GMX Decentralized Spot & Perpertual Exchange Review

GMX is a decentralized spot and perpetual exchange which allows users to trade BTC, ETH and other top digital currencies with up to 30x leverage directly from their wallets. GMX exchange supports low swap fees and zero price impact trades. As a trader you can also save on costs by entering and exiting positions with minimal spread and zero price impact and also get the optimal price without incurring additional costs. Its dynamic pricing is supported by Chainlink Oracles along with TWAP pricing from leading volume decentralized exchanges.

In addition, with GMX traders can reduce liquidation risks since an aggregate of high-quality price feeds determines when liquidations occur which keeps positions safe from temporary wicks. Trading on GMX is supported by a unique multi-asset pool that earns liquidity providers fees from leverage trading (spreads, funding fees & liquidations), market making, swap fees, and asset rebalancing.

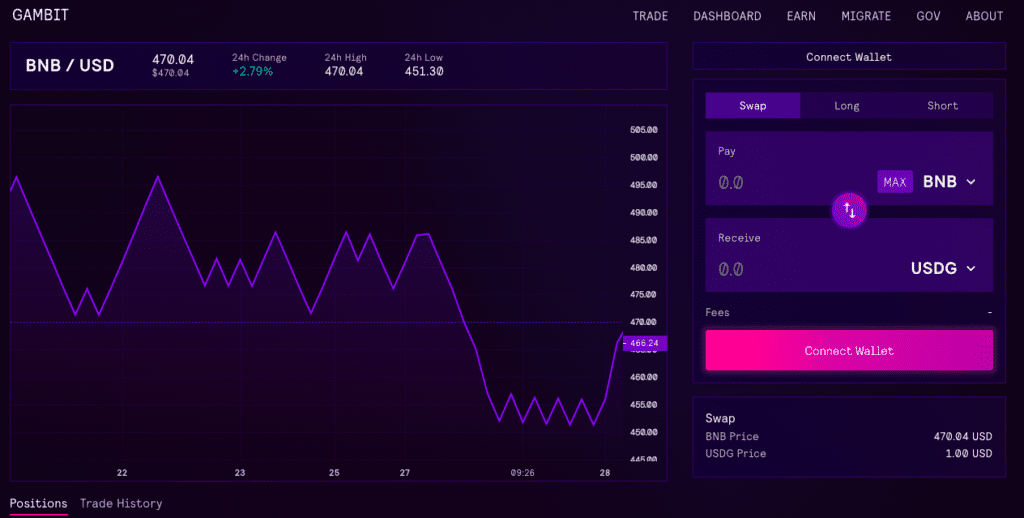

GMX allows simple swaps by allowing users to open positions through a simple swap interface and conveniently swap from any supported asset into the position of their choice.

GMX is available on Binance Smart Chain (Gambit) and Arbitrum. Get started with GMX is fairly straightforward since its a decentralized exchange that allows trading without the need for a username or password.

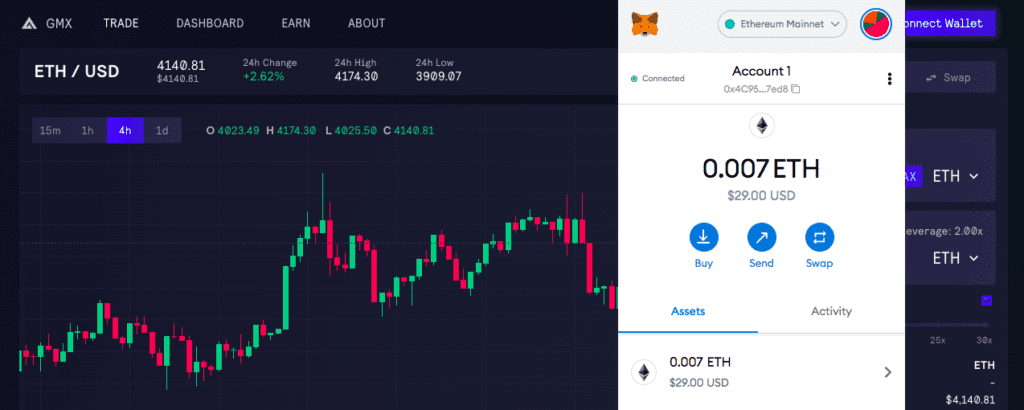

You can use a wallet like Metamask to Connect to the DEX. Once you have a wallet, you are able to then connect your wallet by pressing the “Connect Wallet” button on the GMX Trade page.

To open a position, you can simply click on “Long” or “Short” depending on which side you would like to open a position on.

- Long position – earns a profit if the token’s price goes up and makes a loss if the token’s price goes down.

- Short position – earns a profit if the token’s price goes down and makes a loss if the token’s price goes up.

After selecting your side, you can simply key in the amount you want to pay and the leverage you want to use.

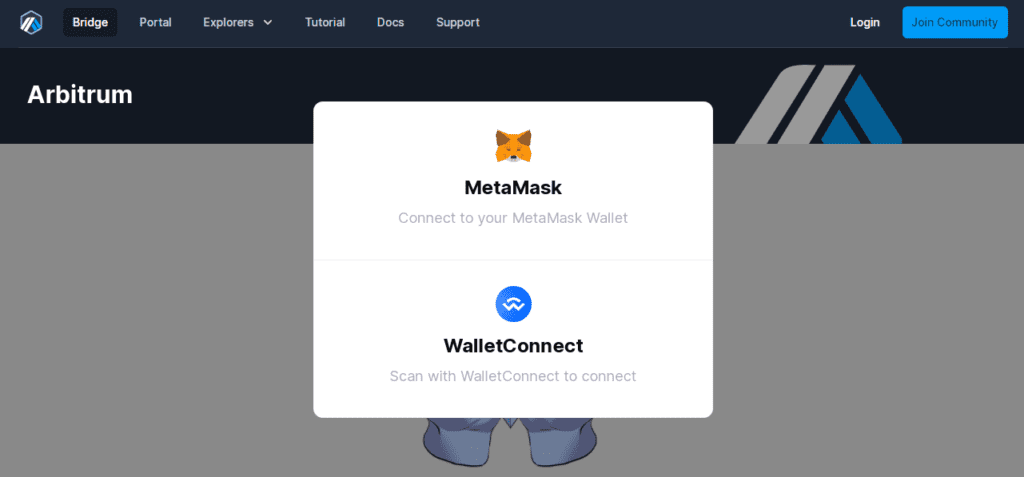

You may need to connect your wallet to Arbitrum which is essentially a suite of Ethereum scaling solutions. Arbitrum supposedly makes it possible to achieve high-throughput, low cost smart contracts. To purchase GMX, please ensure your wallet network is set to Arbitrum and you have some ETH for gas on the Arbitrum network. You can also buy GMX by transferring ETH to Arbitrum using the Arbitrum Bridge. Click here to ensure your wallet is connected to the Arbitrum network. Buy GMX on Uniswap.

Check out the tutorial.

Transfer funds to layer-2

GMX’s token address is 0xfc5A1A6EB076a2C7aD06eD22C90d7E710E35ad0a on Arbitrum. GMX token holders can stake GMX and receive a staked GMX token: 0xd2D1162512F927a7e282Ef43a362659E4F2a728F.

By staking GMX, holders receive escrowed GMX, multiplier points, and ETH rewards. 30% of fees generated from swaps and leverage trading are converted to ETH and distributed to staked GMX tokens. 20% of fees are converted to GLP (the platform’s liquidity provider token) and deposited into the GMX floor price fund. According to GMX, they had traded over $150 million and earned the protocol $300,000 in fees, including Gambit fees as of September 2021. They’d also added almost a million dollars to the floor price fund.

GLP is made up of an index of assets that are used for swaps and leverage trading. It can be minted using any index asset and it can also be burnt in order to redeem any index asset. Holders of the GLP token earn Escrowed GMX rewards and 50% of platform fees distributed in ETH. As GLP holders provide liquidity for leverage trading, they will make a profit when leverage traders make a loss and vice versa.