How to Trade Crypto Options like a Pro

Options 2.0 – Beyond Calls and Puts

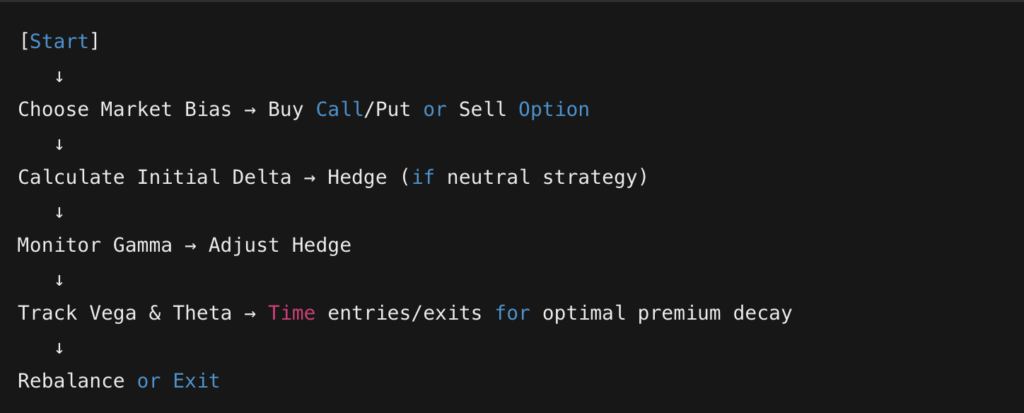

Crypto options trading is evolving fast—and today, it’s not just about choosing between a call or a put. Sophisticated traders now play a deeper game, one that involves understanding the Greeks, especially Delta and Gamma, to manage exposure, amplify returns, and hedge volatility like professionals.

Platforms like Deribit, Polynomial, and HyroTrader are enabling a new breed of traders to apply advanced strategies like gamma scalping and delta hedging to capture edge in the chaos of crypto markets.

The Core Greeks: Delta, Gamma, Vega, Theta

Let’s break down the most important “Greeks” used by crypto options traders:

| Greek | What It Measures | Real-World Example |

|---|---|---|

| Delta | Option price sensitivity to asset price | BTC price moves +$1, call option with delta 0.5 increases by $0.50 |

| Gamma | Rate of change of delta | Gamma = 0.1 → If BTC rises by $1, delta increases from 0.5 to 0.6 |

| Vega | Sensitivity to volatility | Implied volatility spikes → option premium increases |

| Theta | Time decay | With every day closer to expiry, option loses value (theta decay) |

🔍 These metrics can be visualized in real-time on Deribit’s Portfolio Margin dashboard, or through custom overlays on Polynomial and HyroTrader, offering professional-grade analytics.

Advanced Strategies: Delta Hedging & Gamma Scalping

🎯 Delta Hedging

Used to neutralize directional exposure. For instance, if you’re long a BTC call with Delta 0.6, you short 0.6 BTC to offset price risk. This lets you stay volatility-neutral and play pure vega/gamma moves.

🌀 Gamma Scalping

Here, you take advantage of rapid changes in delta during volatile markets. As gamma increases near-the-money, small price changes in BTC cause large swings in delta—scalping this shift becomes lucrative if managed precisely.

Best Platforms for Greek Visualizations

| Platform | Delta/Gamma Tools | Live PnL Charts | Volatility Models | Best For |

|---|---|---|---|---|

| Deribit | ✅ Advanced UI | ✅ Real-time | ✅ Skew + Smile | Professional Options Traders |

| Polynomial | ✅ Simplified | ✅ Embedded | ✅ Model-based | Intermediate Strategy Builders |

| HyroTrader | ✅ Customizable | ✅ Scalable | ✅ Vega Focused | Vega/Gamma Strategy Users |

| gTrade | ❌ Limited | ✅ Options PnL | ❌ Basic | Casual Traders Testing Options |

Use Cases for Advanced Traders

-

Hedge Fund-Style PnL Stability

Institutional players can delta-hedge portfolios to smooth returns and lower volatility exposure. -

High-IV Event Plays

Ahead of major events (e.g., ETF approvals), traders buy options and gamma scalp on volatility bursts. -

Volatility Harvesting

Accumulate premium from selling options while dynamically delta/gamma hedging to stay risk-neutral.

Delta & Gamma Simplified

(See diagram above)

Understand how delta increases as an option moves in the money, and how gamma peaks near ATM (At-the-Money) for maximum reactivity.

Tools to Manage Options Risk

🛠 Platforms like gTrade, Polynomial, and Deribit offer margin calculators, live Greeks dashboards, and risk flags.

✅ Use Theta decay models to track how long you can hold a position profitably

✅ Implement stop-loss triggers based on delta shifts

✅ Monitor implied volatility with real-time vega exposure tracking

How to Trade Delta-Gamma Smartly

If you’re serious about trading crypto options in 2025, understanding how risk and exposure evolve as price and time change is essential. This piece gives you the toolkit to master volatility, trade with precision, and protect your stack like a quant.