Kamino Finance: Redefining Lending, Liquidity, and Leverage in DeFi

Kamino Finance has emerged as a trailblazer in the decentralized finance (DeFi) sector, offering users an innovative and seamless way to provide liquidity and earn yield on-chain. Originally designed to simplify liquidity provision, Kamino has evolved into a comprehensive DeFi protocol that integrates Lending, Liquidity, and Leverage into a single, secure suite of products.

What is Kamino Finance?

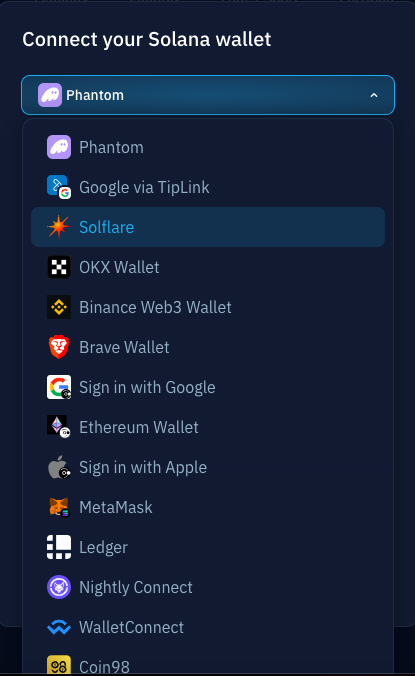

Connect your web3 wallet e.g. Solflare.

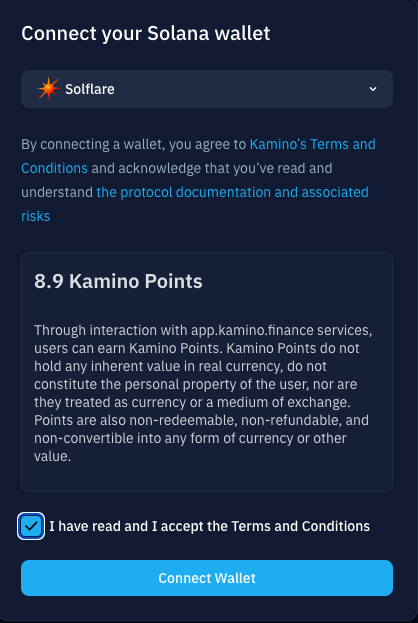

Read and if you agree, accept the terms and conditions.

Kamino Finance gained prominence for its one-click, auto-compounding concentrated liquidity strategies, which quickly became some of the most popular liquidity provider (LP) products on Solana. These strategies laid the foundation for what Kamino represents today: a first-of-its-kind DeFi protocol that unifies the core functionalities of borrowing, lending, and leveraged liquidity provision within a cohesive, user-friendly platform.

Kamino’s innovative design enables users to borrow and lend assets, provide leveraged liquidity to concentrated liquidity decentralized exchanges (DEXs), and build customized automated liquidity strategies. Moreover, it supports the use of concentrated liquidity positions as collateral, all within an industry-leading user experience (UX) that features transparent analytics, detailed performance data, and comprehensive position information.

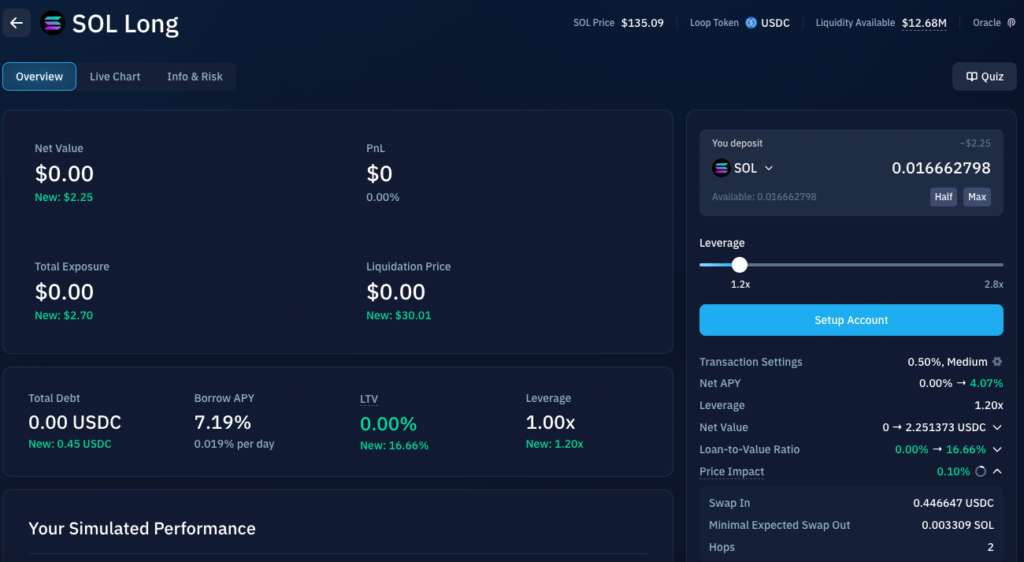

Kamino Long/Short

Kamino Long/Short is a Solana-based leverage trading product that eliminates the excessive funding costs typically associated with leveraged trading.

With the Kamino Long/Short product, users can open long-term directional positions at 2-3x leverage, paying only the standard borrowing costs of Kamino Lend.

Powered by Kamino’s flash loans, Long/Short allows users to establish a one-click leveraged lending position. For example, when taking a long position on $SOL, users borrow USDC against SOL and leverage that position up to their desired exposure — all done instantly by Long/Short.

Regarding borrowing costs in Long/Short, users are charged only the standard Kamino Lend borrow rate for the borrowed asset (e.g., $USDC for all long positions). Additionally, these costs can be offset by the supply rate earned on the collateral side.

Ultimately, Long/Short is set to become a versatile and user-friendly leverage product, featuring a range of position management tools, including:

- Take Profit

- Auto-unwind

- Limit Orders

Moreover, Long/Short positions earn boosted points due to the leverage applied.

How to Get Started on Kamino

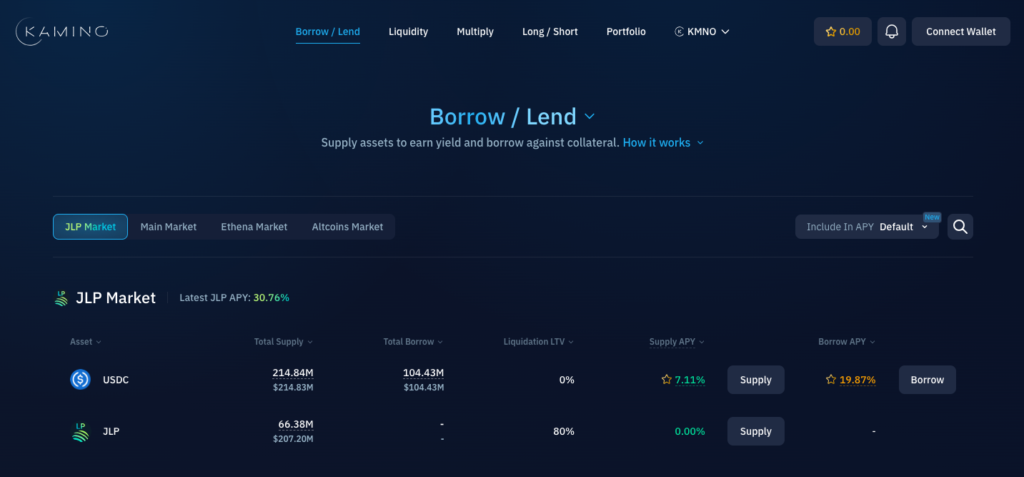

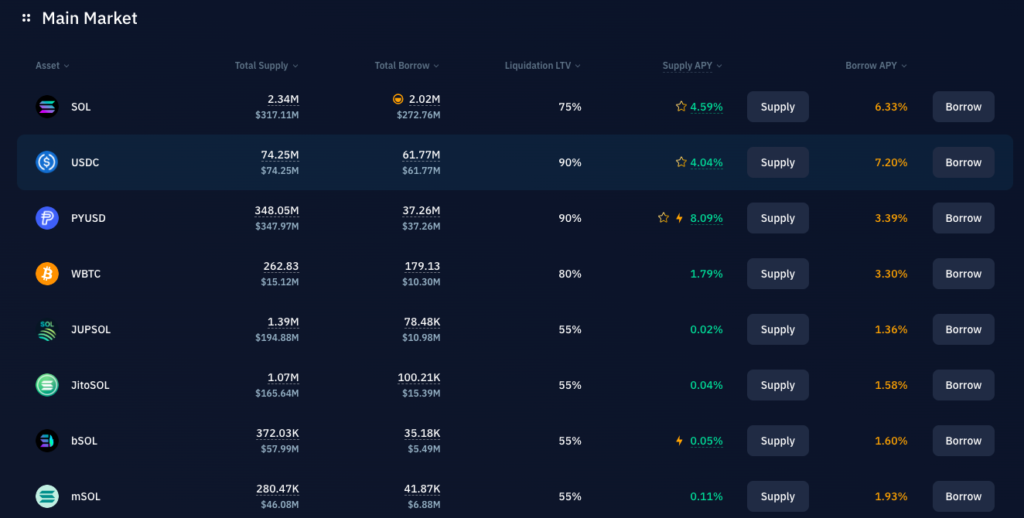

Kamino Lend (K-Lend): A Novel Approach to DeFi Lending

At the heart of Kamino‘s ecosystem is Kamino Lend (K-Lend), a pioneering peer-to-pool borrowing primitive. Designed to power complex financial products with leverage and automation, K-Lend serves as a decentralized matchmaker between borrowers and lenders. This infrastructure underpins Kamino 2.0, a fully integrated decentralized application (dApp) that brings together borrowers, lenders, and liquidity providers, allowing users to express diverse market views and engage throughout all phases of the market cycle.

Key Features of K-Lend

-

Unified Liquidity Market: K-Lend features a single liquidity market, eliminating the inefficiencies of multi-pool designs that fragment liquidity and reduce yields for lenders. This unified approach is combined with an innovative risk engine that isolates risk while maintaining a cohesive liquidity market.

-

Elevation Mode (eMode): Originally introduced in Aave V3 as “Efficiency Mode,” K-Lend’s eMode enables users to borrow highly correlated or soft-pegged assets at more capital-efficient loan-to-value (LTV) ratios. By grouping assets into “elevation groups” (eGroups), K-Lend customizes LTV parameters and liquidation thresholds, unlocking higher leverage and tailored liquidation processes within a single market.

-

CLMM LP Tokens as Collateral (kTokens): Kamino tokenizes concentrated liquidity market maker (CLMM) LP positions into fungible, easily liquidatable SPL tokens called kTokens. These can be used as collateral, allowing users to leverage or borrow against their LP positions.

-

Poly-linear Interest Rate Curve: K-Lend offers an advanced interest rate curve with up to 11 points, providing a more gradual adjustment to supply and borrow rates based on asset utilization. This innovation benefits borrowers by preventing sharp rate increases, enhancing market stability.

-

Protected Collateral and Risk Management: Kamino allows users to protect their collateral from being borrowed by others, reducing exposure to borrower defaults. The protocol also includes robust risk management tools such as deposit and borrow caps, auto-deleveraging mechanisms, and real-time risk simulators to ensure safe and efficient market operations.

-

Advanced Liquidation Mechanisms: K-Lend’s approach to liquidations is designed to minimize user impact. It features soft liquidations that settle a portion of the debt rather than liquidating entire positions, and dynamic liquidation penalties that start at 2% and increase only if necessary, rewarding efficient liquidators while reducing costs for borrowers.

Kamino’s Core Primitives: Automated Liquidity Vaults and Kamino Lend

Kamino’s product suite is built on two core primitives: Automated Liquidity Vaults and Kamino Lend (K-Lend). These are combined to create innovative, one-click products such as Multiply Vaults and Long/Short Vaults, which empower users to leverage their exposure to yield-bearing assets through sophisticated yield strategies.

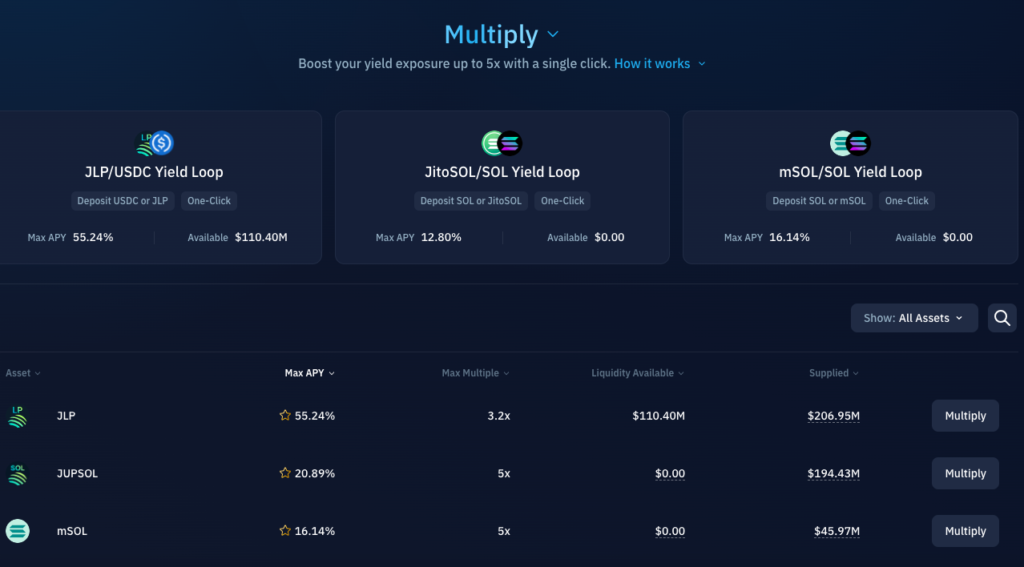

Multiply Vaults: Enhanced Yield Strategies

Multiply Vaults: Enhanced Yield Strategies

The Multiply Vaults enable users to increase their exposure to yield-bearing assets by borrowing underlying assets. This is achieved through the synergy of K-Lend mechanisms like eMode and kToken collateral, providing powerful yield strategies within an intuitive, information-rich interface. The vaults support granular position management, allowing users to maximize their returns while navigating market volatility.

How Multiply Works: Multiply allows users to open a leverage position by borrowing the underlying asset (e.g., borrowing SOL to increase exposure to JitoSOL). Utilizing flash loans and eMode, the system identifies the optimal amount of SOL to borrow, creating a leveraged position that is constantly optimized for maximum yield.

Risk Management and User Security

Kamino takes user security and risk management seriously. The platform’s risk management features include a real-time Risk Simulator, which allows users to view their position risk and simulate market movements. Additionally, Kamino employs robust Oracle Risk Management, incorporating Time Weighted Average Prices (TWAP), Exponentially Weighted Moving Averages (EWMA), and multiple price sources to protect against price manipulations and flash loan exploits.

Deleveraging and Socialized Losses: To maintain platform integrity, Kamino employs an auto-deleverage mechanism to systematically adjust debt and collateral positions. In the event of bad debt, losses are socialized across all users, encouraging prudent position management and providing a buffer against extreme market conditions.

Conclusion: A Pioneering Force in DeFi

Kamino Finance has positioned itself as a leader in the DeFi space by offering a unique blend of automated liquidity products, advanced risk management tools, and a user-centric interface. Its innovative approach to lending, liquidity, and leverage within a unified ecosystem offers users unprecedented opportunities to earn yield, manage risk, and participate fully in the DeFi market cycle. For those seeking a comprehensive, secure, and efficient DeFi solution, Kamino Finance is undeniably a protocol to watch.