HitBTC Exchange Review

HitBTC is a cryptocurrency exchange that boasts over 800 trading pairs and 500+ spot instruments that the platform supports. Users are supposed to be able to trade digital currencies such as Bitcoin, Ethereum, and others. Users can access the trading platform on desktop and they also offer a mobile app on Android and iOS.

The exchange claims to have been a pioneer in automated and algo trader offerings including REST, WebSocket and FIX API. The exchange offers its services globally with the exception of some countries such as the USA, Cuba, North Korea, Sudan, Syria, and few others.

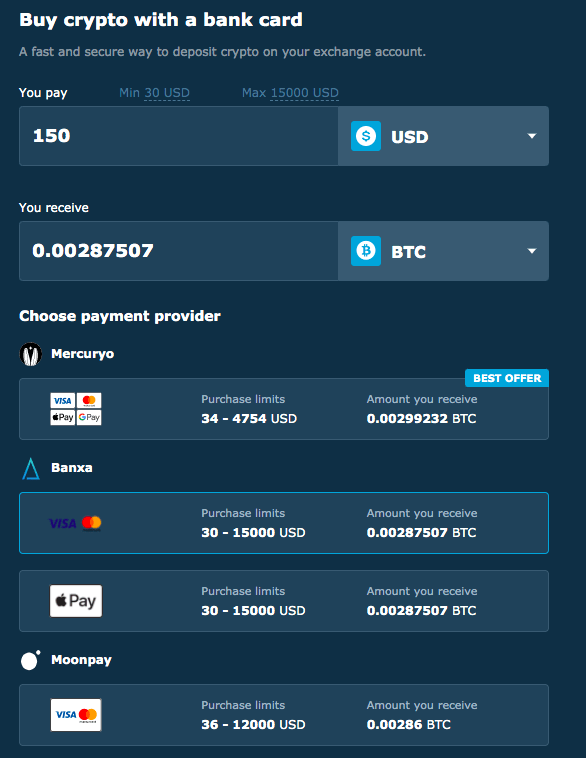

Getting started on the exchange is pretty straightforward. You can sign up with email for example. The general withdrawal limit is 1 BTC daily and 5 BTC monthly but users have the option to KYC and upgrade their accounts in order to have larger withdrawal limits and even lower fees according to the exchange. Users can set up PRO accounts at a partner exchange such as Bequant in order to access additional benefits typically tailored to professional traders and institutional investors. Some of these services will include margin trading and crypto loans, custodial services, automated trading, dedicated support and client managers and more.

Positives

- Users of HitBTC can manage their orders on the exchange via the web-trading interface on TradingView. This means that a user can place buy or sell orders via the TradingView platform without the need to login to the actual HitBTC platform.

- They offer sub-accounts for institutional and corporate clients which are meant to make it possible for clients to create unique subsidiary accounts that they can then use to test out different trading strategies.

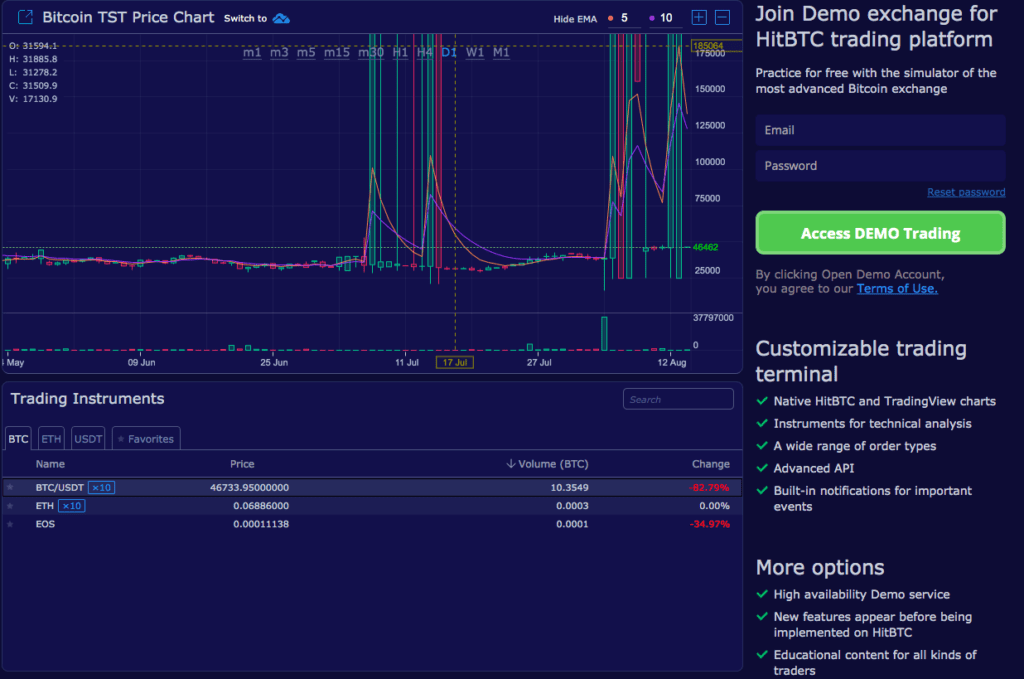

- HitBTC offers a demo trading platform which enables users to practice trading for free using test funds meaning they don’t have to risk their actual crypto assets. The demo platform has most of the features available on the main exchange including a margin trading feature with x5 leverage. They have trading pairs such as EOS/USDT, BTC/USDT, EOS/BTC. After a user signs up on the demo platform, they will receive a virtual demo fund consisting of 100 USDT TST and 0.01 BTC TST that they can use to execute their demo trades.

Negatives

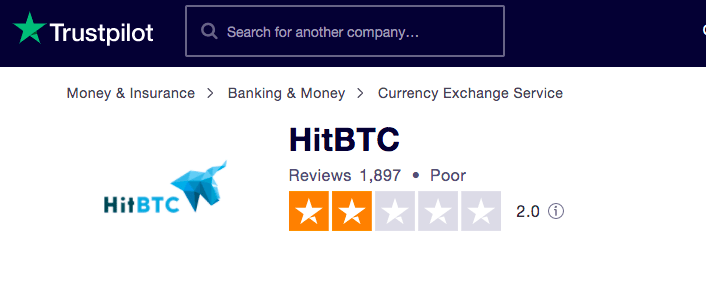

- HitBTC does not seem to have a lot of positive reviews from glancing at review sites such as Trustpilot and BitTrust. Poor response times and bad customer service seems to be their achilles heel.

HIT Token

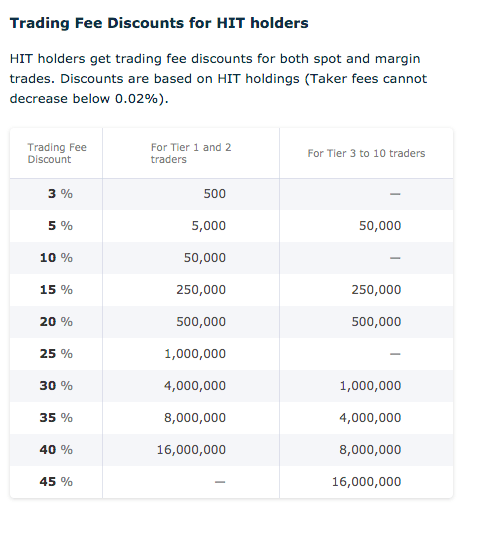

HitBTC launched its own token native to their platform called HIT token. This token is meant to be the foundation of the HitBTC ecosystem and utilised for the provision of rewards and other incentives to the users of the exchange and to those who contribute to the growth of their ecosystem. HIT token is an ERC20 token that has a maximum supply of 2,000,000,000 tokens. Apparently holders of HIT can receive a range of benefits such as up to 45% discounts on trading fees and low commissions for HIT trading pairs. According to the exchange, they aim to extend the utility of the token so that it can be used for staking rewards, collateral for margin and futures trading, lower fees for futures contracts, and much more.

Margin and Futures Trading

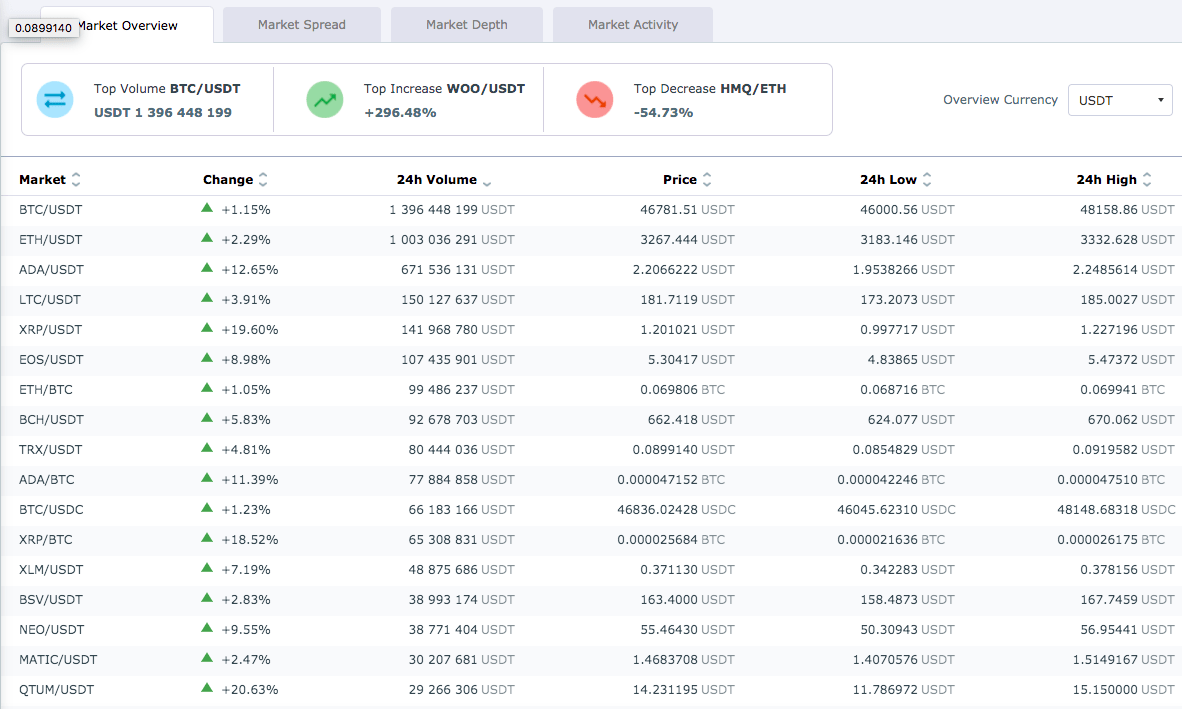

HitBTC recently added a margin trading tool to their main trading platform. Previously, it was a core feature of Demo HitBTC. This means that now users can use leverage. HitBTC offers 5x leverage on ZEC/USDT, BSV/USDT, DASH/USDT, BSV/BTC, XLM/USDT, ZEC/BTC, DASH/BTC, XLM/BTC. Users can use 10x leverage rate for five markets including BCH/USDT, XRP/USDT, ETH/BTC, BCH/BTC, XRP/BTC,EOS/USDT, TRX/USDT, LTC/USDT, ETC/USDT, ADA/USDT, EOS/BTC, TRX/BTC, LTC/BTC, ETC/BTC, ADA/BTC and up to 12x for BTC/USDT, ETH/USDT.

HitBTC futures trading fees are fixed for all tiers at 0.02% for maker fees and 0.05% for taker fees. In addition, the exchange does not charge any commissions associated with funding rates, and all payments are made between traders.

Trading Fees

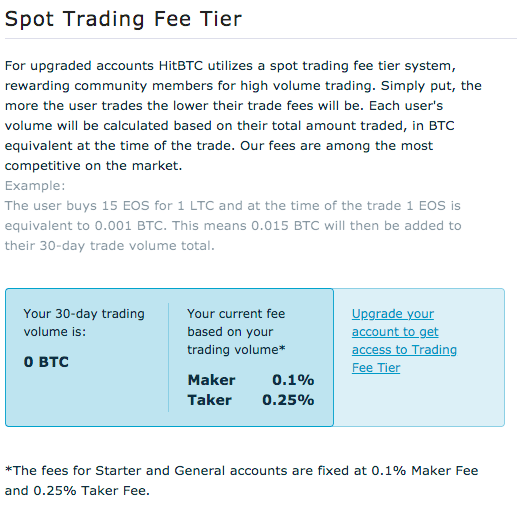

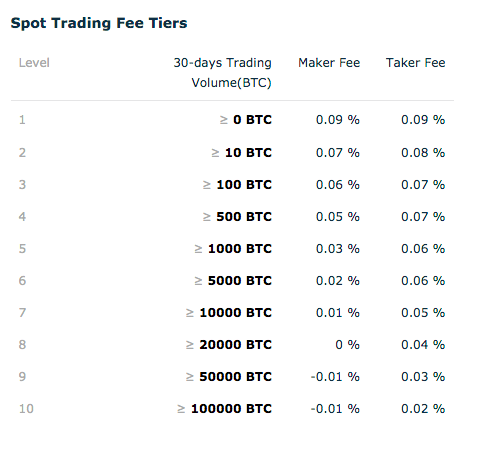

HitBTC uses the ‘maker-taker’ model in order to maximize liquidity and narrow the spread on cryptocurrency markets. This means that they try to incentivise makers to keep adding liquidity to the market and stimulate trading activities. Takers on HitBTC are charged based on the Trading Fee Tier. HitBTC pays a rebate fee to makers for providing liquidity. The exchange also provides APIs to their market makers.

OTC trading

HitBTC’s over-the-counter trading services are geared towards users looking to execute high-volume trades without needing to go through the public order books. The exchange claims to help facilitate deals directly with the counterparty without affecting the market price of the coin or token. HitBTC partnered with Trustedvolumes.com to roll-out this offering. Traders who want to trade over $100,000, HitBTC recommends using their OTC market. The exchange change charges 0.1% in commission for OTC trades.