Most decentralized finance platforms in cryptocurrency are built on the Ethereum blockchain. While this provides many benefits, namely transparent transactions along with no central point of failure for these platforms (meaning they will never go offline), it also makes it very difficult to replicate certain centralized platforms. This is especially true of cryptocurrency exchanges which, if built on Ethereum, would be too expensive to host due to network fees.

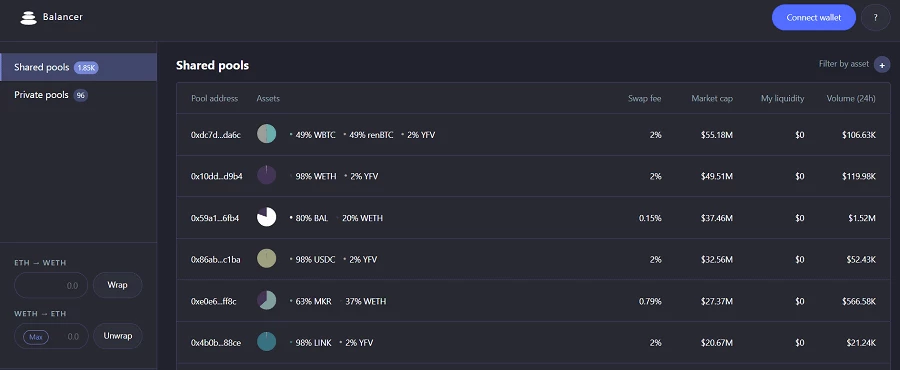

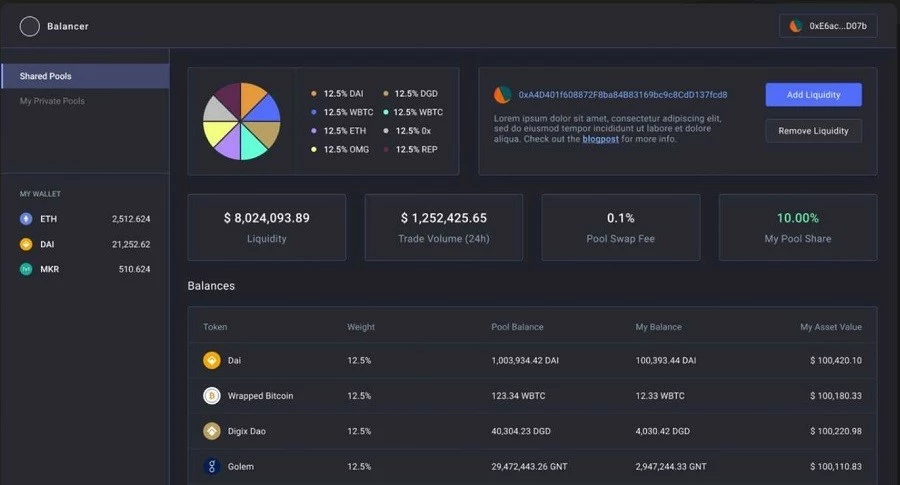

Image via Balancer

Balancer is one of many automated market makers – a decentralized cryptocurrency exchange which uses the ratio of two assets to determine their price (more on this in a moment). What separates Balancer from other decentralized exchanges currently on the market is Balancer’s streamlined platform which is meant to cater to more serious cryptocurrency investors. To the naked eye, Balancer can look more like a professional portfolio management system than a decentralized cryptocurrency exchange.

Who made Balancer?

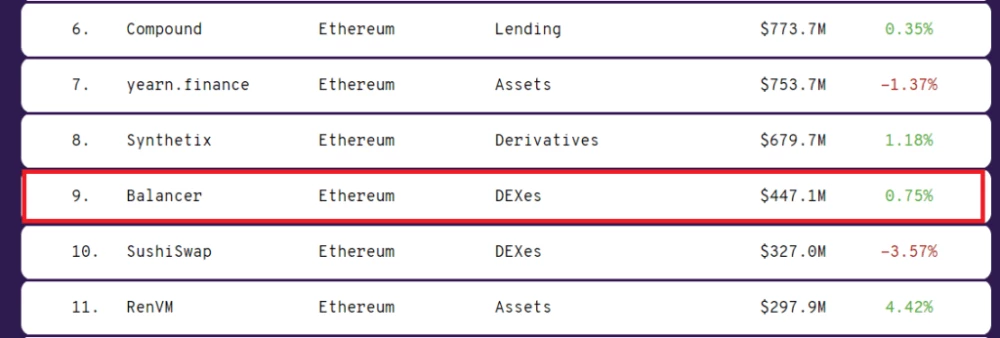

Image Source: Balancer labs

Balancer was created by Balancer Labs, a Brazilian software company which received 3 million USD of seed funding in March of this year to create the Balancer platform. The CEO of Balancer labs is Fernando Martinelli, a man with 4 master’s degrees related to robotics, image processing, and international business. Balancer is one of the highest ranked decentralized finance platforms, with nearly 500 million USD deposited on the platform at the time of writing.

How does Balancer work?

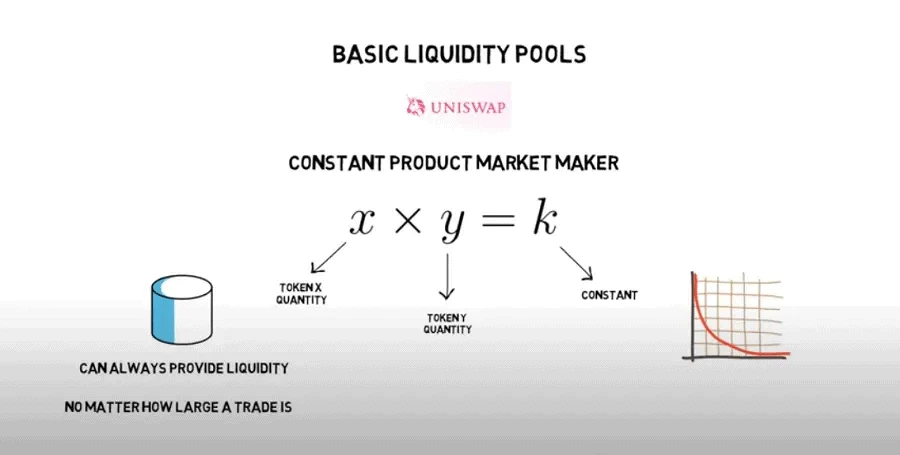

Image via YouTube

The best way to visualize Balancer is as a series of pools. Like other automated market makers, Balancer uses the ratio between assets in each pool to determine their price in lieu of an order book. This is best understood with a simple example. Suppose you have a pool with 10 Ethereum and 1000 USDC (a stablecoin which mirrors the price of the US dollar). This means each ETH is worth 100 USD in this pool. If someone were to come and purchase 1 ETH from this pool, the ratio would change and make the price of the next ETH 111$USD.

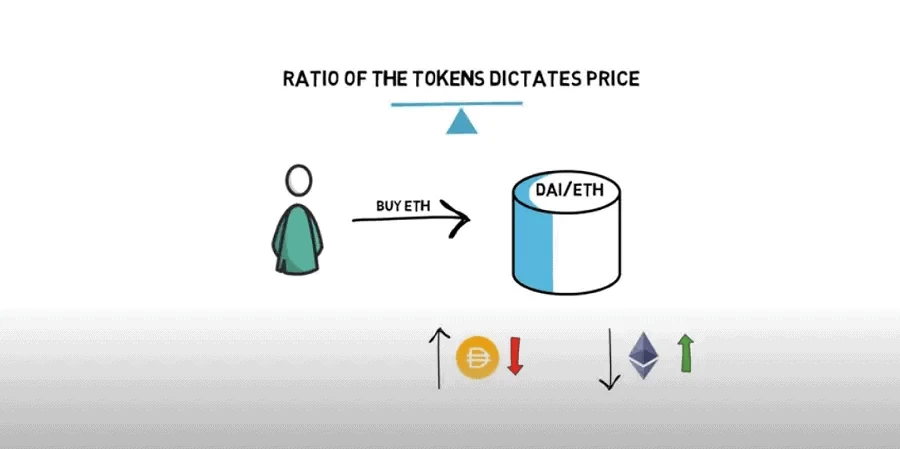

Image via YouTube

It is important to note that these huge changes in price are incredibly rare on decentralized exchanges. This is because these pools will have tens of millions or even billions of dollars of both assets deposited. This means that the price will not fluctuate as it does in the hypothetical example. Moreover, users can deposit their cryptocurrency into these pools to earn passive income which comes from the trading fees of the people using the pools to trade their crypto.

Image via Dapp

In contrast to other decentralized exchanges, Balancer pools can contain up to 8 assets. This makes trading on Balancer more efficient than on other decentralized exchanges and also provides more lucrative rewards to users who “lend” their cryptocurrency to these trading pools. Not only that, but if you have enough cryptocurrency you can even create a new pool of your own, giving you a very handsome passive income (assuming the assets you pooled are in high demand for trading).

Why is Balancer important?

Image via Defipulse

If you were to look at the high interest rates you earn for depositing funds on many decentralized finance platforms, you would be surprised to find that almost all of them are using Balancer in the background. The platform’s simple and professional design combined with the high-interest rates offered for depositing funds makes it an attractive decentralized finance platform for legacy investors. Not only that, but you earn Balancer’s BAL tokens for interacting with the platform. These can be used to vote on changes to it or sold on the market for even more profit.