How AI Powers Derivatives, Perps, and Options

Welcome to the new frontier of crypto trading — where human emotion takes a back seat and AI-powered bots execute lightning-fast decisions across volatile derivatives markets. From delta-neutral grid strategies to volatility-harvesting bots running 24/7, automated trading has become the secret weapon of pros and institutions alike. This guide reveals how AI meets derivatives and why it’s revolutionizing risk, returns, and strategy.

The Rise of AI in Automated Crypto Trading

Trading bots are no longer just for coders. With platforms like Bitunix, HyroTrader, Pionex, and Desk, AI-enhanced bots can execute sophisticated trades using real-time data, machine learning, and customizable logic — all without lifting a finger.

Why AI Matters in Derivatives:

-

Trades happen in milliseconds — AI reacts faster than any human.

-

Risk models can be calculated on-chain, in real time.

-

Bots learn from market patterns and adjust dynamically.

-

They eliminate emotion, greed, and fear.

Types of AI-Powered Trading Bots

Each bot serves a unique role in navigating the fast-paced derivatives ecosystem.

| Bot Type | Purpose |

|---|---|

| Grid Bot | Profits from sideways markets via layered buy/sell orders |

| Delta-Neutral Bot | Hedges long vs short positions to reduce volatility risk |

| Trend-Following | Rides momentum based on moving averages and indicators |

| Arbitrage Bots | Exploits price inefficiencies across platforms or pairs |

| Gamma Scalpers | Adjusts options positions dynamically during volatility |

Top Platforms Supporting AI Bots in 2025

| Platform | Bot Marketplace | Bot Types Offered | Community Ratings |

|---|---|---|---|

| Bitunix | Yes | Grid, Trend, Arbitrage | ⭐⭐⭐⭐☆ |

| HyroTrader | Advanced | AI-backed Option Strategies | ⭐⭐⭐⭐⭐ |

| Pionex | Yes (Built-in) | 16 prebuilt strategies | ⭐⭐⭐⭐☆ |

| Desk | Yes | DeFi-native Perps bots | ⭐⭐⭐⭐ |

Use Cases: Real Alpha from Smart Bots

-

Volatility Harvesting: Gamma scalpers thrive when price swings spike IV (Implied Volatility). These bots read order book dynamics and adjust exposures on platforms like Polynomial and Deribit.

-

Funding Farming: Bots on Bitunix, GRVT, or gTrade auto-position on the high-yield side of the funding rate — flipping long/short based on the yield delta.

-

Arbitrage AI: Between Binance perps and Bybit spot, bots can exploit up to 0.5% inefficiencies — especially during news events.

DIY vs Plug-and-Play Bots

DIY Bots (Advanced)

-

Require coding (Python, TradingView webhooks)

-

Hosted on servers or VPS

-

Best for unique edge and high capital

Plug-and-Play Bots (Beginner Friendly)

-

Pre-configured strategies

-

Hosted by platforms like Pionex, Blofin, or MEXC

-

Adjustable parameters, risk limits, and stop-loss logic

Risk Factors: What Can Go Wrong?

-

Overfitting: Bots that adapt too specifically to historical data may fail in new conditions.

-

Latency: Poor API response can result in missed trades or slippage.

-

Mispricing Models: AI relying on bad oracle data or misaligned volatility models can generate losses.

-

Black Swans: AI doesn’t always recognize macro shocks or geopolitical news — use circuit breakers.

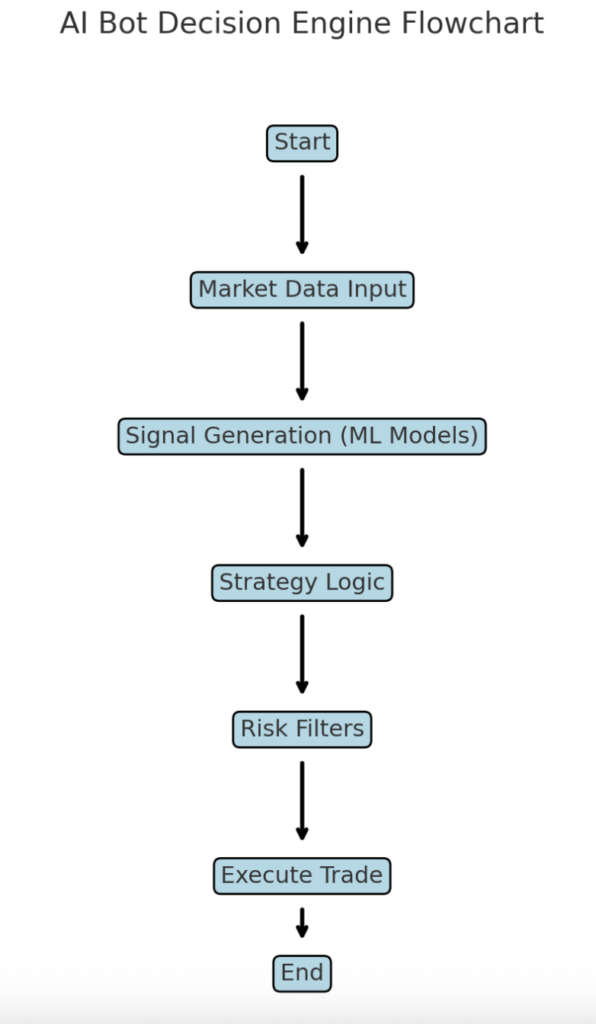

AI Bot Decision Engine

This visual illustrates how bots decide:

-

Market scan ➜

-

Signal confirmation ➜

-

Leverage adjustment ➜

-

Position entry or exit ➜

-

Real-time PnL monitoring ➜

-

Adaptive rebalancing

The AI Edge in Derivatives

✅ AI bots are not hype — they are the edge.

✅ Execute delta-neutral, volatility, and arbitrage strategies 24/7

✅ Pick from Bitunix, HyroTrader, Desk, or Pionex for plug-and-play access

✅ Understand the risk. Use smart dashboards and AI tracking tools.