Arable Protocol Review

What is Arable Protocol?

Arable is at its core a platform for farming and trading synthetic assets (synths). Arable gives users access to yield farms on a variety of different blockchain networks all in one place. The platform is designed to eliminate the complexity of cross-chain farming. With Arable, there’s no need to wrap assets and users are not subjected to costly cross-chain bridging. In addition, Arable offers low swap fees and no slippage. Furthermore, users are able to easily track multiple assets spread across different chains.

Arable provides synthetic derivatives of native chain assets to speculators and farmers. Users do all their farming and trading using synths. The synths can either be pegged to fiat currency or their equivalent native chain token.

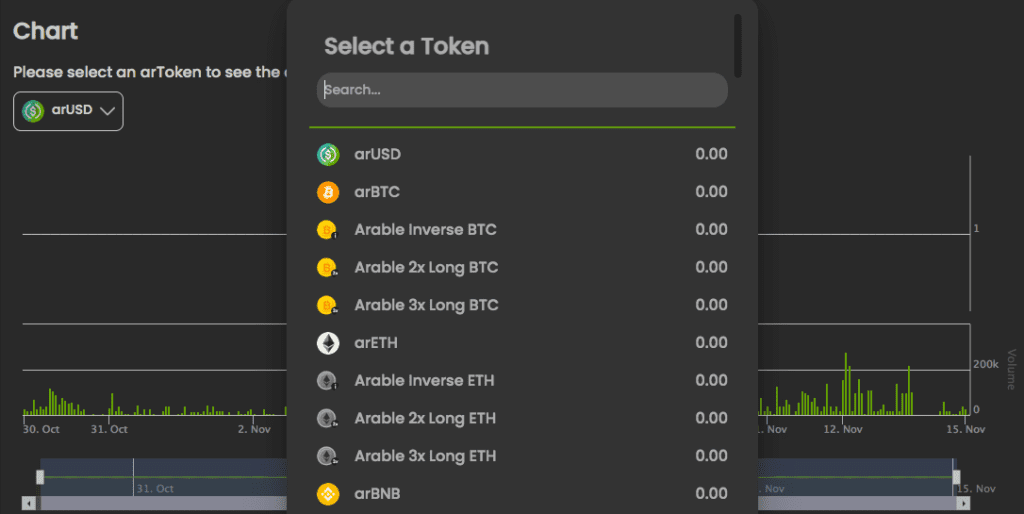

The names of the synthetic tokens available on the platform are prefixed with the letters “ar” for Arable e.g. synthetic USD is named arUSD, etc. All synths on Arable are backed by ACRE which is the native token of Arable. The synths are also backed by other assets such as AVAX or USDT.

What Makes Arable Protocol Unique?

Arable offers users synthetic versions of cryptocurrencies and synthetic farming which makes it unique in the DeFi space since any synth that a user purchases on the DEX can also be farmed.

This can be the synthetics of native chain tokens, liquidity provider (LP) tokens, etc. The APR rates for farms are actually pegged to their native chain counterparts, just as the synths are. This means that a user can receive the same yield. You can read more about farming on Arable here.

Staking on Arable Protocol

Users of Arable can stake the native ecosystem token $ACRE in exchange for rewards in the form of more $ACRE tokens. If you choose to stake $ACRE as a delegator, you’ll also be able to participate in governance of the protocol and have a say in its future development. The APR rate at which these rewards are distributed will change over time since it is not fixed. The changes are subject to the tokenomics.

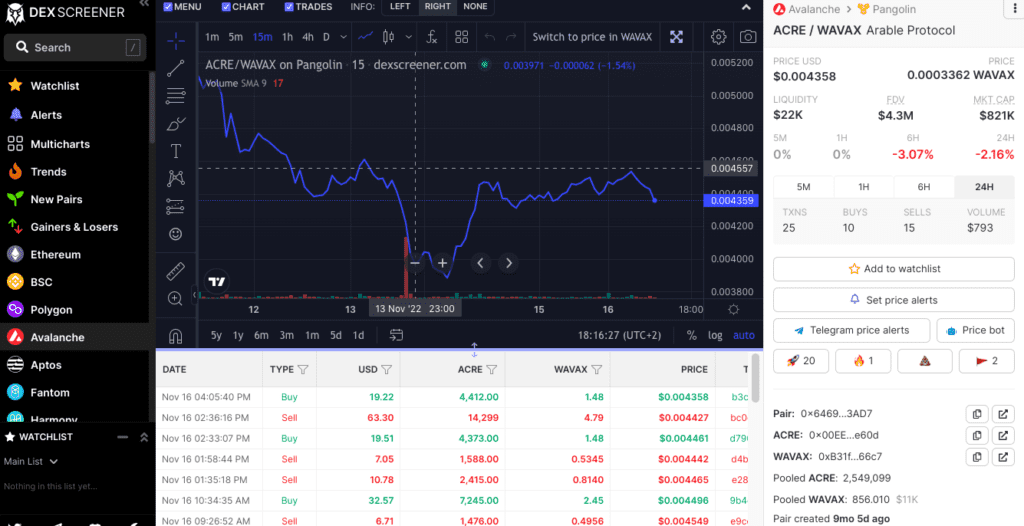

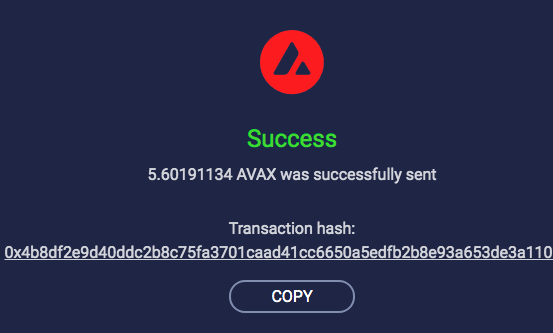

For the purposes of demonstrating and since Arable is built on the Avalanche blockchain, we decided to send some AVAX tokens from a non-custodial wallet to an Avalanche MetaMask wallet so that we could connect to Pangolin and swap the AVAX tokens for $ACRE.

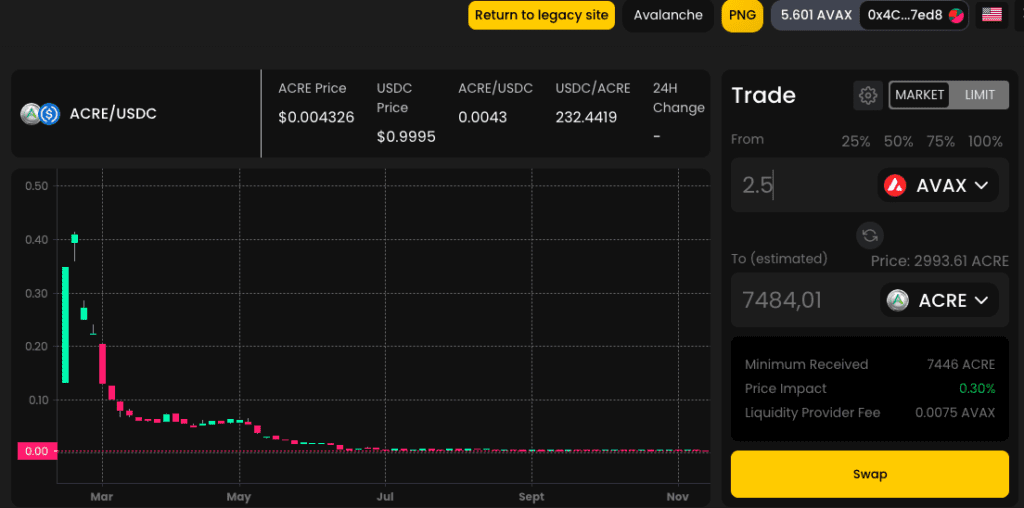

Once the tokens were credited to MetaMask, we could then do the swap on Pangolin as a test transaction.

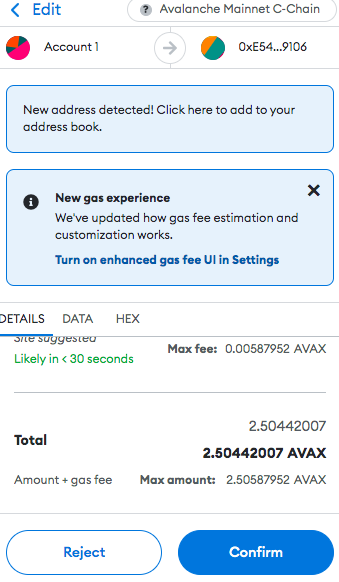

You’ll be prompted to confirm the swap and accept the transaction fee.

You’ll then be directed to MetaMask to confirm the transaction.

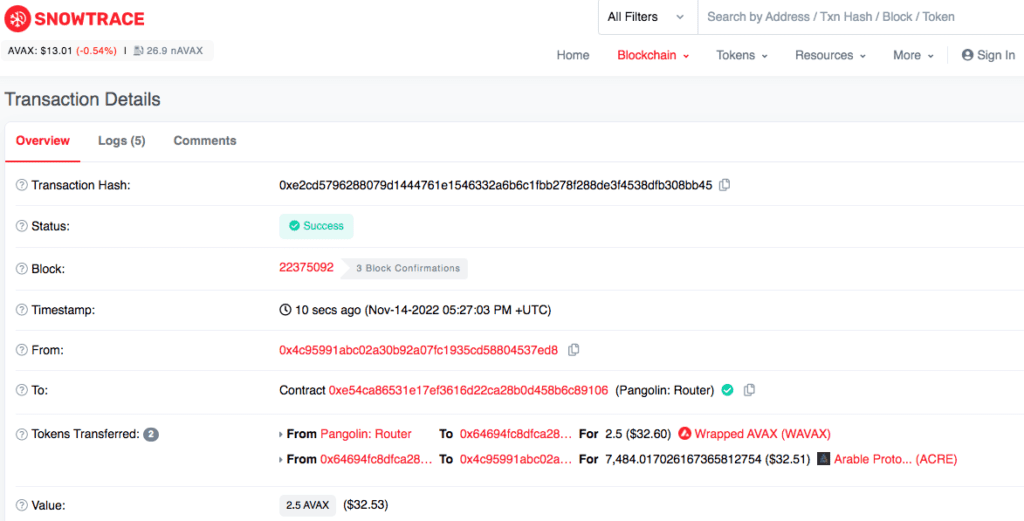

Once your transaction is submitted, you can also verify via the SnowTrace, an Avalanche C-Chain Blockchain Explorer.

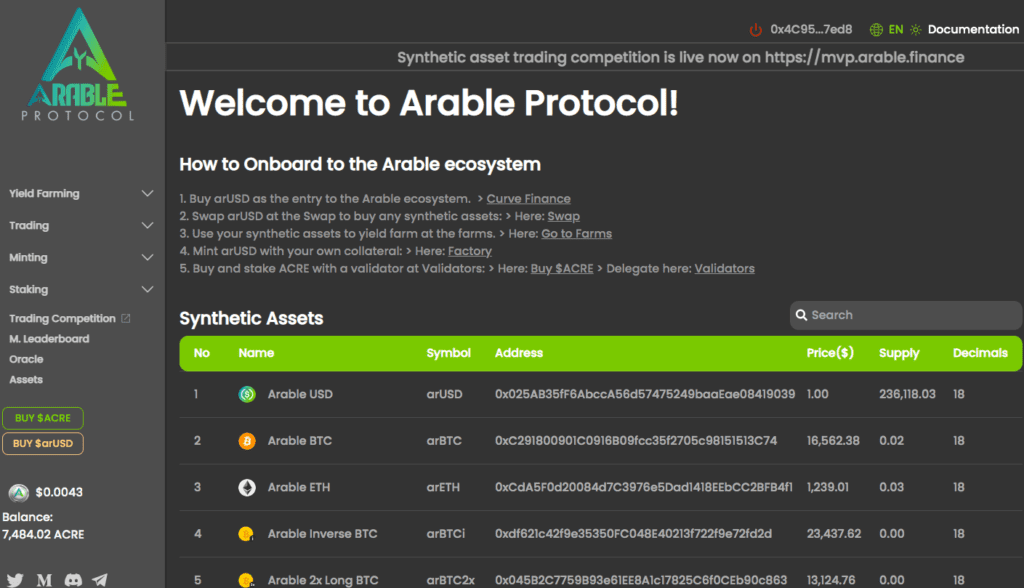

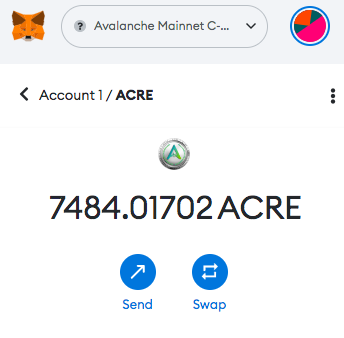

Now all we had to do was go back to https://arable.finance/ and relaunch the app to view the $ACRE token balance which we could then use for trading, staking, minting or yield farming via the Arable protocol.

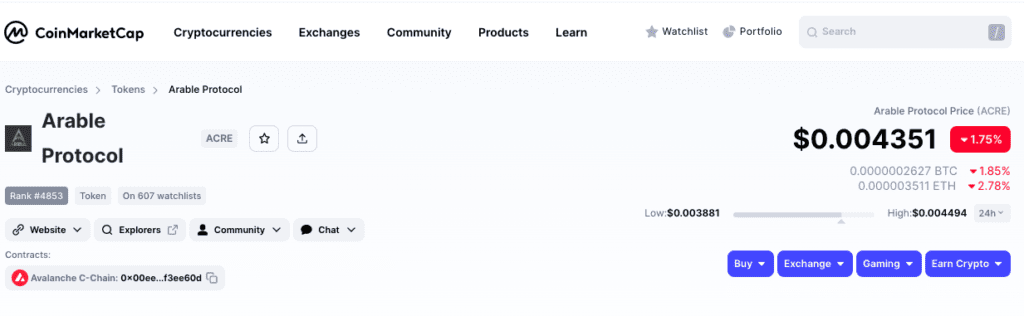

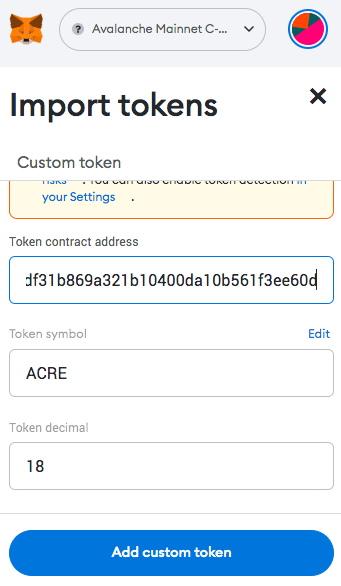

Another way to check whether your tokens are indeed in your wallet is to go back to your MetaMask. You’ll have to import the $ACRE token contract address 0x00ee200df31b869a321b10400da10b561f3ee60d which you can verify on Etherscan or via aggregators such as CoinMarketCap.

You can then manually paste the token contract address in your MetaMask and simply add the token, then you should be able to view your balance.

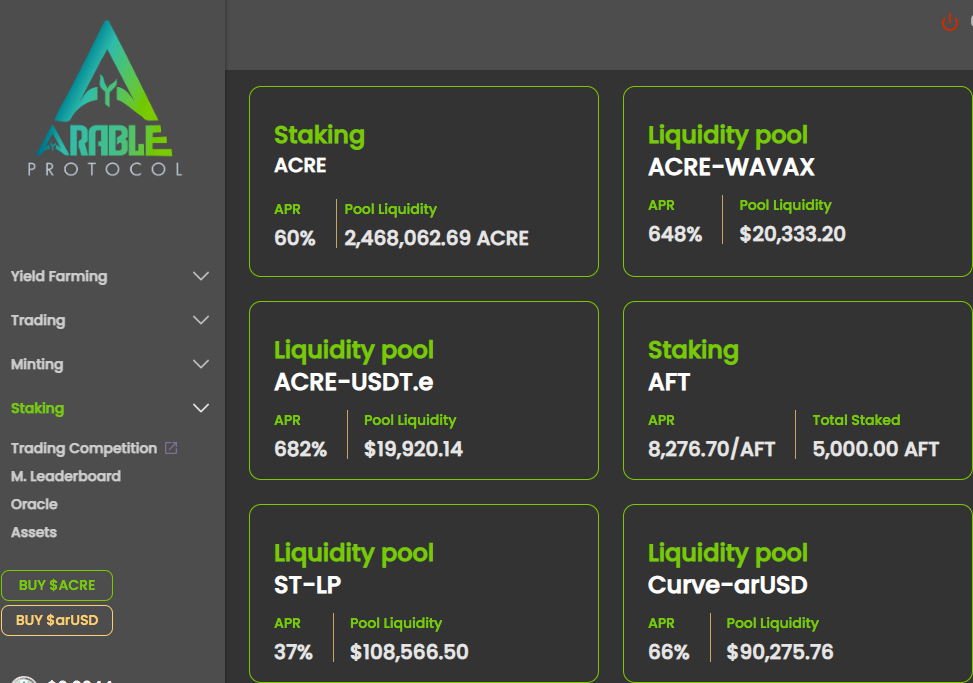

You can choose to do general staking, delegated staking or choose to stake with validators. When a user stakes with Arable, the tokens they provide are locked into a contract and are supposed to start generating rewards right away. A user can claim their accumulated rewards directly into their wallet each epoch i.e. daily.

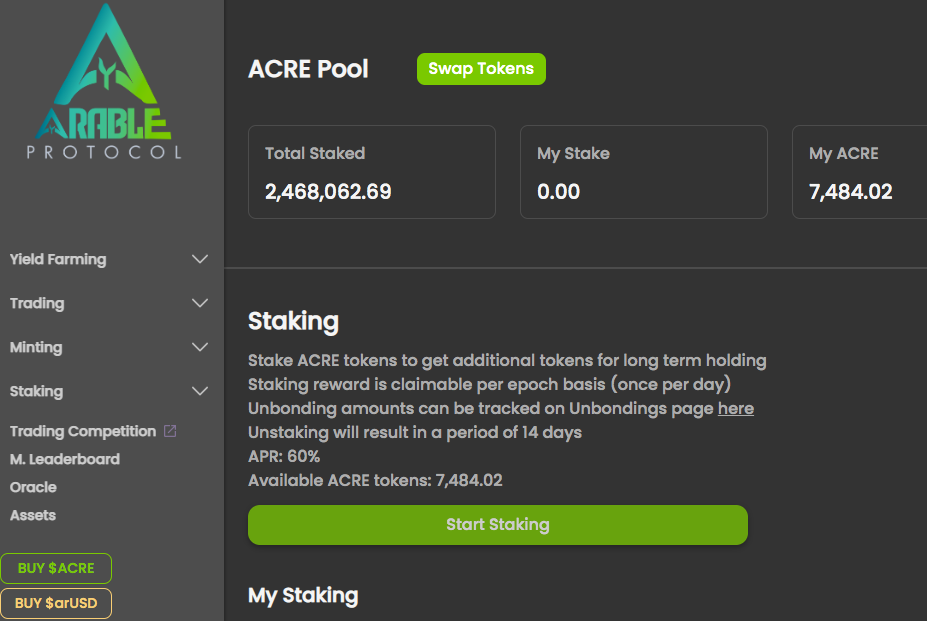

For the purposes of demonstrating, we decided to stake the $ACRE tokens we acquired in the ACRE staking pool which offers an attractive 60% APR. We simply went to the staking pool section of the interface.

From there we clicked “Start Staking”.

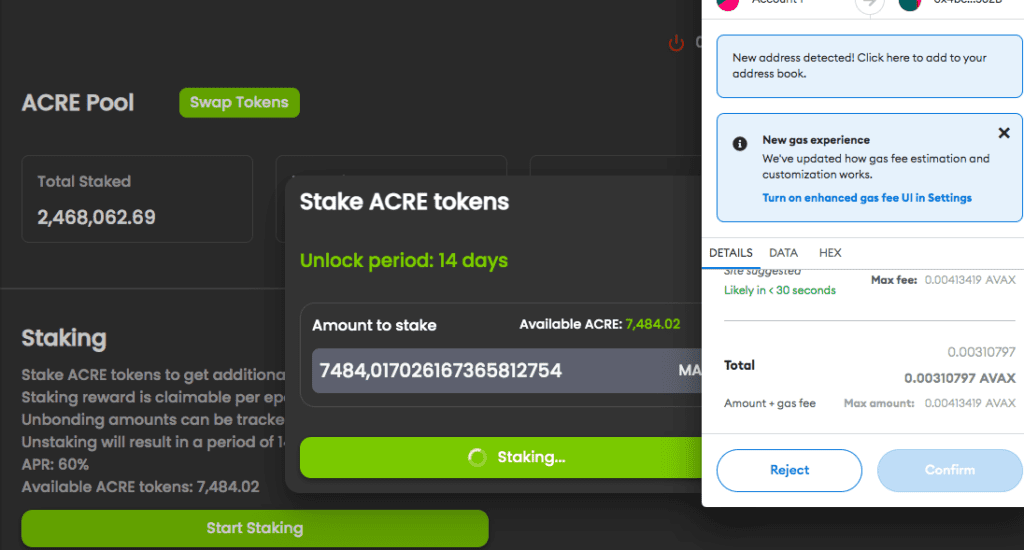

We then chose to stake the full amount of $ACRE tokens we had available.

To proceed, we had to give the smart contract permission to access the $ACRE tokens in our wallet. There’s a very minimal fee charged for this.

Once permissions were granted, we could then proceed to pay the gas fee and stake our tokens.

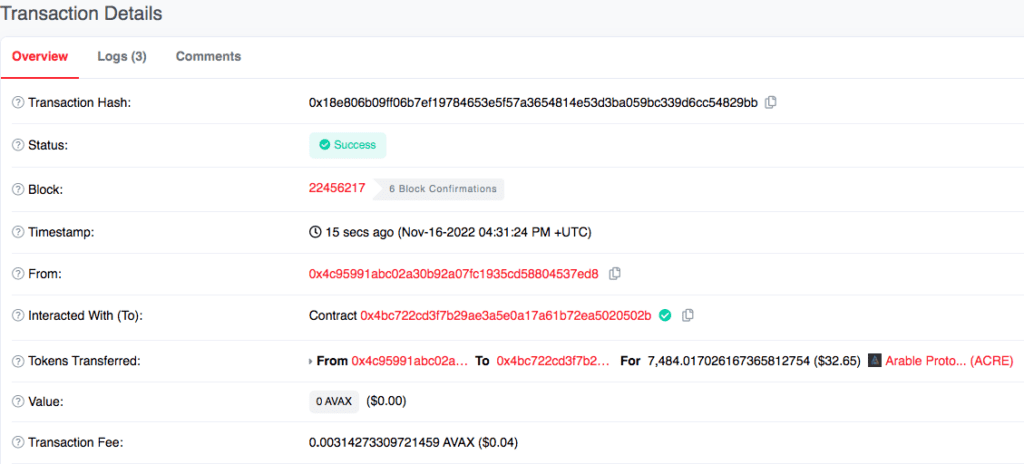

Once the transaction was approved, we could verify it on the block explorer.

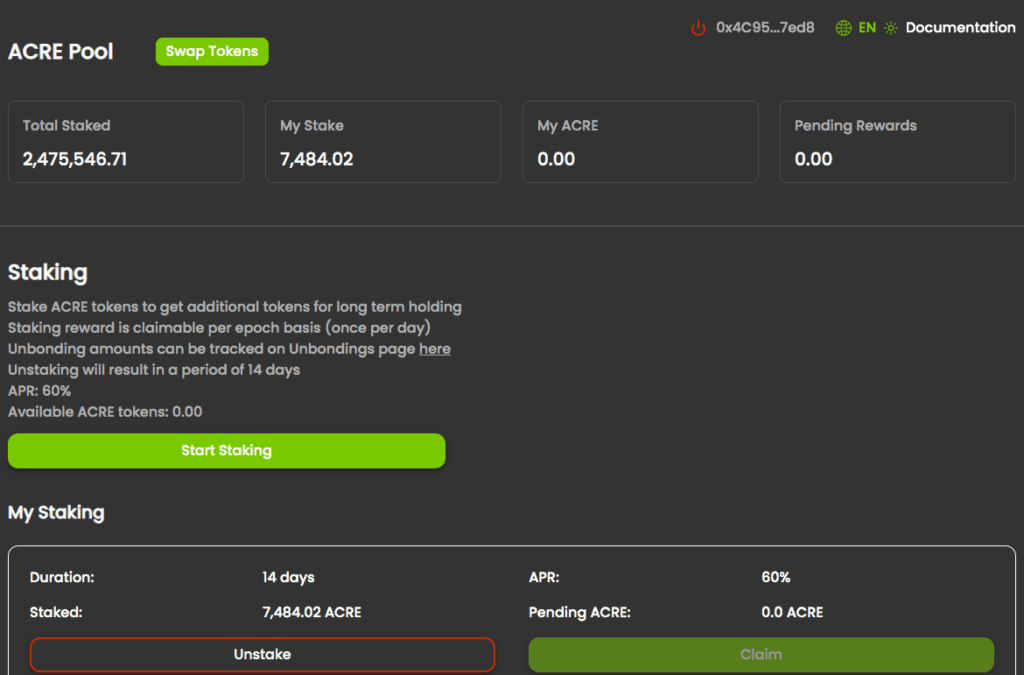

We could also view our stake via the dashboard.

Unstaking, also referred to as unbonding, can be done at any time, however, the tokens remain locked for a waiting period of 14 days from the point of unstaking, and during this unbonding phase, the user will not receive any further rewards.

As a user of these new yield protocols, make sure you understand the associated risks before committing your funds. Happy farming!