Hedget – Decentralized Options Trading Platform Review

What are Decentralized Crypto Options?

Options are financial instruments that give rights but not obligations to buy or sell underlying assets at a preset price on or before the expiration date after a premium is purchased. They are popularly used by traders for speculating, and investors also turn to options for hedging.

Options consist of a call or put, a strike price, and an expiry date. With call options, holders have the right to buy the asset at the strike price at a future date. With put options, they have the right to sell. Options are considered a special type of derivative product since options prices are typically derived from both the prices and fluctuations of the underlying assets.

What is Hedget?

A decentralised protocol designed for options trading, Hedget makes it possible for users to put up collateral, create and trade different options on-chain. HGET is the native token of the platform and is used for governance and more. Hedget Foundation is responsible for issuing HGET tokens. Find out about other crypto options tokens here.

With Hedget, it’s possible for a trader to hedge the risk for their crypto holdings & their debt positions on other lending protocols such as Compound and Aave. In essence, option products make it possible for traders to hedge price fluctuation and risk in their collateralized lending positions. Decentralised options however can be difficult to offer to the public due to lag in settlement and other technological limitations of blockchains. Due to complex business logic that requires advanced querying, which is something that blockchains struggle with, digital financial tools typically rely on relational databases. This is why Hedget’s backend is powered by Chromia Relational blockchain as this is meant to allow for zero fees and better flexibility.

Hedget as a protocol adds in support on Layer 2 to existing blockchains such as Ethereum. It does so in order to enable faster, cheaper, and more complex transactions.

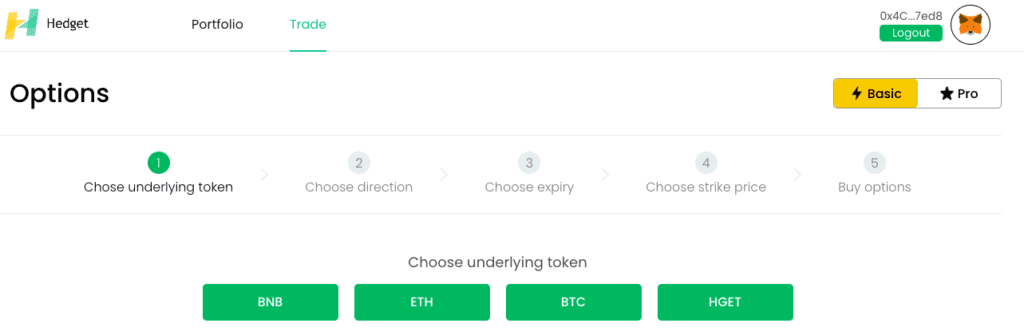

Users of Hedget can buy and sell options products on the platform by providing collateral in the form of digital assets such as stablecoins and cryptocurrencies. To get started, users need to connect their wallets.

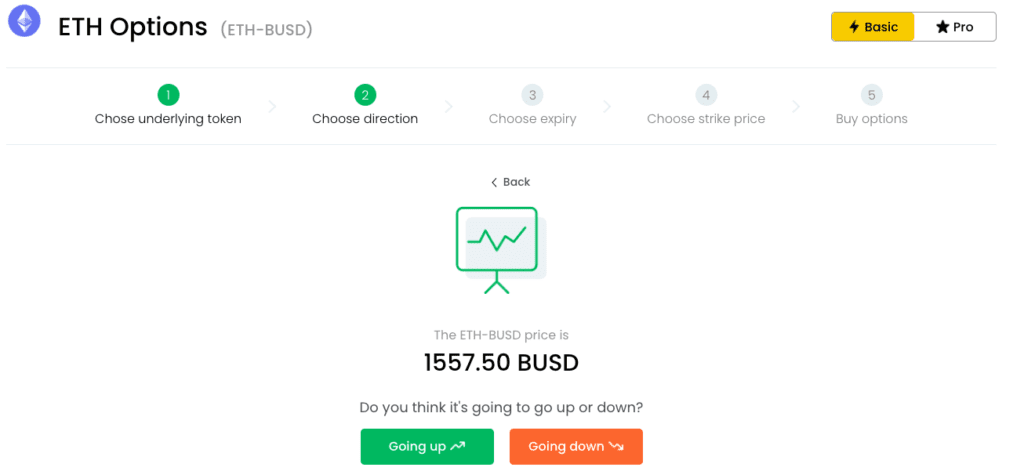

Once a wallet is connected, a user can effectively choose which underlying asset for the options trade. In this case, I choose ETH which is measured against the price of BUSD.

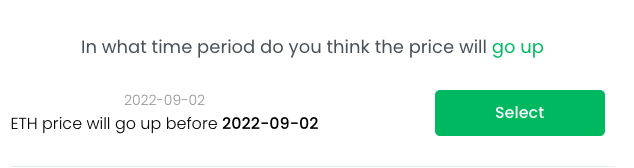

After that you can select whether you think the price of the underlying (ETH in this example) is going up or down.

Personally, with Ethereum’s Merge coming up soon, I’m a bit bearish on ETH price action following the Merge but since there are still a few weeks to go, I chose the “Going Up”/call option because I think ETH can still rally upwards before retracing post ‘Merge’. The time period for the call option is preset.

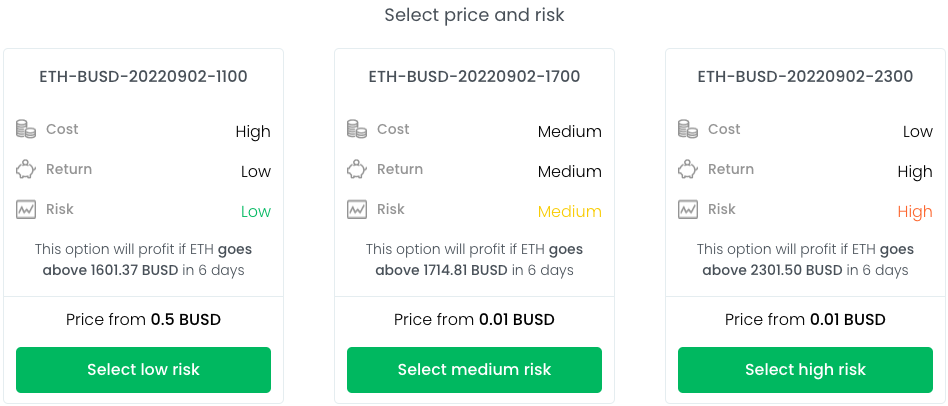

Depending on your risk appetite, you can select the option that aligns with your goals. What’s good is that you can see the values at which your trade will be profitable. Moreover, you also can see the risk level for each option and the return ratio. I select the price and choose the medium risk option for my particular strategy.

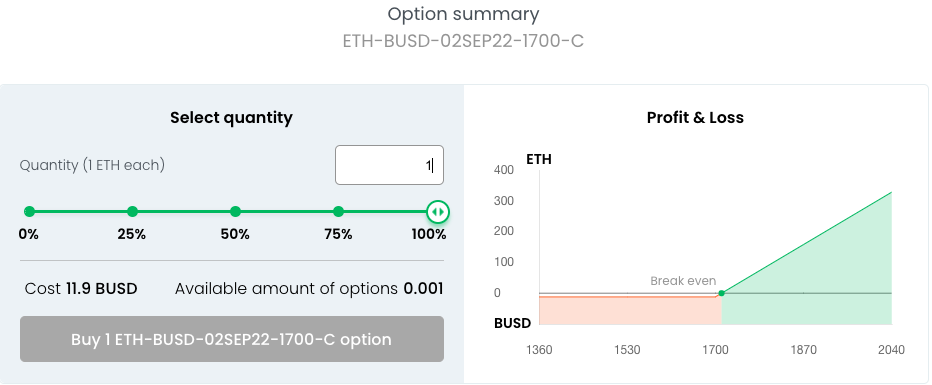

You can then proceed to purchase your call option by posting the underlying collateral required.

What Makes Hedget Unique?

Hedget is comprised of three main components i.e. Ethereum smart contract (ESC) which handles ETH and ERC-20 token deposits and withdrawals and implements physical settlement. The second component is the CTD or Chromia-based blockchain (dApp) which handles trades, tracks ownership of contracts and facilitates the communication that is required in order to perform settlement through Ethereum smart contracts. The final component is the Client-side wallet (CSW) and trading user interface which is responsible for taking commands from users and carrying them out using Ethereum smart contracts and Chromia dApp.

Hedget’s primary goal is to eliminate the need for trusted third parties and has particular design constraints to make this possible. Firstly, token storage is non-custodial. This means that only a user can withdraw their funds. Funds are only moved between users’ accounts when they trade or exercise the option contracts. This is supposed to make Hedget essentially free from counterparty risk.

Hedget requires full collateralization for option sellers since it is impossible to algorithmically assess creditworthiness. The constraints which control users’ funds are implemented directly on Ethereum smart contracts. This is because the Hedget team wants to give users the highest degree of assurance. Purchased options can also be resold at any time.

Hedget has a DAO structure in place to guide further ecosystem developments. HGET tokens will be used to determine transaction fees, reserve requirements, and general functions and features of the platform. HGET tokens will also be used for maintaining the security and reputation engine in the future once margined options are implemented.

Hedget requires options writers who wish to offer options without providing 1:1 collateral to stake HGET tokens which will be used to purchase fully collateralized options as a hedge in case of capital insufficiency risk. This mechanism gives end users assurance that they cannot be adversely affected by the insolvency of an options writer. For more about Hedget, read the Whitepaper.

How does Hedget work?

Each time option products are created, the system mints a token to represent the option. Hedget protocol supports European style options. This means that the options can only be settled at the time of expiry since holders of this type of option are not able to exercise the option even if the price of the underlying assets moves towards a favourable direction.

In order to guarantee the possibility of exercising the option, users of Hedget are required to put up 100% collateral as they create different option products.

Hedget Fee Structure

Hedget charges Taker fees of 0.04% of underlying which matches Deribit and is less than on FTX exchange. Maker fees are -0.02% of underlying which is a really unique offer on the market. Rebate fee is part of liquidity mining so the 0.02% difference between Taker and Maker fees will go to a special Reserve locked for two years and governed by DAO Settlement fee 0.02% + ETH fees (if settled on Ethereum) paid by option buyer. In the first 3-4 years 0.02% settlement fee will be paid by the system from the liquidity mining pool, rewarding option writers, and reducing total fees for option buyers.

Use Cases of Hedget (HGET)

- Hedget could be used in both to-consumer and to-business settings in order to improve capital efficiency and also hedge price risks and lending risks.

- Users are able to trade options directly on the platform and the option products can also be offered as a security feature for various decentralized lending and trading protocols in order to protect users’ collateral.

- Instead of selling volatile assets such as ETH for stablecoins, buying a put option can give holders the right to protect against downward price movement but also enjoy ETH appreciation since they can choose not to exercise the option.

- Hedget can act as protection against liquidation for lending protocols and can be offered to other lending protocols as a security feature against user position liquidation.

What is the future of Hedget?

Hedget is a platform that promises to popularize decentralized options, eliminating third-party risks. The platform and ecosystem has the potential to gain more users as the crypto industry matures. However, it is yet to be seen how regulations may affect these new financial innovations. It is always advisable that you conduct thorough research and due diligence to properly assess the risks associated with options trading and using different trading platforms including Hedget.