Kalshi Event-Based Trading Platform Review

What is Kalshi?

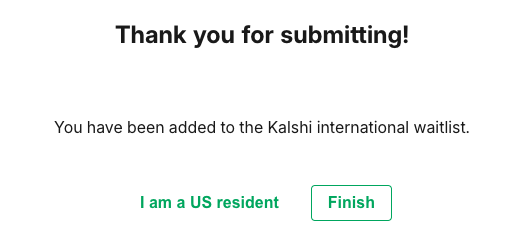

Kalshi is a groundbreaking platform that allows users to trade on the outcomes of real-world events. Through event contracts, users can speculate on everything from political outcomes and economic indicators to cultural milestones and technological breakthroughs. Kalshi democratizes finance by opening the doors of prediction markets to everyday individuals, enabling them to leverage their insights and predictions about future events as tradable commodities.

What are Event Contracts?

Event contracts are a unique form of commodity derivative, regulated by the Commodity Futures Trading Commission (CFTC). Unlike traditional financial instruments that are linked to company performance (like stocks or bonds), event contracts allow traders to bet on the outcome of specific events, such as “Will the Federal Reserve increase interest rates next quarter?” or “Will a specific legislation pass by a certain date?”

Why Trade Event Contracts?

Trading event contracts on Kalshi offers several advantages:

-

Precision in Prediction: Unlike bundled financial instruments, event contracts allow for targeted trading on specific outcomes. This precision reduces the noise and ambiguity often present in other asset classes.

-

Hedging Opportunities: Event contracts provide a way to hedge against specific risks. For example, if you are worried about economic instability due to potential political decisions, you can use Kalshi to hedge against those risks.

-

Access for All: Kalshi is designed to be accessible to all levels of traders, from professionals to beginners. With no restrictions on trading style and no pattern day-trading limitations, users have the freedom to trade as they see fit.

-

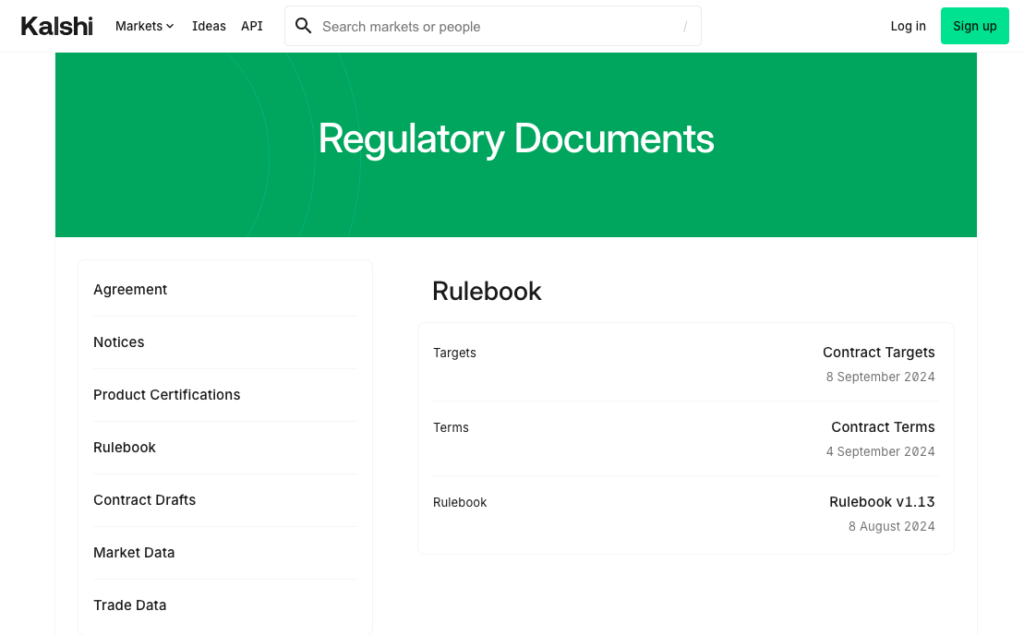

Regulation and Trust: As a CFTC-regulated Designated Contract Market (DCM), Kalshi ensures transparency, integrity, and security, fostering trust among its users.

Getting Started on Kalshi

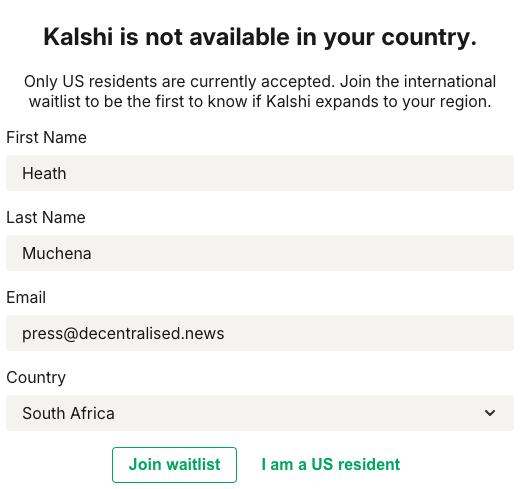

Currently, Kalshi is only available in the US.

You can join the waitlist and get alerted once available in your region.

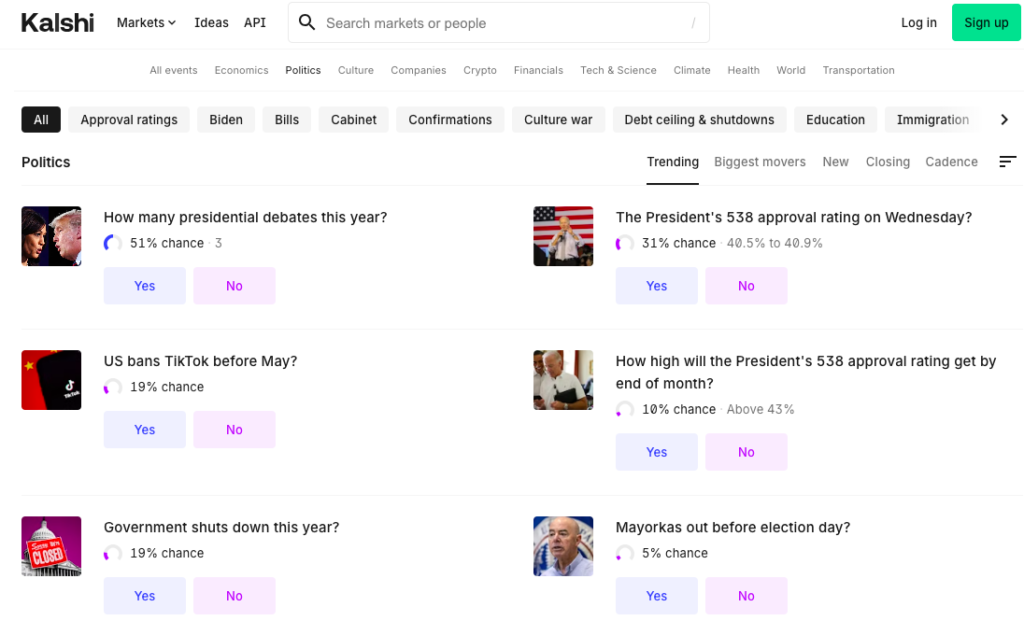

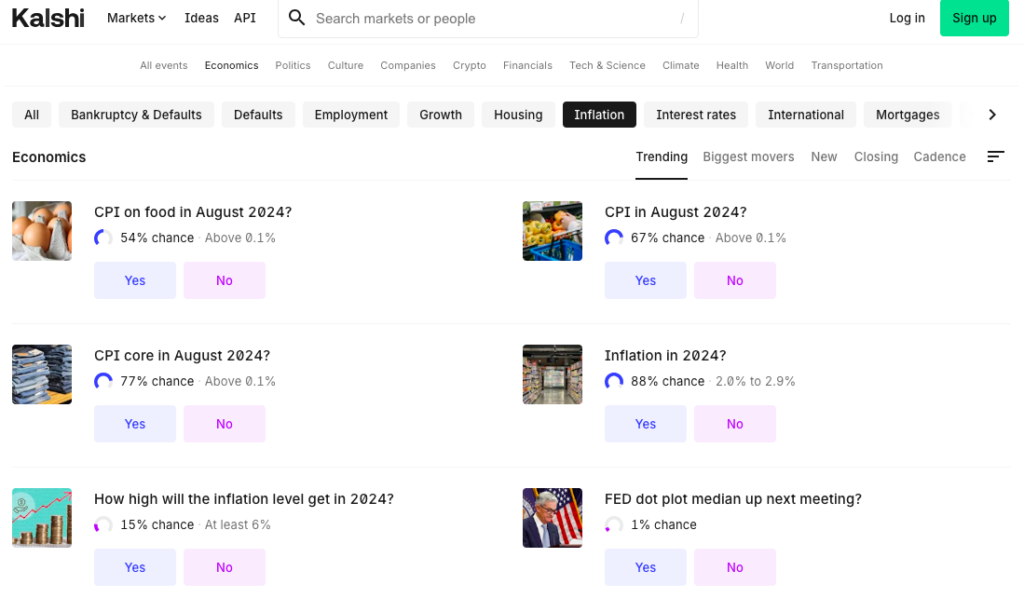

Choosing Your Market

When selecting your first market on Kalshi, you should consider your motivations:

- Trading on Conviction: Pick markets where you have strong opinions or insights.

- Hedging Risk: Choose markets that relate to your current investments or financial exposures. For instance, if you have student loans, you might consider the market on Supreme Court decisions regarding student loan forgiveness.

You can explore available markets on the Kalshi website, where you’ll find popular markets, newly listed ones, and those closing soon.

Placing Your First Trade

To place your first trade on Kalshi:

-

Navigate to the Market: Go to the Markets or Explore page and select the market you’re interested in.

-

Review Market Details: Check the rules section for key information, including open and close dates, payout dates, and the sources for settling the contracts.

-

Choose Your Order Type:

- Quick Order: Instantly buy a specific number of contracts at the best available price. Ideal for fast, immediate trades.

- Limit Order: Specify a price at which you are willing to buy contracts. This order type provides control over the trade price but may not execute immediately.

Understanding Prices and Probabilities

Kalshi’s prices are based on probabilities. For example, if a contract is trading at 40¢, it suggests that the market believes there is a 40% chance of the event occurring. Prices fluctuate based on news and market sentiment, offering opportunities to profit as probabilities change.

Selling Your Position

Once you have purchased contracts, you can decide when to sell:

-

Hold Until Settlement: Keep your position until the market reaches its settlement date. If your prediction is correct, you receive a payout.

-

Sell Early: If you believe the market has peaked or is moving against your prediction, you can sell your position early to lock in profits or minimize losses.

Quick vs. Limit Orders

- Quick Orders: Sell a specific number of contracts at the best available price. This is fast and straightforward.

- Limit Orders: Set a minimum price at which you are willing to sell, providing more control over your exit price.

Market Dynamics and Strategies

Buying Yes vs. Selling No

On Kalshi, buying a Yes contract (predicting that an event will happen) is functionally equivalent to selling a No contract (predicting that it won’t happen). Both actions impact the market’s equilibrium and are treated equally by the system. Choose the action that aligns with your market view and trading strategy.

Collateral Return

When trading in mutually exclusive markets (e.g., “Who will be confirmed as Secretary of State?”), Kalshi uses a collateral return mechanism to manage risk. For example, if you buy No positions on two mutually exclusive outcomes, the maximum loss is capped, allowing you to use funds more efficiently across different positions.

How Markets are Created

Kalshi’s markets are generated from proposals by members or team suggestions. Each proposed market undergoes rigorous evaluation to ensure it is fair, free from manipulation, and based on verifiable outcomes. Once approved, the market is listed for trading.

Engaging with the Kalshi Community

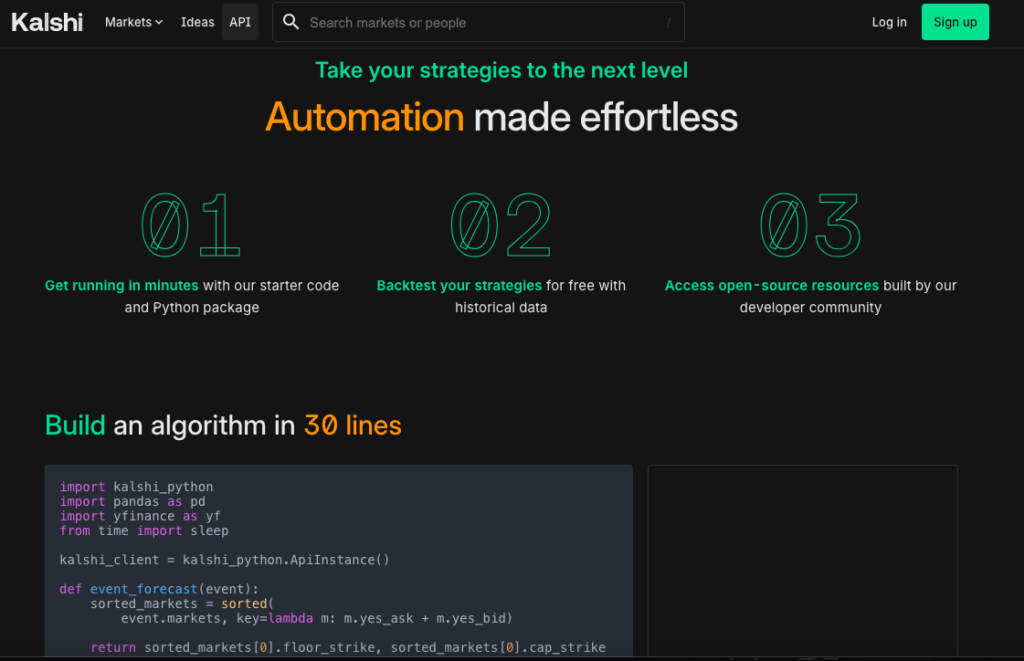

Kalshi Ideas

Kalshi Ideas is a community hub where traders share insights, discuss strategies, and celebrate wins. It’s a virtual trading floor that fosters collaboration, learning, and camaraderie among traders. Engaging with Kalshi Ideas can enhance your understanding of markets, refine your strategies, and connect you with other traders.

Conclusion

Kalshi offers a novel way to engage with financial markets by trading on real-world events. Whether you’re looking to hedge risks, capitalize on insights, or explore a new form of trading, Kalshi provides a transparent, regulated, and inclusive platform to do so. Remember, while trading on Kalshi can be exciting and potentially profitable, it also involves risks. Always conduct thorough research, develop a sound strategy, and trade responsibly.