“Capital markets are still in the early phases of the adoption of blockchain and distributed ledger technologies (DLT) and the industry continues to seek viable use cases. One broad category of such use cases is the creation of digitally tokenized assets, in which the token either represents a property interest that exists only in the Blockchain (such as non-certificated securities) or represents an asset existing off the Blockchain.” – BNY Mellon

According to Markets and Markets, asset tokens, also known as asset-backed tokens (ABT), are digital tokens representing real economy assets. The tokenization market is expected to grow from USD 983 million in 2018 to USD 2.67 trillion by 2023, at a Compound Annual Growth Rate (CAGR) of 22.1% during the forecast period. Major vendors who offer tokenization services have adopted different types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and acquisitions, to expand their offerings in the tokenization market.

Some of the vendors offering tokenization services globally include First Data, Gemalto, Fiserv, Micro Focus, Symantec, Thales e-Security, Visa, WEX, Worldpay, Dell Technologies, CipherCloud, Futurex, Liaison Technologies, Protegrity, TokenEx, Bluefin, Sequent Software, Discover Financial Services, Carta Worldwide, Merchant Link, Ingenico ePayments, Rambus, Mastercard, Verifone, and IP Solution International.

Tokenization leverages blockchain technology in order to securitise both traded and non-traded assets. Managing investments across a wide variety of asset classes is made easy with tokenization since it allows asset owners to have liquidity access much more easily, even for assets that are usually considered illiquid, or hard to sell. From the buyer’s perspective, tokenization offers investment opportunities that were previously inaccessible, especially to smaller investors.

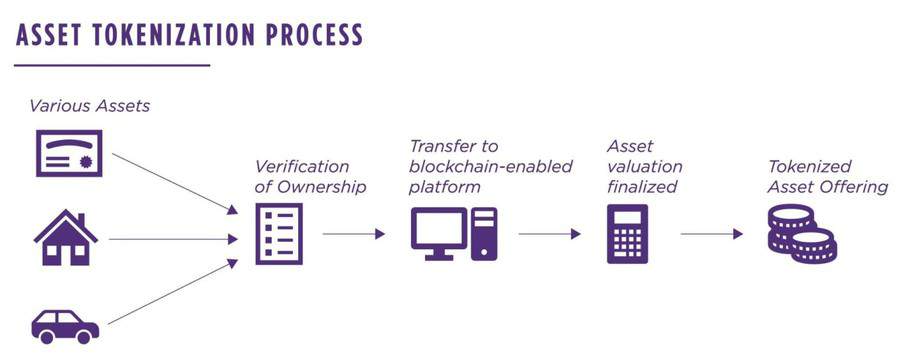

The concept of asset tokenization involves converting the rights to an asset with economic value into a digital token. A token on the blockchain is used to create, generate and stimulate value. It is a unit of account and a means of exchange. A token can essentially be a digital representation of anything. For instance, a token can represent a stock, bond, option or real-estate asset.

A token can also represent an individual’s right to access rights on a blockchain or blockchain-based app. A token on the blockchain can represent any piece of information, like a digital certificate of ownership such as a house or a share in a company, a certificate of credit, patent, provenance data, algorithmic instructions, identity for an IoT device, and so much more.

Currently, there are different definitions of crypto assets, depending on the source and context. Digital assets recorded on a distributed ledger typically derive value from the corresponding assets that they represent. A crypto token or tokenized asset is a digital representation of value or contractual right that is secured by cryptography. This means that the asset is digitally recorded and provides a graphically secured representation of value which is able to be stored and transferred within a distributed ledger.

Asset-backed tokenization is the process of representing real-world assets using digital tokens. What qualifies and what doesn’t qualify as a crypto asset is important because depending on the classification, different types of assets are treated differently from a regulatory and operations perspective. A tokenized blockchain network is an endogenous monetary system with its own supply, demand and liquidity issues. Tokenizing an asset with blockchain technology means establishing a technological, contractual and regulatory framework in which:

- An individual’s lawful possession of a particular blockchain-based token (i.e., lawfully holding or having knowledge of the private keys that govern that token’s transferability at a given time) generally will be treated as representing or symbolizing the holder’s legal rights to or economic interests in a particular asset.

- Lawful transfers interests or legal rights tend to be completed through lawful transfers of a particular token from the current holder of the interests or rights to the new holder.

Many stakeholders of the security value chain including regulators see distributed ledger technology as an enabling record of ownership and the safe-keeping of assets through the provision of a single source of truth, thereby making ownership transparent throughout the lifecycle of an asset and through the custody chain.

Provided there are no regulatory or legal status changes with respect to a particular underlying asset, the status of such an asset shouldn’t be affected by the tokenization processes, legally speaking. Using a token to represent an asset that is already regulated means the status of the asset is unaffected. Nevertheless, the nature and structure of the distributed ledger technology ecosystem in which the security tokens exist may alter the extent to which regulations are applicable.

Through asset tokenization, opportunities for new investment products and new revenue sources created by direct connection to end investors are made available. There are many different types of tokens including exchange tokens, security tokens, work tokens, network value tokens, asset tokens, utility tokens, payment tokens, etc. We’ll explore these different types of tokens in later chapters. Examples of assets that can be tokenized include:

- Commodities, such as gold, diamonds and oil.

- Equity, through Security Tokens.

- IP assets with cash flows.

- Currencies – collateralised stablecoin

- Debt collateralized by Payables and Receivables

- Real Estate with Rental Income (REIT)

The Benefits of Tokenization

| Potential benefits | Details |

| Fractionalization | Assets such as real estate have a high barrier to entry due to large upfront capital required. Fractionalizing such assets democratizes access for retail/small scale investors.Asset tokenization makes selling a fraction of a company possible due to ability to buy or sell tokens representing fractions of ownership. This enables a far broader investor base to participate. |

| Customizability | Tokenization gives investors exposure to individual real estate assets which means portfolios can be customized down to single buildings. |

| Liquidity | Fractionalization increases the pool of potential investors thereby unlocking a global investor base. Secondary markets also facilitate additional liquidity and since liquid assets tend to demand a premium, there’s a chance of asset values increasing depending on supply and demand. |

| Automation via smart contracts | Smart contracts can automate steps such as compliance, document verification, trading, and escrow. Using smart contracts, dividends and other cash flows can be programmatically paid when due. |

| Cost-efficiency | Costs can be significantly reduced by eliminating certain intermediaries and increasing efficiency of processes. |

| Faster settlement times | Depending on the underlying blockchain, tokenization can reduce transaction times since tokens can typically settle in minutes or hours which unlocks the capital that is tied in the market which currently settles at T+3/T+2. Tokenization makes 24×7 trading possible. Smart contracts triggered by predefined parameters can instantaneously complete transactions thereby reducing settlement times from the current durations, at best T+2, to essentially real-time transactions. This can reduce counterparty risk during the transaction and reduces the possibility of trade breaks. |

| Better data transparency | Secure and visible recordkeeping on blockchain increases transparency to the underlying data especially for complex derivative products. |

| Facilitates the creation of structured products | Once assets are tokenized, additional value can be realized which enables the creation of additional layered financial products such as basket of assets and derivatives. |

| Infrastructure upgrade | By digitizing assets on a DLT infrastructure, efficiency can be improved. |

| Decreased cost for reconciliation in securities trading | The blockchain infrastructure provides a digital ledger for the record keeping of each shareholder position. For the issuer, this will greatly improve the efficiency of numerous administrative processes, such as profit sharing, voting rights distribution, buy-backs, and so on. Further, the existence of a secondary market will also facilitate the accounting operations of professional investors, such as net-asset-value calculations. |

| Regulatory innovation | There is slow but steady progress by regulators to lay regulatory frameworks for the creation and exchange of digital asset tokens. In addition, the real-time data and immutability of data held in a digital ledger will enhance protection for investors. |

| Improved asset-liability management | Better management of asset-liability risk through faster transactions and more transparency. |

| Increase in available collateral | Tokenization will widen the range of available and acceptable collateral beyond traditional assets through fractionalization of new asset classes which will noticeably increase the options available to market participants when it comes to selecting non-cash assets as collateral in the securities lending or repo markets. |

| Fraud mitigation | Fraud is common in real estate transactions, so by using immutable blockchain databases the risk is mitigated. |

The advantages of tokenization are more favourable to assets that are not yet traded electronically. These could be works of art or exotic assets and collectables, as well as those assets which require enhanced transparency in payment and data flows in order to improve their liquidity and tradability.

Recommended read: