Crypto Perpetuals: Price Impact, Liquidation Traps & Smart Entry Points

What Are Perpetual Swaps – And Why They Rule the Crypto Derivatives Market

Perpetual futures (or “perps”) are arguably the most traded financial instruments in crypto. Unlike traditional futures, they have no expiration date, allowing traders to hold leveraged positions indefinitely—as long as they can maintain margin.

Perps became popular through BitMEX, but in 2025, platforms like Desk, Bitunix, gTrade, and XT.com dominate the game. They offer advanced tooling, lower fees, and deeper liquidity. With massive open interest across exchanges, perps now influence spot markets more than the spot trades themselves.

Perps vs Traditional Futures

How Perps Influence Spot Price

Due to their 24/7 nature and high leverage, perpetual swaps exert immense price pressure on spot markets—especially during:

-

Funding payment flips (positive → negative)

-

Liquidation cascades

-

High open interest buildups

Example Platforms:

-

Desk: Smart funding alerts, perpetual dominance metrics

-

Bitunix: Real-time price impact vs spot

-

XT.com: Multi-chain perps and liquidation ladders

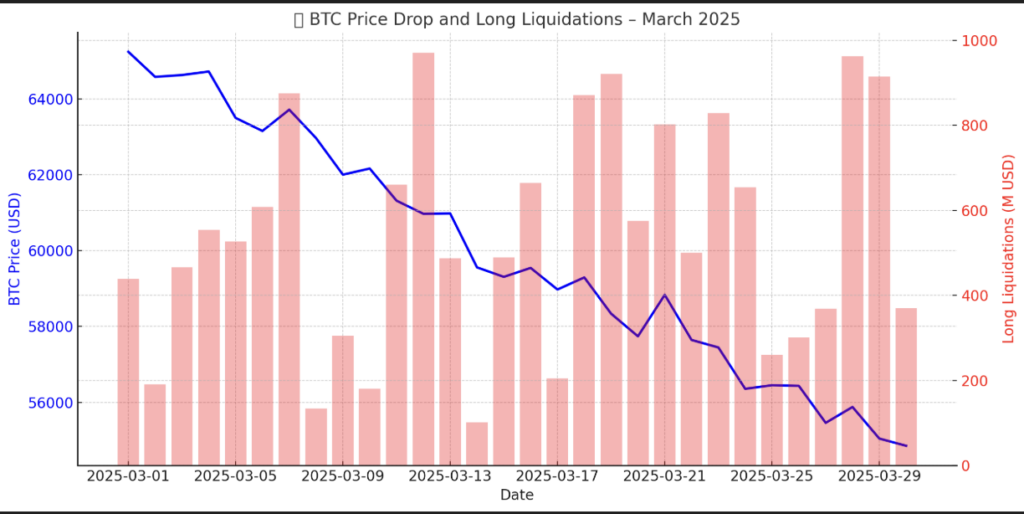

BTC Case Study: Long Liquidation Event

Here’s a simulated chart from March 2025:

-

BTC dropped from $65K to $55K in 3 days.

-

Billions in long positions were liquidated due to poor margin health and overleveraged retail traders.

BTC Price vs Long Liquidations

Tools to Monitor Liquidations & Funding Pressure

| Tool / Platform | Purpose | Key Feature |

|---|---|---|

| gTrade | Track real-time long/short liquidations | On-chain liquidation ladders |

| Hyro | Open Interest & funding dashboards | Historical OI overlays |

| Coinglass | Liquidation heatmaps | Short vs long ratio breakdown |

| CryptoQuant | Funding rate pressure | Whale liquidation alerts |

| DeFiLlama | Aggregated derivatives analytics | DEX vs CEX derivatives analysis |

Pro-Level Entry Strategies in a Perp-Dominated Market

Use these alpha-tested entry strategies to trade smarter, not harder:

✅ Wait for OI Reset: Enter after cascading liquidations wipe out over-leverage.

✅ Funding Rate Fade: When funding spikes extreme (e.g. >0.05%), fade the majority sentiment.

✅ Combine with CVD Divergence: If Cumulative Volume Delta (CVD) shows buying but price isn’t moving—bull trap!

✅ Smart Leverage: Avoid using >5x on volatile pairs unless hedged.

✅ Trailing Stop Strategy: Lock in profits as the position matures during high funding volatility.

How Survive Perpetual Swaps

-

Scan OI & Funding on gTrade

-

Confirm CVD divergence on Hyro

-

Use market-neutral entry (delta-neutral if needed)

-

Set dynamic stop-loss below liquidation walls

-

Harvest funding payments (yield farming in perps)

-

Exit on funding reversal or low OI volume spike