Decentralized Prediction Markets: The Future of Forecasting

Imagine a bustling medieval marketplace, where merchants, travelers, and townsfolk gather to exchange goods, stories, and predictions about the future. The blacksmith wagers on a bountiful harvest, while the merchant bets on the arrival of a long-awaited caravan. These informal prediction markets have existed for centuries, and while the scene has changed dramatically, the essence remains the same: leveraging collective wisdom to forecast future events.

Today, the age-old practice of prediction has found a sophisticated ally in blockchain technology. Decentralized prediction markets are emerging as a transformative tool, offering unparalleled transparency, security, and efficiency. Let’s delve into the intricate world of blockchain-based prediction markets and explore how they are revolutionizing the way we forecast the future.

The Genesis of Modern Prediction Markets

Prediction markets are not a novel concept. The University of Iowa pioneered one of the first modern prediction markets in the late 1980s with the Iowa Electronic Markets (IEM). The IEM allowed participants to buy and sell contracts based on the outcomes of political events, providing surprisingly accurate forecasts. The success of IEM demonstrated the potential of prediction markets to aggregate dispersed information and produce reliable predictions.

Fast forward to the 21st century, and the landscape has evolved with the advent of blockchain technology. Traditional prediction markets, while effective, suffer from centralization and potential manipulation. Enter blockchain – a decentralized ledger system that ensures transparency and trust through immutable records and smart contracts.

Mechanisms of Decentralized Prediction Markets

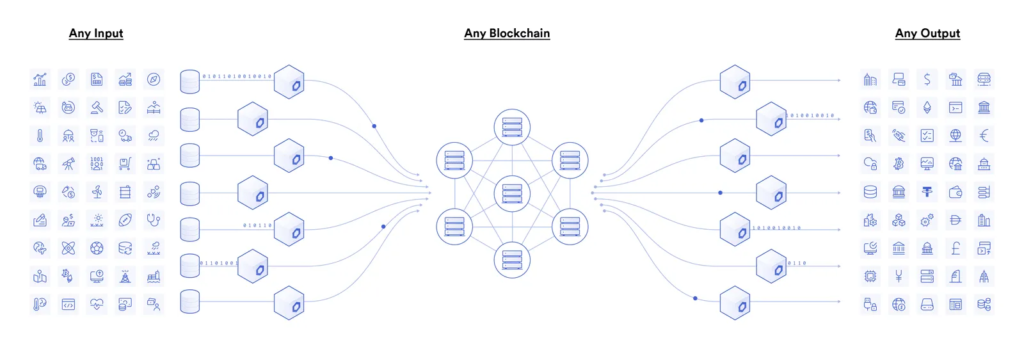

At the heart of decentralized prediction markets lies the blockchain, a digital ledger that records every transaction transparently and immutably. This foundational layer guarantees that all predictions and outcomes are permanently documented, providing an unalterable history that fosters trust and reliability.

Smart contracts are the backbone of these markets. These self-executing contracts automate the entire process – from creating and managing prediction markets to settling outcomes. By eliminating intermediaries, smart contracts ensure that the rules are followed precisely, reducing the risk of manipulation and fraud.

Participants in decentralized prediction markets use blockchain-based tokens to represent their predictions. This tokenization allows seamless trading, enabling users to buy, sell, or trade their predictions on various outcomes. The decentralized nature of these markets ensures that no single entity can control or manipulate the market, providing a level playing field for all participants.

The Role of Decentralized Oracles

For decentralized prediction markets to function accurately, they rely on decentralized oracles – information feeds that bring real-world data onto the blockchain. These oracles gather and verify data from multiple sources, ensuring that the information used to settle predictions is accurate and trustworthy.

Consider the historical anecdote of the Greek Pythia, the oracle of Delphi, who was consulted for her predictions about future events. In a similar vein, decentralized oracles act as modern-day Pythias, providing reliable data that underpins the predictions made on these platforms.

Advantages of Decentralized Prediction Markets

Decentralized prediction markets offer numerous advantages over their traditional counterparts. First and foremost, they provide unparalleled transparency and immutability. Every transaction and prediction is recorded on the blockchain, creating a permanent and unalterable history that fosters trust among participants.

Additionally, these markets significantly reduce counterparty risk. By eliminating intermediaries and relying on smart contracts, participants can engage directly with the market, minimizing the potential for manipulation or fraud.

Global accessibility is another key benefit. Decentralized prediction markets break down geographical barriers, allowing anyone with an internet connection to participate. This inclusivity not only enriches the market with diverse perspectives but also enhances market efficiency.

Cost efficiency is another compelling advantage. Traditional prediction markets often involve intermediaries and associated fees, which can be substantial. In contrast, decentralized prediction markets leverage blockchain technology to reduce transaction costs, benefiting both market creators and participants.

Finally, decentralized prediction markets are inherently resistant to censorship. The decentralized nature of blockchain technology ensures that no single entity can control or restrict access to the market. This resilience is particularly valuable in regions where traditional prediction markets may be subject to regulatory constraints.

Real-World Examples of Decentralized Prediction Markets

Several notable decentralized prediction markets have emerged, each offering unique features and advantages:

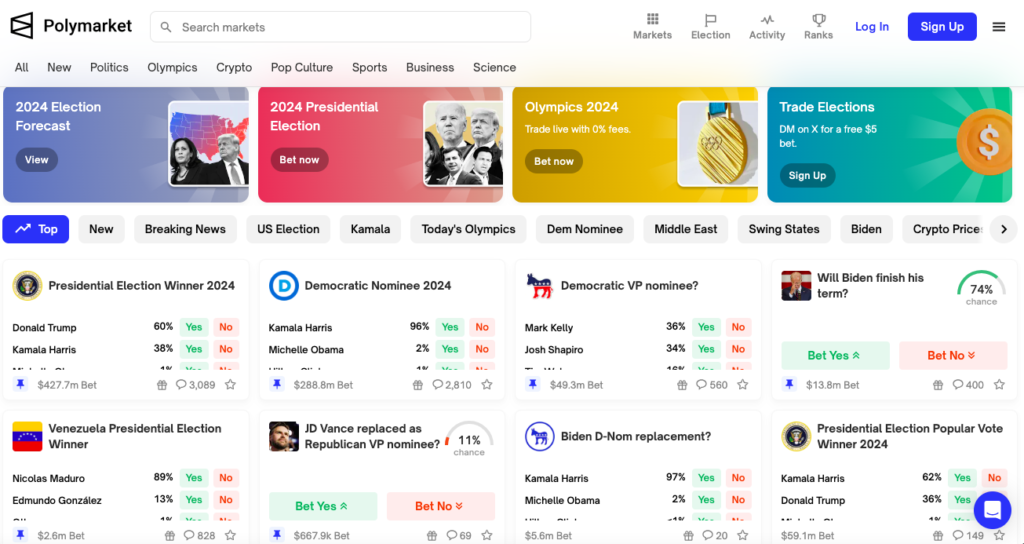

Polymarket: Built on the Polygon network, Polymarket focuses on current events, offering a user-friendly interface and a wide range of event categories. Its emphasis on accessibility and ease of use has made it a popular choice among prediction enthusiasts.

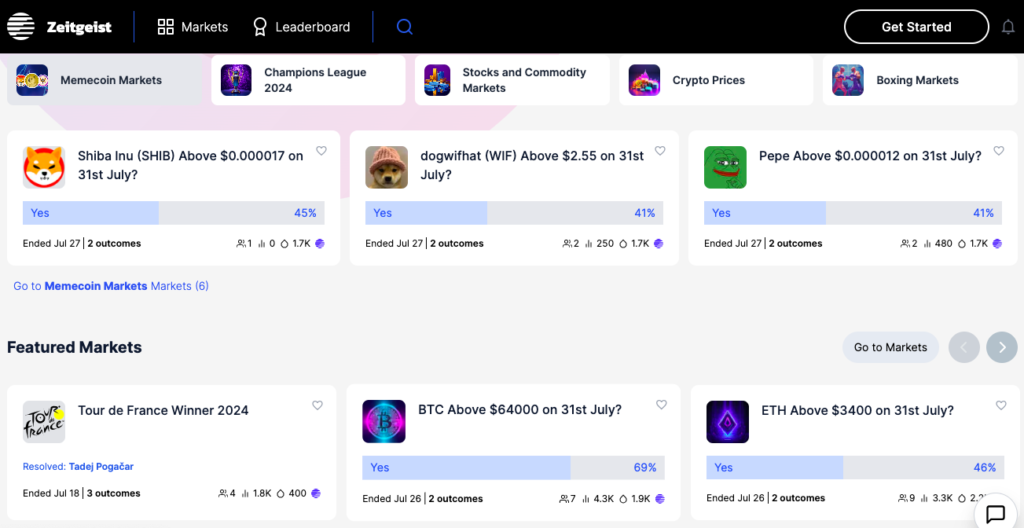

Zeitgeist: Operating on the Kusama network, Zeitgeist stands out for its scalability and user engagement. It offers innovative prediction markets that cover a diverse array of events, leveraging advanced blockchain technology to enhance user experience.

What is the Future of Blockchain-based Prediction Markets?

Despite the numerous advantages, decentralized prediction markets face several challenges. Regulatory uncertainty remains a significant hurdle, as different jurisdictions have varying laws regarding prediction markets and gambling. Additionally, the potential for market manipulation and technical vulnerabilities poses risks that need to be addressed.

However, ongoing advancements in blockchain technology and smart contract development hold promise for overcoming these challenges. As the technology matures and regulatory frameworks evolve, decentralized prediction markets are likely to gain wider acceptance and adoption. Protocols such as Azuro are making it easier for developers to create world class front-ends e.g. Bookmaker, JuicyBet, BoxBet, BookieBot, XYZBET for prediction markets by providing the infrastructure and liquidity layers for blockchain-powered prediction markets.

Decentralized prediction markets represent a paradigm shift in how we forecast and engage with future events. By leveraging blockchain technology, these markets offer transparency, security, and inclusivity that traditional prediction markets cannot match. As we continue to witness the growth and evolution of this sector, the potential for decentralized prediction markets to revolutionize forecasting becomes increasingly evident. The marketplace of the future is here, and it is decentralized, transparent, and accessible to all.