the platform, you need to connect your web3 wallet e.g. MetaMask.

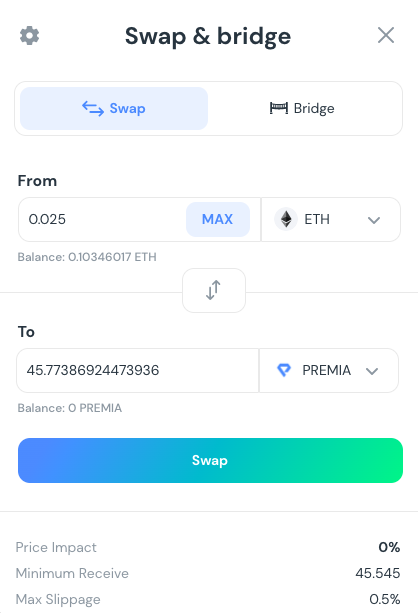

Once your wallet is connected, you can choose to proceed to buy the native token PREMIA.

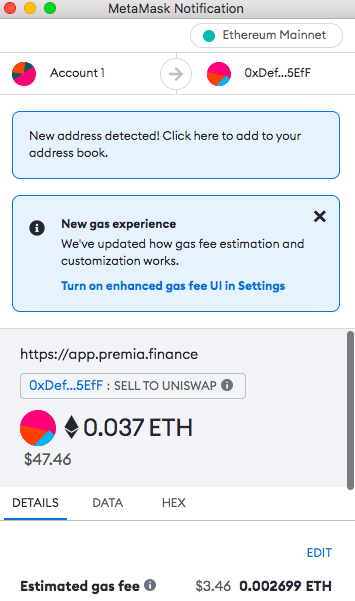

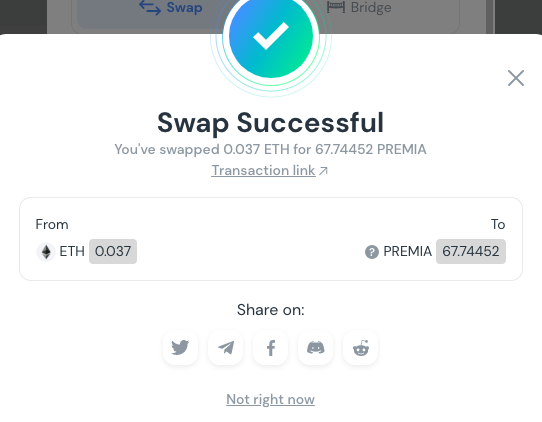

Once you confirm the swap, you will receive your PREMIA tokens.

As you can see for the purposes of demonstrating – in this purchase, I made the transaction on the Ethereum mainnet via Uniswap, however, Premia has more TVL on Arbitrum.

Why are Options Important to the Maturity of Decentralized Finance?

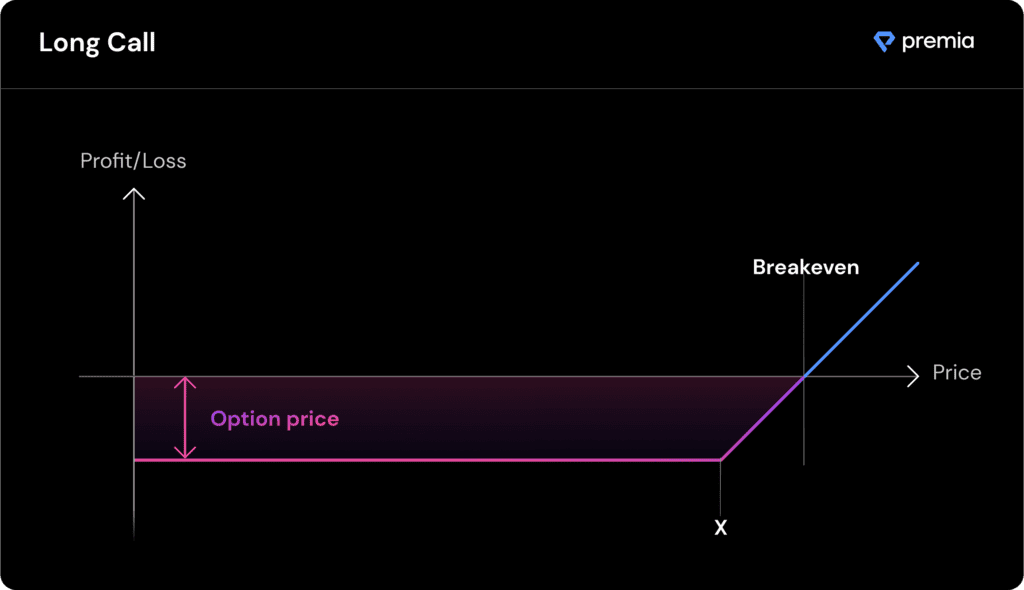

Options are typically used for hedging risk, which one can look at as purchasing insurance against the downside risk of tokens they already own via Put Options or hedging on the upside risk of tokens they do not already own via Call Options. As a result, buyers of call options can be said to believe the underlying token could go up in price over time.

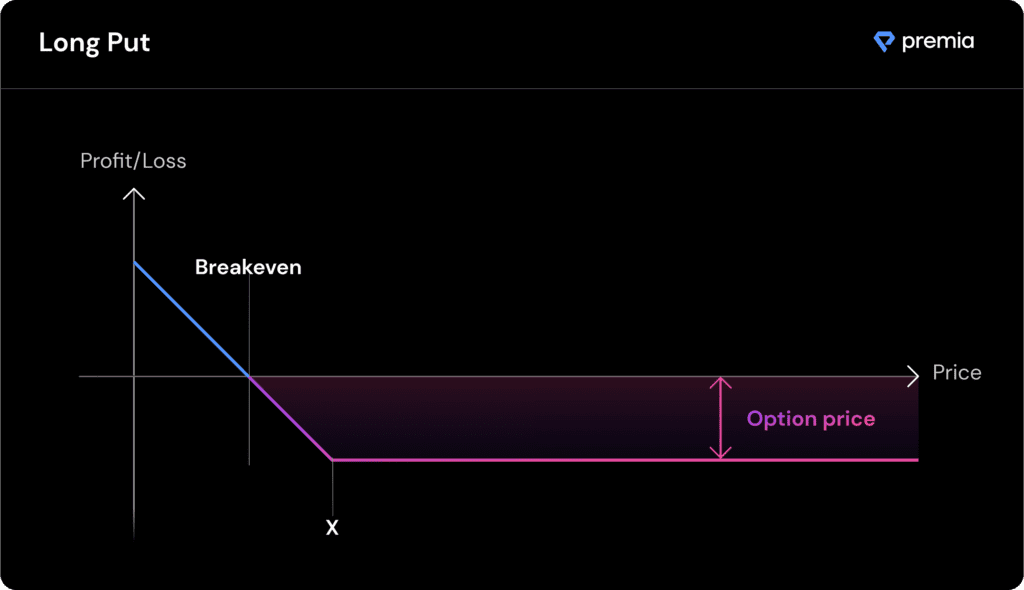

Put options, on the other hand, essentially give the owner of the option a right to sell the said amount of the underlying token at the said strike price. This has to take place by the option’s maturity date. In that case, you can also say that buyers of put options generally believe the underlying token could go down in price over time.

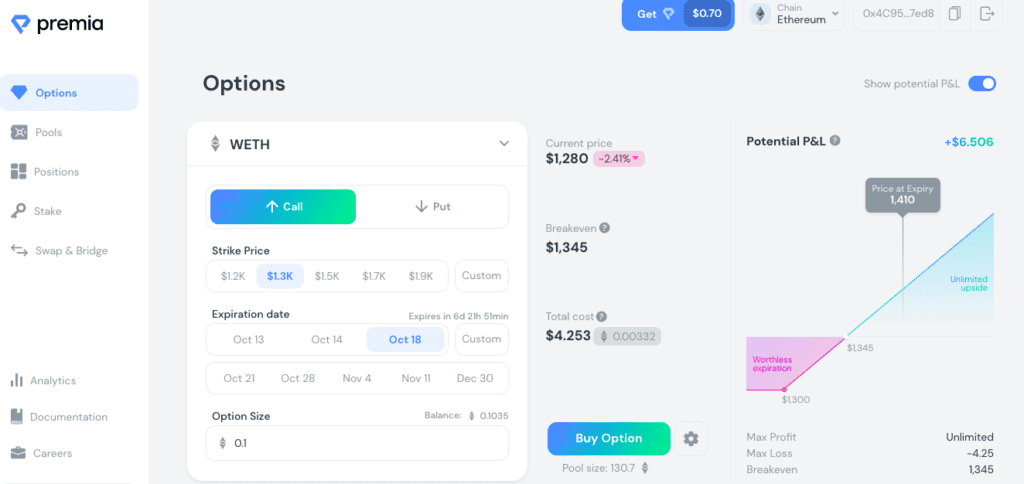

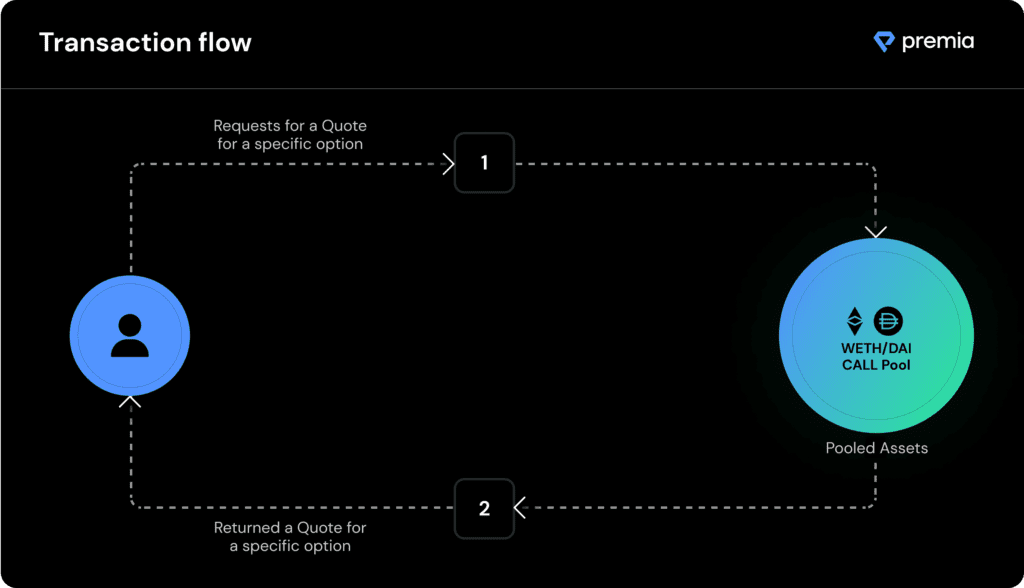

Premia users are able to purchase American-style options on Premia’s automated market maker (AMM) by simply selecting the details of the option that they would like to trade, e.g. the token pair, strike price, and maturity. Upon entering those details, the user will typically receive a quote that is denoted in terms of the underlying asset for call options or indeed the base asset for put options. Once the user agrees with the price, they are then able to execute the transaction in order to facilitate the trade and purchase the option for the quoted price.

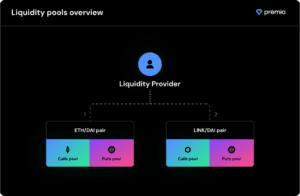

The relative supply versus demand of capital in a pool that a user requests a quote from is priced automatically by the underlying option dynamics. On Premia, each asset pair typically comes with two pools i.e. a ‘call’ and a ‘put’ pool – which is meant to make it easier for both liquidity providers to choose which pool they would prefer to underwrite. It is also meant to make it easier for option buyers to choose which direction they would like to trade. This is seen as a win-win situation.

Whenever a user decides to buy an option from the pool, they are able to effectively send the details of the option that they would like to purchase to the pool, and then the pool will return a quoted price for the user’s selected size, the strike price, and also the maturity date. In the case that a user is in agreement with the price, they are then able to execute the trade with an on-chain transaction. This meant that the option will at that point be owned by the purchaser and it would be represented as an ERC-1155 token in their selected wallet. This makes it possible for the user to transfer the option and also to exercise it at a future time if they so wish.

Exercising & Settlement on Premia

In order to minimize the amount of funds that need to change hands, Premia fully collateralizes options at any given time. If the price of the underlying asset is lower than the breakeven price at the time of exercise, then that put option is pretty much considered ‘in the money’. This generally implies that the user is essentially entitled to the payoff which is calculated by subtracting the spot price from the strike price of the underlying. This difference is calculated automatically and then settled in cash (i.e. the base token) to the option buyer.

In the case that the user purchases an option, they are able to exercise that option at any time after the initial purchase. The advantage with options is that they can be exercised in full or in partial amounts over a period of time. If an option is ‘in the money’, the payoff is automatically locked in for the owner of the option to be able to, at their convenience and after maturity, exercise the option with no penalty.

What Makes Premia DeFi Options Platform Unique?

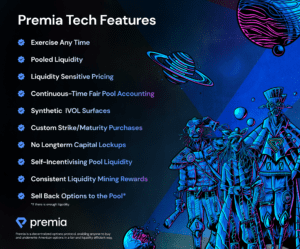

Premia provides solutions to a number of problems that other options protocols haven’t yet brought to the decentralized finance market such as market driven option pricing, optimal liquidity pool utilization, pool-to-peer architecture that is capital efficient and a platform that offers instant withdrawals and risk management features for liquidity providers.

Premia has pioneered market driven options pricing and liquidity sensitive returns for liquidity providers. It is also at forefront when it comes to offering returns on liquidity i.e. options premiums that are priced according to the supply or demand of capital that is available in each pool. This means that larger demand translates to higher option prices, which consequently boosts returns for liquidity providers.

What’s even better is that liquidity providers also have control over which markets they underwrite. This is unlike underwriting the entire volatility market since liquidity providers are able to implement tailored strategies to granularly provision their liquidity to the exact pools (and options) that they wish to. Due to its automated pool pricing mechanism, Premia actually incentivizes liquidity providers to enter a pool from the time that it is launched in order to stand a greater chance of earning the highest returns. This helps to lower slippage when the time comes for the first options to be purchased from a pool.

PREMIA Token

Premia also offers attractive and dynamic token rewards to liquidity providers and PREMIA token stakers who are able to accrue PREMIA tokens over time through the Liquidity Mining program and the xPREMIA system. The amount that is rewarded tends to depend on the size of the position and the length of the deposit subject to the amount of protocol fees that are generated.

Users of Premia are able to buy options with any asset as long as there is liquidity available on the decentralized exchange. If a user decides to purchase an option with an asset that is different from the default payment token, their asset will be swapped to the payment token on the DEX with the best price before the option is purchased. This is all done simultaneously and seamlessly in a single transaction to provide a better user experience.

Capital or liquidity in the pools for trading options is provided by liquidity providers such that when a trader purchases an option, the liquidity provider simultaneously underwrites the option to the buyer. It is important to note once more that all options on Premia are fully collateralized and can be exercised at any time before or after the option’s expiration.

Once an option expires, its value is locked to the option’s value at the time of expiration. When an option is exercised, the exercise reward is then sent to the option holder. Subsequently, the remaining collateral is then sent back to the liquidity provider’s free capital pool, which makes it available to be used once more in order to underwrite future options or in other instances, to be withdrawn by the depositor together with the premiums that would have been earned from selling the option.

Liquidity providers on Premia have the opportunity to take advantage of market-competitive yields from option premiums, in addition to Premia rewards from the Liquidity Mining program. This is done in order to make it possible for traders to have the best possible prices and an optimum trading experience, to ensure that volume and returns for liquidity providers and PREMIA stakers are sustainable. Nonetheless, it is important to also note that Premia is currently available in beta so it is important to understand the risks before using the platform.