Liquity – Interest-free Borrowing on Ethereum

What is Liquity?

Liquity is described as a decentralized borrowing protocol that makes it possible for users to draw 0% interest loans against Ether which is used as collateral. Essentially, Liquity is protocol software that enables its users to create interest-free liquidity in LUSD – a USD pegged stablecoin. It makes this possible through making it convenient to deposit ETH towards autonomous smart contracts. ETH is the only collateral type accepted by Liquity.

The LUSD stablecoin asset maintains its stability through a fully decentralized and smart contract based liquidation mechanism and a Stability Pool. The native token of the Liquity ecosystem is LQTY which earns holders technical fees from involved smart contracts which automatically and autonomously are subject to deductions.

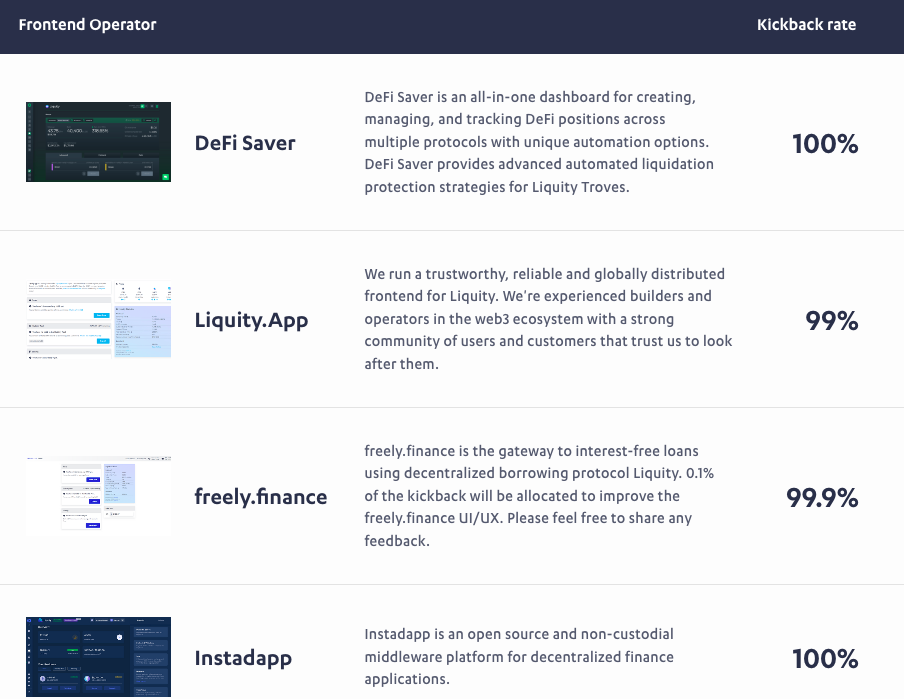

Liquity AG based in Zurich, Switzerland was involved in developing the Liquity Protocol Software but they do not take any risk since the Liquity Protocol Software runs in a fully decentralized and autonomous manner on the Ethereum network. Liquity AG has neither access to control or influence the transactions, deposits or allocations that are made by the users and the involved smart contracts using the Liquity Protocol Software. What’s even more interesting is that Liquity AG does not operate their own frontend, nor has it entered in any relationship with frontend operators.

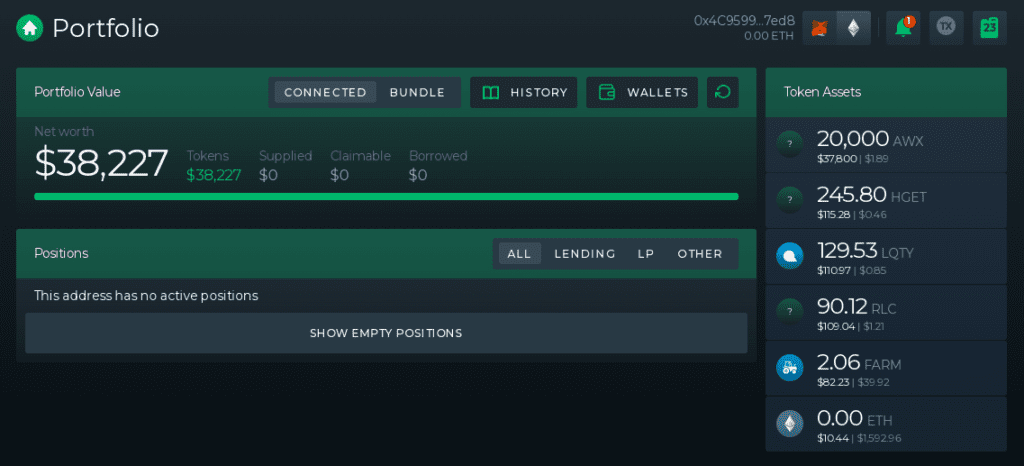

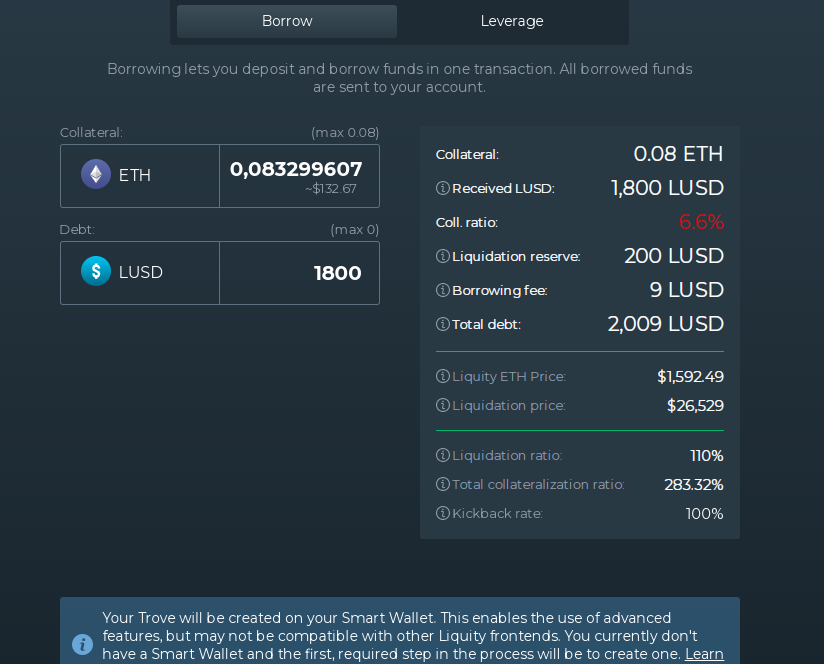

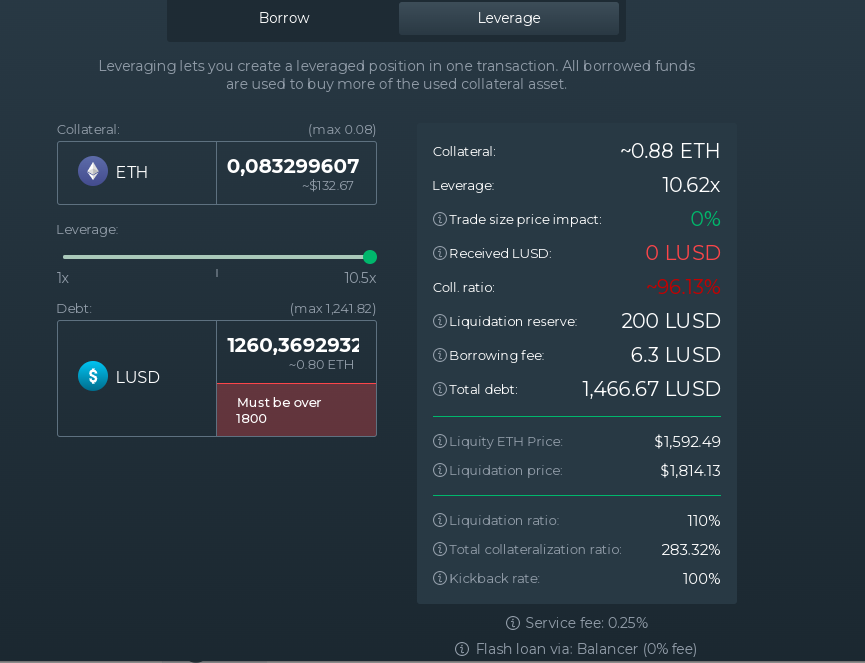

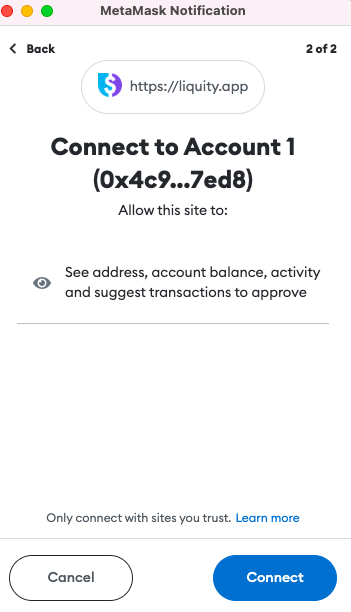

Loans through Liquity are paid out in LUSD and need to maintain a minimum collateral ratio of 110%.The loans are also secured by a Stability Pool that contains LUSD and by borrowers that collectively act as guarantors of last resort. As a protocol, Liquity is non-custodial, immutable, and governance-free. Connecting to Liquity is simple. You can choose a front-end of choice. In this case, we chose DeFi Saver which we connected to MetaMask.

What is Liquity’s Value Proposition?

Stable-value assets are crucial to sustainable ecosystem development for Ethereum applications which have billions of dollars worth of total volume locked. The challenge is that most of the stablecoins available on the market come in the form of centralized, fiat-collateralized stablecoins such as Tether and USDC which pose certain third-party risks. Only a small portion of decentralized stablecoins such as DAI make up the stablecoin supply.

Liquity’s goal is to create a more capital efficient and user-friendly way for users to be able to borrow stablecoins. Liquity has gone a step further by taking a governance-free approach in order to ensure that the protocol remains decentralized. The project does however have some notable partners in the crypto space.

Liquity’s key benefits

- With Liquity, a borrower does not need to worry about accruing debt since the loans have a 0% interest rate.

- The minimum collateral ratio of 110% means more efficient usage of ETH that is deposited.

- Liquity has no governance which means all operations are algorithmic and fully automated. The protocol parameters are also set at the time a contract is deployed.

- LUSD is redeemed at any time and at face value for the underlying collateral.

- Liquity contracts have no admin keys making it fully decentralized. It is accessible via multiple interfaces hosted by several different Frontend Operators. This feature makes Liquity censorship resistant.

How to use Liquity

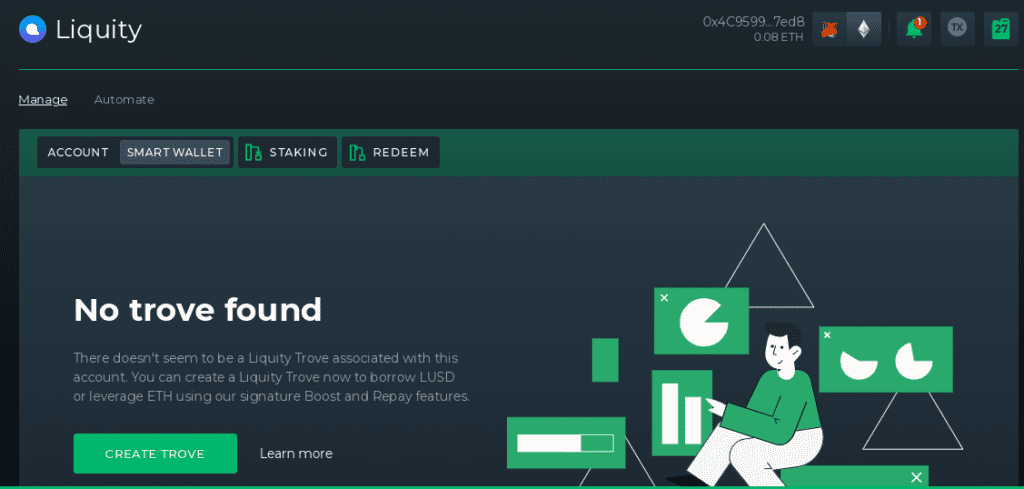

After choosing a web interface to access the Liquity protocol, a user can effectively borrow LUSD against ETH by simply opening a Trove.

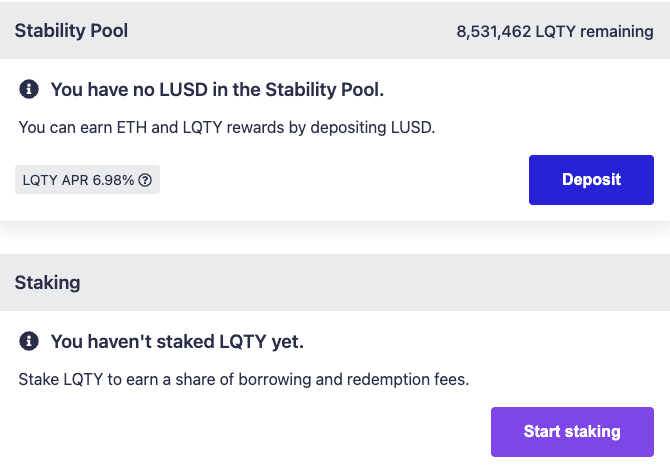

In addition, users can contribute to the security of Liquity by providing LUSD to the Stability Pool and in exchange they will receive rewards. Furthermore, users can also stake LQTY and earn the fee revenue that is paid by users for borrowing or redeeming LUSD. Lastly, users can also redeem LUSD for USD worth of ETH when the LUSD peg falls below $1. Learn more about the stability mechanism.

LQTY is essentially a secondary token that is issued by Liquity and it captures the fee revenue that is generated by the system, thereby incentivizing early adopters and frontends. The total supply of LQTY is capped at 100,000,000 tokens. Learn more about LQTY Rewards and Distribution.

In order to borrow LUSD, a user needs a wallet e.g. MetaMask and sufficient Ether to open a Trove and pay the gas fees. If the user wishes to become a Stability Pool depositor or LQTY staker, they will be required to have LUSD and/or LQTY tokens. LUSD can be borrowed by opening a Trove and LQTY can be earned by positioning yourself as a Stability Pool depositor. Uniswap or other decentralized exchanges also make it possible to acquire LQTY tokens from the open market e.g. you can swap ETH for LTQY in your Metamask wallet.

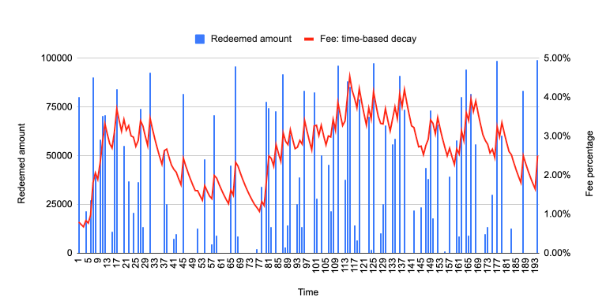

Fees on Liquity

A one-off fee is charged whenever LUSD is borrowed, and also when LUSD is redeemed. Borrowers are liable to pay a borrowing fee on loans as a percentage of the drawn amount (in LUSD). Also a redemption fee is charged on the amount that is paid to users by the system (in ETH) i.e. when exchanging LUSD for ETH. It is important for users to understand that redemption is actually separate from repaying a loan as a borrower, which is free of charge i.e. no interest is charged.

The two types of fees i.e. borrowing and redemption fees both depend on the redemption volumes. This means that they increase upon every redemption in function of the redeemed amount, and they also decay over time as long as no redemptions are initiatied. This mechanism is meant to throttle large redemptions with higher fees, and to throttle borrowing directly after large redemption volumes. The fee decay over time is meant to ensures that the fee for both borrowers and redeemers will be lowered when redemptions volumes are low.

The protocol work in such a way that fees cannot become smaller than 0.5% (except in Recovery Mode), which is meant to be a protective mechanism for the redemption facility to prevent it from being misused by arbitrageurs who may attempt front-running the price feed. The borrowing fee is capped at 5%. This is seen as making it possible to keep the system attractive for borrowers even when the monetary contracts due to redemptions. Besides this, both fees are identical.

Risks of using Liquity

Liquity is a non-custodial system which means that all the tokens that are sent to the protocol are infact held and managed algorithmically and without the interference of third parties. This makes funds subject to only the rules that are set forth in the smart contract code, which has been audited by Trail of Bits and Coinspect. See the reports here. However, there are still a couple of scenarios whereby a users can potentially lose their funds:

- As a borrower (Trove owner) with collateral in ETH that is liquidated, you will still keep your borrowed LUSD, but your Trove will be indeed closed and your collateral thus used to compensate Stability Pool depositors.

- As a Stability Pool depositor when your deposited LUSD is used to repay debt from liquidated borrowers. Any time borrowers’ collateral drops below 110%, liquidations are triggered. This means that you’ll receive more ETH in return with a very high probability. But in the case that ETH decreases in price and you maintain exposure, the value in your total pool deposits may be lost.

It is also important to note that LUSD is not hard-pegged to the USD. This means that it can pretty much deviate ever so slightly in either direction, under certain market conditions. Fro more details, check out On Price Stability of LUSD.

Staking LQTY

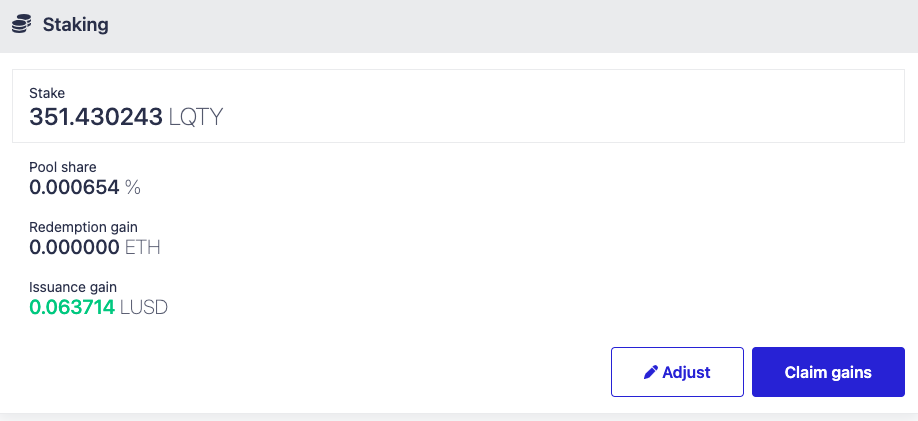

By staking LQTY, users can earn the revenue from issuance fees (in LUSD) and redemption fees (in ETH).

To get started, choose a frontend that you want to use for staking. In this example, we chose Liquity App.

You have to connect your web wallet.

Once connected you can view the stats.

You can proceed to stake.

You can choose how many LQTY tokens you wish to stake and once you have staked, you can see what percentage of the pool share rewards you’re entitled to and how much you accrue in ETH or LUSD. You’ll also be able to claim your rewards or adjust your stake easily.