InsurAce – Cover Against DeFi Hacks, Smart Contract Bugs & Stablecoin Depegging

What is InsurAce?

InsurAce is described as a decentralized protocol that makes it possible for users to purchase mutual protection for their digital assets against losses that can result from a wide range of risks such as hacks, smart contract bugs, stablecoin de-pegging, among many.

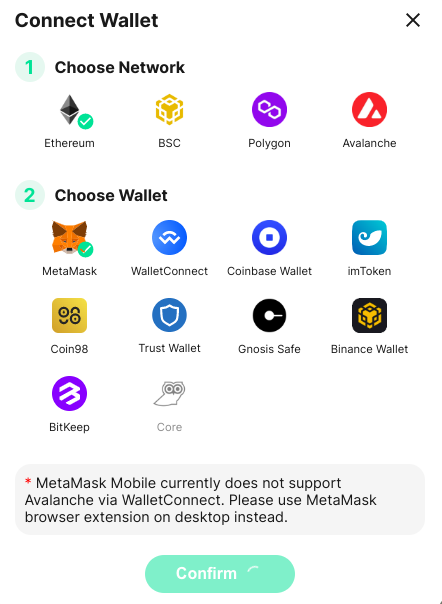

With InsurAce, users can get cover that is shared in two mutual pools under the InsurAce protocol (cover payment pool and underwriting mining pool). These pools are governed by members and membership rights are represented by the $INSUR token. This structure makes InsurAce a mutual. To get cover or use the protocol, visit https://www.insurace.io/ and you’ll be able to connect your web3 wallet e.g. MetaMask.

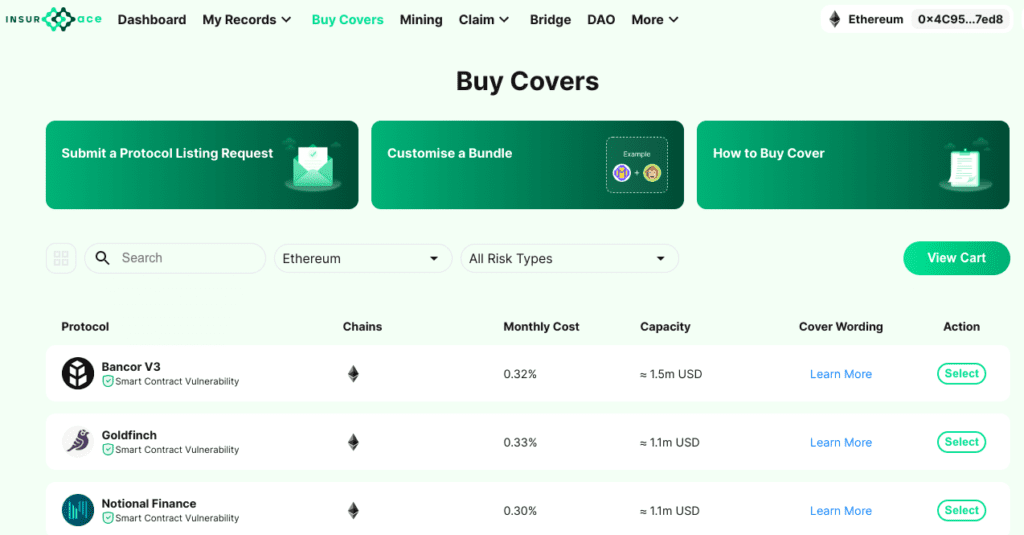

Once connected, you will be able to choose the right cover based on the type of chain you wish to get coverage for e.g. Ethereum, Binance Smart Chain, Polygon, Avalanche, Solana, Arbitrum, Fantom, Celo, Harmony, etc. You also have the option to choose which types of risks you need cover for e.g. Smart Contract Vulnerability, Custodian Risks, Stablecoin Depegging, or Bundle Cover. You can also customize your cover bundle for institutional grade investors which requires a minimum purchased cover amount of $500,000 and minimum purchased cover period of 1 month.

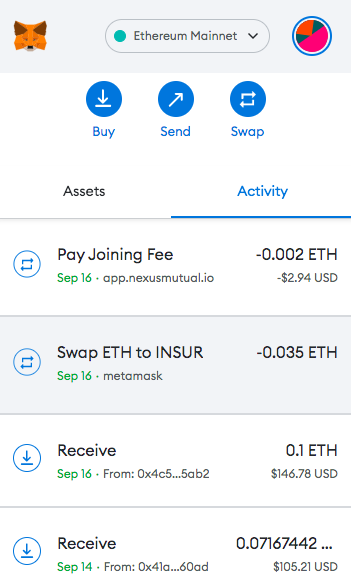

If you wish to purchase cover with INSUR tokens that you acquire from secondary marketplaces, you can simply use your web wallet to swap ETH for INSUR for example.

What is InsurAce’s Value Proposition?

InsurAce gives access to multi-chain cover and aims to fill in the gap for portfolio-based protection. It offers:

- Cover Payment – risk diversification is designed into the InsurAce protocol’s products with unique pricing models that optimize cover cost. The cover also gives the holder access to domain expertise, and investments which may assist with offsetting cover costs. This is why InsurAce protocol is in a position to offer low prices for its products.

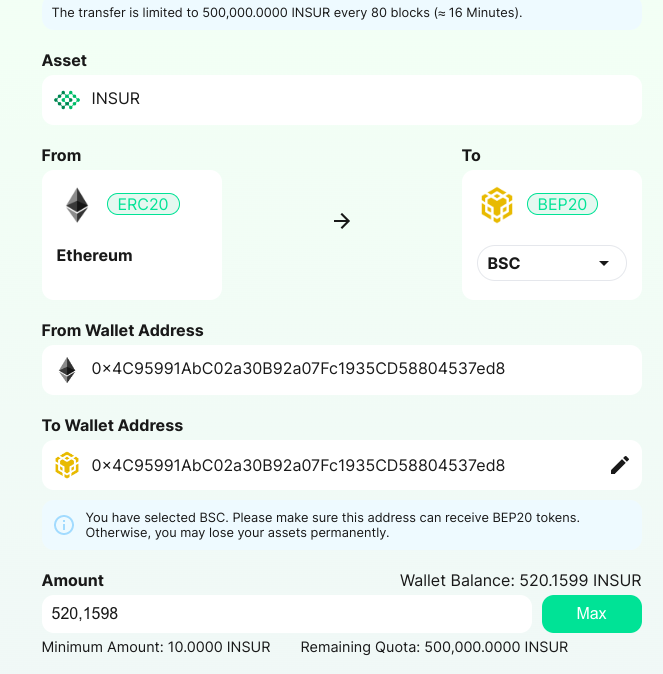

- Advanced Product Suite – InsurAce offers cover for a basket of DeFi protocols which creates a diversified risk management capability for investors. InsurAce also offers bridge services, allowing users to transfer $INSUR tokens across Ethereum, Binance Smart Chain, Polygon and Avalanche. When using the bridge service, please provide the correct wallet address to receive the tokens.

- SCR Mining – this allows participants to earn $INSUR tokens by simply staking underwriting capital into the mining pool. This capital is managed through the InsurAce protocol’s risk control models and dynamic Solvency Capital Requirement (SCR) adjustments. This means that any secure and free capital will be used to generate investment returns as a way to help better manage the rate of $INSUR emission, arguably making a strong case for the tokenomics of the ecosystem that is powered by the native token.

- Sustainable Returns – other mutuals such as Nexus Mutual have faced challenges when it comes to offering sustainable incentives since their investment returns tend to be derived from cover payments, which have relatively low yield when compared to lending and borrowing platforms such as Aave and Compound. The problem with low returns is that it discourages liquidity provisioning from capital providers, which then amplifies other problems e.g. the inability to provide competitive pricing and unlimited cover. Underwriters with InsurAce can directly invest in different products with varying degrees of risk levels and they can also stake in the mining pool to earn investment yields in the form of $INSUR tokens and they can also earn returns that come from cover payments.

How InsurAce Works?

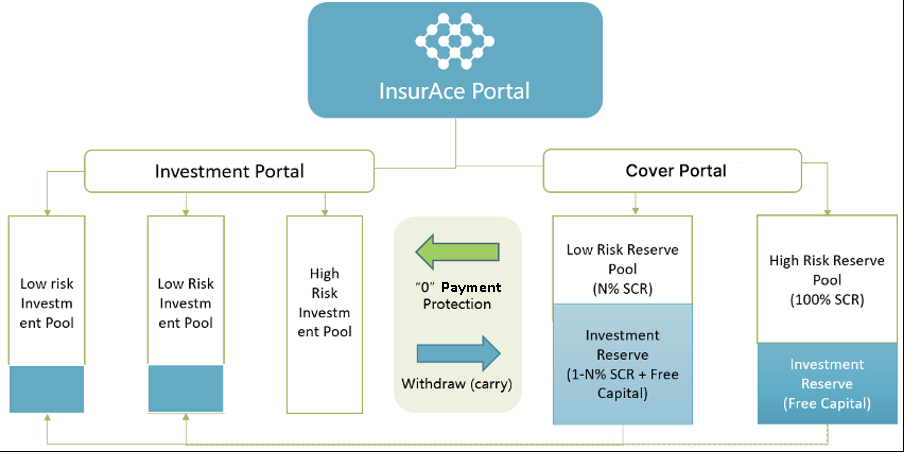

InsurAce operates a Cover arm and an Investment arm of the business. The Cover arm is responsible for the management of capital pools which assist in maintaining InsurAce protocol’s solvency and ultimately ensuring that it continues to meet cover obligations. The Investment arm, on the other hand, focuses more on the management of investment pools that generate returns which are then subsequently used to finance possible claim payouts and also attract investment capital. When there is unutilized capital in the Cover capital pool, it may be transferred to the Investment pool in order to earn higher yields and even subsidize users’ costs from cover payments.

The InsurAce protocol’s operational and development costs, token buybacks, community incentives, ecosystem collaborations, etc. are also funded from the revenues that are generated from cover payments and investments.

Is it worth using InsurAce?

As a decentralized multi-chain protocol that is striving to provide reliable, robust and secure risk protection services to DeFi users, InsurAce is making it possible for users to better protect their investment funds against a wide range of risks that can be encountered in the digital asset space.

InsurAce provides cross-chain coverage for over 140+ protocols running on all the major blockchain networks including Ethereum, Solana, BSC, Polygon, Fantom, Arbitrum, Avalanche, Harmony, and many others. InsurAce also offers portfolio-based cover which makes it possible for the user to select cover for multiple protocols running on different chains with varying degrees of risks associated with each.

Since the InsurAce protocol is permissionless, users are not required to hold any $INSUR tokens in order to have access to the platform. Users can purchase cover using other digital assets such as USDT, USDC, ETH, etc. In fact, cover purchasers are rewarded with $INSUR tokens which grant governance powers when purchasing different types of covers from the protocol. This means a user can have any number of wallets and still be able to access InsurAce protocol by simply connecting their wallet to the InsurAce dApp. InsurAce also has a great incentivized referral program where every time your friends successfully buy covers using your referral link or code, you will both receive $INSUR rewards which amount to 5% of the cover payment for the covers purchased.

InsurAce shows great promise. The team is active and continuously updating the community on developments. They put emphasis on their focus on fair claims handling, extension provisions, increments, or transferring capabilities to existing covers. InsurAce looks to also continue collaborating with other DeFi protocols to form a network of cross protections, cover syndication, and so much more for the benefit of users and they are constantly expanding and improving the InsurAce protocol’s product line in order to better cover risks present in DeFi. The project also has a good number of investors and partners.

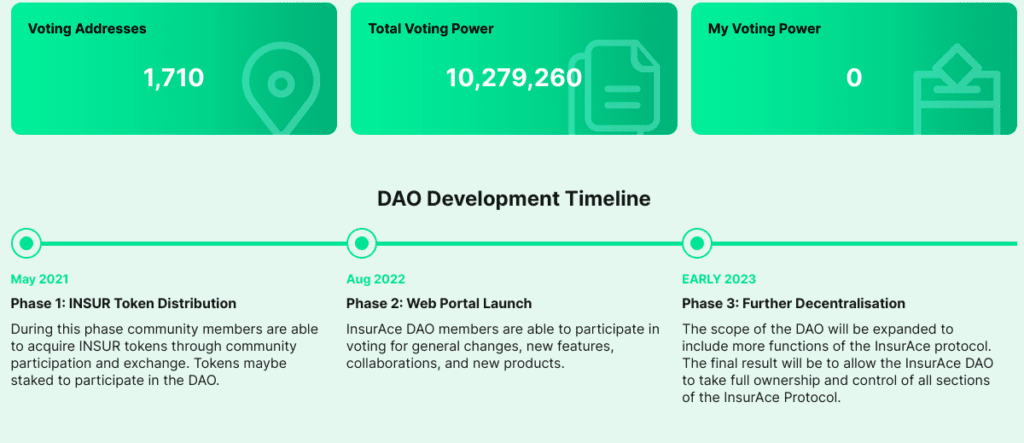

InsurAce seems to have successfully established a governance structure that promotes robust product development, efficient claim assessments, effective community engagement, token distribution, and so much more. It is highly recommended that you do your own research before using InsurAce or hold $INSUR tokens.

Any holder of the tokens can participate in the Insur DAO and contribute or influence the development of the ecosystem. The project’s smart contracts have been audited by PeckShield and SlowMist.