Altcoin Season Is Coming… Here’s the Smart Money Playbook📈

The Altcoin Season May Not Be a Single Event, But a Staggered Series of Mini-Cycles

Historically, true altcoin seasons have not been singular explosive events, but rather multiple waves of rotation. For example:

- In 2017, there was an early altcoin pump (spring), followed by a lull, and then a euphoric altcoin mania in December.

- In 2021, we saw DeFi season (summer 2020–Q1 2021), a correction, and then a meme/Metaverse rally in Q4.

Implication: The 2025 altcoin season could unfold in phases — starting with L1s or AI/DePIN tokens, then rotating to meme coins or niche ecosystems (e.g., Solana or Base coins), especially if BTC consolidates after its peak.

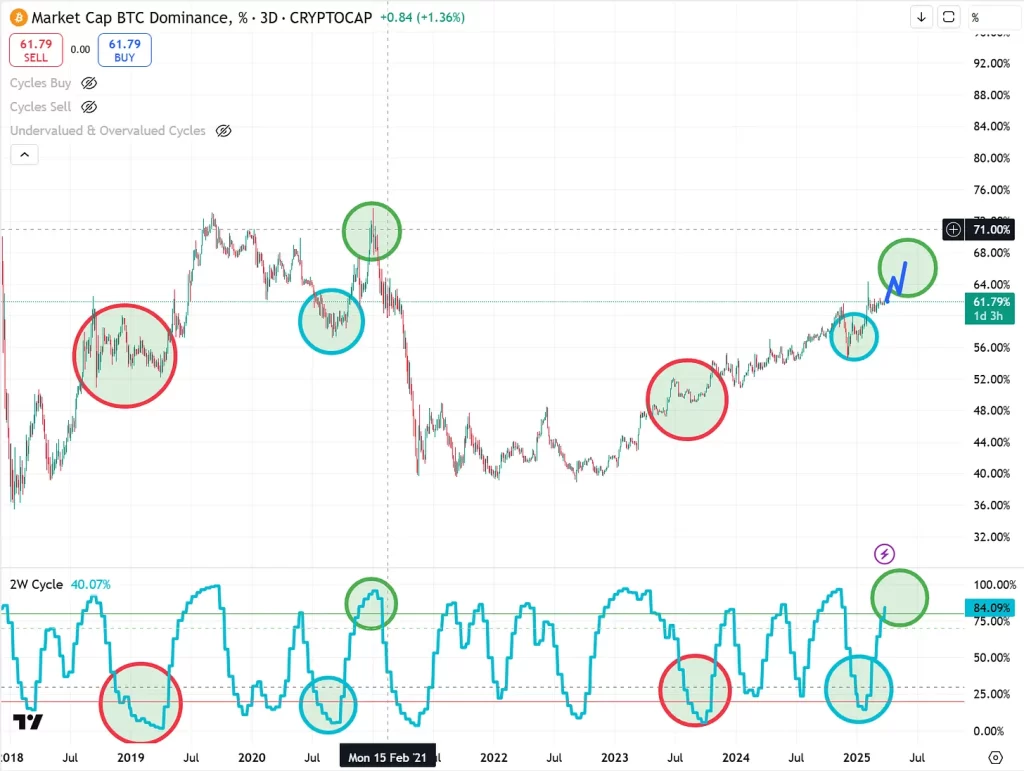

Altcoin Season Likely Begins After BTC’s Final Impulse — Not During It

In both prior cycles:

-

Bitcoin dominance peaked shortly before its final price top.

-

Altcoins outperformed once BTC volatility dropped post-peak.

In this cycle, Bitcoin dominance is on its final leg up, and the ETH/BTC ratio has not yet fully retraced to its prior -80 to -90% historical bottoms. Thus:

Implication: Altcoin season likely kicks off in mid-to-late 2025, after BTC tops and enters a sideways or descending phase — a “capital rotation” moment when investors take profits from BTC and rotate into higher-risk altcoins.

A Sustained ETH Rally is a Precondition for Altcoin Season

The ETH/BTC ratio historically serves as a leading indicator for broader altcoin strength. Currently:

-

ETH/BTC is nearing the lower bound (around 0.02–0.03).

-

ETH is down ~73% from the top in BTC terms, but this is still less than the previous cycle’s ~89% retracement.

Implication: ETH likely needs to fall slightly more or stabilize longer at a key support level before altcoins can truly rally. The ETH/BTC bottom is an essential trigger, not just a coincident signal.

The Real Altcoin Boom May Coincide with Peak Retail Inflows + AI Mania

Past altcoin seasons coincided with retail euphoria and dominant narratives:

-

2017: ICOs

-

2021: NFTs + Memecoins

In 2025, narratives like AI tokens, Real-World Assets (RWA), and DePIN may dominate attention.

Implication: Look for Google Trends, TikTok/YouTube hype, and increased exchange listings (especially from Binance and Coinbase) around these themes. When these metrics spike alongside ETH/BTC bottoming and BTC dominance falling — that’s the convergence for a parabolic altcoin rally.

Altcoin Season Could Peak After Bitcoin Dominance Falls to 38–40%

In past cycles, Bitcoin dominance fell:

-

From 70% → ~38% (in 2017–18)

-

From 71% → 40% (in 2021)

We’re likely repeating a similar pattern now. Bitcoin dominance rising to ~58–60%, then falling hard, could mark a massive altcoin inflow moment.

Implication: Monitor dominance closely. Once it falls below 50%, capital starts rotating fast — and below 42%, expect FOMO-driven retail speculation in altcoins.

Macro Conditions Are a New Variable

Unlike past cycles, the 2025 bull market overlaps with:

-

Potential Fed rate cuts

-

Political change (e.g., U.S. election outcomes)

-

Spot ETH ETF approvals

-

Institutional inflows through traditional finance

These may extend the cycle or amplify certain phases.

Implication: Be open to the possibility of a longer, more structurally supported altcoin season than previous cycles — especially if ETF inflows to ETH create reflexive narratives that spill over to the rest of the altcoin market.

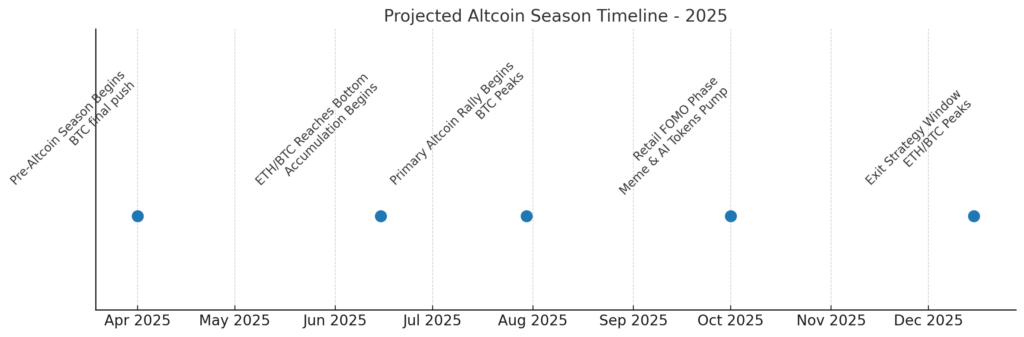

Final Forecast:

-

Pre-altcoin season phase: Q2 2025 (final BTC push, ETH/BTC finds bottom)

-

Primary altcoin rally begins: Q3 2025 (BTC peaks and consolidates, ETH/BTC rebounds)

-

Retail-driven blow-off top for altcoins: Q4 2025 (BTC dominance < 42%, ETH gains strength, memecoins + niche sectors explode)

-

Exit strategy window: Between Bitcoin dominance bottoming and ETH/BTC topping again (~0.075–0.08)