Aboard Decentralized Derivatives Exchange Review

What is Aboard Exchange?

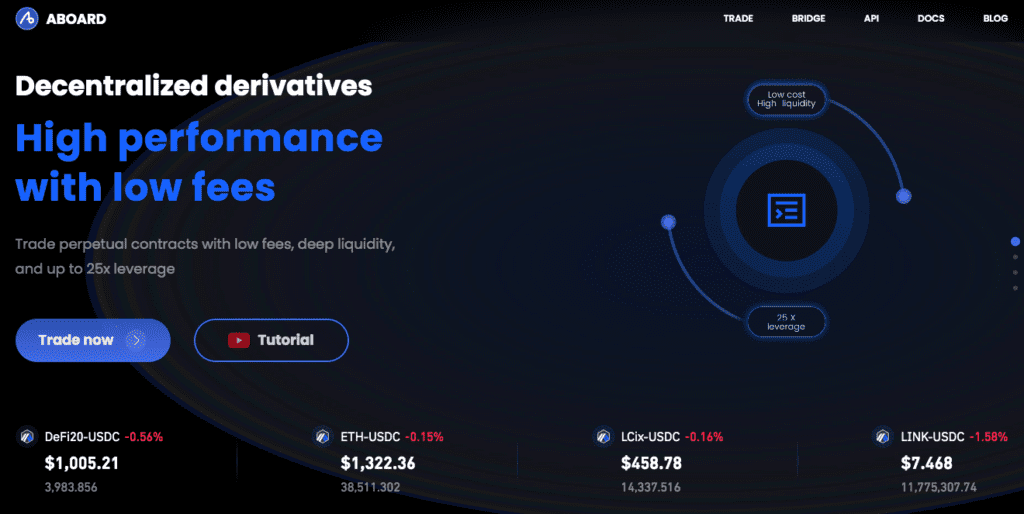

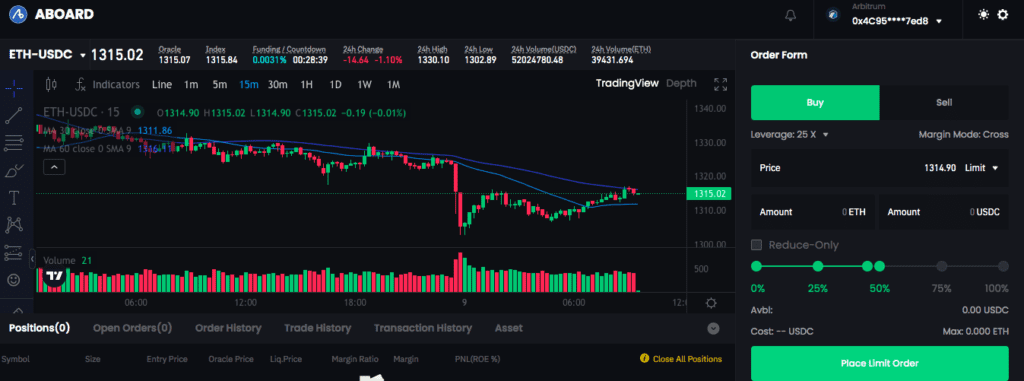

Aboard is an order-book decentralized derivatives exchange that makes it possible for users to trade low-fee perpetual contracts with up to 25x leverage. The Aboard protocol includes an order-book decentralized derivatives exchange promising more products, improved efficiencies, and advanced trading tools. Users of Aboard can enjoy gas-free perpetual trading.

Aboard also makes use of an innovative order-book style trading core and layer2 rollup solution for the purposes of minimising latency and trading costs. In addition, Aboard comes with an advisory protocol aimed at being a platform for fund managers to be able to create trading strategies. The advisory protocol is meant to use smart contracts to connect crypto investors with DeFi fund managers directly. It is also meant for investors to pick strategies transparently and in an immutable way.

What makes Aboard Exchange unique?

Aboard’s core offerings include perpetual futures, indices and index perpetuals, and options. All that in addition to spot, margin and lending.

A perpetual future contract has no settlement date and it’s designed to imitate a margin spot market. Aboard offers several pairs of perpetual contracts for trade, i.e. BTC-USDC, ETH-USDC, AAVE-USDC, LCix- USDC, LINK-USDC, SUSHI-USDC, and UNI-USDC. A user is able to choose up to 25x leverage and also make use of a cross-margin trading system in order to maximise capital efficiency. Perpetual contracts come with insurance funds, which limits the probability of counterparty liquidation.

Index and index futures can provide an investor with the exposure to a specific industry through purchasing index spots or futures. With Aboard, a trader is able to speculate on the direction of the index with only one contract. In addition, they could also extract market alpha through buying best performing tokens and hedging with shorts on the index future. Most traditional markets actually offer index futures products, for example in the USA you have E-mini S&P 500 and E-mini Nasdaq-100. In Hong Kong you have Hang Seng index futures, and in China you have CSI 300.

DeFi didn’t have such products prompting Aboard to launch the LCix-USDC index perpetual futures at the beginning of the year (Jan 2022) in order to fill the gap. The LCix index tracks the performance of Bitcoin, Ether, and Binance Coin and is a capitalization-weighted index. Aboard has more indices in their roadmap including a DeFi Index, NFT index, Metaverse Index, Infrastructure Index, and Public Chain Index.

Furthermore, Aboard has an option system that employs a traditional T-shape display. The contract sequence is automatically generated based on the current price of the underlies. Aboard then introduces market makers and adopts external implied volatility in order to optimally price options and provide a superior trading experience. By charging a portfolio option margin aligned to the greek risk dimensions, Aboard maximises capital efficiency for each asset. Aboard supports automatic settlements. This means that upon expiry, Aboard will carry out cash settlement for open positions according to the underlying price. Traditional options with fixed maturity are also an offering on Aboard’s roadmap. The team also plans to launch perpetual option contracts.

Margin and spot trading is the focus for the Aboard team with lending and borrowing products planned for release before year end (2022).

Getting started on Aboard is pretty straightforward, however, the world of derivatives can be tricky to grasp for the novice trader. To get started go to: https://aboard.exchange/. Should you wish to trade simply click the “Trade” tab.

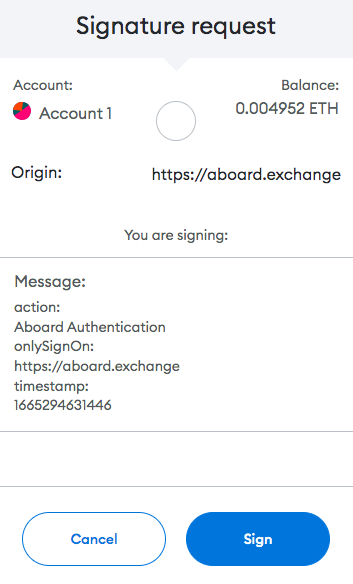

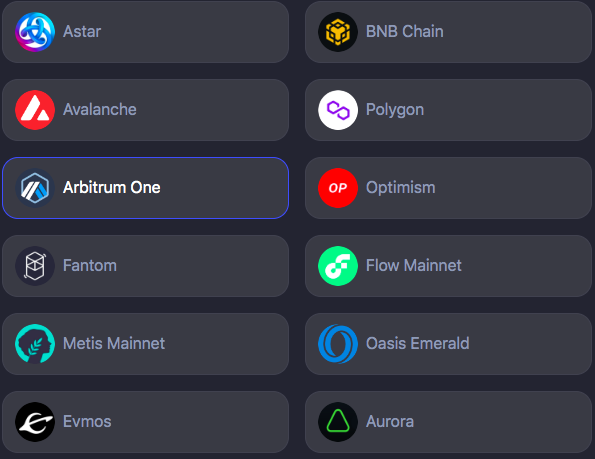

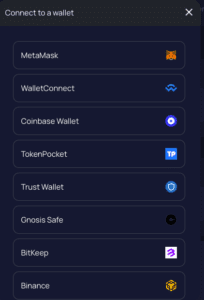

You will come to the trading interface. Aboard is a multi-chain protocol that is deployed on different networks including Arbitrum, Binance Smart Chain, Solana, Optimism, Near, Polygon, ZkSync, Starkware and more. You need to connect your web3 wallet in order to use the exchange. In my case, I connected my MetaMask wallet.

Once your wallet is connected, you can then proceed to use the platform.

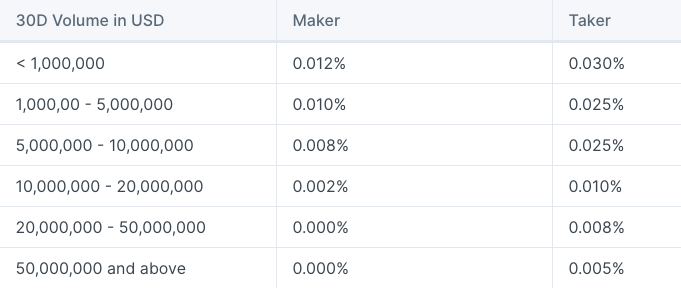

Aboard Exchange Fee Structure

Aboard Exchange makes use of a standard maker-taker fee structure across all trading pairs. Users need to pay gas fees when depositing to Aboard Exchange, however, the exchange covers withdrawal gas fees for all traders.

Aboard Bridge Explained

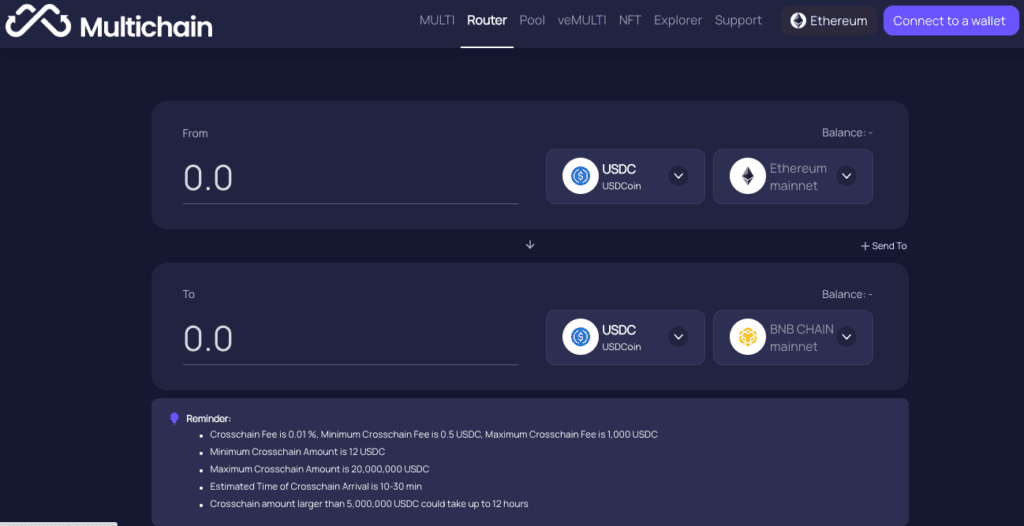

Aboard offers a Celer Network and multi-chain bridge. There are several destination chains that enable at least one token transfer from Ethereum Mainnet.

A user needs to connect their wallet in order to use the bridge.

ABE Token Use Cases

ABE token is the governance and utility token of the Aboard exchange. It is used for bootstrapping liquidity and boosts the network effect. ABE is also used as a reward and governance token to facilitate decentralised governance and for incentivizing the Aboard community. ABE tokens can be used by traders for a number of things including offsetting trading fees when participants stake ABE tokens proportional to their holdings. Token holders have weighted voting rights that are also proportional to their holdings. ABE tokens can also be staked in mining pools and rewards are received in return. They are also used for liquidity provision and trading incentives. The tokens can also be staked for unlocking the Advisory protocol function and other advanced functions including portfolio management and risk control. Users will also be able to pay their asset management fees with ABE tokens.