Mute zkRoll-up DeFi Platform Review

Automated market maker (AMM) exchange, farming platform, and bond platform

Fundamentally, Mute is a DeFi platform that provides a liquidity nexus for all protocols developed on zkSync. In particular, Mute’s primary application, the Mute Switch, functions as an AMM DEX with limit orders, a yield farming platform, and a bond platform. Mute offers a way for protocols on zkSync to effectively encourage liquidity for their specific applications.

Mute Switch

The Mute Switch is a zkRollup-based DeFi platform constructed on zkSync v2. Engage in investments and trading, generate returns, and partake in Bonds within a single decentralized, community-oriented platform. Enjoy the safety of Ethereum without the burden of excessive gas fees.

Features include:

- AMM based DEX w/ Limit orders

- Stable and Normal AMM curve pools

- Variable LP fees: Stable (0.01%-2%), Normal (0.01%-10%)

- Fixed and Dynamic Protocol fees

- 0% LP minting fee

- 1-3s settlements

- 95%+ gas cost savings compared to L1 ETH

- Yield Generation Platform

- Bond Offerings

- DAO

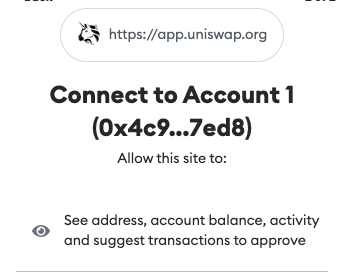

Mute Wallet

Mute Switch is a Layer 2 Dex based on zk-Rollup technology. You first need to deposit assets from your Layer 1 ETH wallet to your Layer 2 zkSync wallet to experience gas-free and real-time token transfers and swaps. With the wallet, you can have total control over your assets through private keys, your assets will be stored safely inside a verifiable zkRollup and you can withdraw your assets to the Layer 1 wallet at any time.

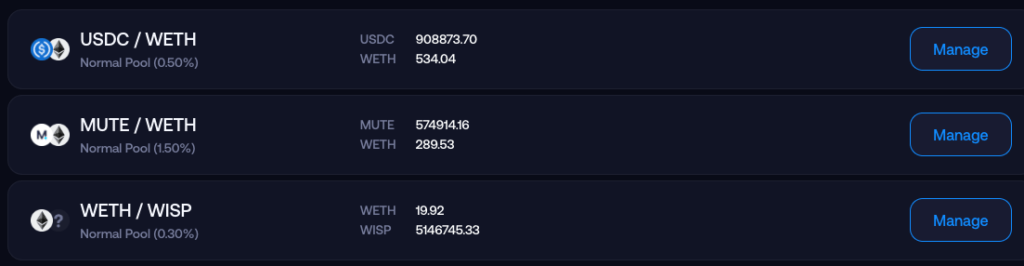

Liquidity Pools

Pool Structure

The Mute Switch features a dynamic arrangement for Liquidity Pools, enabling the use of both Stable and Normal AMM curves.

Stable Pool – Assets trading within a narrow price range (e.g., USDC/DAI)

Normal Pool – Assets trading without correlation (e.g., ETH/WBTC)

Both Normal and Stable pools can exist for the same assets, with the Mute Switch identifying the most favorable trade irrespective of pool variety.

Fees for each pool operate independently from others. Each pool type has a minimum-maximum fee that can be determined by LPs:

– Stable: 0.01%-2%

– Normal: 0.01%-10%

Stable Pools

Stable pools cater to assets expected to trade within a narrow price range, enabling high volume trades to enjoy capital-efficient swaps. Once pricing is established during pool creation, the trade price retains a tight spread – ensure accurate pricing for these pools.

Normal Pools

Normal pools accommodate non-correlated and volatile-priced assets. These pools employ a standard AMM formula and are suitable for most trading pairs.

Dynamic Pools

The Mute Switch supports pool creation with LP fees ranging from 0.01% up to 10% for normal pools and 2% for stable pools. These fees can only be altered through the LP governance system once established during pair creation. An LP provider (or delegated provider) possessing 50%+ vote weight can always modify this fee. To avoid exploitation, a 0.1% fee is imposed on total votes when adjusting pool fees, preventing flash loans from altering fee structures without incurring losses.

This straightforward dynamic fee pool with governance offers a potent system and tool for numerous DeFi and crypto projects.

Game Theory

Analyzing traditional CEX markets and even most NFT marketplaces reveals that fees of 1%+ are standard for market makers (spread) and content creators & teams (NFTs). This fee system empowers not only individual LP providers but also projects focusing on Protocol Owned Liquidity (POL) to set their base fee for their pairs, allowing them to develop a more substantial revenue stream compared to what is available on most conventional AMM-based DEXs.

Governance

The Mute Switch features a pre-built LP governance and delegation system, facilitating the development of complex protocols on top of the Mute Switch protocol while enabling dynamic fees within any LP pool.

Each LP pool has an LP fee established during pair creation, ranging from 0.1% to 10% based on the LP provider’s preference as the pool creator. Only one fee can be set at a time, ensuring that all LPs participate within that fee range.

The LP governance system permits pool fee adjustments based on an account controlling over 50% of the pool votes. Votes correspond directly to LP token supply balances. However, an LP provider may decide to delegate their ‘votes’ to another provider, enabling parties to campaign for delegates and increase their pool weight.

Mute has chosen this design over a multi-fee pool type for several reasons; the main one being that the pool with the most substantial liquidity will always be traded compared to its counterparts (pools with lower fees and less liquidity). Consequently, it is more advantageous to centralize liquidity within a single pool and implement a governance system that allows for dynamic fees.

Protocol Fees

The protocol has 2 type of fees:

- Dynamic (% of the LP pool fees)

- Fixed (fixed % of the overall trade)

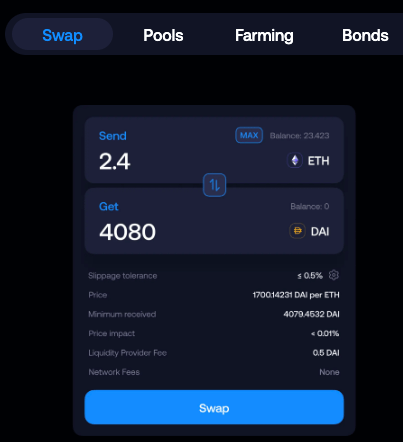

Limit Orders

Limit orders on the Switch employ the native AMM as a provider of liquidity and inventory. As a result, limit orders may experience significant or minimal slippage, depending on the order volume and liquidity depth of the traded pair.

Regardless of whether a limit order causes a 10% slippage on the AMM pair being traded, the limit order owner still receives the amount for which the order was placed.

For limit orders to function, there is an open market of market-making bots that scan and execute trades based on their strategies and fees.

A visualization:

A limit order is placed to buy token X with 1 ETH. Once the order is created and approved, it will be filled when the AMM can support that purchase without any loss to the market-making bots. Due to the nature of smart contracts, manually placed events like limit orders are not executed automatically. Instead, an open market of bots continuously scans limit orders to identify those that can be filled with any additional fees the bots want to charge. This free market encourages competition, ensuring that fees remain low. Bot fees do not affect what the limit order receives, only the execution price at the AMM level.

If your order cannot execute without causing a 10% slippage because the native pair’s liquidity is low compared to the trade, the trade will execute once token X is trading at a minimum of -10% of your purchase price. This is because executing the limit order will increase the AMM pair price by 10%, and to fill the limit order with the requested amounts, this is the minimum deviation that needs to occur for the order to fill successfully. Although the AMM pair experiences slippage in this case, the limit order is filled at the requested price.

Additionally, there is the opportunity for inventory-based market-making.

Mute Bonds

Bonding involves exchanging MUTE-ETH LP shares for MUTE tokens with the Mute DAO. The protocol offers a specified amount of MUTE and a vesting period for the trade. It’s crucial to understand that when you buy a bond, you are selling your LP shares/tokens. The Mute DAO compensates you with more Mute than you would receive on the market, but your exposure shifts entirely to Mute and no longer to MUTE-ETH LP.

The objective of Mute bonds is to augment the Protocol Owned Liquidity through the Mute DAO, which boosts the treasury revenue and long-term liquidity for the protocol. Bonding allows users to acquire Mute at a reduced cost basis, providing them with a benefit.

Bonds are available on a first-come, first-served basis.

Mute Token

Mute is the gas that powers growth of the entire ecosystem via the Mute DAO & revenue based funding proposals.

The Mute ecosystem benefits directly through a revenue based buy back and make initiative used to fuel ecosystem growth.

Tokenomics

Max Supply

40,000,000 $MUTE

Circulating Supply

40,000,000 $MUTE

Token Allocation

Mute initially emerged as a proof-of-work blockchain network, aiming to develop a layer-two solution utilizing zero-knowledge proofs. The project eventually shifted to the ERC-20 standard and started building on zkSync. Throughout this evolution, Mute stayed dedicated to fairness and decentralization. It was introduced fairly, without an ICO, pre-seed, or early investments, and it was GPU mineable. Around 10% of block rewards were designated for the Mute treasury. The transition from Mute’s native chain to ERC-20 was executed via a 1:1 coin/token swap. All swaps were performed transparently and can be verified on the Ethereum Blockchain through Etherscan.

Approximately 8% of the total Mute token supply resides in the Treasury wallet. These funds are being utilized to support Mute’s ongoing development, and the treasury address’s history and movements can be monitored. In the future, the DAO will control the treasury and its L2 assets via dMute.

Moreover, Mute has incorporated a side token called VOICE into its total supply. As part of this integration, VOICE token holders could exchange their tokens for Mute tokens at a 1:197.55 ratio. The resulting Mute tokens are factored into the project’s total supply, and VOICE token holders can still perform this swap using the smart contract. You can learn more about this here.

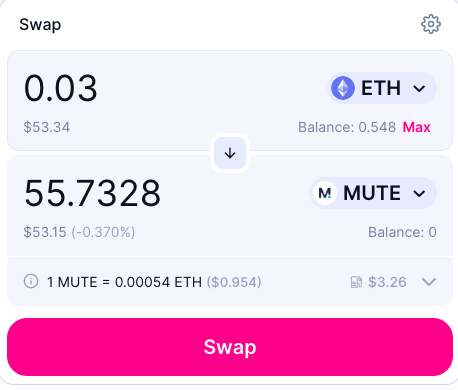

In order to purchase MUTE tokens, simply go to Uniswap.

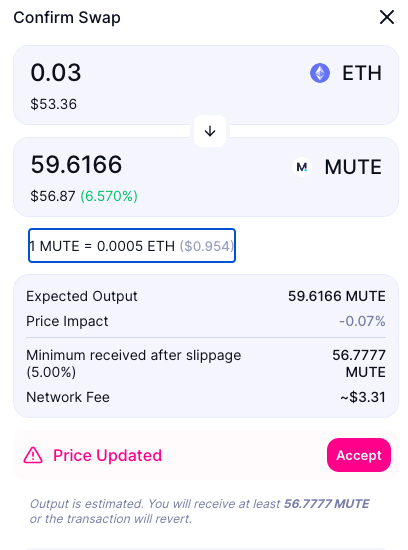

Price quotes can be adjusted pretty quickly on DEXes so always check you are happy with the order price.

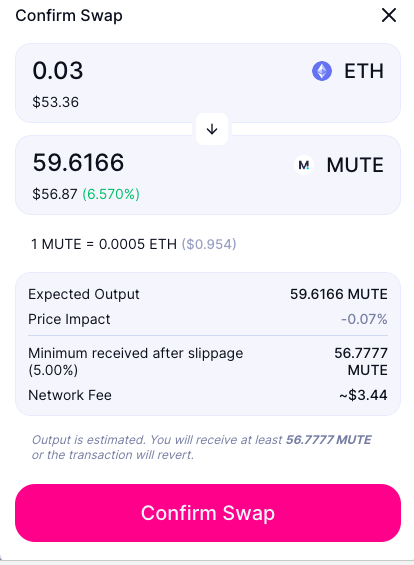

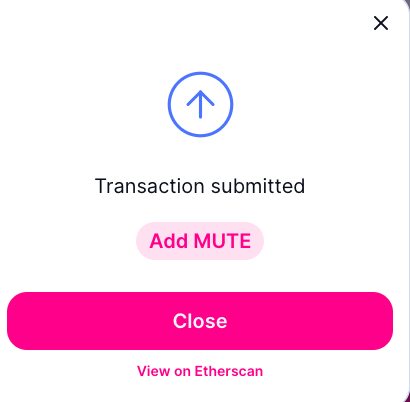

Pay the gas fee and confirm the transaction.

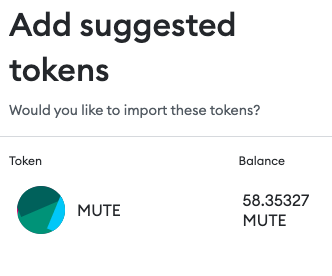

You can then add the token to your web3 wallet.

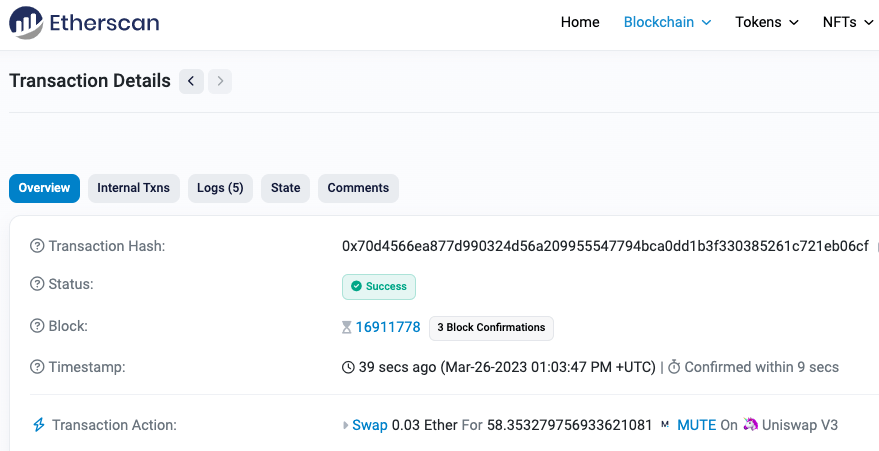

You can check if the tokens have been credited to your wallet and you can also verify the transaction on Etherscan.

The Team

The Mute team possesses extensive experience with Zero-Knowledge protocols in the crypto sphere. Prior to Mute, the team developed the first Zero-Knowledge Atomic Swap protocol between BTC and UTXO-based chains, as well as pioneering work on Zerocoin and Sigma addressing schemes and transactions. They now apply their knowledge and skillset to Mute and their latest endeavor: the Mute DAO. Boasting a team with a history of innovation and proficiency, Mute is poised to emerge as a key contender in the zkDeFi domain by building on zkSync and delivering lasting value to its community.

Find out more about Mute

Twitter: @mute_io Discord: mute Telegram: t.me/mute_io Medium: blog.mute.io

Check out reviews of other top zkRollup platforms such as ZigZag and Scroll.