DESO DEX – Openfund Platform Review

What is DESO DEX & Openfund?

DESO DEX is an on-chain, non-custodial order book exchange capable of processing 40,000 matches per second. It is currently in public beta and offers zero fees. Previously known as DAODAO, Openfund is the cross-chain crypto-native fundraising platform that allows anyone to start, fund, and trade up to 2274 tokens.

At its core, Openfund is a tool for raising money using a crypto token/coin. What’s great about Openfund is that it does not impose any constraints as far as decentralization or autonomy which effectively means that if anyone wishes to launch a centralized project on Openfund and that project happens to have a coin, they should be able to do so without any confusion for them or their backers.

To get started, simply visit https://openfund.com/

If you already have a DESO account then you can go ahead and sign in. If not, sign up and log in with MetaMask.

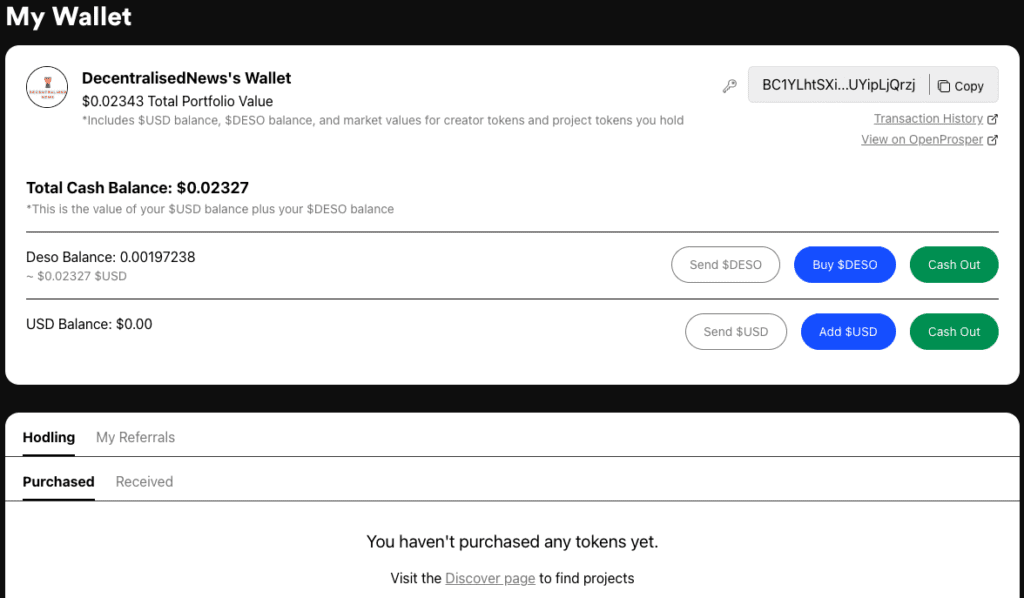

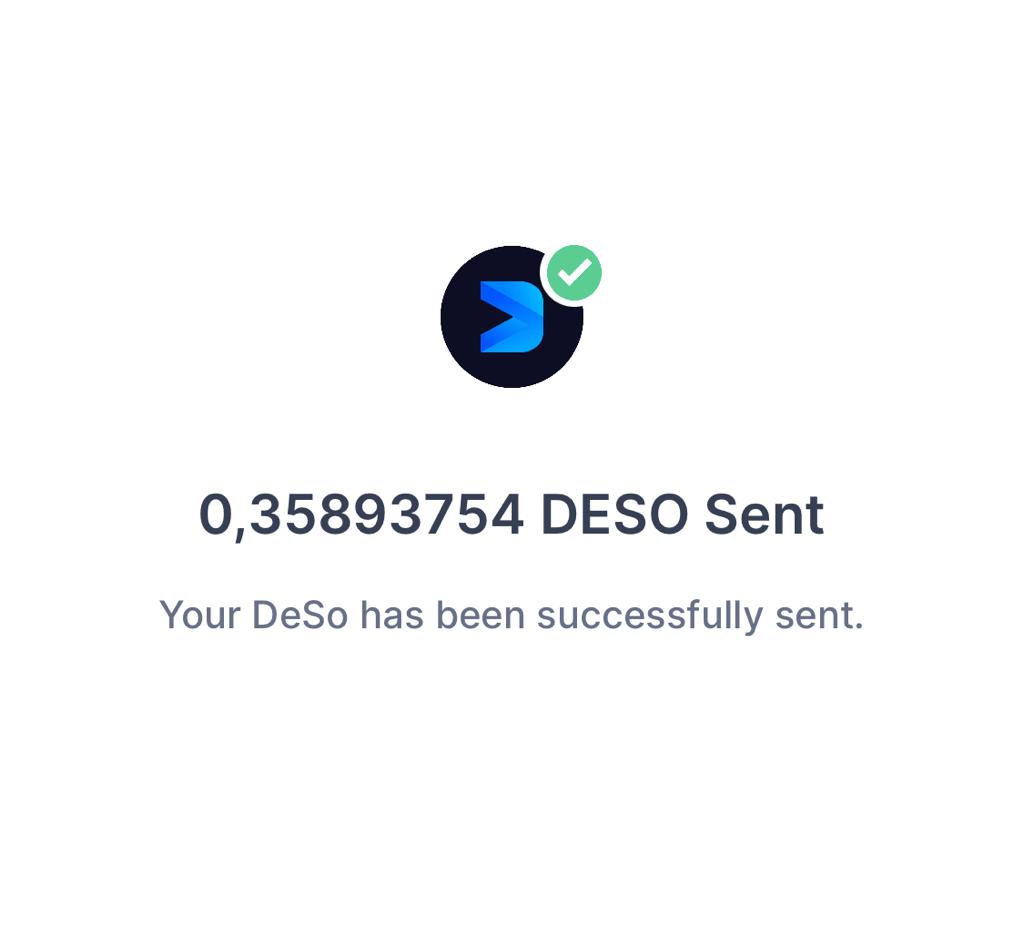

Once you’ve connected your DESO account/MetaMask wallet, you can proceed to fund your wallet as you will need to use the $DESO native ecosystem token to acquire $openfund or for trading on the DEX. Since we already had some $DESO tokens in our Blockchain wallet, we simply made a small test transaction from the Blockchain wallet to Openfund DEX’s wallet to see if the process works as promised. As you can see here, the wallet barely had funds in it.

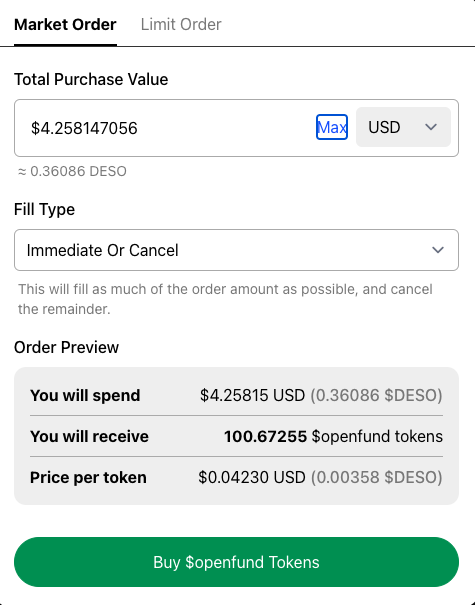

Now that we managed to top up the wallet with $DESO tokens, we were able to purchase Openfund tokens and use the DEX.

Now you can see that our wallet has been topped up and we were able to proceed to purchase $openfund tokens.

You can check your wallet to verify if your order has been executed.

DeSo DEX enables secondary trading of Openfund tokens, providing instant liquidity to founders and their contributors, and unlocking capital they can use to grow their startups. Openfund is designed to make it possible for Bitcoin, Ethereum, or Solana users to invest in promising founders before they pitch to venture capitalists – a model touted as disruptive to the traditional early-stage financing model since it unlocks immediate liquidity for both founders and contributors.

With Openfund, it is anticipated that founders will no longer need to wait 10 or more years for their company to ‘go public’ and become traded on a liquid exchange. In addition, founders on Openfund are able to provide contributors a liquid token with their purchase, which can be instantly traded on the DeSo DEX which offers fast and gasless transactions.

It is yet to be seen how thse new models develop overtime and how many participants will be onboarded into such ecosystems. It is advisable to try out platforms such as Openfund, if for anything, just to stay up to speed with how open ecosystems and Web3 technologies are disrupting and changing the traditional landscape. Check out our full review of DESO blockchain and its ecosystem.