BloFin Crypto Exchange Review (2025)

✅ BloFin Rating: 4.7/5

🔒 Security: 1:1 Reserves, Fireblocks Custody, AI-powered KYT

🧠 Best For: Copy Traders, Derivatives Traders, Bot Users

🚫 Not Ideal For: U.S. users, DCA investors, fiat on-ramping

🗺️ Available in: 150+ Countries (🇿🇦 South Africa included!)

What Is BloFin?

BloFin is a Cayman Islands–based cryptocurrency exchange launched in 2019 by Tao “Matt” Hu, a VC veteran with investments in Twitch and Unity. In just a few years, BloFin has evolved into a powerhouse for futures and copy trading, now serving over 150 countries with a feature-rich suite tailored for serious traders.

⚡ “Where whales are made” — BloFin’s tagline reflects its focus on high-volume and leverage-heavy traders.

Key Features

| Feature | Description |

|---|---|

| 🪙 Spot & Futures Trading | Over 400 assets, 350+ perpetual contracts, up to 150x leverage |

| 🤖 Trading Bots | Signal bots using TradingView integration |

| 👥 Copy Trading | Follow elite traders with transparent P&L stats |

| 🎮 Demo Mode | Risk-free trading with 50,000 USDT virtual funds |

| 🔐 Security | Fireblocks custody, KYT via AnChain.AI, 1:1 Proof of Reserves |

| 📲 Mobile & Desktop App | Pro-grade interface with TradingView, indicators, and portfolio tools |

| 💸 Staking & Earn | Flexible/fixed staking on BTC, ETH, and USDT |

| 🤝 Affiliate Program | Up to 50% commission, sub-affiliates, and custom referral links |

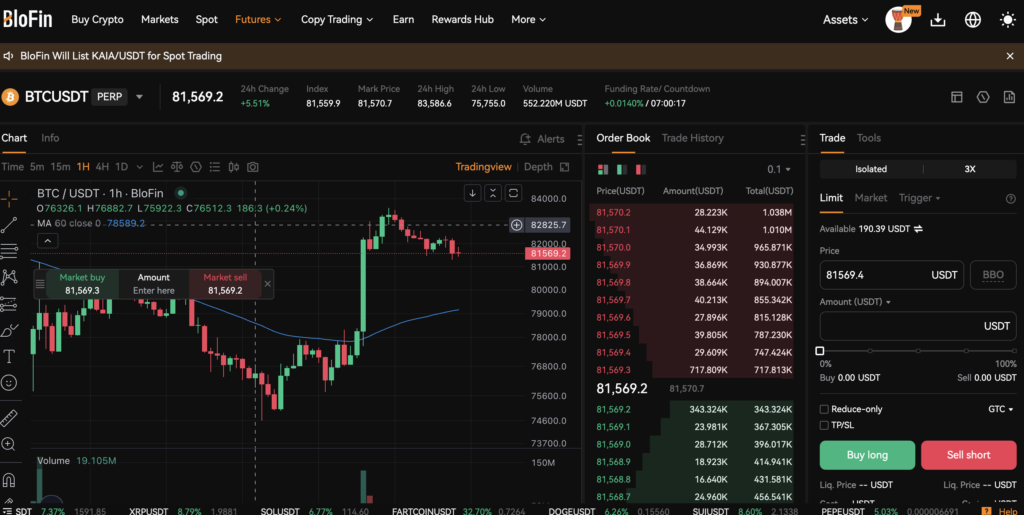

Trading Experience

📊 Platforms:

-

Desktop: Pro tools, TradingView charts, customizable layout

-

Mobile: Intuitive UI, fast execution, futures, spot, and copy trading supported

What Stands Out?

-

Lightning-fast execution

-

Smooth order placement

-

Advanced order types: Market, Limit, SL/TP, FOK, IOC, Trailing Stop

🔒 Security & Transparency

BloFin has never been hacked — a rare feat in crypto. Here’s what powers its trust factor:

| Security Measure | Description |

|---|---|

| 🔐 1:1 Proof of Reserves | Verified reserves of BTC, ETH, USDT |

| 🔍 KYT Monitoring | AI-based transaction tracking via AnChain & Chainalysis |

| 🧯 Fireblocks Custody + Insurance | Institutional-grade wallet insurance |

| 🧾 Bi-monthly Audits | Transparent reporting with on-chain data |

| 🔐 Account Security | 2FA, biometric login, anti-phishing codes |

🛡️ CER.live Score: BBB | Reserve Ratios: BTC (170%), USDT (150%)

💰 Fees Breakdown

BloFin boasts some of the lowest fees in the industry.

🔵 Spot Trading Fees

| VIP Tier | 30d Volume | Maker Fee | Taker Fee |

|---|---|---|---|

| VIP 0 | – | 0.100% | 0.100% |

| VIP 5 | ≥$8M | 0.010% | 0.0325% |

🔴 Futures Trading Fees

| VIP Tier | 30d Volume | Maker Fee | Taker Fee |

|---|---|---|---|

| VIP 0 | – | 0.020% | 0.060% |

| VIP 5 | ≥$500M | 0.000% | 0.035% |

💸 Withdrawal Fee: Network only (no platform fee)

❌ Fiat Deposits: Not supported directly – use Apple Pay, cards, etc.

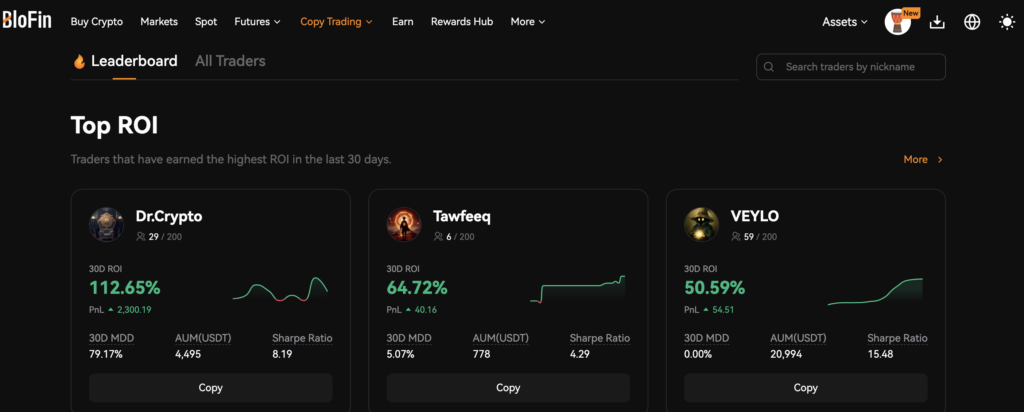

Copy Trading & Trading Bots

Copy Trading Breakdown

| Role | Description |

|---|---|

| Master Trader | Executes trades, earns 10% of copier’s profits |

| Copier | Follows trades using Fixed Amount or Fixed Ratio modes |

✅ Advanced features: Set TP/SL, use Cross or Isolated Margin

Signal Bot

-

Integrates with TradingView alerts

-

Automates trade entries with margin, leverage & SL/TP

-

Free for all users

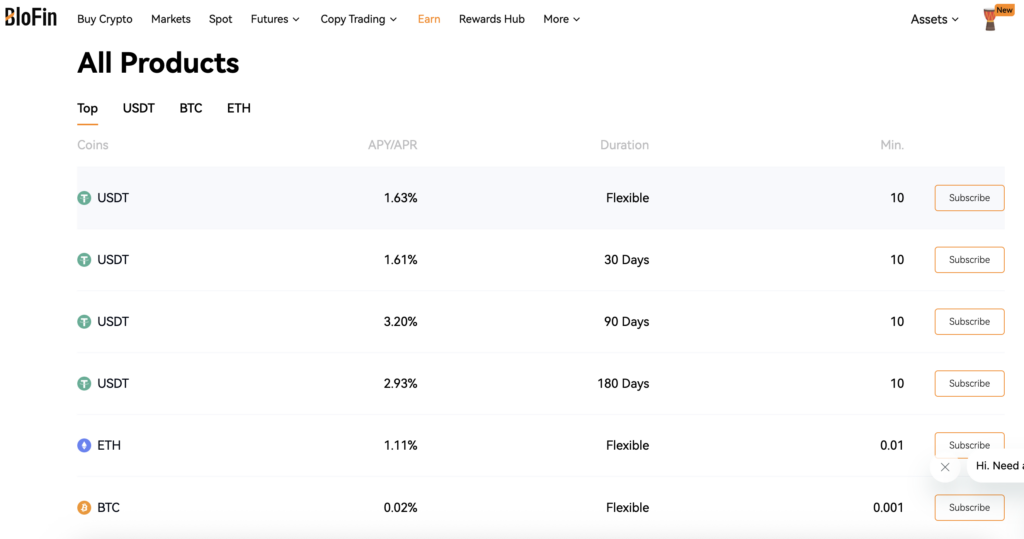

BloFin Earn & Staking

BloFin Earn allows you to stake:

-

BTC

-

ETH

-

USDT

| Staking Type | Flexibility | Yield | Duration |

|---|---|---|---|

| Flexible | Redeem anytime | ~0.10% | – |

| Fixed | Locked term | 3–4% | 7–360 days |

💡 Yields calculated daily with snapshot-based tracking.

Supported Assets

| Market | Number of Pairs |

|---|---|

| Spot | 129+ |

| Futures | 350+ |

| Tokens | 400+ |

✅ Includes majors (BTC, ETH), DeFi, AI, RWA, and memecoins (WIF, PEPE, BONK)

⚠️ No Coin-M or Options yet. Only USDT-M perpetual contracts.

KYC & Withdrawal Limits

| Level | KYC Required | Daily Withdrawal Limit |

|---|---|---|

| 0 | No | 20,000 USDT |

| 1 | Yes (ID) | 1,000,000 USDT |

| 2 | Yes (Address) | 2,000,000 USDT |

KYC is optional, making BloFin attractive for privacy-first users. Still, higher tiers unlock bigger withdrawals.

🎁 Bonuses & Affiliate Program

Welcome Bonus: 💰 Up to 5,000 USDT

-

Deposit ≥ 100k USDT and trade ≥ 10M USDT in 15 days

-

Daily Mystery Boxes and Challenges via Activity Center

Affiliate Program

| Level | Commission | Sub-Affiliate Commission |

|---|---|---|

| 1 | 40% | 40% |

| 3 | 50% | 50% |

💸 Commissions paid every 6 hours in USDT

📢 Promote via blog, social media, or referral links

✅ Pros & ❌ Cons

| ✅ Pros | ❌ Cons |

|---|---|

| 1:1 asset reserves & third-party insurance | No direct fiat withdrawals |

| Low fees & tiered VIP structure | No licensing from major jurisdictions |

| Copy trading & trading bots | Lacks social trading and spot margin |

| Over 400 tokens supported | Limited customer support languages |

| Demo trading and educational academy | No Lite Mode for new traders |

| Powerful desktop & mobile platforms | Missing some advanced order types (e.g., TWAP) |

🤔 FAQs

Is BloFin regulated?

No, BloFin isn’t licensed in major jurisdictions but claims localized compliance.

Is BloFin safe?

Yes, with 1:1 reserves, Fireblocks custody, and no hacks to date.

Can U.S. users access BloFin?

Officially, no. U.S. users are restricted.

Does BloFin require KYC?

Not unless you exceed 20k USDT in withdrawals per day.

Does BloFin support bots?

Yes, Signal Bots are available via TradingView integration.

Is BloFin Worth It?

🔥 Rating: 4.7/5 — One of the best non-KYC exchanges for advanced traders.

BloFin isn’t just another crypto exchange — it’s a sophisticated, security-first, trading-centric ecosystem designed for futures traders, copy traders, and bot lovers. While it lacks some features like fiat off-ramping and licensing transparency, its ultra-low fees, deep markets, and robust security infrastructure make it a top choice for high-volume and privacy-focused traders.

If you’re looking for a secure, advanced, and trader-friendly platform — BloFin might just be your next home base.