Bridgesplit | Fractionalized SMB-2367 (DAOJONES) Review

A crypto asset on the Solana platform, Fractionalized SMB-2367 (DAOJONES) has a total and maximum supply of 100,000. The project is run by Bridgesplit, a protocol which is described as the financial infrastructure for cross-chain non-fungible tokens. The project aims to provide the composability and liquidity that is required to make Web3 more efficient. The project is backed by some notable players in the digital asset markets including Coinbase Ventures, Solana Ventures, CoinFund and others.

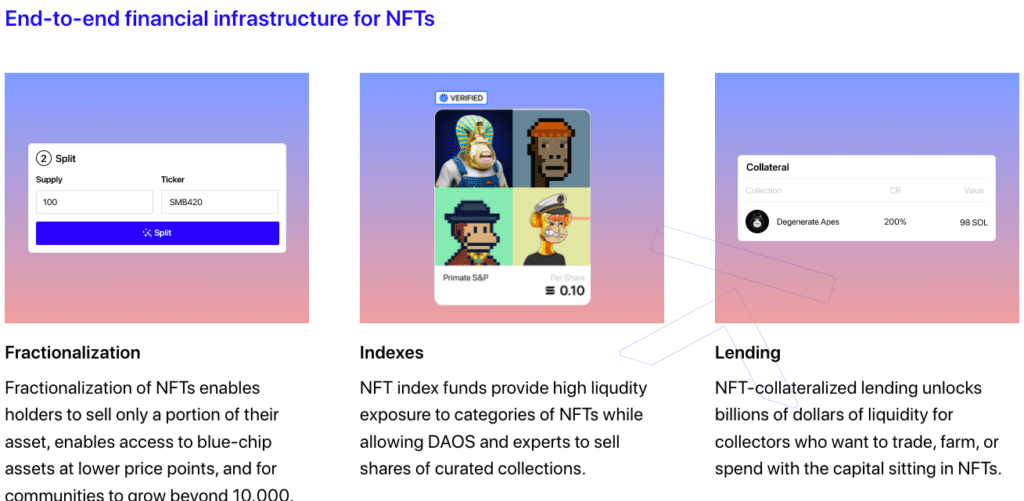

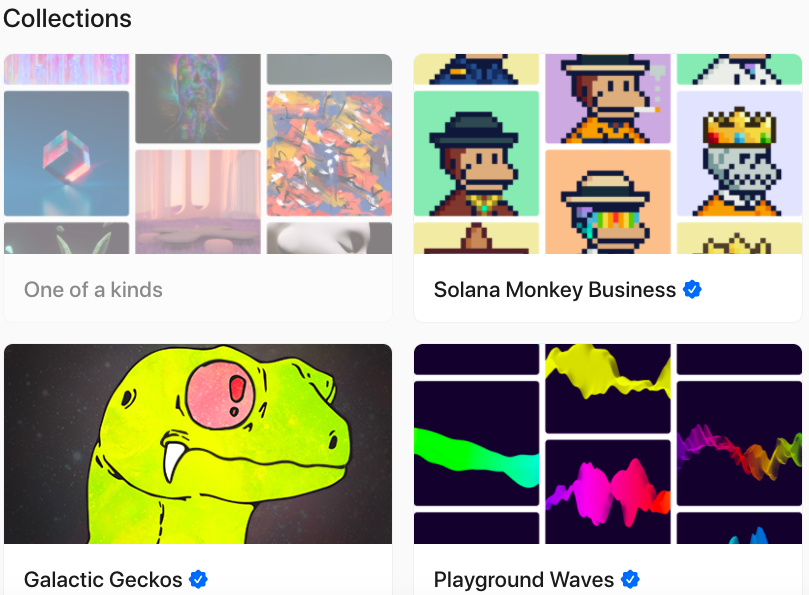

Bridgesplit is trying to cater to huge NFT collectors and allows NFT lock-ups in order for holders to have better utility for their holdings. Bridgesplit claims to be the first decentralized finance stack for non-fungible tokens. The Bridgesplit protocol has several core functions including NFT fractionalization, NFT index funds, NFT derivatives and scalable NFT collateralized lending. The project has a vision to create more liquid NFT markets. NFT fractionalization using Bridgesplit is live on mainnet. Index funds are live on devnet.

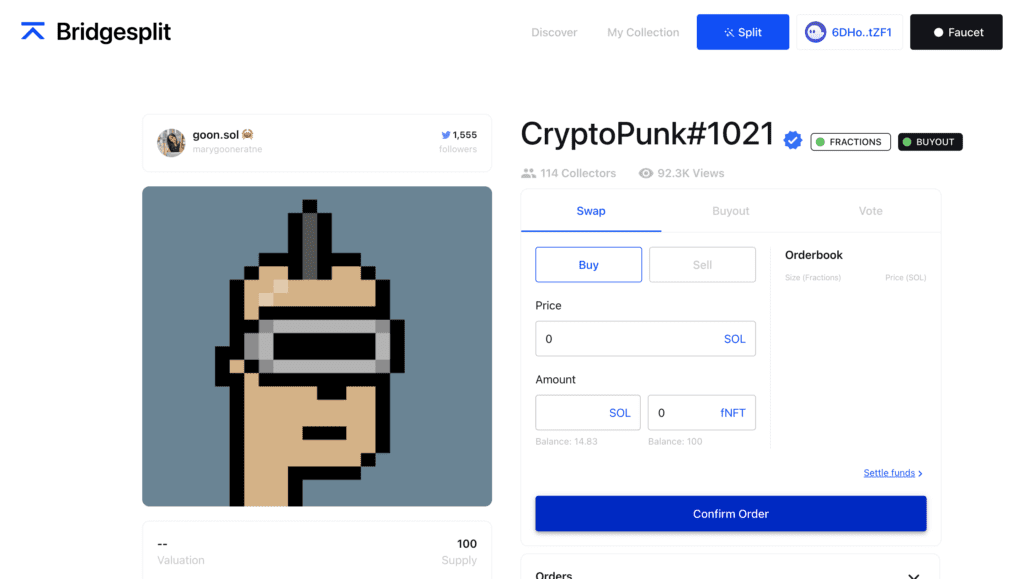

NFT fractionalization using Bridgesplit

When an NFT owner decides to fractionalize a non-fungible digital collectible, a new token to represent fractions of the NFT held in a smart contract is minted. Those fractions are supposed to be unique for each NFT. Fractionalization on Bridgesplit is currently only open to whitelisted projects (at the time of writing). For those interested in participating in the Alpha mainnet, they can fill out this form.

How to fractionalize an NFT?

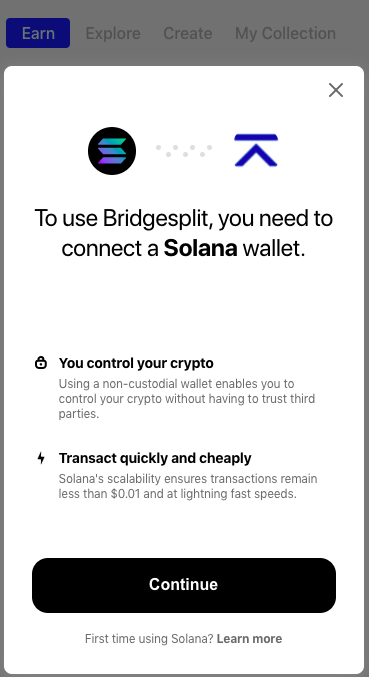

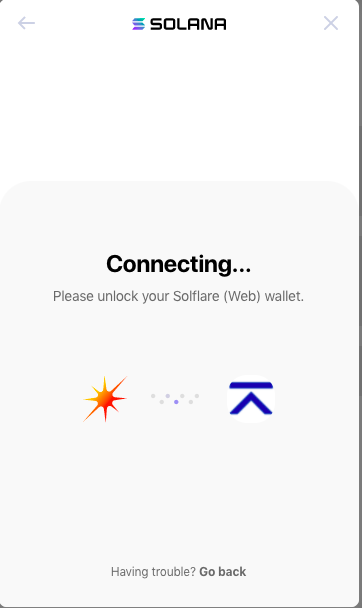

First you go to https://app.bridgesplit.com/swap and connect your wallet. To use Bridgesplit, you need to connect a Solana wallet. Solana’s scalability makes it possible to have transactions that are less than $0.01 and that process quickly.

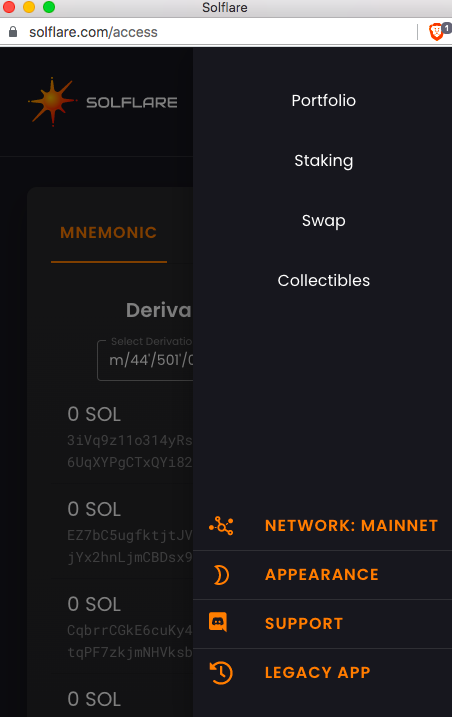

Solflare is a good Solana wallet to use for this.

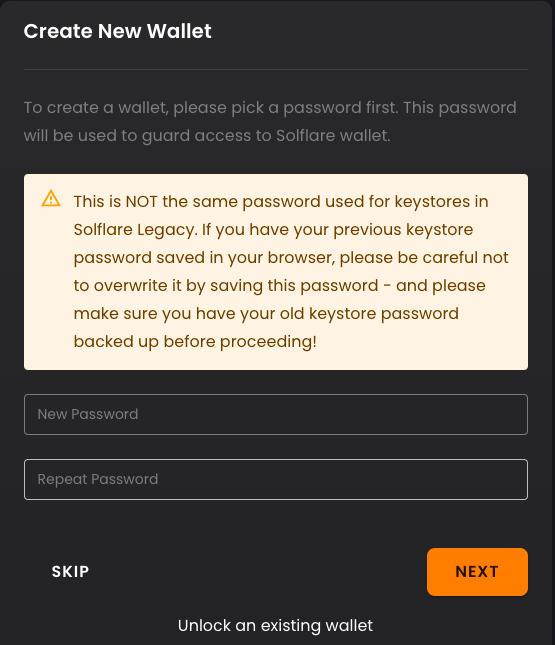

Connect your wallet if you already have one. If not, simply download and create a new wallet. Once you create your wallet, ensure that you save your back up phrase securely and set a password.

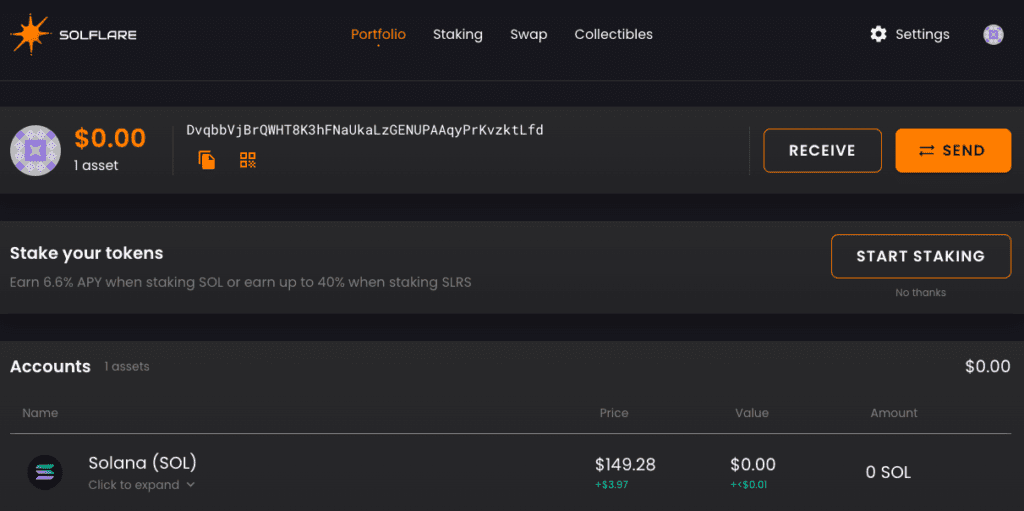

Once your wallet is set up, you can deposit SOL tokens. From there you can then access the platform features including staking, swapping and NFTs. You can connect via the browser extension or web wallet.

You can now access Bridgesplit to either swap, yield, create NFTs or access the digital collectibles market to view the collections.

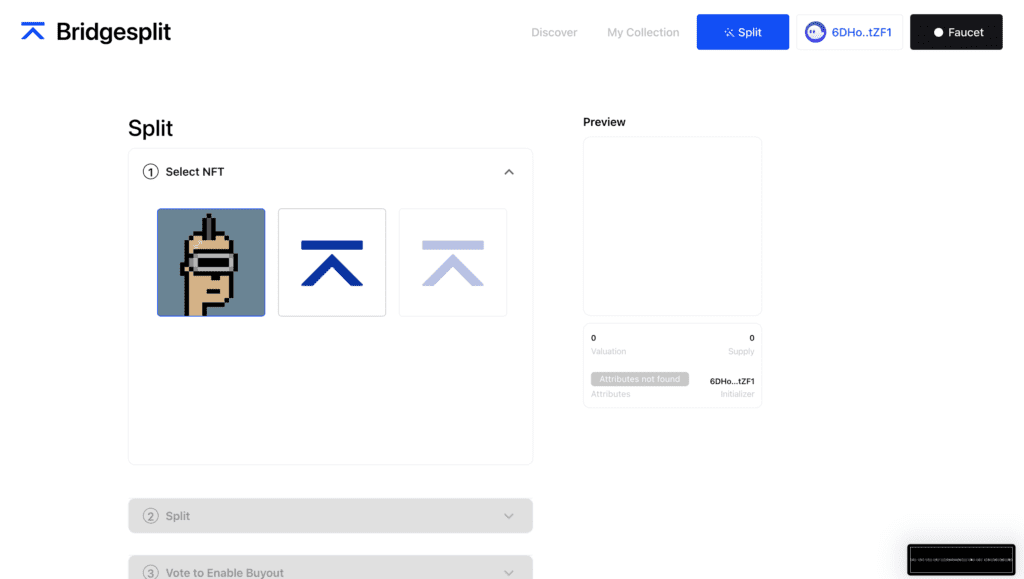

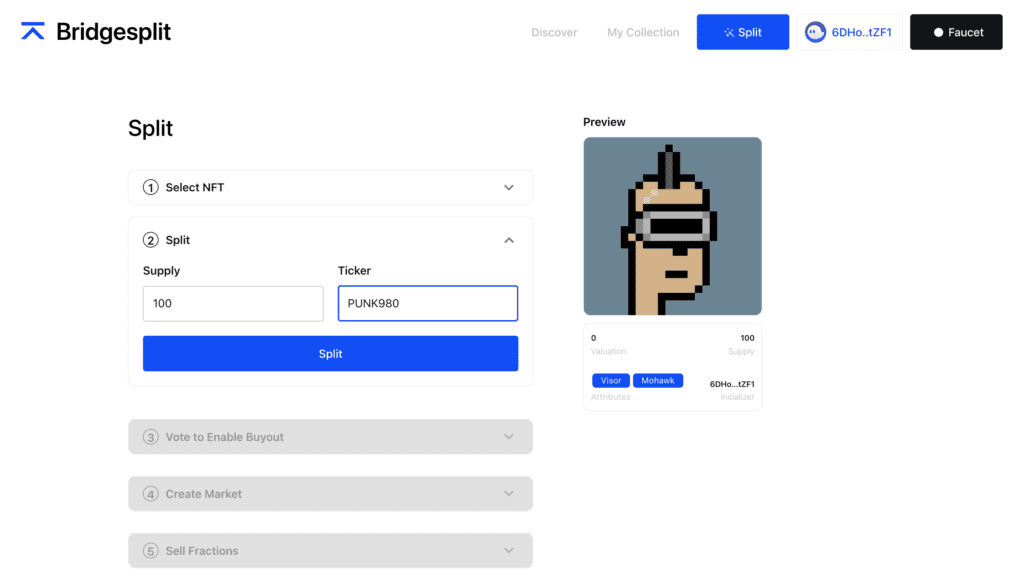

To fractionalize your NFT, you can select the NFT from your wallet. Once that’s done, you will be able to then select the number of fractions that you wish to split your NFT into and receive all the fractions.

You’ll then be able to choose the NFT’s fraction ticker.

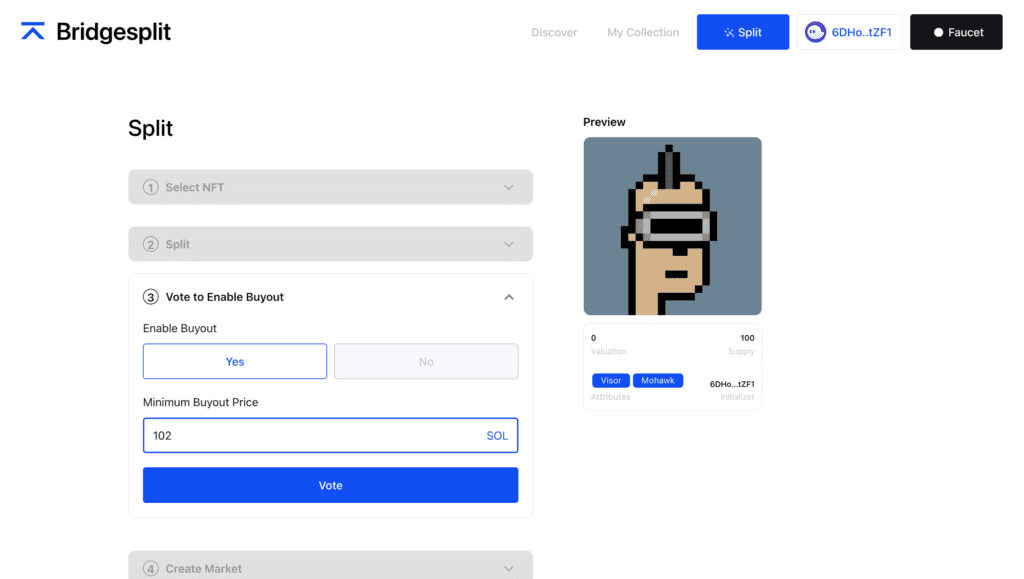

From here, you can also select whether or not you would like to vote in order to ‘Enable Buyout’ of the underlying NFT. You can also determine the minimum price that you’re prepared to accept for the buyout.

So now that your NFT is fractionalized, you’ll have fractions in your wallet which are also viewable from your collection. There’ll be a prompt for you to choose to create a market for your fractions. You also get the option to sell fractions.

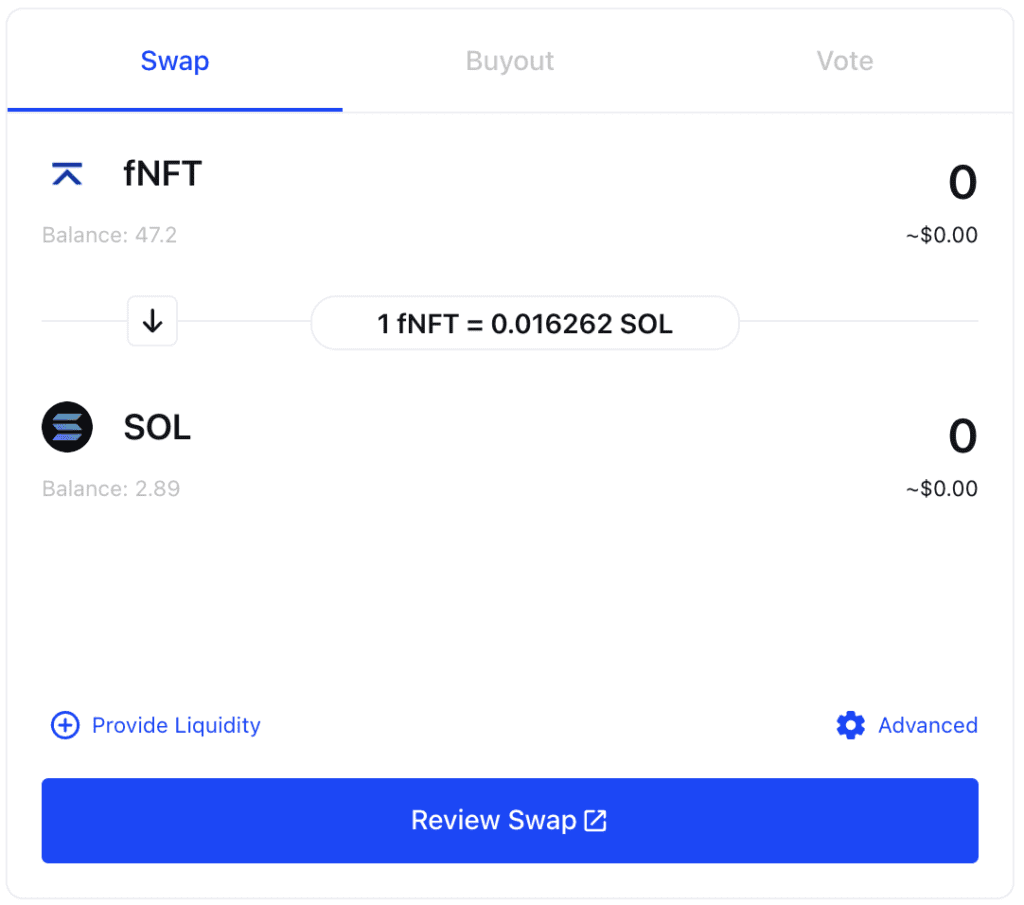

For low-liquidity markets, Bridgesplit’s protocol supports the creation of a Raydium (RAY) automated market maker (AMM) on top of a Serum orderbook. Fraction holders are able to provide liquidity to the AMM and earn fees. They can also place orders on the orderbook.

If the NFT has not been bought out, collectors can purchase fractions from the markets which can be seen on the vault page. The Raydium powered AMM makes it possible for users to trade between SOL and fractions. The price will be automatically set by supply and demand.

The liquidity pools on Bridgesplit make it possible for anyone to provide liquidity by simply adding their fractions and SOL Tokens to a pool. When a user adds liquidity to a pool, they receive liquidity provider (LP) tokens. Let’s say a user deposits $DAOJONES and $SOL into a pool for example, they will receive DAOJONES-SOL RLP tokens which are meant to represent a proportional share of the pooled assets.

This makes it possible for the user to reclaim their funds at any time. Whenever a user makes a swap between $DAOJONES and $SOL, there’s a 0.25% fee that is taken on the trade. Of that, 0.22% is deposited back to the LP pool. 0.03% goes to RAY staking. This is so that Raydium’s infrastructure can continue to be supported. Users still need to familiarize themselves with risks such as impermanent loss.

Token holders of Fractionalized SMB-2367 (DAOJONES) can vote on whether or not to enable a buyout of the whole NFT and also vote on the price can it be bought out at, unless the NFT is already on auction or is already bought out.

When a buyout is enabled, the asset’s price will be reflected in index shares. Individual assets are only able to be bought out by using the index’s shares which means that the true “price” of an asset actually depends on the amount of SOL that the curator has determined that the particular asset is worth relative to the total curator-determined value for the pool.

Another factor will be the price of a share. If a curator decides to change the relative prices of an asset in a Dynamic Index, what happens is that the total value or the supply of shares of the index will remain the same, however, each asset will be priced differently relative to one another.

Under the buyout tab, users can view the status of the vote for buyout. A buyout is only enabled once at least 51% of the token holders have voted in support of that buyout. Once this buyout option is enabled, any user can pretty much start a 24 hour auction for that particular NFT and the auction typically starts at the minimum buyout price (MBP) which is determined by establishing the median of all user votes for the MBP.

Users also have an option to purchase the NFT in an instance for 1.75x the current auction price. Furthermore, as soon as the auction commences, voting is then disabled and the NFT will be bought out. What’s fascinating about the mechanism of the platform is that – let’s say a buyout is enabled, but an auction has not actually started and buyout vote drops below 51%, that buyout feature will be automatically disabled. It’s also important to note that the MBP is always the higher between the floor price for the NFT and the voted price. This is to disincentivize market manipulation.

For more detailed guides on how to use the platform check out the official guides.