Margex Crypto Exchange Review

What is Margex?

Founded in 2020, Margex crypto exchange is operated by Margex Trading Solutions Ltd, a company registered and incorporated under the International Business Companies Act of 1994 of the Republic of Seychelles.

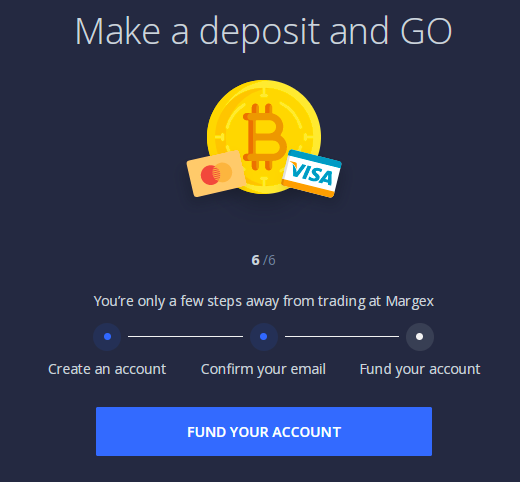

Getting started on Margex is a simple process. A user only needs an email address and a secure password to register an account. Once the account is registered, a user can verify their email and gain access to the platform.

The exchange offers different cryptocurrencies for trading including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and much more. The platform also supports fiat currencies such as GDP, AUD, and SGD. The minimum deposit is $10. Margex also offers about 8 trading pairs and the app is available on Google Playstore (Android) and App Store (iOS).

Margex Deposits and Withdrawals

A deposit can be initiated by a simple click. The deposited funds tokens are instantly transferred to the user’s open accounts. One deposit method permits users to deposit funds from their private wallets to the Margex account. The other is via a user’s bank account card.

Crypto assets can be purchased on Margex using a debit or credit card via the Changelly or Changenow widgets integrated with the platform which allows users to have the crypto assets deposited into their Margex wallet once their card payment is processed. Users can also utilise other third-party services. Initiating withdrawals is also straightforward.

When a user signs up to Margex, they are eligible for different incentives.

Trading on Margex Crypto Exchange

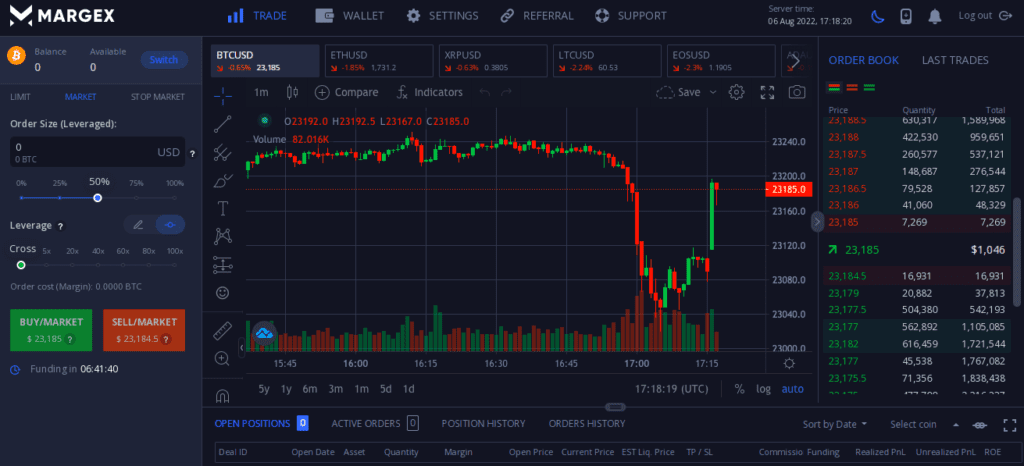

Margex offers demo trading to make it possible for beginner and experienced traders to test out their strategies using trading indicators without the risk of losing real funds. The demo trading feature also allows users to familiarise themselves with the different order types offered on Margex e.g. market, limit, and conditional orders which allow traders to lock in perpetual futures of price triggers when they occur during price volatility.

Strengths of Margex Trading Platform

- Margex’s main strength is its friendly user interface.

- The platform offers aggregated and deep liquidity trading pairs which makes it possible for users to access high liquidity, minimum slippage, and thinner spreads. Better entry and exit prices and instant market order execution is also made possible as a result.

- Offers many order types including limit, market and stop market orders. Users can also utilise protective stop loss and take profit functions to minimise risk and gain profits by closing positions automatically when asset prices reach the ‘stop loss’ or ‘take profit’ prices.

- Allows leverage trading at 100x for those with high risk appetites. Leveraged trading comes with enormous risks and traders are always advised to use extra caution when trading with leverage.

- Apparently Margex has a custom-built trading engine that is capable of processing up to 100,000 TPS.

- On Margex, a trader can trade any existing pair with a collateral of their own preference.

- The company claims to have a custom-built security protocol. According to Margex, all user funds on the platform are stored in segregated cold-wallet storage. The exchange accounts also come with 2FA, end-to-end data encryption, etc. They also have an MP-Shield artificial intelligence-based system which monitors data feeds from all liquidity providers for irregularities and denies suspicious trading activities such as spoofing and bluffing.

- 24/7 live chat and email customer support are available.

- KYC is not required to start trading.

Weaknesses of Margex Crypto Exchange

- Users can only withdraw funds once per day and only in Bitcoin.

- Competitor platforms such as FTX, Bybit, Phemex, Deribit, BitMEX, KuCoin, Bitget have deeper liquidity and more recognizable brands.

- The platform does not service traders from certain jurisdictions e.g. United States of America, Québec in Canada, Hong Kong, Seychelles, Bermuda, Cuba, Crimea and Sevastopol, Iran, Syria, North Korea or Sudan, or Afghanistan.

Margex Referral Program

Margex of 40% referral rewards to users who recommend others to the platform. Fees are generated from trading fees charged to users. Referral payments are made in BTC and the commission is automatically sent to the user’s Margex wallet.

Trading fees and Funding Rates on Margex

When an order is executed on Margex, it is charged a trade fee depending on the order Type used for example: maker fee: 0.019% (for LIMIT orders) and taker fee: 0.060% (for MARKET orders).

Funding rates are typically linked to a ‘current ratio of Longs to Shorts’ and the underlying market volatility. Funding costs on Margex are due every 8 hours at 00:00, 08:00 and 16:00 UTC. No funding will be charged If a position is closed before the funding cut-off time. Users can check the funding countdown timer on the Trade page, at the bottom of the order placement module.

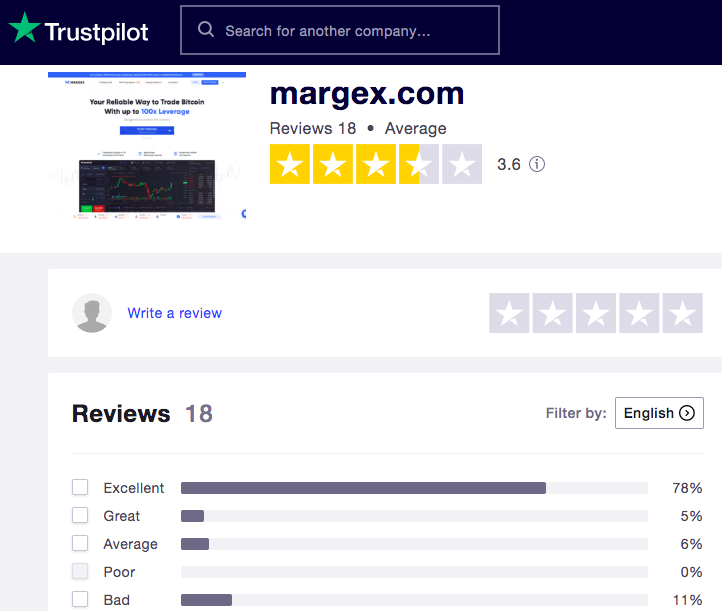

Is Margex A Good Exchange? Margex Crypto Exchange Reviews

Margex has decent customer reviews. Generally, there’s not a lot of information regarding the team etc. However, the platform is simple, easy to use and conveniently available on any device.

The exchange is predominantly a leverage trading platform, thus users with limited crypto trading experience are advised to exercise extra caution when using platforms such as Margex and other crypto derivatives platforms e.g. BitMEX, Huobi, KuCoin, Phemex, Bybit and others. Margex is still fairly new to the market which means it has room to grow but that could also mean that it may face a lot more challenges that come with growing a crypto exchange and earning a top-tier reputation especially when there are so many other good alternative platforms users can choose to use e.g. BTSE and FTX. Remember, do your due diligence and learn how to avoid crypto trading risks as much as possible.