Fulcrum (bZx) non-custodial crypto margin trading DeFi platform

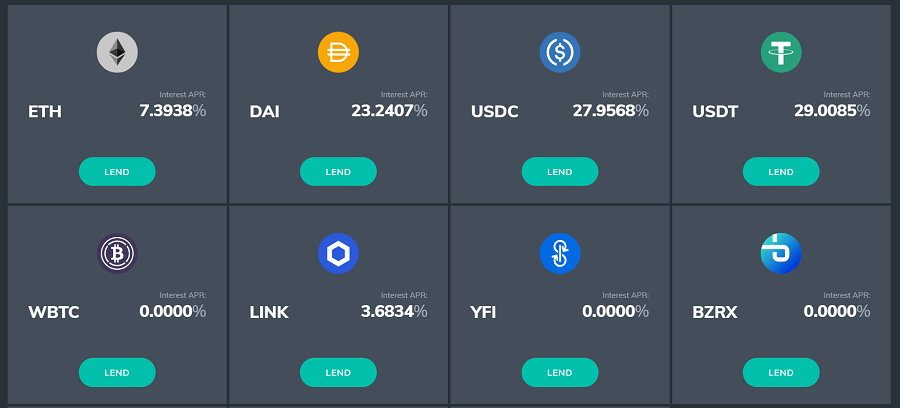

The notion of “no risk no reward” is known best by experienced traders which deal with leverage – risking entire portfolios to make an unbelievable amount of money. Conversely, the average person may be content to put their savings somewhere to generate interest. Oddly enough, both of these needs are satisfied by Fulcrum, a decentralized margin trading platform which offers annual interest rates of over 30% on funds lent to the platform.

Who made Fulcrum?

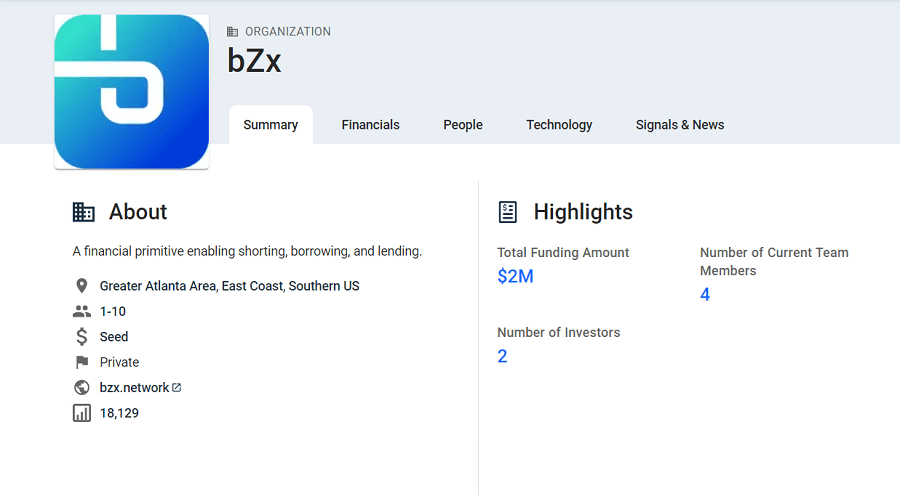

As was just noted, Fulcrum can be thought of as one of the “front ends” of BZX. BZX was founded in 2017 by Tom Bean, a former systems engineer at Nokia, and Kyle Kistner, a computational biologist. In contrast to many other cryptocurrency projects, BZX only raised around 2 million USD. Despite this small amount of funding, the duo went on to develop and release the Fulcrum platform in June 2019, well before many other larger projects.

How does Fulcrum work?

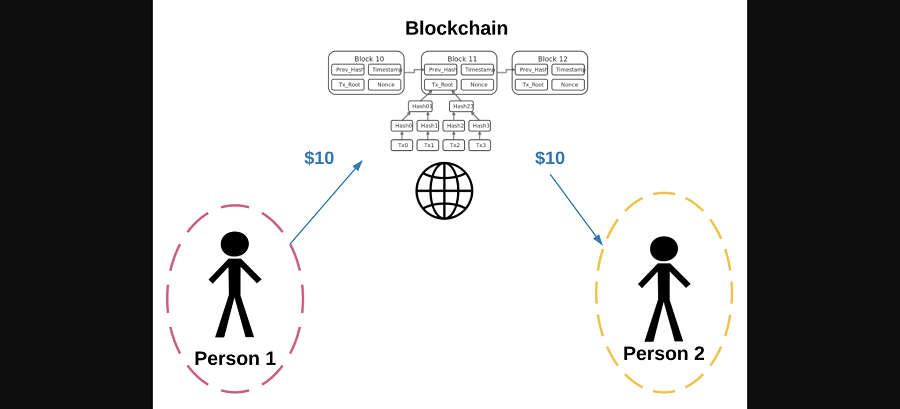

Like most other decentralized applications, Fulcrum is built on the Ethereum blockchain. While Ethereum is a tradeable cryptocurrency, it also makes it possible to create decentralized platforms and applications which are very similar to regular platforms and applications. The difference is that decentralized platforms like Fulcrum are stored across multiple computers which are participating in Ethereum’s network. This means that there is no central point of failure – it is virtually impossible for the platform to go offline.

As noted in the introduction, Fulcrum allows you to do two things: trade with margin and lend your assets to the platform to receive an incredibly high passive income on your cryptocurrency. Both of these functions involve a complex arrangement of ERC-20 tokens, special Ethereum tokens which are created when you deposit cryptocurrency onto the platform. These can represent 5x leveraged positions as well as accrue interest.

In plain English, on Fulcrum you are able to perform some very advanced trades which are incredibly risky but can be incredibly profitable. As such, Fulcrum is not recommended for those who are inexperienced traders. Those who are less prone to risk can lend their cryptocurrency to the platform to receive high interest rates which come from the trading fees and liquidated funds of traders on the platform.

Why is Fulcrum important?

Fulcrum reveals just how flexible and profitable decentralized finance can be. What’s more is that the trading and lending services the platform offers are available to anyone with an internet connection. It is not necessary to fill out any paperwork or provide any personal information. For advanced high risk trades, this is almost always mandatory with popular centralized alternatives such as Robinhood.

It is important to note however that Fulcrum has fallen back in the leaderboards and therefore may not be the most optimal platform to trade on. Consequently however, there are currently very high rewards being offered to those which lend their assets to Fulcrum. The best part is that these assets can be withdrawn at any time.