Hyperliquid: A Comprehensive Review of the Innovative L1 Blockchain

What is Hyperliquid?

Hyperliquid is a high-performance Layer 1 (L1) blockchain optimized for creating a fully on-chain, open financial system. It allows users to build applications that interface seamlessly with native components, ensuring an uncompromised end-user experience.

Key Features of Hyperliquid L1

Performance

The Hyperliquid L1 can manage an entire ecosystem of permissionless financial applications with a block latency of less than one second. It currently supports 100,000 orders per second, showcasing its robust capacity.

Consensus Algorithm: HyperBFT

Hyperliquid uses HyperBFT, a custom consensus algorithm inspired by Hotstuff and its successors. This algorithm and the networking stack are optimized to support high throughput and low latency.

Native Applications

Hyperliquid DEX

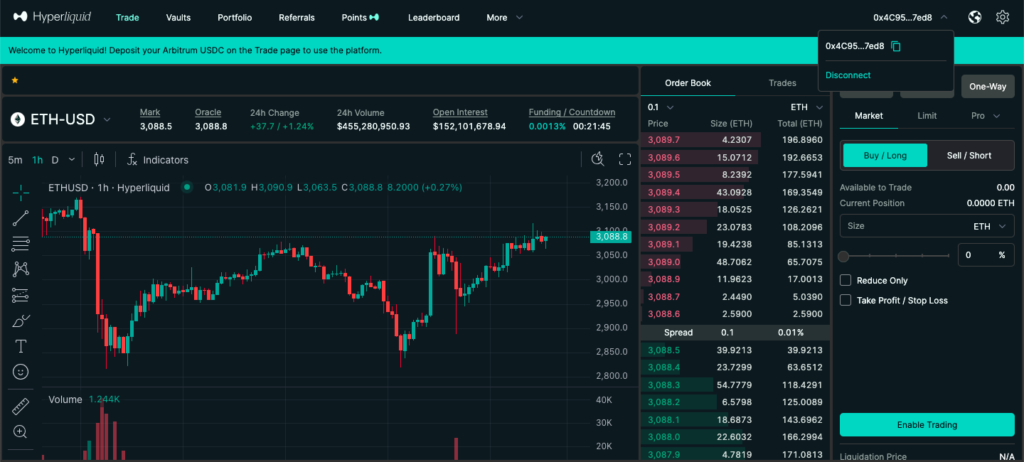

The flagship application of Hyperliquid is its fully on-chain perpetuals order book exchange. This DEX handles every order, cancel, trade, and liquidation transparently on-chain, providing a secure and efficient trading environment.

How to Trade using Hyperliquid

Perpetuals Trading

Users can start trading on the Hyperliquid Perpetuals DEX with an EVM wallet or by logging in with an email address. The onboarding process is straightforward, ensuring quick access to the trading platform.

Supported Assets

Hyperliquid supports a wide range of assets for trading, including major cryptocurrencies like BTC, ETH, and many others, with varying leverage options up to 50x for certain assets.

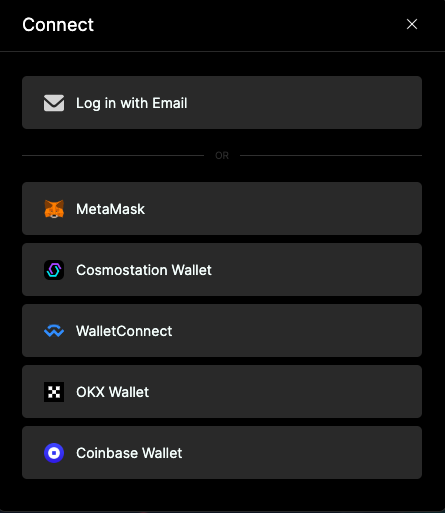

Connect your web3 wallet.

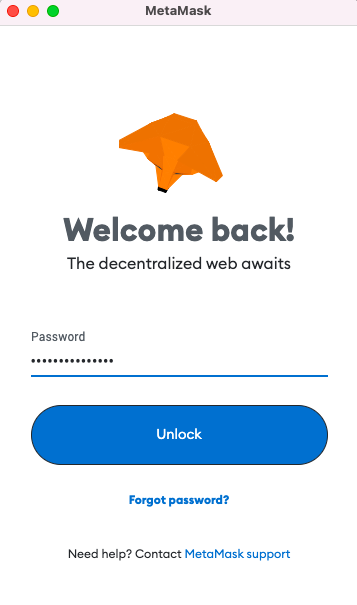

For this demonstration, we’ll be using MetaMask.

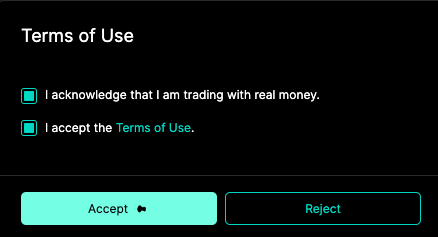

Accept the terms and conditions.

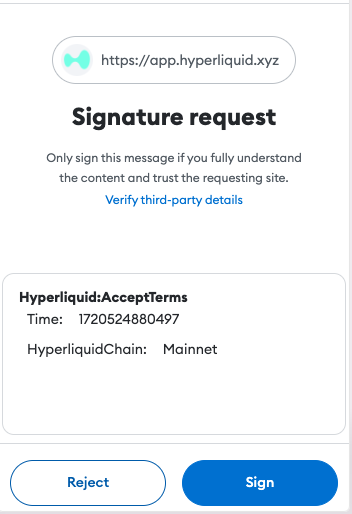

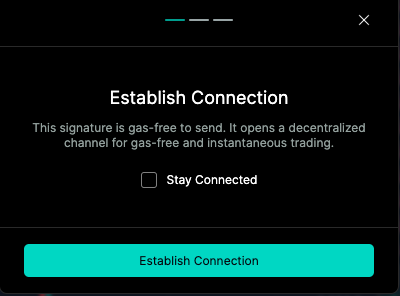

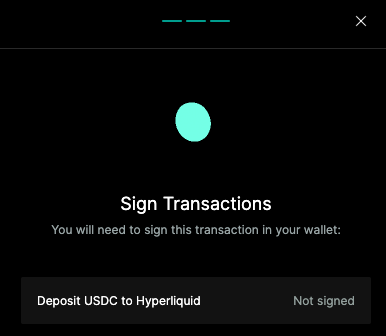

Sign to give the smart contact permissions to interact with your wallet.

Proceed to enable trading.

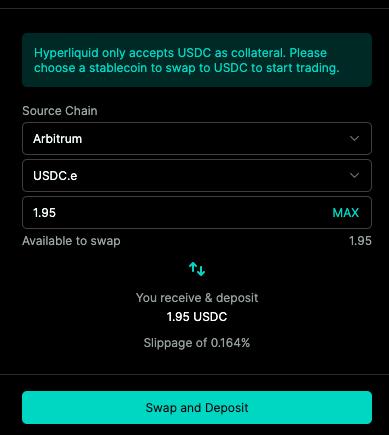

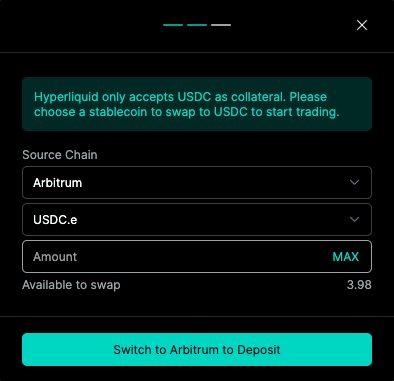

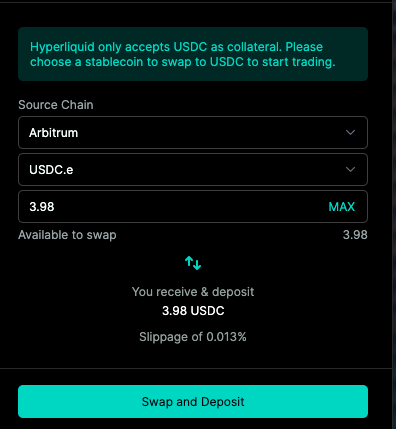

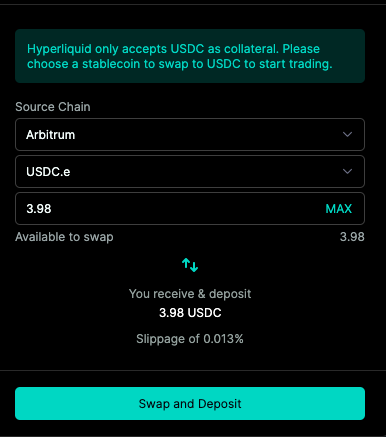

Hyperliquid accepts USDC as collateral.

In order to have enough to execute a trade using Hyperliquid, I will have to bridge some assets.

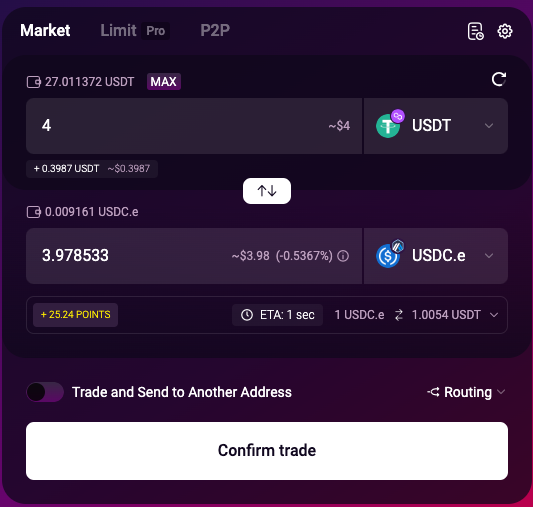

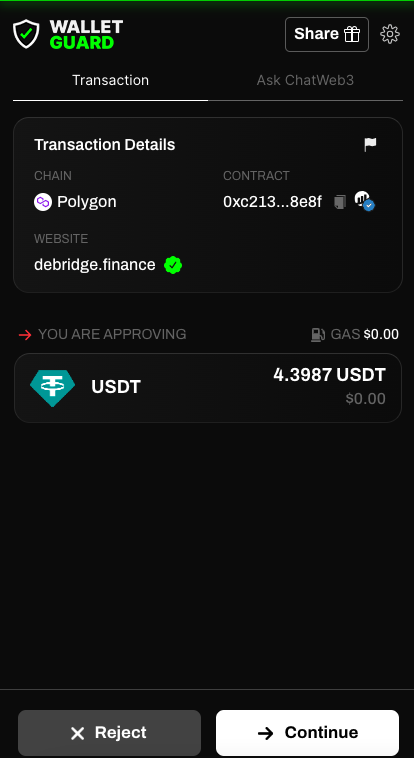

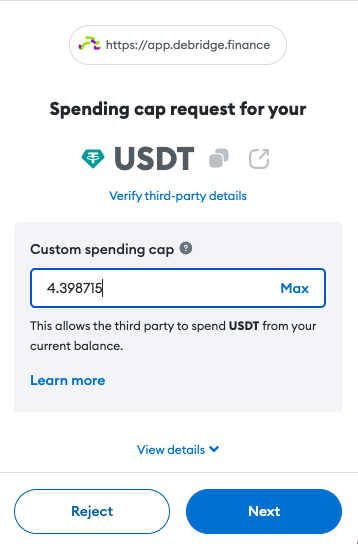

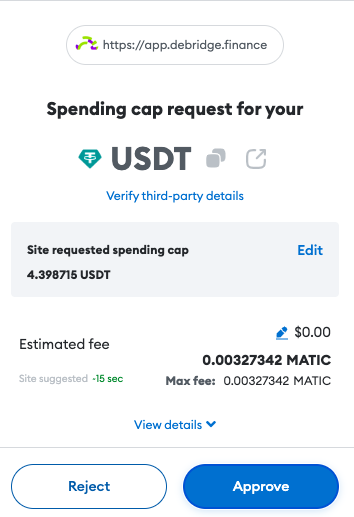

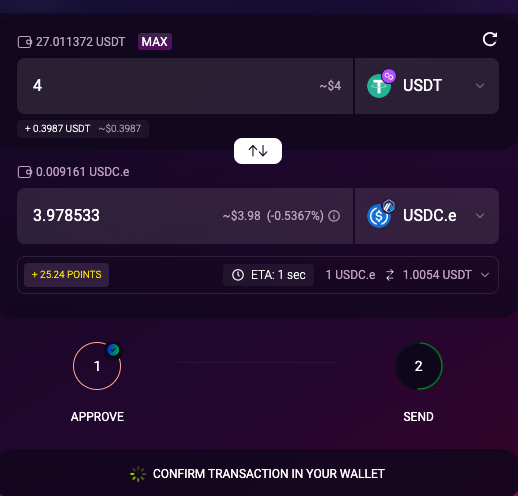

For this demonstration, we are going to bridge USDT on Polygon to USDC on Arbitrum using deBridge.

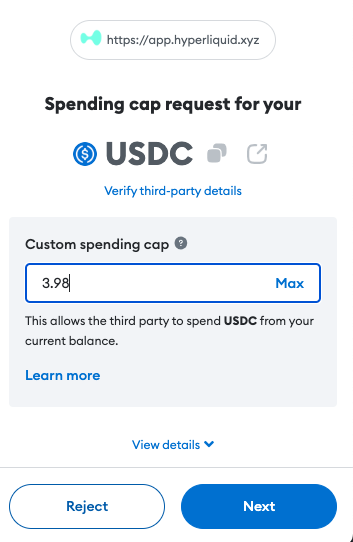

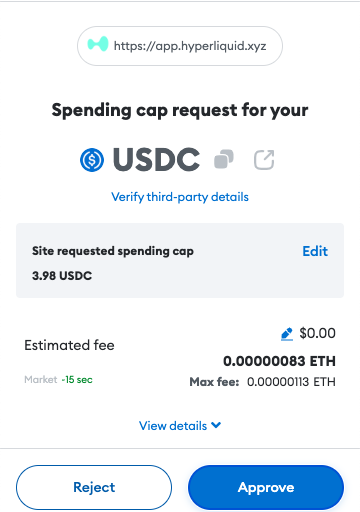

Set your spending cap.

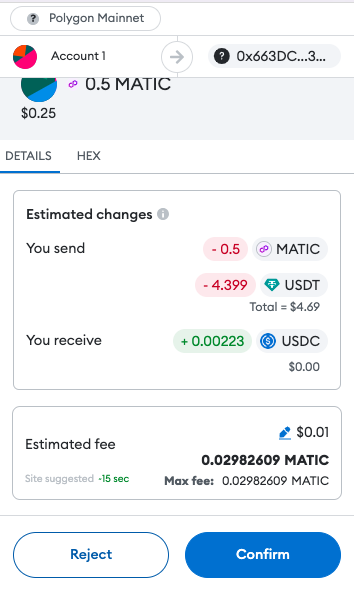

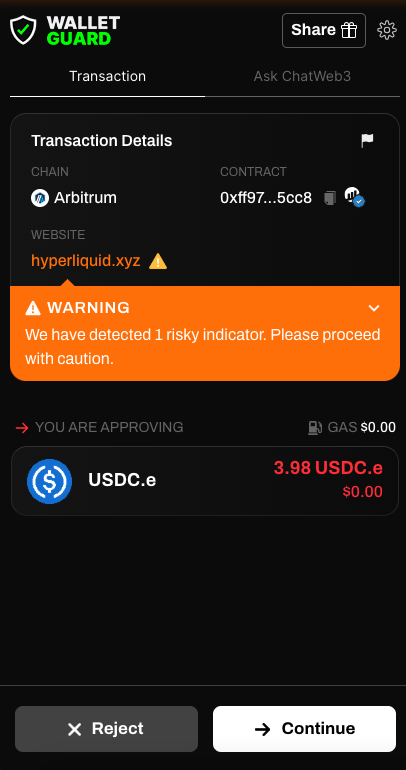

Pay the gas fee.

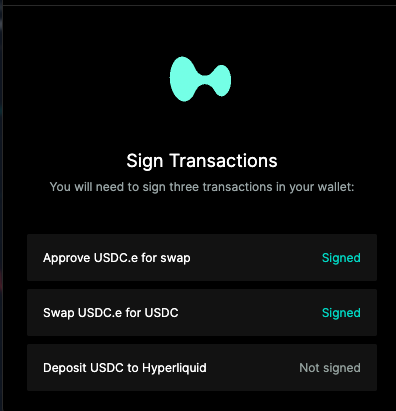

Confirm the transaction.

Make sure you’re using the correct network.

Proceed to swap and deposit.

Set the spending cap and pay the gas fee.

![]()

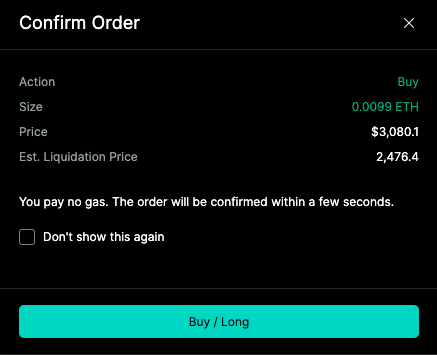

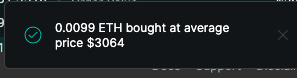

Now that we have funds available we can proceed to trade.

You can execute market or limit orders to go LONG or SHORT.

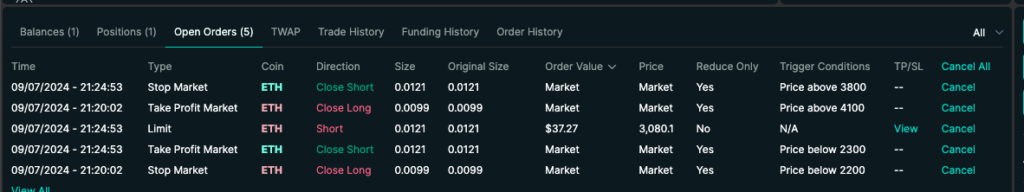

You can easily track your open positions on the dashboard.

Margining and Liquidation

Margin Modes

Hyperliquid offers cross margin and isolated margin modes, allowing users to manage their collateral efficiently. Liquidations are handled robustly to protect the platform’s solvency and user investments.

Liquidator Vault

The liquidator vault democratizes the liquidation process, allowing users to participate and profit from liquidations through the HLP (Hyperliquidity Provider) protocol vault.

Funding and Fees

Funding Rates

Hyperliquid employs a periodic funding mechanism to ensure the price of perpetual contracts stays close to the underlying asset’s price. Funding rates are calculated based on the difference between the contract’s price and the spot price of the underlying asset.

Trading Fees

Fees on Hyperliquid are community-directed, with a volume-based fee schedule. Maker rebates and referral rewards enhance the trading experience, benefiting the entire community rather than just a select few.

Technical Overview of Hyperliquid Platform

Latency and Throughput

Hyperliquid boasts impressive performance metrics with a median end-to-end latency of 0.2 seconds and 99th percentile latency of 0.9 seconds. The mainnet supports 100,000 orders per second, with potential scalability to millions.

EVM Bridge

Hyperliquid operates an EVM bridge secured by the same validator set as the L1. This bridge ensures secure and efficient deposits and withdrawals, adding an extra layer of reliability to the network.

API Servers

Hyperliquid’s API servers are permissionless and act as non-validating proxies to the network. They provide a familiar interface for automated traders used to centralized exchanges and solve load balancing and DDOS protection issues effectively.

Innovative Token Standards

HIP-1: Native Token Standard

HIP-1 is a capped supply fungible token standard that supports on-chain spot order books. It integrates seamlessly with USDC for margining and trading.

HIP-2: Hyperliquidity

Inspired by Uniswap, HIP-2 is a fully decentralized on-chain strategy that supports sophisticated order book liquidity. It democratizes liquidity, ensuring that even early-phase tokens can achieve price discovery effectively.

Conclusion

Hyperliquid stands out as a cutting-edge L1 blockchain optimized for high performance and full decentralization. Its native applications, robust consensus algorithm, and innovative token standards position it as a leading platform in the DeFi space. Whether you’re a trader, developer, or liquidity provider, Hyperliquid offers a comprehensive and efficient environment for all your financial activities.