Gains Network – gTrade Decentralized Leverage Trading Platform Review

What is gTrade? Gains Network Explained

Gains Network is a DeFi ecosystem on Polygon consisting of a leverage trading platform, staking pools and a bridge. The main offering is gTrade, a decentralized leveraged trading platform that is described as liquidity-efficient and user-friendly due to its synthetic architecture design that is supposed to make it capital efficient, thereby lowering trading fees. The platform offers numerous pairs with varying degrees of leverage i.e. up to 150x on digital assets, up to 1000x on forex, and up to 100x on stocks.

The Gains Network protocol is powered by ERC20 utility tokens (GNS) and ERC721 non-fungible utility tokens (NFTs). The tokens are designed to be used within the platform and make it possible for users to have ownership of the protocol by capturing revenue and through governance as the DAO gets established. The vision of the team is to provide GNS holders with platform fees through single-sided staking. Burning of GNS is done using platform revenue and NFT holders get reduced spreads and boosted rewards. What’s unique is that you also have NFT bots that execute limit orders and liquidations.

How to Use gTrade Leverage Trading Platform

Getting started on gTrade is simple. No sign up is required to use the platform.

To access the platform features, a user needs to connect their web3 wallet.

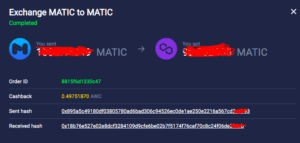

Once connected, a user can proceed to utilize the platform and take trading positions. In order to purchase GNS tokens, I decided to send some MATIC to my MetaMask from another wallet. But before that I decided to swap my MATIC (ETH) to MATIC (Polygon) and then credit my MetaMask MATIC wallet on Polygon Network since that is where GNS can be traded.

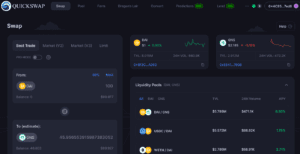

It may have been easier to get the GNS tokens directly from the Gain Network website which would redirect you to QuickSwap where you’d be able to swap DAI for GNS.

Once that is sorted you can proceed to trade on the gTrade decentralized leverage trading platform. gTrade effectively helps users trade on the spot price of crypto assets, stocks, and a number of major forex pairs with leverage.

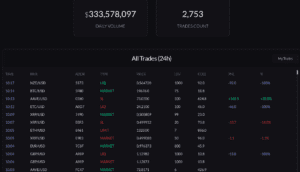

GNS is already achieving significant daily trading volumes.

GNS Token Explained Simply

GNS token ($GNS) acts as a mechanism of liquidity efficiency to offer the best trading experience and returns for ecosystem participants. The token has been net deflationary over the course of its existence. It began as the $GFARM2 token on Ethereum, distributed in an ETH pool and a GFARM2/ETH LP pool. It was later bridged to Polygon, with a 1:1000 split to $GNS. The development of the token’s use cases is seen as a way to sustainably grow the ecosystem.

The initial use case for GNS was minting and burning to back trading, now the token supports the liquidity efficiency of the DAI vault through the minting of rewards for GNS/DAI liquidity pool providers, NFT bots, and affiliates, so that the DAI remains within the vault to adds stability through the reduction of vault drawdowns and supporting the vault’s over-collateralization. GNS is burned when the DAI vault becomes overcollateralized adequately in order to offer a decent buffer for DAI vault stakers. The overcollateralization ratio is currently 130% which is set to counter the inflation from GNS/DAI LP rewards and NFT bot rewards.

In addition, GNS also ensures that in future, early adopters do not have a percentage of their platform interest diluted by whales. GNA is seen as the backstop to traders winning on gTrade, not via minting, but through potential OTC sales of the protocol wallets’ reserves, i.e. if required. It will also be the main way in which to have governance over the protocol. Since the protocol doesn’t yet have sufficient protocol-owned liquidity, it shares the trading fees that are generated by gTrade in order to incentivize the GNS/DAI liquidity pool and the DAI vault. The long-term roadmap does prioritize owning more of the liquidity so that incentives can be issued directly to the GNS single staking pool.

What Makes Gains Network (gTrade) Unique?

- No deposit or signup required.

- Offers crypto, forex, and stocks with commodities and indices to be made available in the near future.

- Users have full custody of their funds.

- 100% on-chain execution of trades.

- Real-time custom Chainlink decentralized oracle network.

- Gains offers high liquidity & low price impacts.

- No scam-wicks.

- Offers high leverage e.g. up to 150x on cryptos, 1000x on forex, and 100x on stocks.

- Fees are competitive fees e.g. exactly 0.08% on every order.

- Good user experience and an intuitive trading interface.

- No order books or liquidity for each pair.

- Synthetic leverage (not borrowed).

Fees

Much like most leveraged trading platforms, gTrade’s fees are applied on the collateral x leverage of a user’s trade i.e. position size. The trading fee is applied when opening the trade and also when closing. The fee is currently 0.08% of leveraged value on opening and closing, for all crypto assets, and 0.008% for forex. There is also a spread on the price of each pair when opening a trade. This is meant to prevent high-frequency bots exploiting small price movements.

The price impact typically will depend on the position size of a trade and the liquidity of the pair on spot exchanges. This is meant to prevent manipulating the spot price of assets that are listed on the platform. gTrade also charges funding fees i.e. on the position size and rollover fees i.e. on the collateral in order to manage the risk of their DAI vault, depending on the net exposure of a pair, and depending on its volatility.

Fees collected are then distributed to the team, project fund, liquidity providers & GNS staking, affiliates, and to the NFT holders that execute the limit orders and liquidations in a decentralized way. Check out the full fee breakdown.

What are GNS NFTs?

Gains Network has unique NFTs that are a set of 5 different types of NFTs. These are described as the master keys of the ecosystem since they unlock several exclusive benefits including reduced spread when trading: -15% (Bronze), -20% (Silver), -25% (Gold), -30% (Platinum), and -35% (Diamond). Users need to simply hold the NFTs in their trading wallet.

All NFTs can execute equally and users are able to run bots to get rewards from executing liquidations and limit orders. There are a set of instructions on how to set-up and run the bots here.

If a user stakes up to three NFTs, they can essentially boost their LP or SSS rewards. The boosts are 2% (Bronze), 3% (Silver), 5% (Gold), 8% (Platinum), and 13% (Diamond). Only 1500 NFTs are available in the ecosystem and they are split as follows:

GNS NFTs are there to offer boosted levels of liquidity pool rewards and single-sided staking. With an NFT, a user gets a larger share of rewards with the same capital and without an NFT, the APR displayed on the staking page will be the average APR the user receives based on the previous week of rewards. For example, if you have 1 Diamond NFT, 1 Platinum NFT, and 1 Silver NFT your total boost would be 13+8+3=24%. This means that the user gets 24% more rewards compared to the quoted or displayed APR on the platform.

The GNS NFTs were effectively claimed by liquidity providers who supplied at least 1% of the total liquidity and in return they were rewarded with NFT credits which allowed the minting of the GNS NFTs. Bronze NFTs required the least and the diamond NFTs required the most amount of credits.

Conclusion

Gains Network is an innovative player in the burgeouning DeFi and decentralised derivatives market that has been made possible by blockchain technology. It is however important to note that these platforms are still developing and extreme caution should be exercised when using them.