Bitcoin DeFi: A Comprehensive Analysis of BTCFi’s Emerging Ecosystem

Bitcoin, the first cryptocurrency, was once synonymous with simple peer-to-peer transactions and a store of value. Today, however, Bitcoin’s role is expanding rapidly within decentralized finance (DeFi), with an emerging ecosystem – commonly known as Bitcoin DeFi (BTCFi) – that seeks to challenge Ethereum’s long-standing dominance. Through an exploration of on-chain data, this article unpacks the growth trajectory, innovations, and challenges of BTCFi, offering insights into its potential to reshape the DeFi sector.

The Paradigm Shift: From Peer-to-Peer to DeFi Powerhouse

Originally designed as a peer-to-peer electronic cash system, Bitcoin’s underlying architecture was inherently limited when compared to Ethereum’s flexible, smart-contract-friendly framework. Bitcoin’s Unspent Transaction Output (UTXO) model, limited scripting language, lack of Turing completeness, and relatively slower transaction throughput all posed barriers to the development of DeFi applications. While these attributes enhance Bitcoin’s security and decentralization, they restrict its ability to support the complexity required for DeFi functionalities such as decentralized exchanges (DEXs) and lending platforms.

However, Bitcoin’s security model and unrivaled adoption led developers to innovate, bypassing these limitations and laying the groundwork for the BTCFi movement.

Early Attempts: Pioneering Bitcoin DeFi

Despite the constraints of Bitcoin’s original design, several notable early initiatives sought to extend its functionality:

- Colored Coins (2012-2013): This concept allowed for the creation of assets on Bitcoin’s blockchain, effectively coloring certain coins with metadata representing real-world assets.

- Counterparty (2014): This protocol enabled custom assets on the Bitcoin network and pioneered the early NFT space on Bitcoin.

- Lightning Network (2015-present): As a Layer 2 solution, Lightning Network introduced payment channels that allowed for faster, more complex transactions, setting the stage for DeFi applications.

- Liquid Network (2018-present): A sidechain developed by Blockstream, Liquid supports digital assets and more complex financial transactions, facilitating a Bitcoin DeFi infrastructure.

- Taproot Upgrade (2021): By condensing complex transactions into single hashes via Merklized Alternative Script Trees (MAST), Taproot improved Bitcoin’s smart contract capabilities, reducing fees and enhancing transaction privacy.

These efforts, combined with Bitcoin’s decentralized security model, inspired the next wave of Layer-2 and sidechain solutions designed to bring full-fledged DeFi functionality to Bitcoin.

Key Innovations: Unlocking Smart Contracts on Bitcoin

Several protocols are now driving Bitcoin’s DeFi revolution by enabling smart contracts and complex financial applications. The following projects illustrate the scope of innovation in BTCFi:

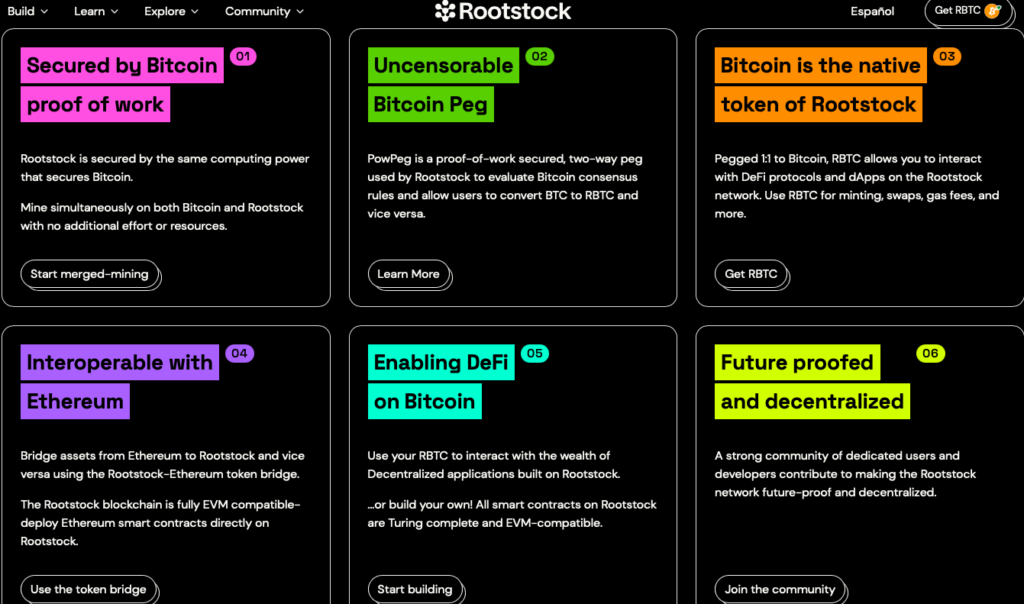

- Rootstock (RSK): A Bitcoin sidechain, Rootstock leverages 60% of Bitcoin’s hashing power to enable Ethereum-compatible smart contracts. Rootstock’s dual-mining and Powpeg BTC-to-RBTC conversion system facilitate a secure and scalable environment for DeFi development on Bitcoin.

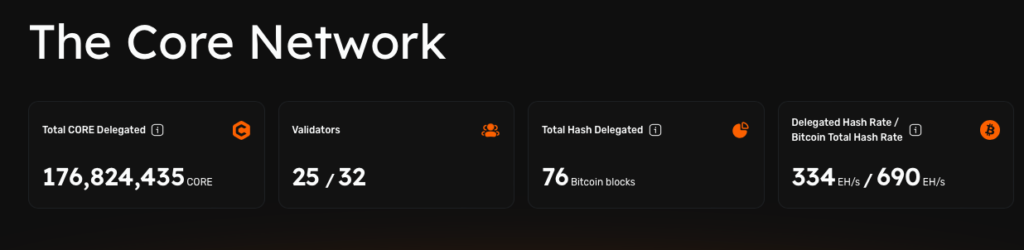

- Core Blockchain: This EVM-compatible Layer 1 blockchain introduces a dual staking model with BTC, transforming Bitcoin into a yield-bearing asset. Core’s integration of Bitcoin into its security and staking models has led to its rapid adoption within the DeFi space.

- Merlin Chain: As a Layer 2 Bitcoin solution utilizing ZK-Rollups, Merlin Chain extends Bitcoin’s DeFi capabilities through wrapped BTC assets, staking rewards, and decentralized oracle integration.

- BEVM: The Bitcoin-EVM (BEVM) solution allows seamless deployment of Ethereum DeFi applications on Bitcoin, using BTC as gas. BEVM integrates Ethereum’s vast DeFi ecosystem into Bitcoin’s infrastructure, offering a secure platform for cross-chain applications.

These innovations signal that BTCFi is not just about replicating Ethereum’s model – it is leveraging Bitcoin’s unique strengths to create a distinct DeFi ecosystem with powerful security and decentralization attributes.

Growth and Adoption: BTCFi By the Numbers

According to data from Footprint Analytics, the total value locked (TVL) across Bitcoin Layer 2 solutions and sidechains hit $1.07 billion as of September 2024, a remarkable 5.7x increase since January 2024. Leading the pack are Core (27.6% of total TVL), Bitlayer (25.6%), and Rootstock (13.8%). This meteoric rise underscores the increasing utility and adoption of Bitcoin within DeFi, driven by the appeal of yield-bearing Bitcoin assets and secure DeFi environments.

Major BTCFi Projects

As the BTCFi ecosystem grows, several standout projects are pushing Bitcoin into new frontiers:

- Pell Network: Operating on multiple chains, Pell’s restaking protocol provides secure validation services and yield optimization, positioning it as a critical player in Bitcoin’s liquidity and security infrastructure.

- Avalon Finance: Known for its multi-chain DeFi services, Avalon integrates lending and derivatives trading across Bitlayer, Core, and Merlin Chain. Its algorithmic stablecoin and isolated lending pools make it a versatile platform for Bitcoin DeFi.

- MoneyOnChain: Built on Rootstock, MoneyOnChain offers Bitcoin-backed stablecoins, leveraging Bitcoin’s liquidity for passive income through leveraged tokens and decentralized token exchanges.

Comparative Analysis: Bitcoin vs. Ethereum DeFi

While Bitcoin DeFi is gaining traction, it still lags behind Ethereum in terms of total TVL and ecosystem maturity. For example, over 150K BTC are locked in Ethereum’s DeFi ecosystem, compared to just under 9K BTC in Bitcoin’s native DeFi projects. Ethereum’s broader range of DeFi products, combined with mature developer ecosystems, has made it the go-to platform for DeFi enthusiasts.

However, Bitcoin DeFi offers unmatched security, as it operates within Bitcoin’s robust and decentralized framework, eliminating the need for custodians or cross-chain bridges, which add layers of risk in Ethereum’s wrapped BTC solutions.

Opportunities and Challenges: Navigating BTCFi’s Future

The future of BTCFi holds immense potential but faces several key challenges:

- Scalability: While Layer 2 solutions and sidechains have expanded Bitcoin’s DeFi capabilities, transaction throughput remains a concern.

- Regulatory Risks: As governments impose stricter regulations on DeFi, Bitcoin’s decentralized nature may attract increased scrutiny, particularly around AML and KYC requirements.

On the flip side, advancements in technologies like Zero-Knowledge Proofs and Discreet Log Contracts (DLCs) could enable Bitcoin to unlock even more complex DeFi applications, expanding its utility as programmable money.

Conclusion: A Promising Frontier

Bitcoin’s DeFi evolution marks a significant paradigm shift, transforming its role from a mere store of value into a fully-fledged participant in decentralized finance. As BTCFi continues to grow, driven by Layer 2 solutions, sidechains, and innovative protocols, it holds the potential to challenge Ethereum’s dominance in the space. With continued technological advancements and growing institutional interest, Bitcoin is poised to become a central player in the broader DeFi ecosystem, offering a secure, decentralized, and increasingly sophisticated financial infrastructure.

The future of Bitcoin DeFi is just beginning, and those who tap into its potential early may find themselves at the forefront of the next wave of decentralized innovation.