Maximizing Profits with AI-Driven Crypto Arbitrage Strategies

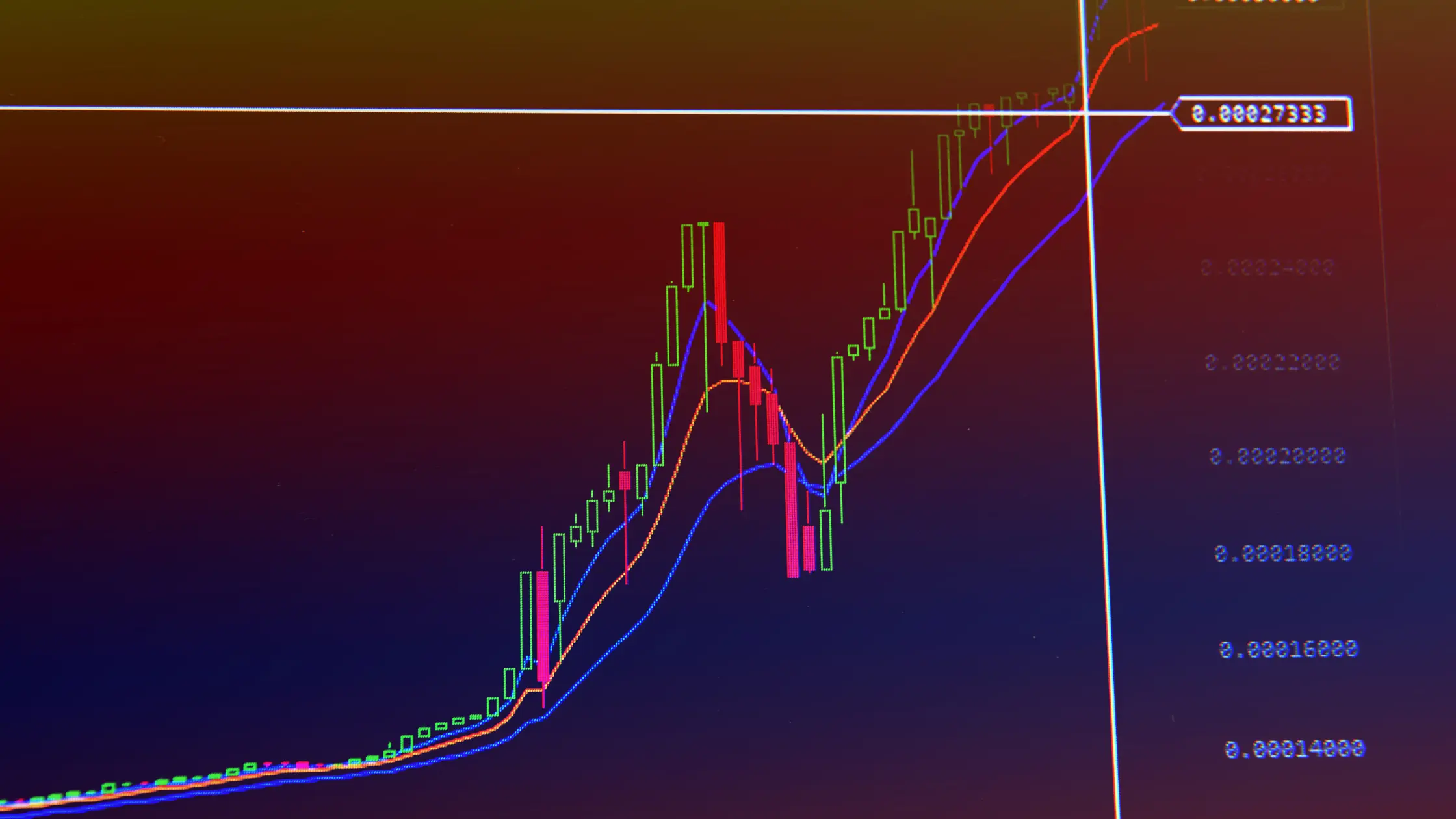

In the fast-paced world of cryptocurrency trading, arbitrage opportunities arise from the price discrepancies of the same asset across different exchanges or trading pairs. Exploiting these opportunities manually can be challenging due to the rapid pace at which prices change and the need for constant monitoring. Enter AI-driven arbitrage strategies – sophisticated, automated systems designed to identify and capitalize on these price differences with precision and speed. This article explores how AI can be leveraged to develop and execute arbitrage strategies in the crypto markets, enhancing efficiency and profitability.

Understanding Arbitrage in Crypto Markets

Arbitrage is the practice of buying an asset in one market at a lower price and simultaneously selling it in another market at a higher price, thus profiting from the price difference. In the context of cryptocurrency, arbitrage opportunities can be categorized into:

- Spatial Arbitrage: Exploiting price differences of the same asset across different exchanges.

- Triangular Arbitrage: Taking advantage of price differences between three different trading pairs within the same exchange.

The Role of AI in Arbitrage

AI-driven arbitrage strategies leverage machine learning algorithms, real-time data processing, and automation to identify and exploit arbitrage opportunities more effectively than human traders. Here are the key components and processes involved in designing an AI-driven arbitrage system:

Data Collection and Real-Time Monitoring

Data Collection

AI systems rely on vast amounts of data to function effectively. For arbitrage, this involves collecting real-time price data, order book data, and transaction fees from multiple exchanges. Connecting to exchange APIs is essential for continuous data feeds.

Real-Time Monitoring

AI algorithms monitor prices across various exchanges and trading pairs in real-time. This continuous monitoring allows the system to detect arbitrage opportunities the moment they arise.

Feature Engineering

Feature engineering involves creating informative features from raw data that can be used by AI models to identify arbitrage opportunities. Key features include:

- Price Differences: Calculating the price differences of the same asset across different exchanges or pairs.

- Transaction Fees: Including fees in the calculation to ensure the arbitrage opportunity is profitable after accounting for costs.

- Liquidity Metrics: Assessing the depth of the order book to ensure sufficient liquidity for executing trades without significant slippage.

Machine Learning Models

Model Selection

Selecting the right machine learning models is crucial for accurate prediction and decision-making. Common models used in AI-driven arbitrage include:

- Regression Models: Predicting price movements and differences.

- Classification Models: Identifying whether an arbitrage opportunity exists.

- Reinforcement Learning: Learning optimal trading strategies through trial and error.

Model Training

Training these models involves feeding them historical and real-time data. The models learn to identify patterns and make predictions about future price movements and arbitrage opportunities.

Strategy Execution

Trade Execution Engine

A critical component of the AI-driven arbitrage system is the trade execution engine. This engine is responsible for placing buy and sell orders across different exchanges simultaneously. Key considerations include:

- Low Latency: Ensuring trades are executed quickly to take advantage of short-lived arbitrage opportunities.

- Order Splitting: Splitting large orders to minimize market impact and avoid significant slippage.

Smart Order Routing

Smart order routing algorithms direct orders to the most favorable exchanges, considering factors such as price, liquidity, and fees. This ensures the most efficient execution of arbitrage trades.

Risk Management

Effective risk management is essential to protect profits and mitigate losses. Key risk management strategies include:

- Position Sizing: Determining the appropriate trade size based on risk tolerance and market conditions.

- Stop-Loss Mechanisms: Automatically exiting trades that move against the predicted direction to limit losses.

- Diversification: Spreading arbitrage activities across multiple assets and exchanges to reduce exposure to any single market.

Continuous Learning and Adaptation

The cryptocurrency market is highly dynamic, with conditions changing rapidly. AI-driven arbitrage systems must continuously learn and adapt to these changes. Implementing a feedback loop where the system learns from past trades and adjusts its strategies accordingly is crucial for maintaining long-term profitability.

Advantages of AI-Driven Arbitrage

- Speed and Efficiency: AI systems can process vast amounts of data and execute trades much faster than humans.

- Accuracy: Machine learning models can identify subtle patterns and opportunities that may be missed by manual analysis.

- Automation: Reduces the need for constant human oversight, allowing traders to focus on strategy development and optimization.

- Scalability: AI systems can monitor and trade across multiple exchanges and assets simultaneously, increasing the scope of arbitrage opportunities.

Challenges and Considerations

While AI-driven arbitrage offers significant advantages, it also comes with challenges:

- Data Quality: Ensuring the accuracy and reliability of data from multiple sources is crucial.

- Latency: Minimizing latency in data processing and trade execution is essential to capitalize on fleeting arbitrage opportunities.

- Regulatory Compliance: Navigating the regulatory landscape for automated trading and arbitrage across different jurisdictions can be complex.

Conclusion

AI-driven arbitrage strategies represent a powerful tool for traders looking to exploit price discrepancies in the cryptocurrency market. By leveraging advanced machine learning algorithms, real-time data processing, and automated trade execution, these systems can identify and capitalize on arbitrage opportunities with greater speed and precision than ever before. As technology continues to evolve, AI-driven arbitrage is poised to become an increasingly integral part of the trading landscape, offering new avenues for profitability and efficiency.