Debt, Demographics, and De-dollarization

Structural deficits, aging populations, and a weakening dollar reserve role are converging into a perfect financial storm. The world is shifting – and America’s financial dominance is no longer untouchable.

A Fragile Foundation Beneath U.S. Power

The pillars of U.S. global influence – economic dynamism, monetary supremacy, and military reach have long rested on one thing: the strength of the dollar. But as the U.S. piles on debt, grows older, and overplays its financial leverage abroad, those pillars are beginning to crack.

In 2025, America’s fiscal trajectory is more precarious than ever. Annual deficits north of $2 trillion are now structural, not cyclical. And with baby boomers retiring en masse, the nation is racing toward an entitlement explosion. Meanwhile, the global appetite for the dollar is fading – not in a crash, but a controlled decline.

This isn’t just a blip. It’s the beginning of a financial realignment with deep implications for markets, geopolitics, and the future of American power.

A Top-Heavy Social Contract

The U.S. social fabric is aging – fast. By 2030, every Baby Boomer will be over 65. That means more people collecting from, and fewer paying into, programs like Social Security and Medicare. Politically, these entitlements are untouchable – yet financially, they are unsustainable.

Projected U.S. Social Security and Medicare Costs, 2025–2045 (% of GDP)

| Year | Social Security | Medicare | Combined Entitlements |

|---|---|---|---|

| 2025 | 5.2% | 4.6% | 9.8% |

| 2035 | 6.0% | 5.8% | 11.8% |

| 2045 | 6.3% | 6.6% | 12.9% |

As demographics worsen, Washington is caught between a rock and a gray-haired hard place. With each election, older voters gain influence, making cuts politically suicidal. The result: more borrowing, more printing, and mounting pressure on the dollar.

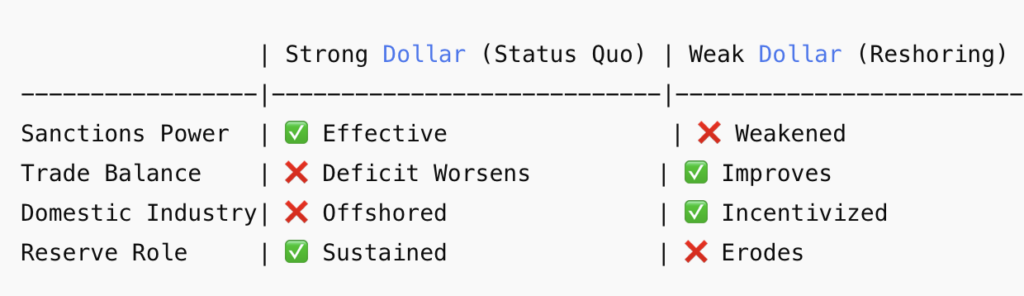

Weaponizing the Dollar vs. Reshoring Industry

The U.S. uses the dollar like a scalpel – cutting off adversaries from SWIFT, freezing foreign reserves, sanctioning trade. But this weaponization comes at a cost. Each move pushes countries to explore alternative financial systems.

At the same time, Washington wants to bring back manufacturing, rebuild supply chains, and reduce reliance on foreign powers like China. But reshoring is expensive – and inflationary – without a weaker dollar and looser fiscal policy.

Policy Trade-Off Matrix – Dollar Hegemony vs Economic Reshoring

In short, you can’t have both. A strong-dollar foreign policy collides with weak-dollar industrial policy. The U.S. is trapped in its own contradictions.

Debt Interest as a Time Bomb

In 2021, just 8% of U.S. tax revenue went toward paying interest on the national debt. In 2025, that figure is approaching 20%. By 2030, it could exceed 25%. At that point, the U.S. government becomes a pass-through vehicle – collecting taxes to pay creditors.

Case Study: Canada’s 1990s Fiscal Crisis

In the mid-1990s, Canada faced a similar bind: interest consumed over 30% of federal revenue. The country was forced into emergency austerity – slashing programs, cutting spending, and radically reforming pensions. The U.S., with its global entanglements and aging population, will find it far harder to replicate that playbook.

The De-Dollarization Drip

No country wants to upend the dollar overnight. But they’re quietly preparing for its diminished role.

-

China and Brazil now settle much of their trade in yuan.

-

Gold purchases by central banks are at record highs.

-

Crypto adoption is accelerating in regions plagued by inflation or capital controls.

Each action is a drop in the de-dollarization bucket. Taken together, they signal a rising appetite for alternatives – not because they’re perfect, but because the dollar no longer feels safe or neutral.

As fiscal dominance – when deficits drive monetary policy – takes root in America, trust in dollar-denominated assets continues to erode.

Investment Outlook: Follow the Hard Assets

In this environment, portfolios are being quietly re-engineered:

-

Hard assets > paper assets: Gold, Bitcoin, energy, and commodities hedge against currency debasement.

-

Regionalization: Capital flows increasingly favor “fortress economies” with low debt, healthy trade balances, and energy independence.

-

Risk re-pricing: U.S. bonds may no longer be the risk-free asset they once were—especially if the Fed is forced to monetize debt in perpetuity.

A Multipolar Monetary Future

America’s fiscal engine is overheating. The demographic clock is ticking. And the dollar is no longer the unchallenged linchpin of global finance.

Together, these three forces – debt, demographics, and de-dollarization – are forming a structural supercycle that could redefine everything from asset allocation to geopolitical power.

The future isn’t binary – it’s multipolar. And as trust in fiat wanes, trustless assets are rising to fill the void.

The question isn’t whether the financial world will change. It’s how prepared you are when it does.