Mycelium Perpetual Swaps Decentralized Derivatives Exchange Review

What is Mycelium?

Formerly known as Tracer DAO, Mycelium builds financial market infrastructure on public blockchains. Mycelium specialises in data provision via the Mycelium Node and a derivatives exchange Mycelium Perpetual Swaps which makes it possible for users to open leveraged long and/or short positions on digital assets.

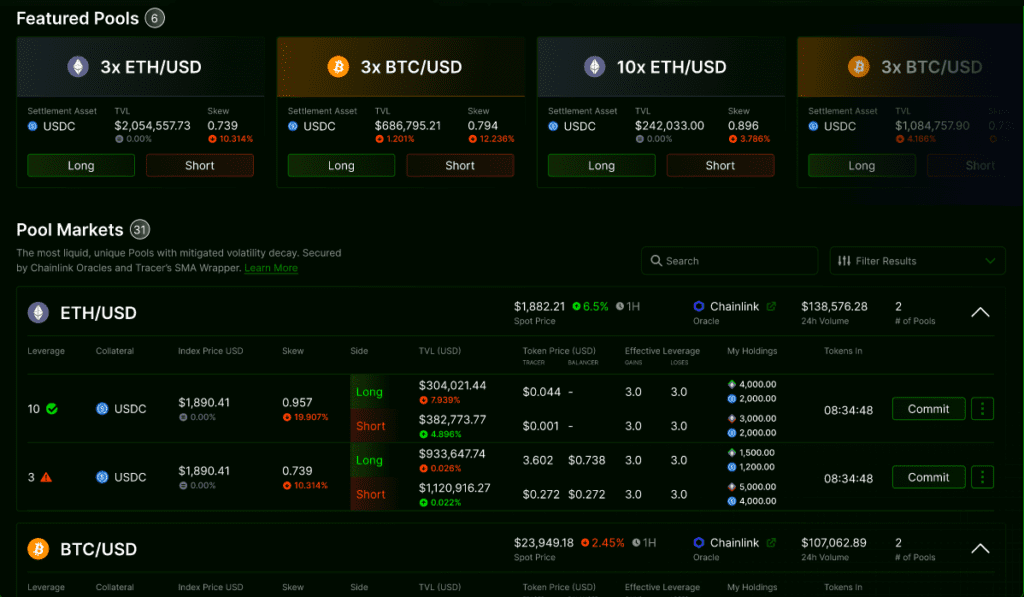

Users trade against the Mycelium Liquidity Pool (MLP) which is comprised of a basket of blue-chip assets and stablecoins that are pooled together. The pool acts as a global leveraged trading automated market maker (AMM) and a universal counterparty to traders. Essentially, the liquidity pool agrees to be the counterparty to any long or short trade at the given price, for an asset it holds, until it runs out of that particular asset. MLP also allows traders to swap between any two assets in the pool, stablecoins included.

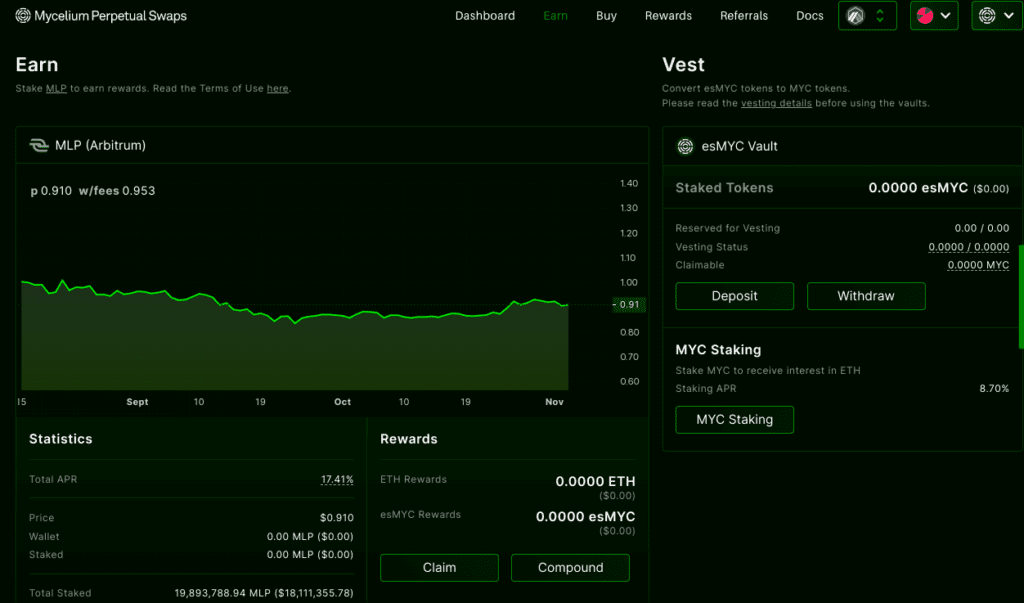

On Mycelium, liquidity providers are able to deposit any whitelisted asset into the MLP pool in return for MLP tokens, which represent the liquidity provider’s share in the diversified liquidity pool. Liquidity providers have exposure to potential capital appreciation of the MLP token if long exposed to the base assets such as ETH or BTC in the pool. Liquidity providers or holders of MLP tokens are capable of earning income from trading fees in the form of ETH rewards and esMYC rewards which come in the form of a token which has the right to vest over six months into $MYC i.e. when staked in the esMYC vesting vault. The MLP token performance is easy to track.

What Makes Mycelium Perpetual Swaps DEX Unique?

Traders that use Mycelium Perpetual Swaps can expect:

- Low fees i.e. 0.09% entry and exit fees to maximise trading profits.

- Frequent rewards i.e. every fortnight, if a user is in the top 5% of traders they can earn 5% of fees.

- Good liquid markets for BTC, ETH, UNI, BAL, LINK, CRV and FXS.

- Up to 30x, with liquidations set at 100x in order to minimise risk.

MLP Staking

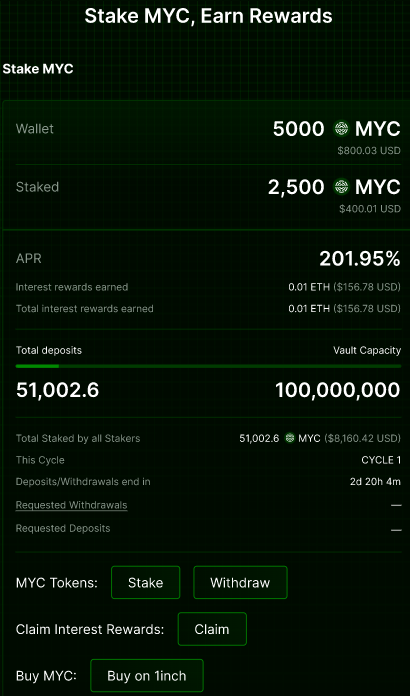

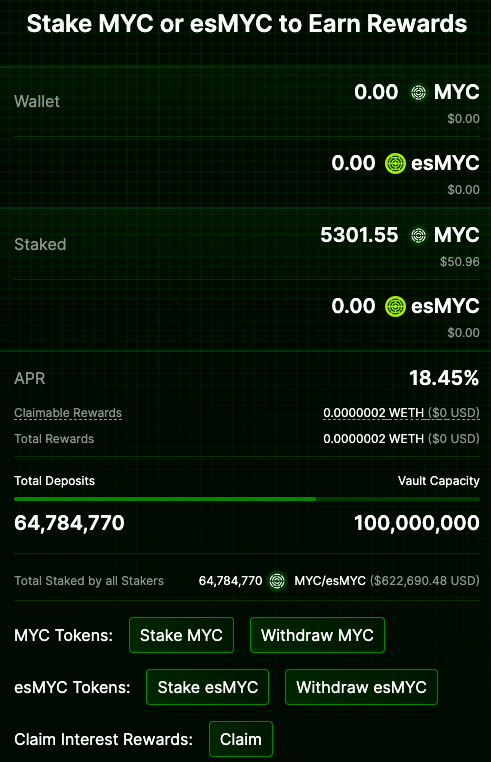

Mycelium aims to provide maximum utility to $MYC token holders. Millions of MYC tokens are lent to the Mycelium Treasury, with rewards as high as 269% that are paid in ETH. When a staker deposits MYC, they are essentially entering into a loan agreement with the Mycelium Treasury to start earning the rewards.

MYC staking provides MYC token holders with the opportunity to earn ETH rewards on their idle MYC. By simply depositing MYC into the vault, MYC holders can start to earn staking rewards that are paid on a continuous basis. MYC staking is hosted on Arbitrum. This means that in order to participate, MYC holders would need to bridge their assets. What’s nice about Mycelium is that there are no minimum deposits of MYC and the MYC staking program is made available to all holders irrespective of the size of their holdings. If a staker wishes to claim their rewards, they can simply do so via the Claim button. At present, the program doesn’t come with an auto-compounding feature, however, the team is said to be working on making this feature available to users.

Getting started with MYC staking is simple. Visit stake.mycelium.xyz. It is important to remember that MLP stakers indeed earn rewards via a combination of ETH rewards i.e. fees that are generated from swaps and leveraged trading converted to ETH. They can also earn via market making i.e. a small spread on the long tail assets including LINK and UNI for example, which accrues to MLP holders through the appreciation of the MLP token, and esMYC.

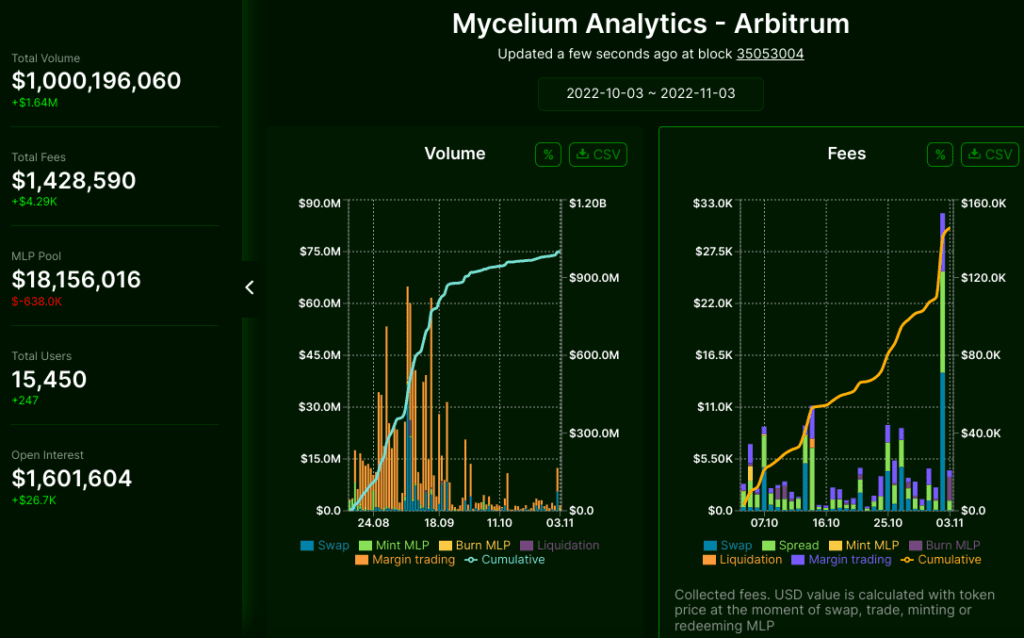

MLP holders earn 70% of fees generated on the platform and MLP returns target a yield of 25% APR through a combination of esMYC distributions and ETH earned by fees. According to empirical analysis of the platform, MLP holders have earned between ~20-45% APR.

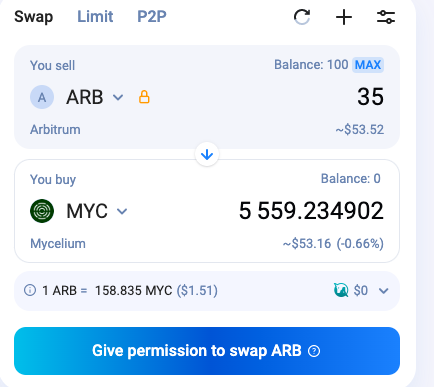

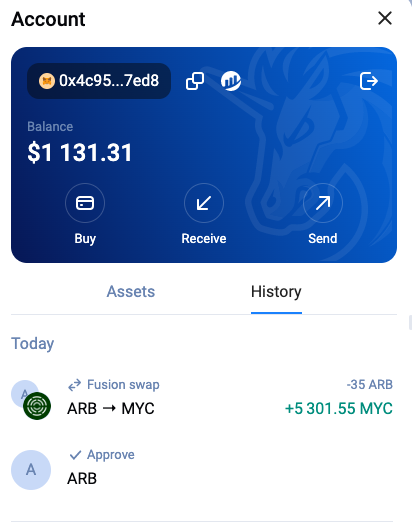

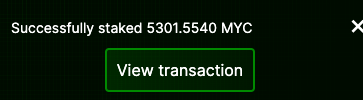

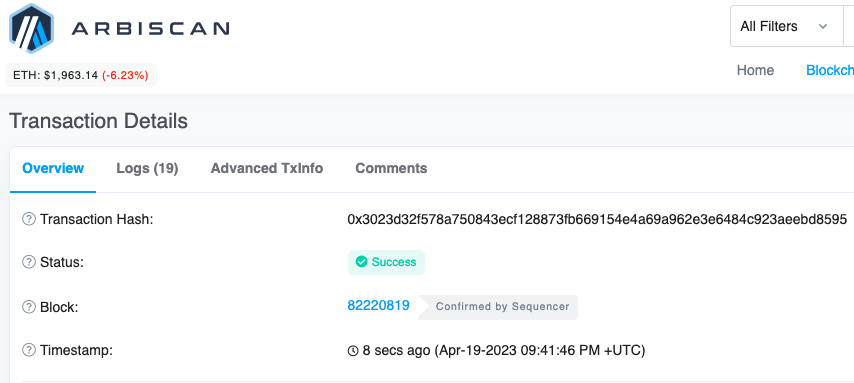

To stake, first purchase some MYC tokens. You can do this most conveniently by using 1inch. As you can see in the example below, we swapped ARB tokens for MYC.

Give the necessary approvals to the smart contracts to be able to access your tokens.

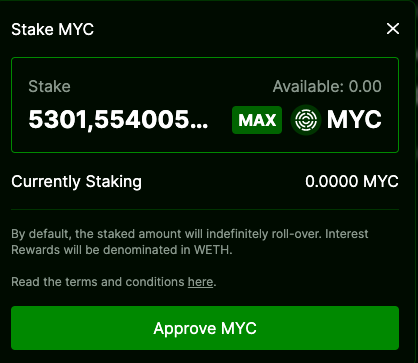

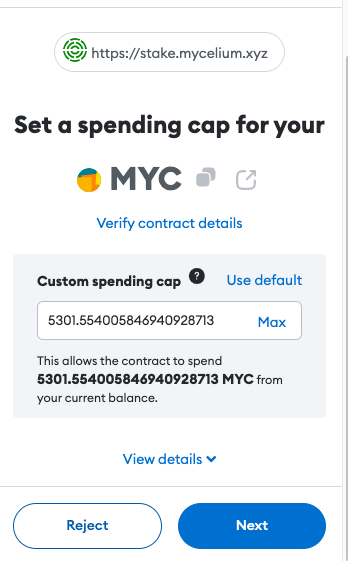

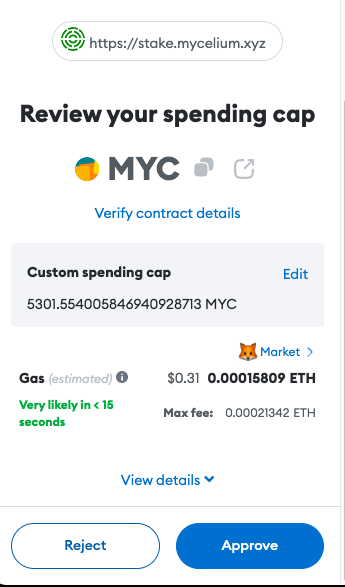

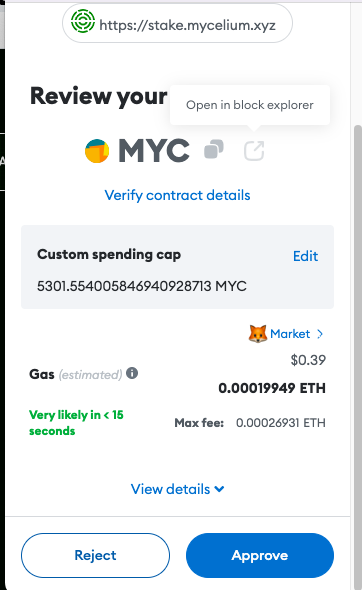

Set your spending cap.

Pay the associated gas fees.

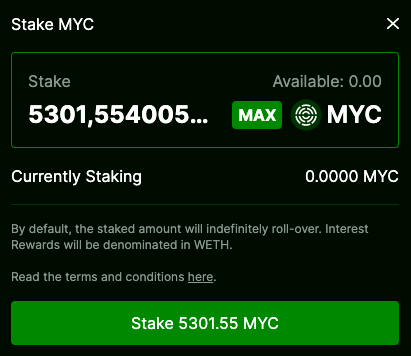

Now you can proceed to stake your MYC tokens.

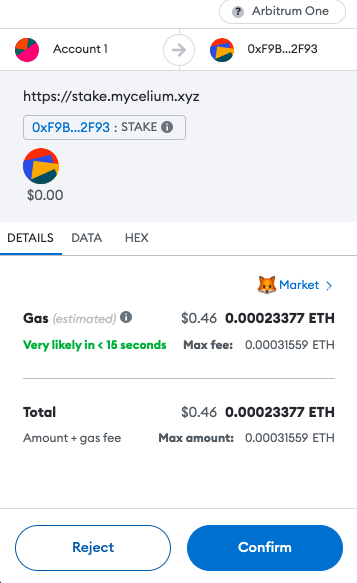

Once again pay the gas fee.

Check Arbiscan for confirmation.

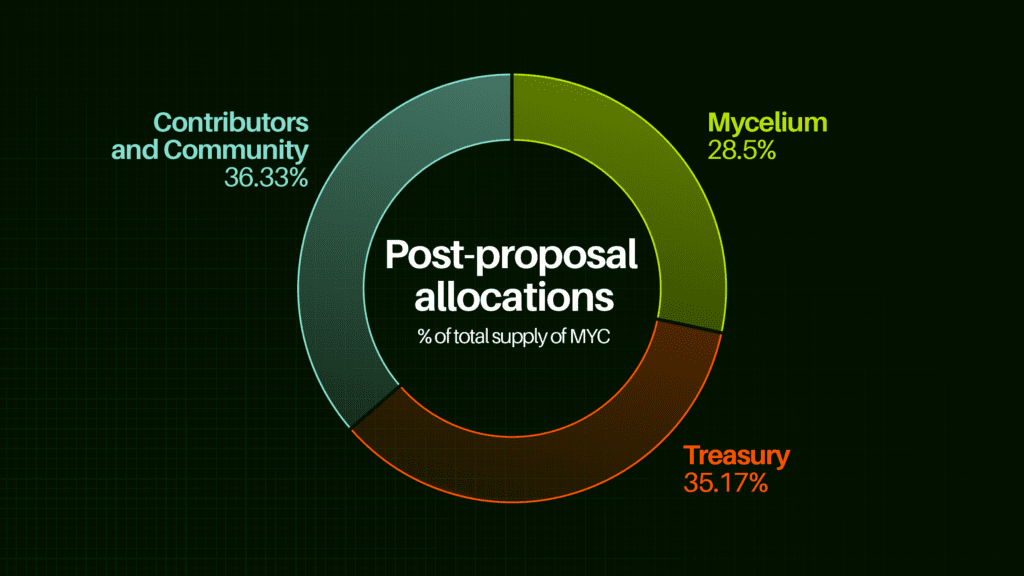

MYC Token

MYC is a utility and governance token of the Mycelium ecosystem. $MYC holders are able to participate in MYC Staking and this gives MYC holders the opportunity to earn rewards.

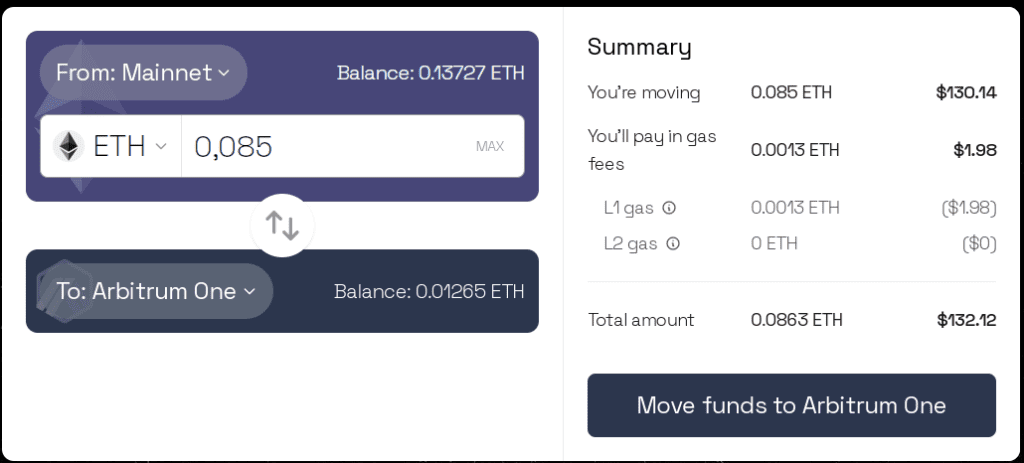

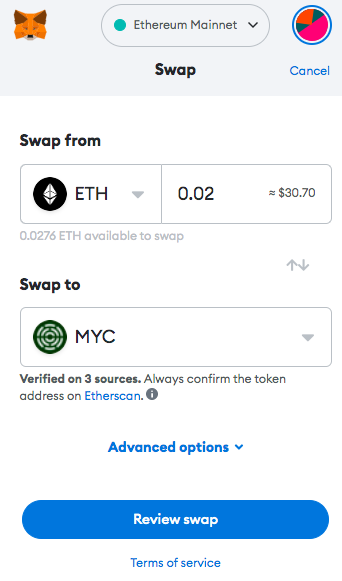

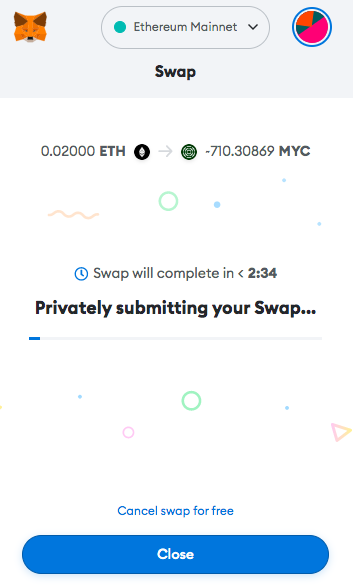

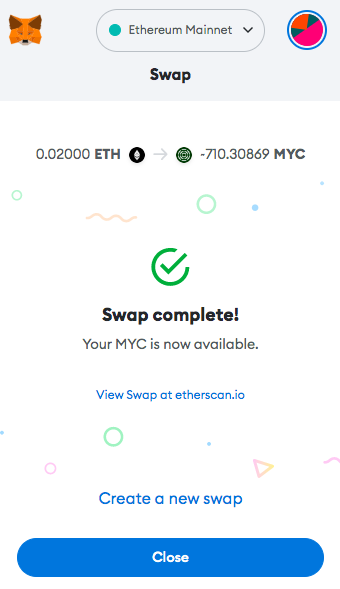

In order to purchase MYC, I deposited ETH to my ETH wallet on Arbitrum. In order to do so, I had to bridge some ETH from the Ethereum blockchain on my MetaMask wallet using the Arbitrum bridge. Users can also trade on Mycelium Perpetual Swaps using a web3 wallet such as Metamask.

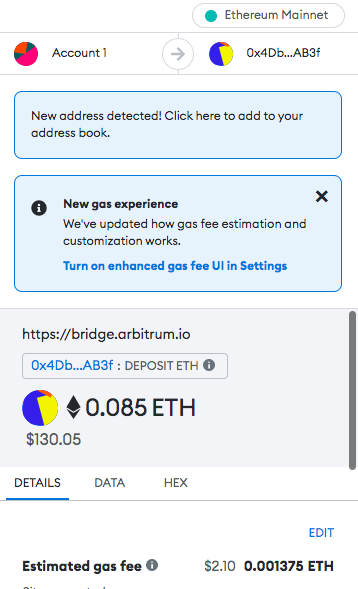

I then had to authorise the transaction in MetaMask.

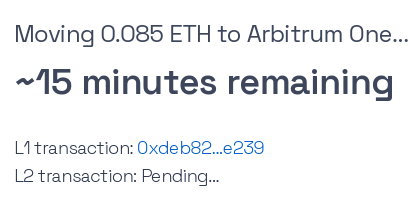

Once that was sorted, I could then wait for my ETH wallet on Arbitrum to be credited.

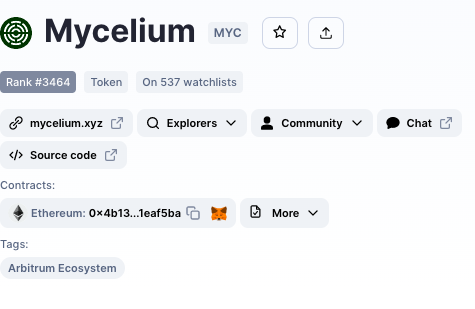

Okay, so things didn’t go as planned but let’s still document process here. After bridging ETH to Arbitrum, we actually remembered that we can’t swap from a wallet on Arbitrum network. Can only use another decentralised exchange e.g. SushiSwap to execute trades on Arbitrum. In addition, also found out that MYC tokens are actually on the Ethereum network so then proceeded to add the contract address to MetaMask. Coinmarketcap makes it easy for you to do that but you should always verify the token address on Etherscan.

Once I had the token specs in my MetaMask, I then proceeded with a test transaction.

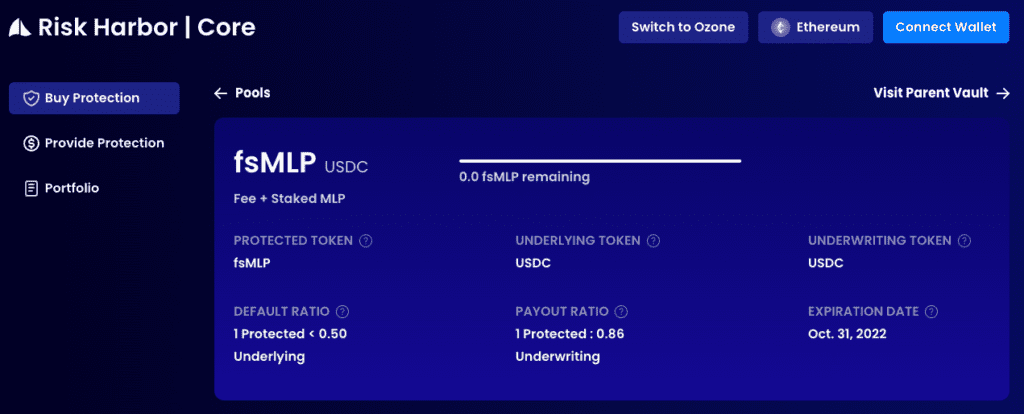

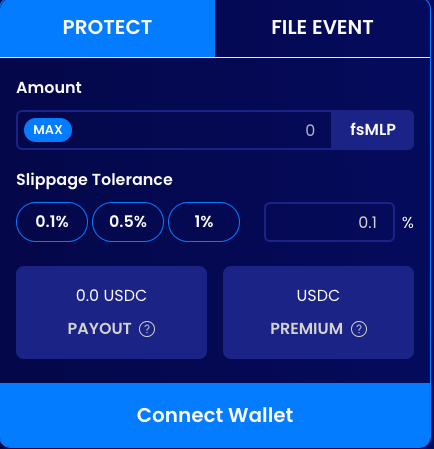

MLP Insurance

Mycelium pool offers protection on the liquidity token that represents liquidity providers’ positions i.e. MLP. A user is able to file an event and have it paid out within three blocks. This is if the price of MLP falls below a threshold as determined by MLP assets under management or the MLP supply. This covers a range of risk types including rug pulls, smart contract exploits, the volatility of unstable assets, governance attacks, and other risks that could significantly impact or reduce the MLP assets under management or MLP supply ratio.

Policyholders are paid out in USDC if any hacks occur. However, if USDC loses its 1:1 peg to the US dollar, the underwriting capital will maintain its value. Additionally, if say another protocol in the vault does suffer a default event before this pool does, the vault is in a position to potentially default and then be unable to pay out the full value of the protection.

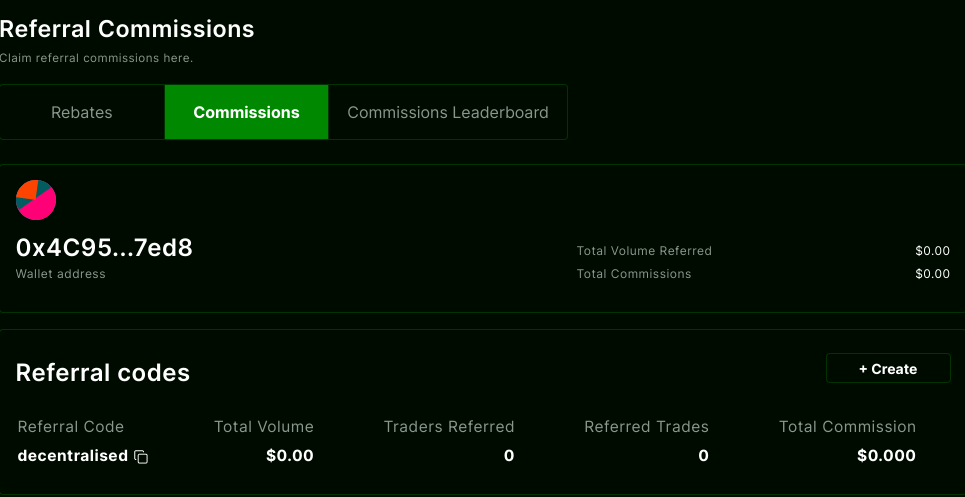

Mycelium Perpetual Swaps DEX Referral Program

Mycelium has a good referral program that people can choose to participate in.

There are prizes that can be won for referring traders to the platform.

Conclusion

Mycelium Perpetual Swaps decentralized derivatives exchange is one of the few crypto derivatives exchanges that offers decentralized trading. Others include Gains and Premia. These differ from centralized crypto derivatives trading platforms such as Bybit, BTSE, CoinW, Deribit, Binance, Huobi, OKX, KuCoin, BitMEX, FTX, etc. Users should always be aware of the risks involved in crypto trading. Check out some tips on how to trade digital assets.