Eversend Review

Eversend one-stop financial services hub review.

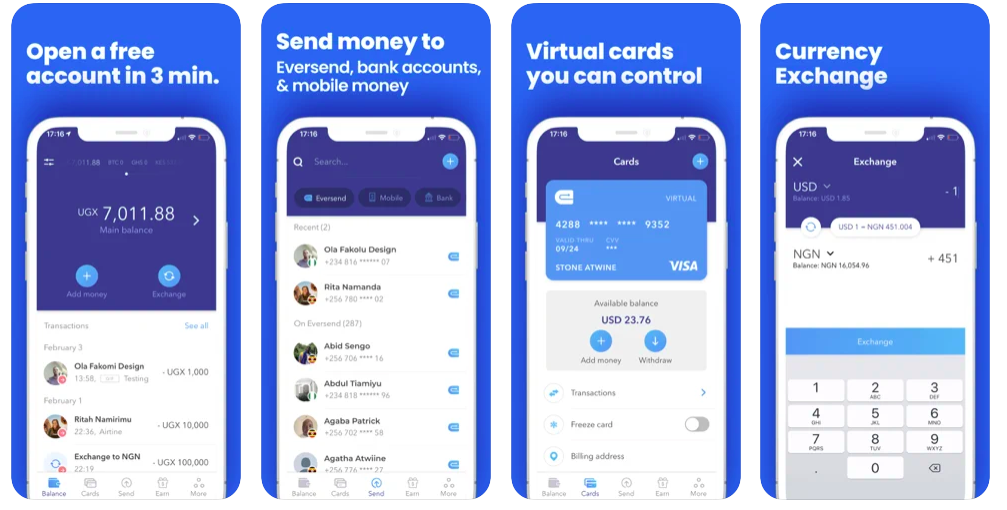

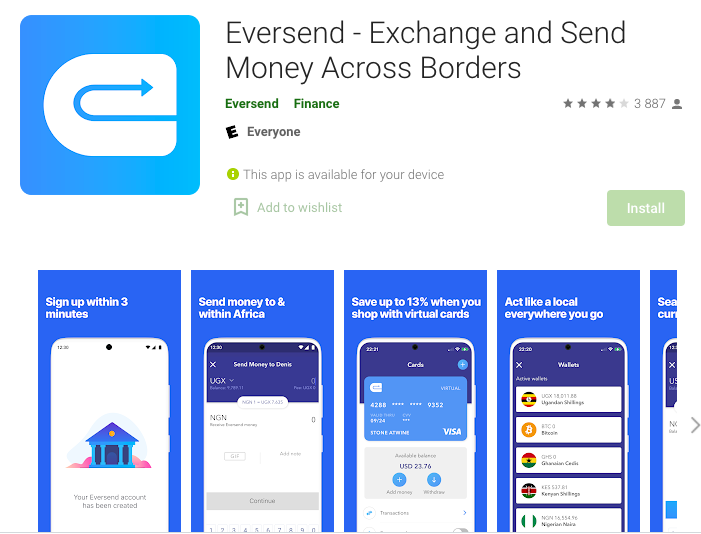

Dubbed Africa’s first neobank, Eversend is described as a one-stop financial services hub that enables mobile app (App store or Google play store) users in supported countries to exchange currencies, save, manage and send money at the best possible rates, both online and offline. More than that, it’s a remittance service which also allows users to pay bills and send airtime to other users. Eversend even offers a debit card that users can use for making online purchases.

Overview

- Easy to use app – users can simply launch the application and sign up with email and have instant access to the platform once they complete account and user verification.

- KYC is done with any official document such as a national ID, passport, drivers permit and then complete video verification.

- Users can exchange their currencies e.g. from Uganda Shillings to US Dollars within the app.

- Money that users have in their e-wallet can also be exchanged with Eversend app to currencies such as USD, EUR, NGN, KES, UGX, RWF and GBP.

- Freelancers can generate a payment link and send it to their contractors who are able to pay them via Eversend.

- Eversend makes it possible for its users to pay a variety of different bills including airtime, electricity bills, insurance, etc. The service is available in a number of countries including Nigeria, Ghana, Rwanda, Kenya, Tanzania, Eswatini, and Uganda.

- Users have numerous money transfer options including M-Pesa, Airtel Money, Equitel, MTN Mobile Money, Mobile Money, Mobile Top Up, Credit Card and Debit Card (Mastercard, Visa, and Maestro).

- Users can hold and exchange multiple currencies since they offer a multi-currency e-wallet.

- Eversend charges relatively low transaction fees compared to other remittance apps. Sending funds to another Eversend wallet is free. Charges on the foreign exchange rate are between 1.5-3.5%. Costs are always reflected in the app prior to a user sending the money.

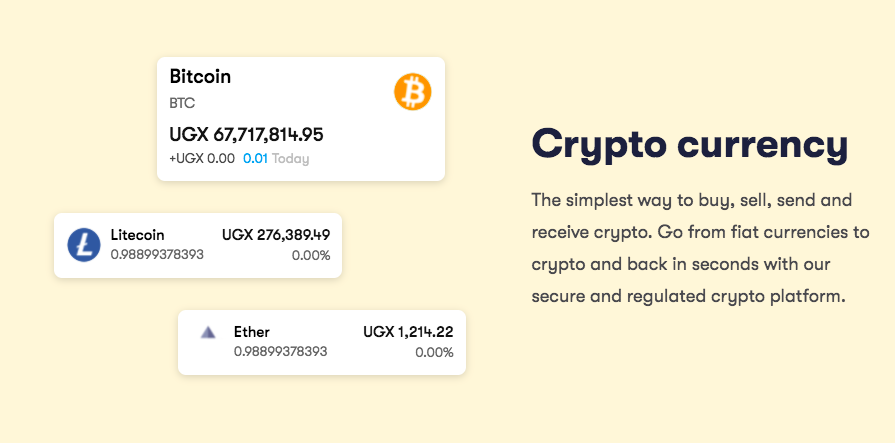

- Eversend offers a simple way to buy, sell, send and receive crypto. Users are able to go from fiat currencies to crypto and back conveniently.

- Africa based users will have access to US stocks with their stocks offering.

- Sending money to a mobile money account or Eversend wallet is fairly quick, taking on average up to 5 minutes, however, sending money to a bank account on the other hand may take between 1-3 days.

- Transfer limits are dependent on several factors including the country from which the sender is sending from, payment, and delivery method. The app shows users their transfer limits. Users can only store up to US$3000 on Eversend which could be a measure put in place to limit the amount of risk each user is exposed to on the platform and/or for compliance.

- Users can send money to Uganda, Kenya, Rwanda, and Tanzania using Eversend and they can send money from United States, Nigeria, South Africa, Kenya, Ghana, Australia, Belgium, Canada, India, Uganda, France, Germany, Netherlands, Switzerland, United Kingdom, South Korea, Turkey, United Arab Emirates, Rwanda, Eswatini, and Tanzania.

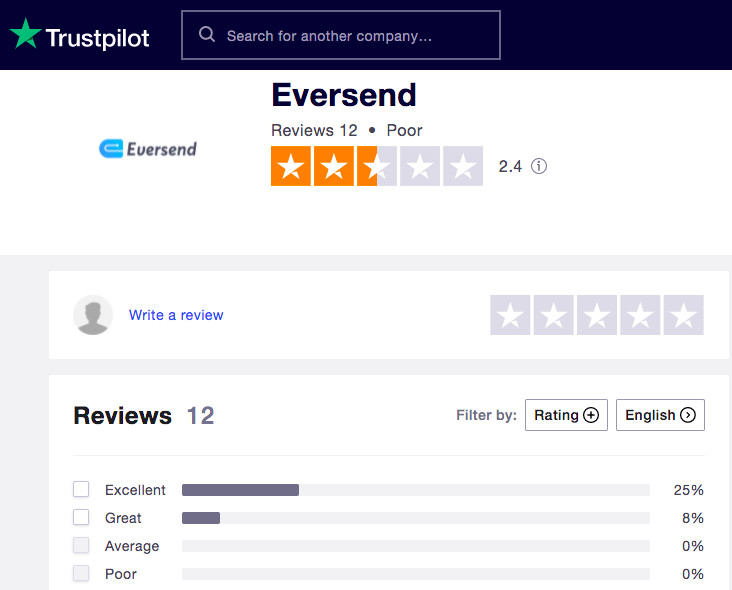

- Eversend has mixed reviews across a number of platforms but overall it appears to be a decent platform.

- Eversend offers virtual cards. According to Eversend, banks in Africa charge users up to 15% in hidden foreign exchange fees when they pay online with their local currency bank cards, so if users opt for the Eversend USD virtual cards they will have an opportunity to save up to as much as 13%.

- Eversend also offers in-app customer service.