DLN (deSwap Liquidity Network) Platform Review

What is deSwap Liquidity Network (DLN)?

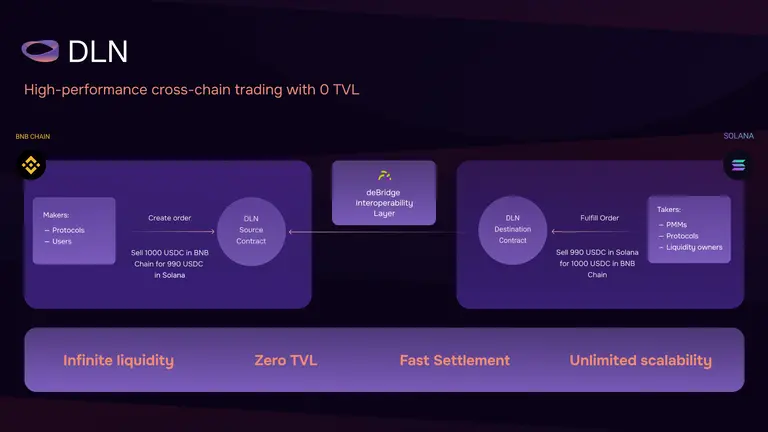

DLN is a cutting-edge cross-chain trading system that operates through two distinct layers:

- Protocol Layer: Utilizes on-chain smart contracts.

- Infrastructure Layer: Employs Takers to handle off-chain matching and on-chain trade settlement.

Within the DLN protocol layer, smart contracts are accessible by any on-chain address (referred to as a Maker) to initiate limit orders for cross-chain trades. When an order is placed, the Maker specifies the input token amount on the source chain and the desired parameters for the destination chain, such as the token address and the amount to be received. This specified amount is then temporarily locked by the DLN smart contract on the source chain.

Any on-chain address (known as a Taker) with adequate liquidity on the destination chain can fulfill the order by calling the corresponding DLN smart contract method and supplying the required liquidity.

Once the order is fulfilled, the Taker triggers a cross-chain message via the DLN smart contract using the deBridge messaging infrastructure. Upon message delivery, the source chain releases the locked funds to the Taker’s address, thereby completing the trade.

How to Trade Cross-chain using DLN

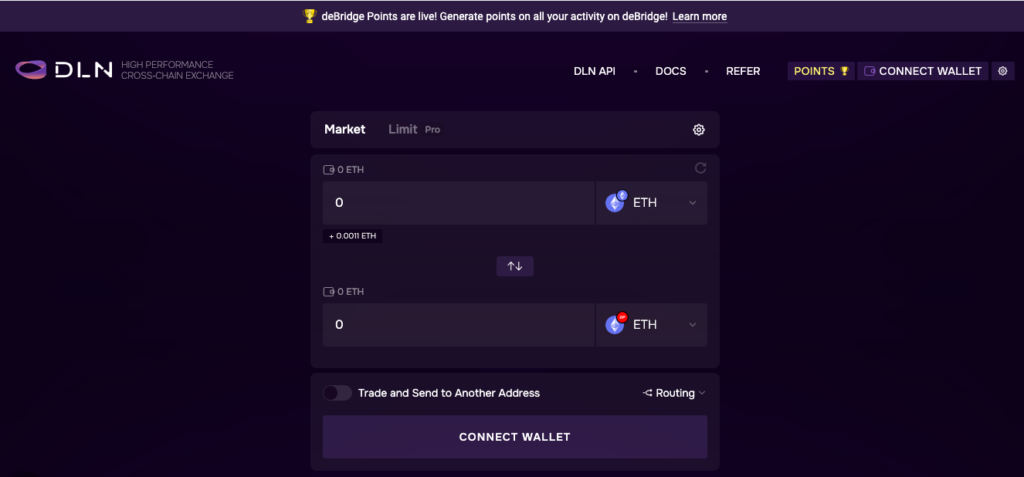

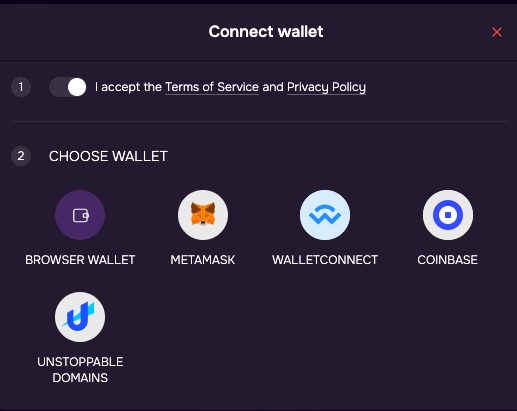

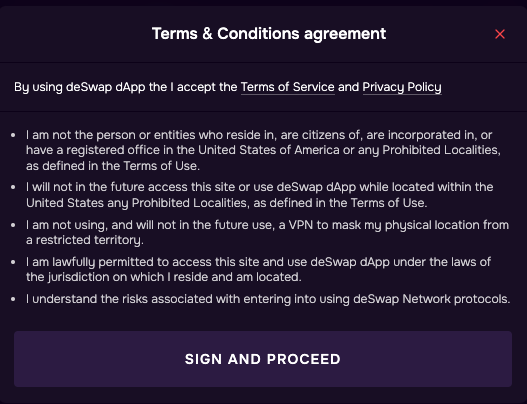

Visit the DLN homepage and Connect your web3 wallet.

For this demonstration, we’ll be using MetaMask wallet.

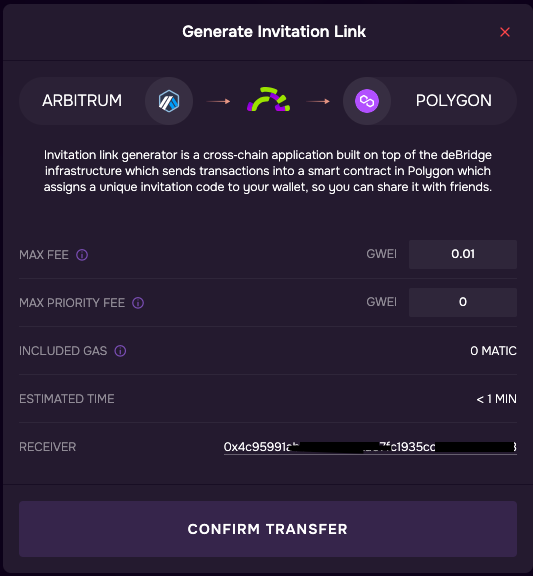

Take the opportunity to generate your referral link and make passive income.

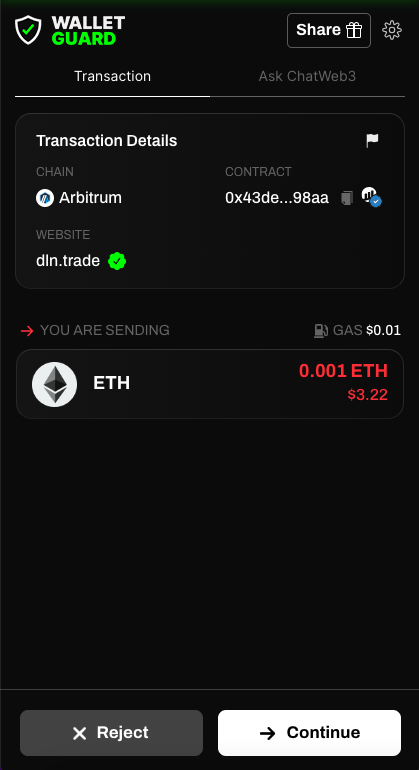

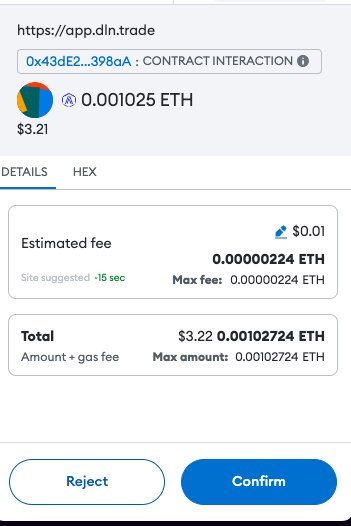

Confirm the transaction.

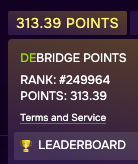

Pay the gas and earn deBridge points in the process.

Now proceed to take your cross-chain trades.

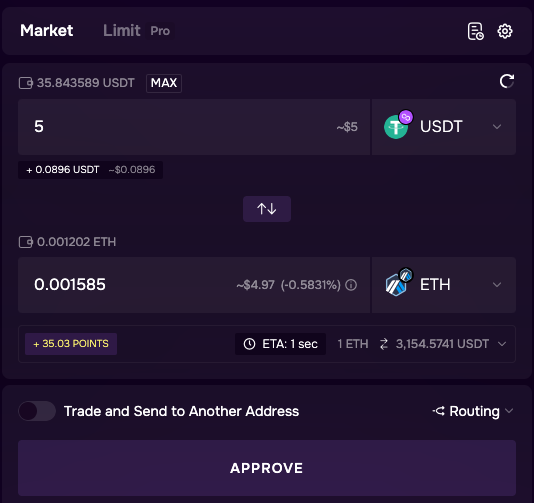

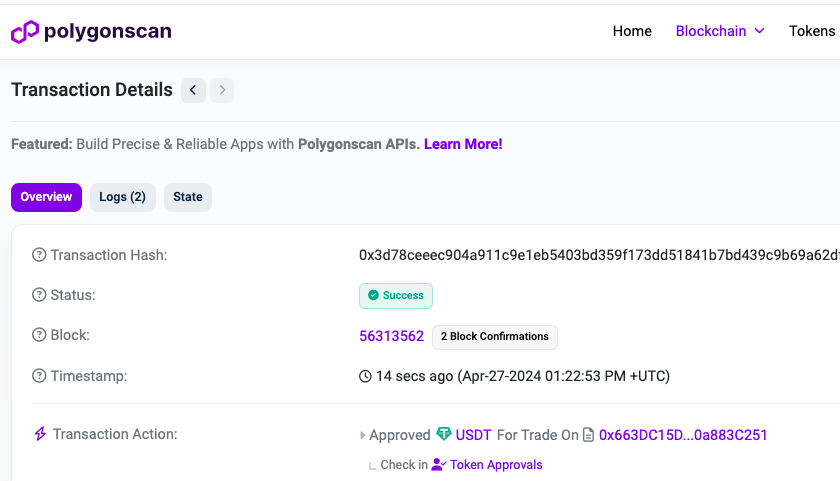

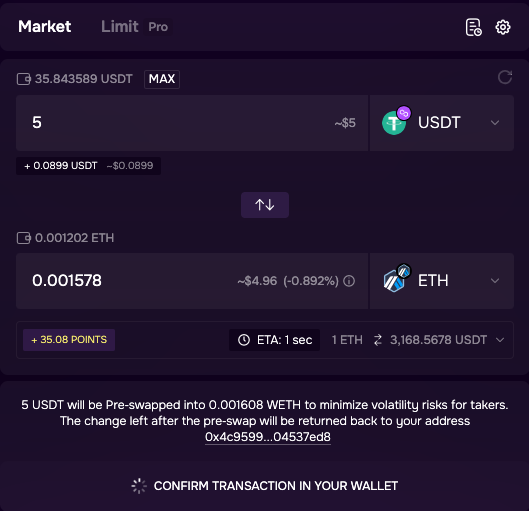

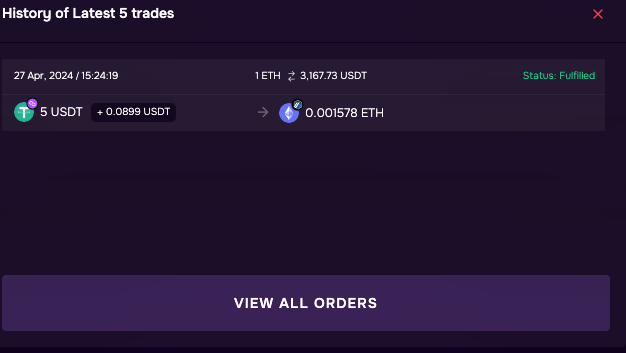

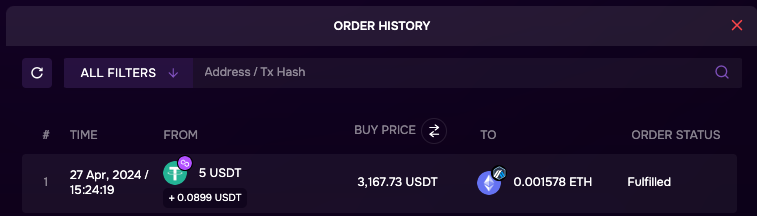

In this example, we’ll be trading USDT on Polygon for ETH on Arbitrum.

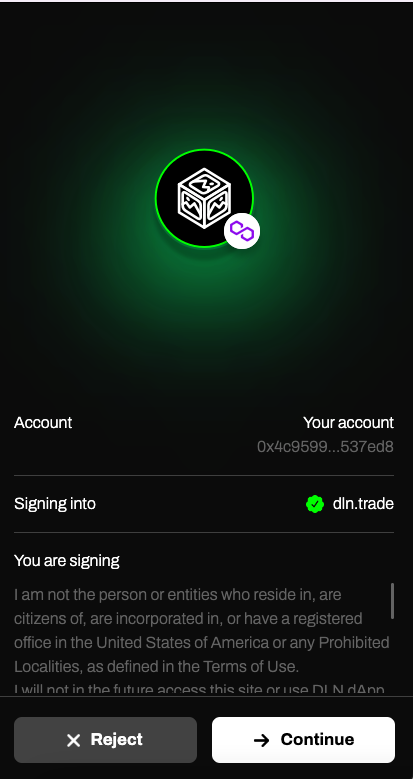

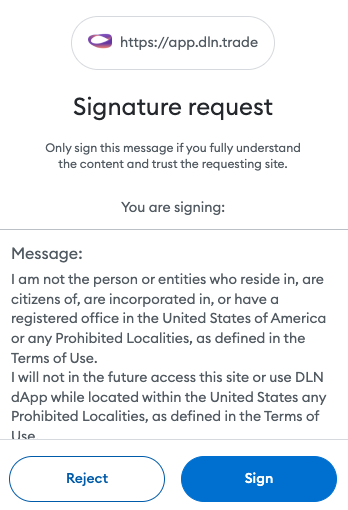

Sign transaction to proceed.

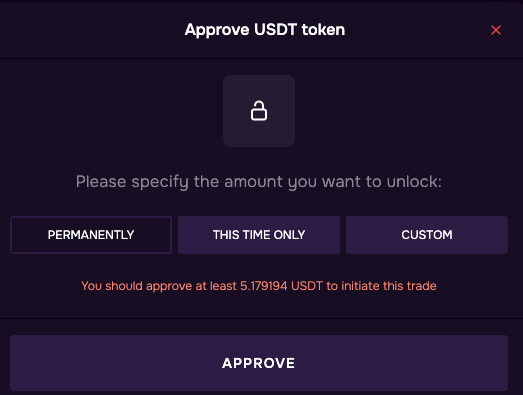

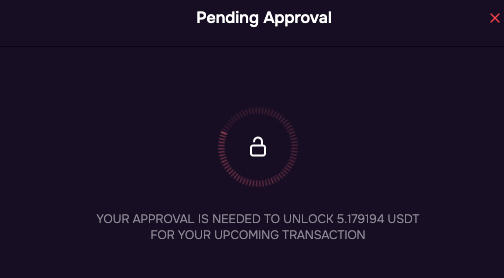

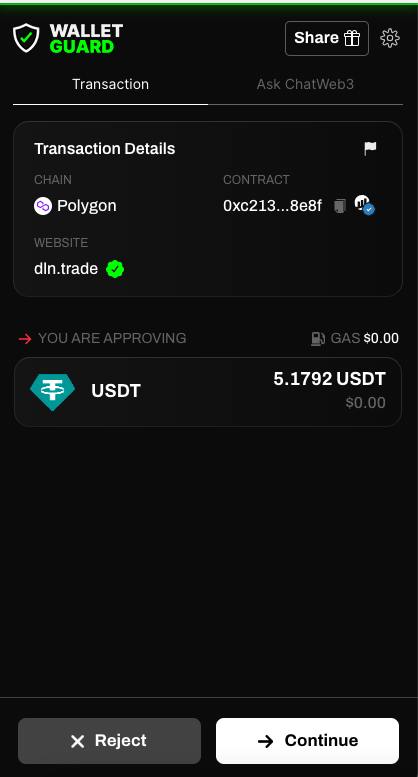

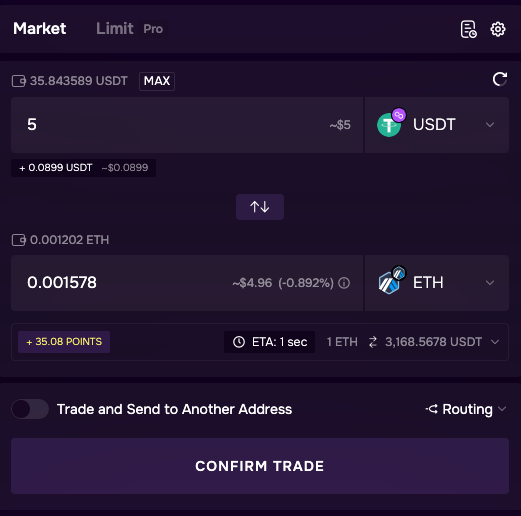

Approve token for trading.

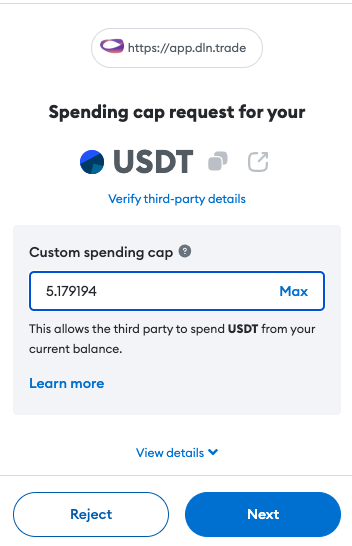

Set your spending cap.

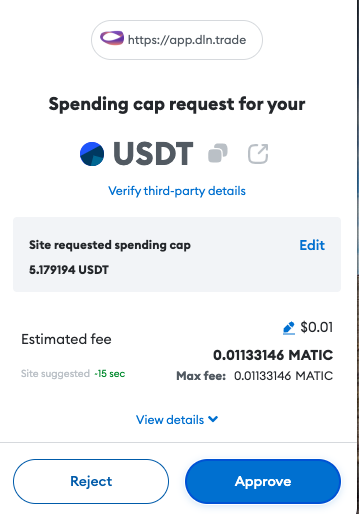

Pay the gas fee.

Pay the gas fee.

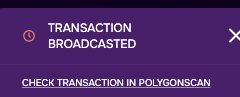

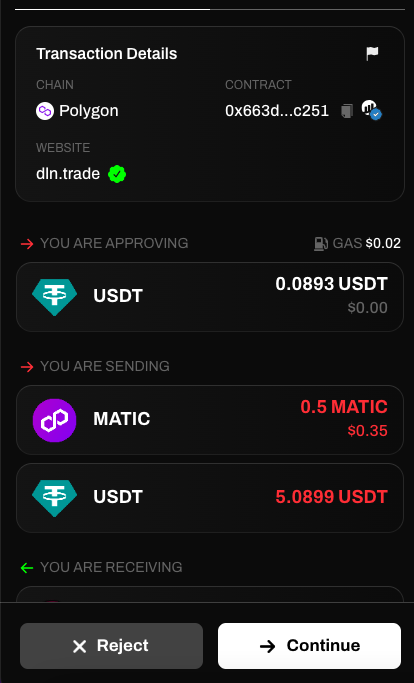

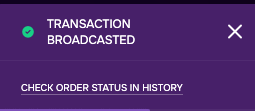

Once the transaction is broadcasted the network, you can verify on the block explorer.

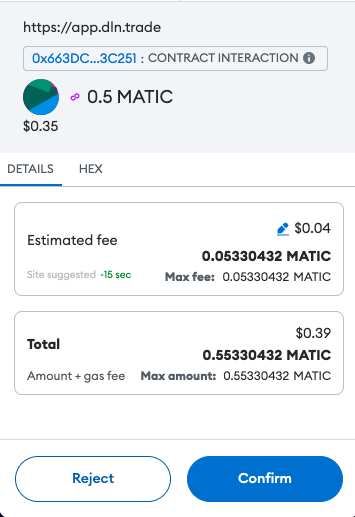

Now you can confirm the trade.

Give your wallet the necessary permissions to proceed.

Pay the gas fee.

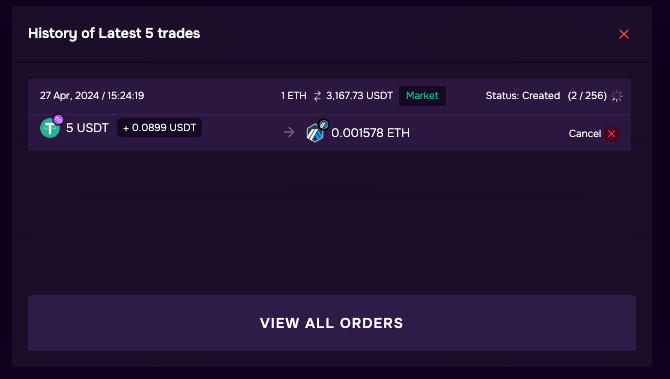

Once your order is created you’ll be able to see details of the transaction in your trade history.

What Makes DLN Unique?

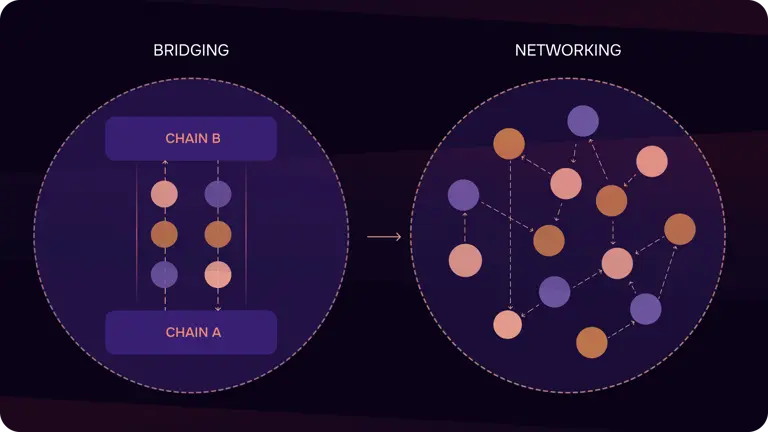

DLN’s (deSwap Liquidity Network) high-performance cross-chain trading infrastructure powered by deBridge, features a distinctive 0-TVL (Total Value Locked) design. DLN avoids the use of liquidity pools by executing all trades asynchronously through a self-organizing liquidity network. This setup allows developers and projects to experience the fastest cross-chain operations available, facilitating swift liquidity and information transfers with quicker finality than traditional cross-chain solutions.

DLN shifts the cross-chain approach from bridging to networking, offering numerous unique features for applications and users:

- Limit orders for any cross-chain trade

- Zero slippage regardless of order size

- Unlimited market depth

- Guaranteed rates with low fees

- Quick settlement

- Native token trading (eliminating custodial risks of wrapped assets)

- Zero locked liquidity risk (0-TVL)

- Highly scalable, capable of processing any trading volume

- Gasless limit orders (users can place orders without upfront costs; tokens are deducted only upon guaranteed execution on the destination chain) (coming soon)

- Order + call data feature, allowing instructions to be executed alongside order fulfillment

DLN’s asynchronous design offers an exceptional user experience by simplifying technical complexities such as slippage, MEV, gas limits, and transaction finality. This benefits both end-users and professional market makers, who can monetize idle on-chain liquidity by fulfilling orders placed through DLN.