Crypto 2024: Key Market Insights & Emerging Trends

The crypto landscape in 2024 has been marked by remarkable growth and transformation, reflecting the industry’s resilience and innovation. This year has witnessed significant developments across various sectors, from stablecoins and derivatives to prediction markets and NFTs. As we delve into these key trends and innovations, we uncover the driving forces behind the market’s evolution and the future trajectory of the crypto ecosystem.

The Stablecoin Resurgence

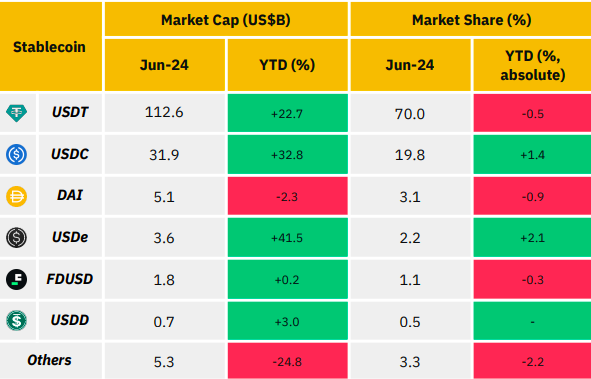

After a period of contraction following the TerraUSD (UST) crash, the stablecoin market has staged a notable recovery. The market capitalization of stablecoins has surged by 23.3% since the beginning of the year, reaching $161 billion, a two-year high. This resurgence underscores the critical role of stablecoins as a source of dollar liquidity for financing crypto exposure.

Tether’s USDT and Circle’s USDC continue to dominate, capturing approximately 90% of the market share. Tether’s USDT, despite a slight dip in market share, saw its circulating supply increase by 22.7% year-to-date. Tether’s record-breaking net profit of $4.52 billion in the first quarter of 2024, bolstered by its U.S. Treasury holdings, further cements its position as a leading player. Circle’s USDC, after a challenging 2023, has also shown signs of recovery, with a 32.8% increase in market capitalization.

Innovations such as Ethena’s USDe and First Digital’s FDUSD have also made their mark, contributing to the diversification and growth of the stablecoin market. Ethena’s unique synthetic dollar protocol and successful airdrop campaigns have driven its rapid growth, while FDUSD’s utility on platforms like Binance highlights its rising prominence.

The Rise of On-Chain Derivatives

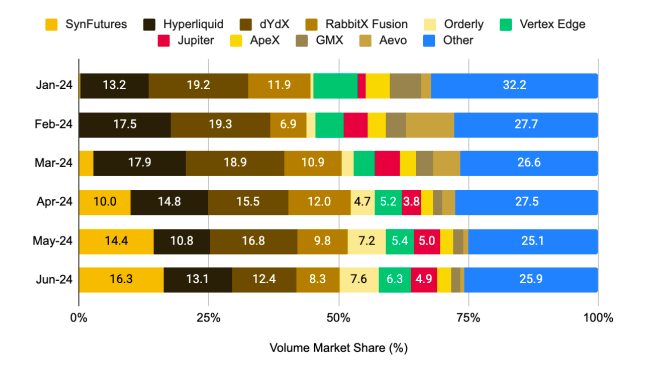

On-chain derivatives have experienced significant adoption, with average daily volumes climbing from $1.8 billion last year to $5.0 billion this year. This growth has been fueled by innovations such as pre-market offerings and the emergence of new protocols like SynFutures, Hyperliquid, and RabbitX. These protocols have gained traction by leveraging the airdrop meta and points incentives, drawing numerous users and boosting volumes.

Hyperliquid, in particular, has impressed with its strong volumes, often surpassing $1 billion daily. Its fully on-chain operations and competitive fees have positioned it as a leading player, often outperforming established rivals like dYdX. The introduction of pre-market offerings for unlisted tokens has also opened new avenues for investor sentiment and trading strategies.

Prediction Markets: A Breakthrough Sector

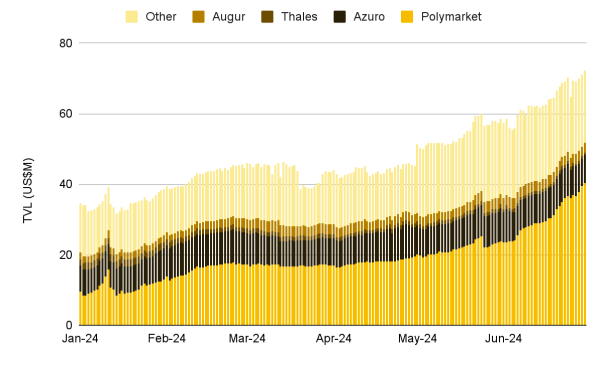

Prediction markets, long overshadowed by other DeFi sub-sectors, have witnessed a resurgence in 2024. Total value locked (TVL) in prediction markets has increased by 108.1% year-to-date, with net deposits exceeding $70 million for the first time. Political events, particularly the U.S. election, have driven market activity, with Polymarket leading the charge with a 55.6% market dominance.

To sustain growth beyond election cycles, prediction markets must attract robust liquidity. The integration of AI participants could play a transformative role, enhancing market efficiency and accuracy by generating content, recommending events, and optimizing liquidity allocation.

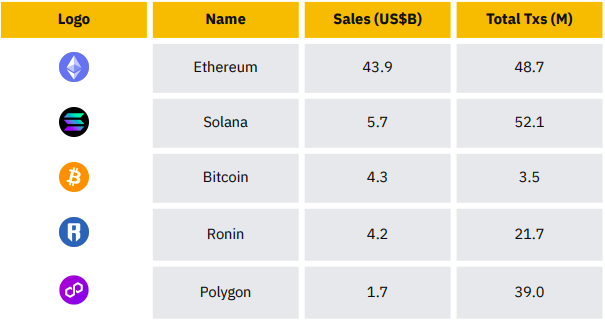

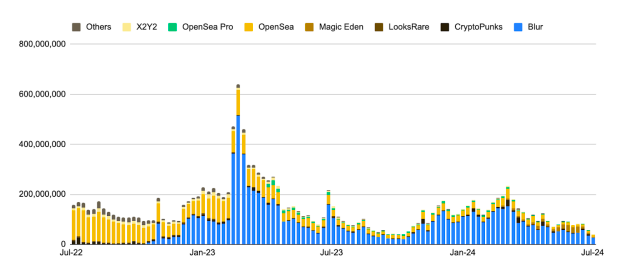

NFTs and the Evolution of Digital Ownership

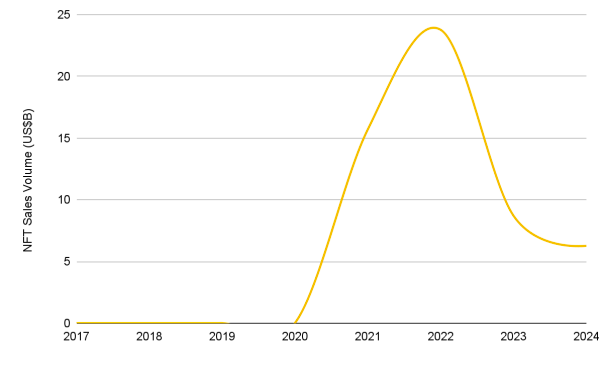

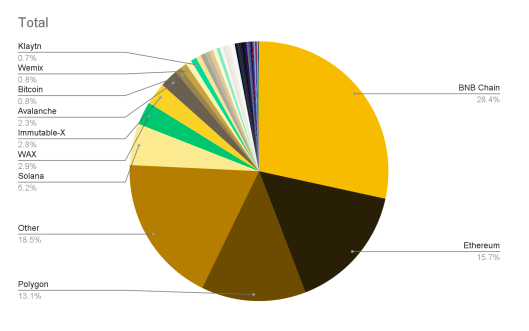

The NFT market, despite facing challenges, continues to evolve. While sales have declined from their 2021 peak, innovations and strategic shifts are reshaping the landscape.

Projects like Pudgy Penguins are building alternative intellectual property (IP) with their plush toys, demonstrating the potential for physical merchandise tied to NFT collections.

Bitcoin NFTs have also gained traction, with marketplaces capitalizing on their growth. The introduction of NFT L2 solutions and the continued development of decentralized NFT marketplaces like Blur and Magic Eden highlight the ongoing innovation in this space.

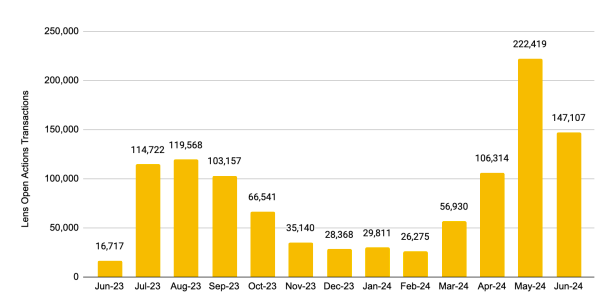

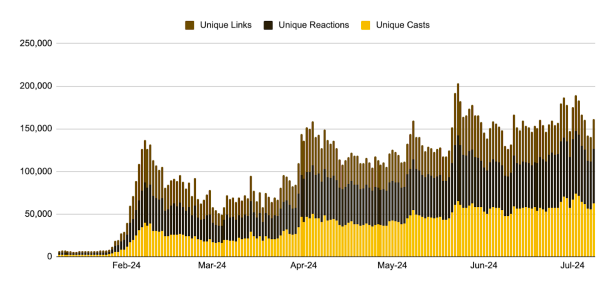

The Growth of Web3 Social and Gaming

Web3 social applications and gaming have emerged as key areas of interest. Lens Protocol and Farcaster are leading the way in decentralized social networking, leveraging blockchain technology to enhance user experience and engagement. Lens Protocol’s integration of ERC-6551 and its upcoming Lens Network are significant milestones in the Web3 social space.

In gaming, projects like Ronin and XAI are developing specialized gaming chains and infrastructure to support blockchain-enabled games.

Ronin’s zkEVMs and XAI’s Layer-3 chain for gaming at scale exemplify the push towards creating comprehensive tools for Web3 gaming.

Memecoins and Market Dynamics

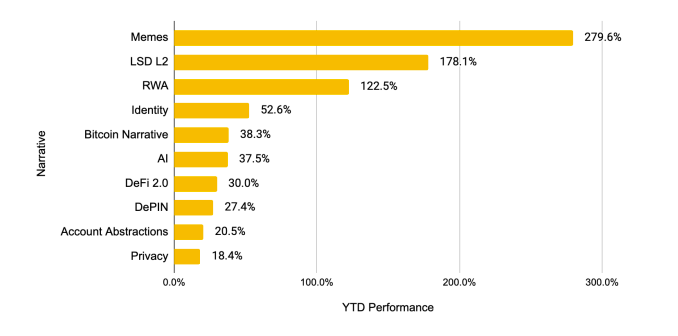

Memecoins have driven significant activity and attention within the crypto community. The sector has returned an impressive 279% year-to-date, with Solana and Base emerging as popular avenues for memecoin trading.

The success of memecoins can be attributed to their unique token supply structures, which eliminate future dilutions and appeal to retail investors seeking accessible opportunities.

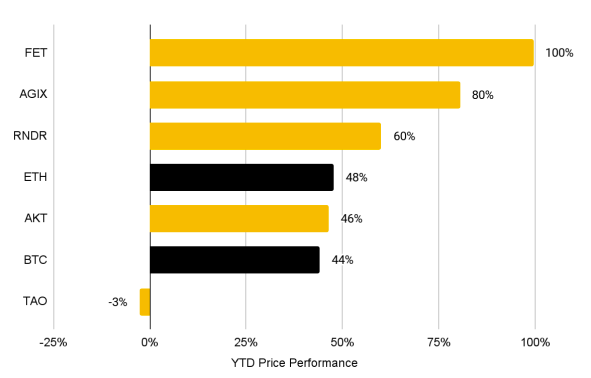

AI and Crypto: A Synergistic Future

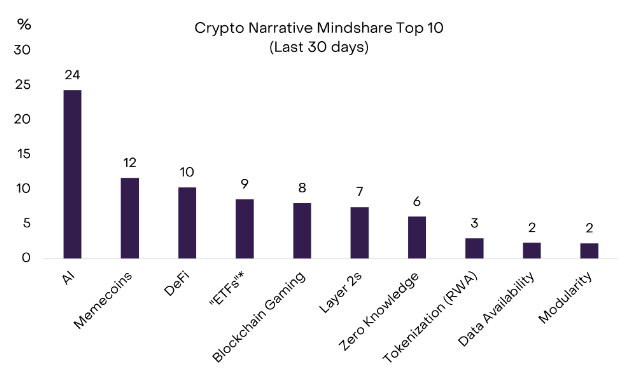

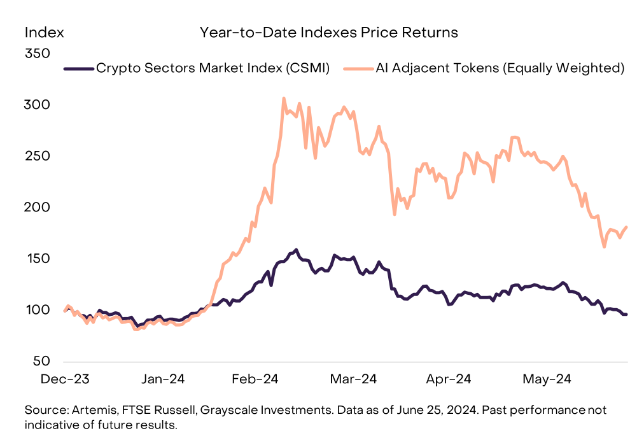

The convergence of AI and crypto has become a compelling narrative in 2024.

AI x crypto projects are leveraging the synergies between these technologies to create innovative solutions. The Artificial Superintelligence Alliance (ASI) merger between Fetch.ai, Singularity.net, and Ocean Protocol highlights the growing interest in decentralized AI ecosystems.

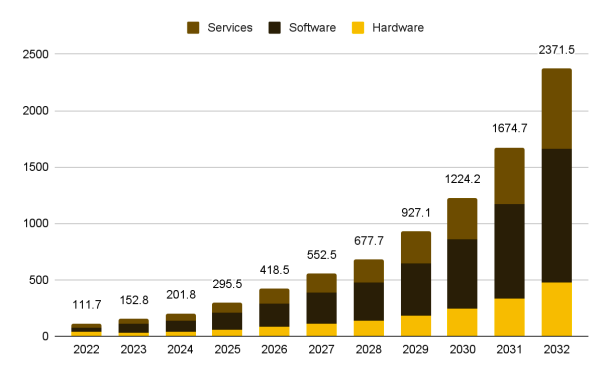

Decentralized compute systems, AI-driven on-chain applications, and enhancements in smart contract functionality are some of the notable developments.

As AI continues to integrate with crypto, we expect to see more sophisticated and value-driven use cases emerge.

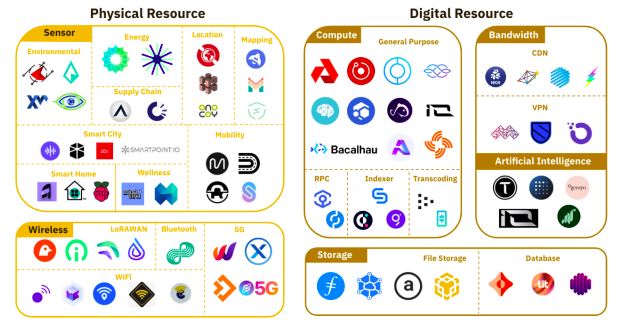

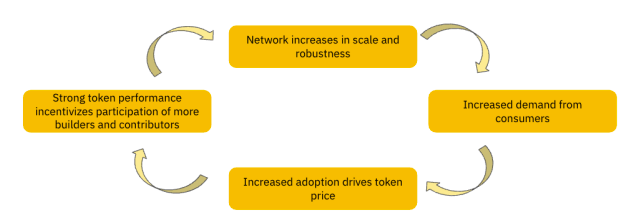

Decentralized Physical Infrastructure Networks (DePIN)

DePIN projects have gained traction, offering decentralized solutions for network infrastructure. These projects leverage blockchain technology and crypto economics to create transparent and verifiable infrastructure networks. The potential for DePIN to coexist with traditional infrastructure players and power Web2 front-ends is significant, promising cost-efficiency and transparency.

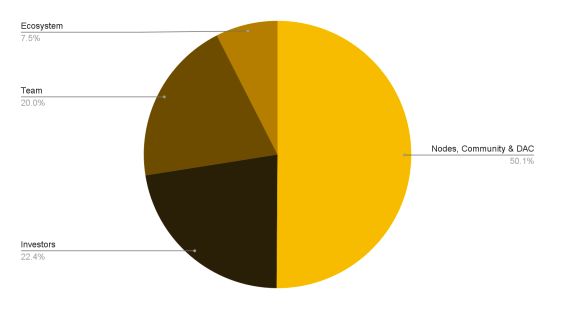

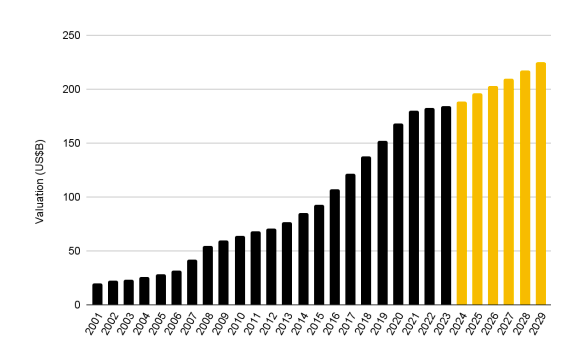

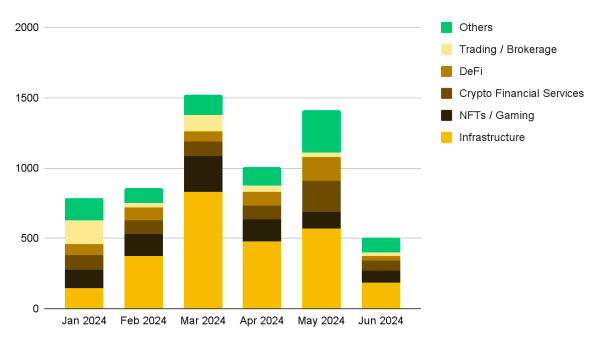

The Future of Crypto VC and Institutional Adoption

Crypto venture capital has seen a rebound in 2024, with a notable increase in deal count and capital invested. Web3, Layer 1, and infrastructure projects have attracted significant funding, reflecting growing investor interest and confidence. The approval of spot Bitcoin and Ether ETFs by the U.S. SEC has also played a pivotal role in enhancing institutional adoption.

Real-world assets (RWAs) continue to emerge as a significant sector, with traditional financial institutions increasingly exploring asset tokenization. The launch of tokenized funds by BlackRock, Fidelity, and others underscores the growing interest in integrating blockchain technology with traditional finance.

Key Takeaways

As we navigate the dynamic landscape of 2024, the crypto market continues to evolve, driven by innovation and strategic developments across various sectors.

From stablecoins and derivatives to prediction markets and NFTs, each segment presents unique opportunities and challenges. The integration of AI and the growth of Web3 social and gaming further highlight the transformative potential of blockchain technology. As institutional adoption increases and new use cases emerge, the future of crypto looks promising, offering a glimpse into a more decentralized and inclusive financial ecosystem.

From stablecoins and derivatives to prediction markets and NFTs, each segment presents unique opportunities and challenges. The integration of AI and the growth of Web3 social and gaming further highlight the transformative potential of blockchain technology. As institutional adoption increases and new use cases emerge, the future of crypto looks promising, offering a glimpse into a more decentralized and inclusive financial ecosystem.

Credits: Binance Research, GrayScale Research.