Liquid Crypto Exchange Platform Review

Liquid Exchange

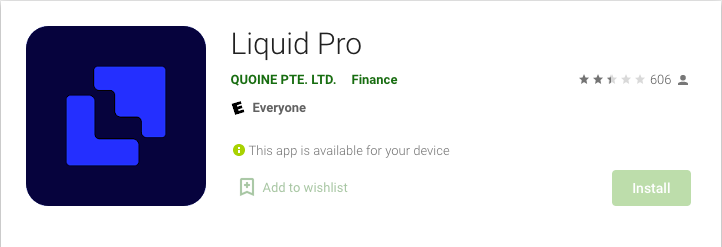

Liquid crypto trading platform is a product by Quoine, a blockchain-based fintech company headquartered in Japan and that has offices in Singapore, Vietnam and even the USA. Liquid is regulated in Japan. It is one of the largest exchanges in Asia by volume. Liquid was co-founded in 2014 by Mike Kayamori who is now the CEO at Liquid Global. Users can trade on their mobile using Liquid Pro apps on iOS and Android or alternatively sign up or log on using desktop.

Liquid Pro mobile app reviews seem to have a lower score coming from the Android users compared to iOS. Perhaps there’s room for improvement in the user-friendly category but it appears most negative reviews are targeted at their customer service.

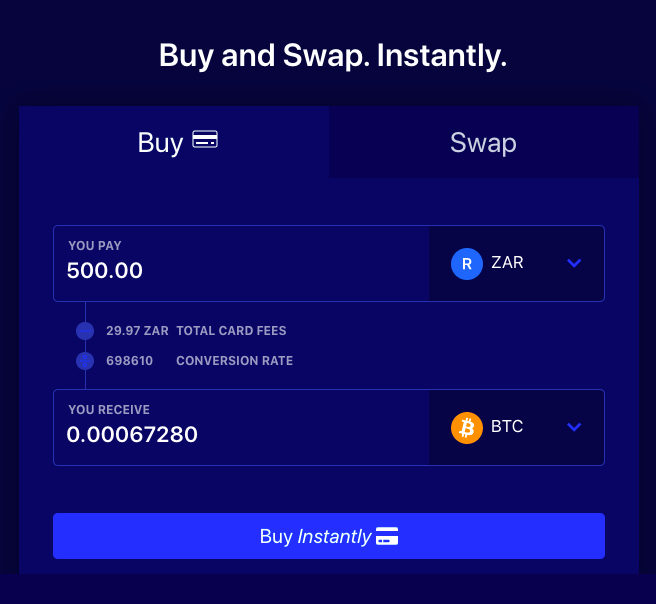

Liquid offers access to more than 100 fiat and digital currencies. The exchange supports digital currency trading against fiat pairs including JPY, USD, SGD, AUD, EUR.

Liquid as the name suggests is focused on liquidity. It has been reported that some cryptocurrency exchanges make claims about being liquid when in fact their order books are thin and the platforms have fake volumes and wash trading takes place on such exchanges.

Liquid apparently has real liquidity. They have an External World Book liquidity feature which combines liquidity from several external exchanges in order to provide users the best experience on their platform. The proprietary software engine enhances the liquidity on Liquid through the provision of price stability, order book depth and liquidity sourcing from other exchanges.

Fees

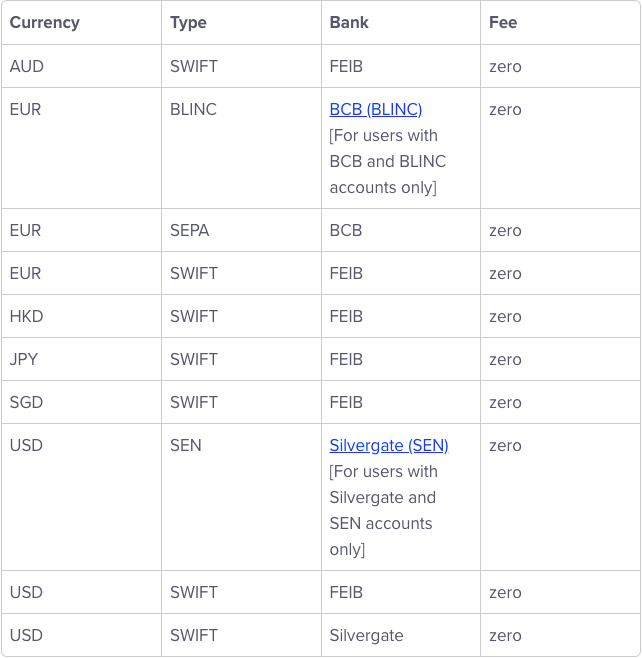

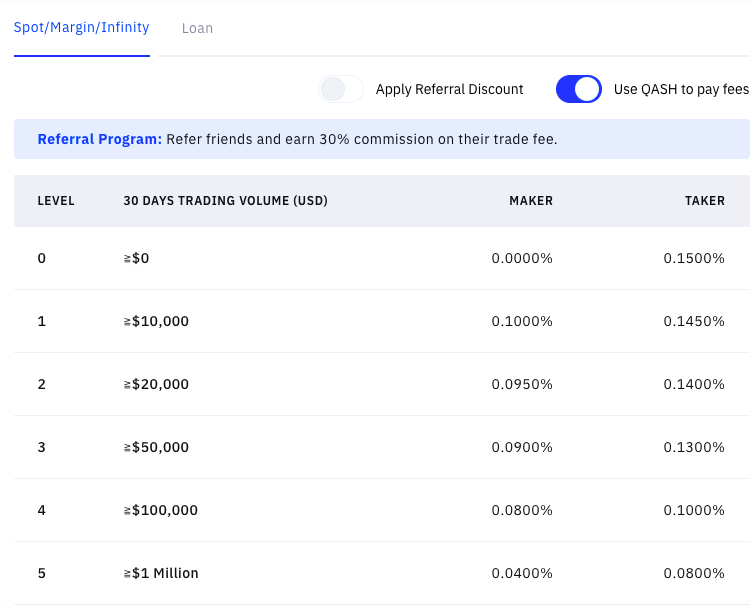

The fee structure on Liquid rewards traders by lowering their trading fees when they trade more. The lowest level has zero maker fees when a trader pays fees in QASH. QASH – a native token of the Liquid exchange platform used to pay for services and receive benefits and discounts. For example, traders get a 50% discount on trading fees when using QASH. Trading fees are charged according to a user’s trading volume over the last 30 days on the exchange. Some currency pairs are not subject to the trading fee discount by paying in QASH eg. USDT-ZUSD, ZUSD-USD, GYEN-JPY, USDC-USD, XSGD-SGD. There are no fees for crypto deposits. Liquid doesn’t charge fees for fiat deposits but users may be charged by their banks. They currently use the following banks and payment processors:

Crypto withdrawals between Liquid wallets have zero fees. In general, crypto withdrawal fees are subject to change depending on a range of factors such as a surge in mining transaction or gas fees. Liquid typically reserves the maximum possible fee 0.3% at order entry in order to cover all possible fee payments at order execution.

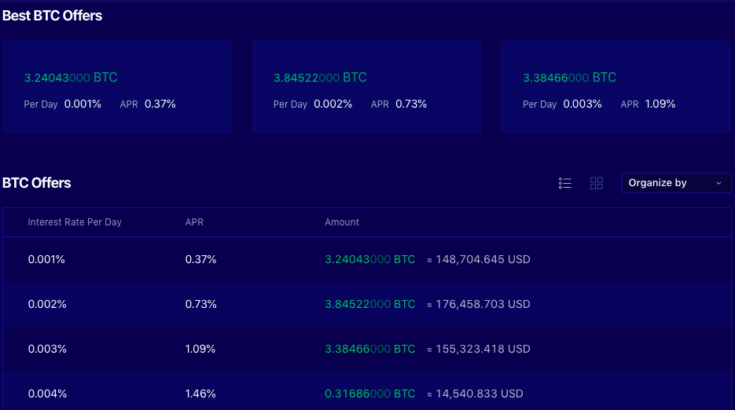

Liquid users can also lend out their digital assets or fiat in order to earn daily interest on loans that are taken by margin traders. As long as the trades are open, such loans generate interest. Once the trades the funds are tied to are closed, all funds are returned to the lender. Users can lend by simply selecting the currency they wish to lend and then clicking “Create an offer”. They can also adjust the interest rate and specify the amount of currency for the loan. Once an offer is taken, it becomes a loan and is displayed under the Loans tab. The amount of this offer is subsequently deducted from the lender’s balance. Users can check “Auto Re-loan ” if they wish to have the loan become a loan offer repeatedly once paid back to them by the initial borrower. Users can choose to uncheck this option if they simply want the loan returned to their balance instead of being reloaned. The “Interest Payment Fee” is 50% of the interest earned. Liquid collects this amount from the lender whenever interest is credited.

Strengths

Strengths

- Liquid platform also offers Liquid Tap, a WebSocket service.

- Fast, secure withdrawals leveraging MPC technology.

- Effective swap feature.

- API initiated withdrawals.

- Users can initiate a transfer of fiat currency to their Liquid account to a verified external bank account at any time.

- Liquid offers margin trading for select crypto-fiat pairings. Users can margin trade with BTC, BCH and ETH with a number of funding currencies, as well as BTC and QASH. Liquid offers zero funding fees for day traders and up to 25x leverage.

- The platform offers Liquid Infinity – a Bitcoin Contracts For Difference (CFD) product.

- Users can trade perpetual contracts.

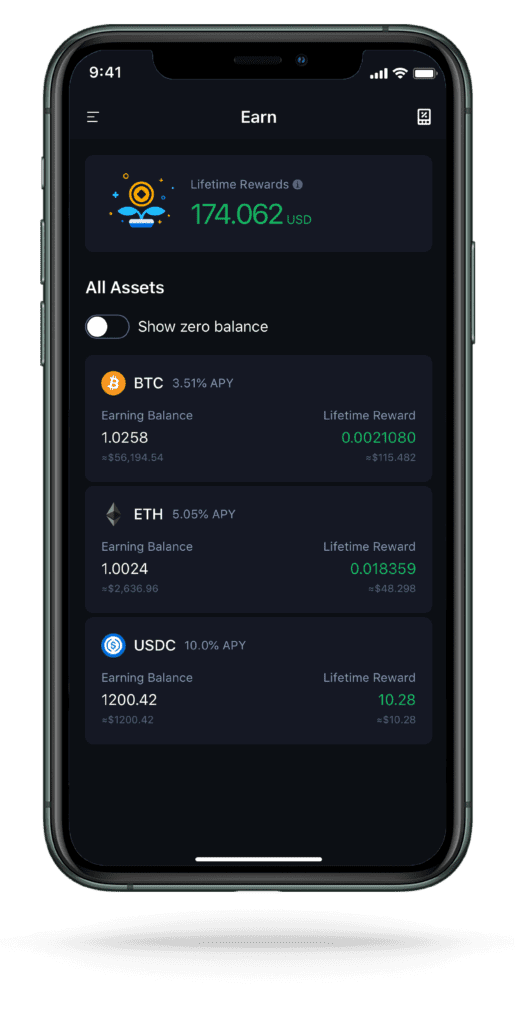

- Users have access to the Liquid Earn service which is offered through Celsius Network Limited as the third‐party service provider.

Weaknesses

Liquid platform security has become questionable in light of the recently reported $80 million+ hack in which digital currencies were moved from the exchange. In response other exchanges such as KuCoin apparently blacklisted the addresses that had received some of the stolen funds.

- Users cannot use the platform if located in or resident of prohibited locations including USA and Japan.

- Liquid can, without notice and for any reason, terminate support for a currency.

- The platform requires users to KYC.

- Transfers of fiat currency to or from your Liquid account depend on third parties who maintain the applicable External Bank Account which means it may at times take longer than users would like to process their transfers so Liquid does not guarantee users will receive funds in their accounts within a specific time frame.

Referral Program

Liquid platform has a referral program which rewards users for introducing other users to the exchange. Every time a user refers someone to Liquid, they become a lifetime referee and there are no limits as far as how many people a user can refer. The user will receive 30% of their referee’s trading fees. What’s great is that Liquid referral also gives a 10% discount on trading fees to those new users who sign up using a referral link. Payouts for referrals are credited to a user’s Liquid account once every 24 hours in the currency the fee is paid by their referee.