MyConstant P2P Lending Platform Review

What is MyConstant?

MyConstant was launched in 2019 and is operated by CONST LLC. Initially, the project was meant to establish a stablecoin, however, shortly after creating its stablecoin CONST, the project team pivoted to focus on building a platform for investing in global peer-to-peer (P2P) lending with USD or crypto. Zon Chu is the Co-founder and CEO of MyConstant and the company has its headquarters located in Riverside California, USA.

It is important for users to understand that MyConstant is not a bank or deposit account, nor is it a regulated financial institution. The company does not pay interest on any funds or other assets held in a user’s MyConstant account and all assets directly held by the company are not insured by the company, any third party or any government agency. In fact, MyConstant works with independent third-party financial institutions such as Prime Trust to provide cash management for the fiat deposits. According to MyConstant, during times when the fiat deposits are not loaned out, they are held in one or more depository accounts at US banks or trust companies whose deposits may be insured. MyConstant claims to have over 200,000 customers in over 200 countries across the globe.

MyConstant is a platform that allows users to swap one asset for another, and borrow against their portfolios. When a user invests, they first send funds to MyConstant’s custodial partner Prime Trust, an accredited US financial institution. MyConstant then lends on behalf of the customer to collateralized borrowers, liquidity pools, and decentralized exchanges in return for interest. When the time comes when the customer wishes to make a withdrawal, Prime Trust will process the withdrawal request.

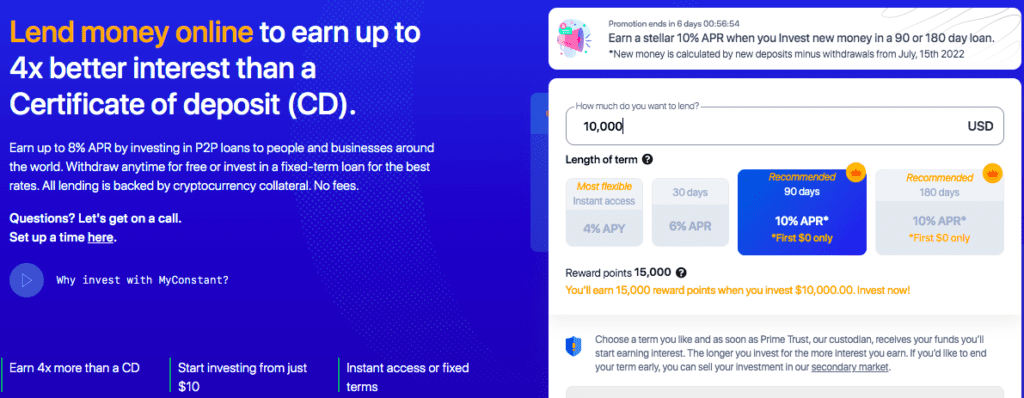

MyConstant does not charge fees for fiat (USD etc) withdrawals. The customer gets to keep the interest earned up to the moment they withdraw the funds. Customers can choose the instant access account or invest for a fixed term.

MyConstant’s instant access account has a 24-hour term that’s automatically extended every 24 hours unless the customer chooses to disable the product or withdraw their funds.

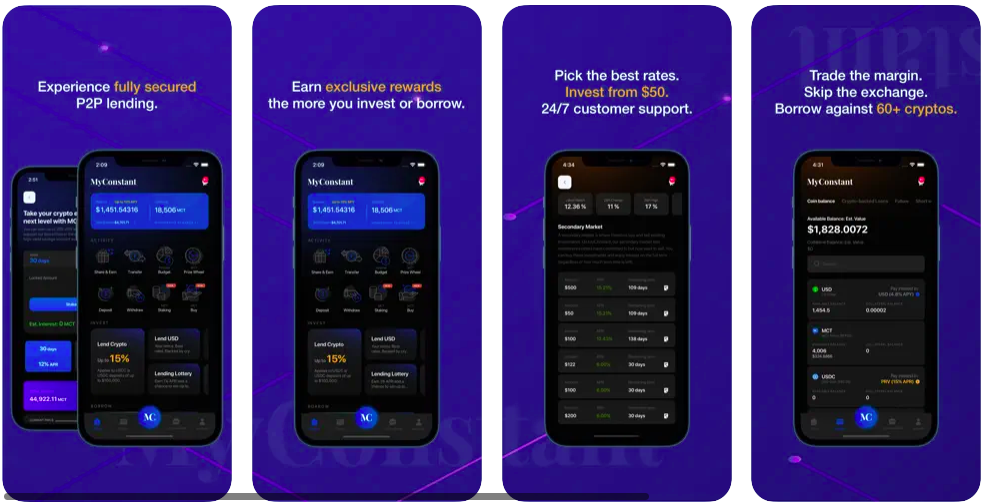

MyConstant provides customers with a user-friendly app which is available on the App Store and Google Play Store.

Why Choose MyConstant?

MyConstant loans lenders’ money to borrowers by putting funds into a liquidity pool and lending directly from the pool in the Flex program. The other way is the non-Flex p2p program in which the individual borrowers are matched with lender funds. MyConstant doesn’t use the liquidity pool of the Flex program but instead in this program, the platform plays matchmaker on rates and terms between borrowers and lenders.

MyConstant has a membership program with three tiers with additional benefits i.e. Gold, Platinum and Diamond. The benefits range from USD credited to user accounts or partial interest earned by friends referred to the platform.

Lending

With MyConstant, users can lend crypto and earn up to 12.5% APY on stablecoins e.g. Tether (USDT), USD Coin (USDC). Users can also earn 4% APY on digital assets such as Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Dai (DAI), Solana (SOL), Polkadot (DOT), Chainlink (LINK), Polygon (MATIC), ApeCoin (APE), and Basic Attention (BAT). Interest is compounded every second on transactions and users can withdraw the interest and principal anytime without need to worry about additional fees, penalties, or lock-ups.

Borrowing

Users of MyConstant can borrow cash or stablecoins from rates that are as low as 0% APR. Users can borrow against their digital asset portfolio if they wish to raise capital quickly without selling off their assets. Borrowers and lenders are matched instantly on the p2p platform and funds can be disbursed in a matter of minutes. MyConstant also claims that users can repay their loans in $MCT tokens or over 80 other different cryptocurrencies, stablecoins, or fiat USD with no repayment penalties.

Those who choose to use MCT tokens can get discounts and rewards and pay as little as 3.6% APR on loans. They also can get up to 4 extra Lending Lottery tickets, up to 90% discount on swapping fees from only 0.01%. Double referral rewards i.e. $20 + 20% referee interest is also payable when using MCT.

Crypto-backed business loans

MyConstant claims to be able to provide up to $10 million in business loans with no credit checks and borrowers can use different types of crypto collateral and also customize their loans while getting competitive interest repayment rates.

Asset support

MyConstant supports a number of crypto assets including ZRX (ZRX), Fantom (FTM), Stellar (XLM), Harmony (ONE), yearn.finance (YFI), Compound (COMP), SushiSwap (SUSHI), Curve DAO Token (CRV), Balancer (BAL), Aave (AAVE), Axie Infinity (AXS), Avalanche (AVAX), NEAR Protocol (NEAR), The Sandbox (SAND), Uniswap (UNI), Biconomy (BICO), Cosmos (ATOM), and many others.

Futures on MyConstant

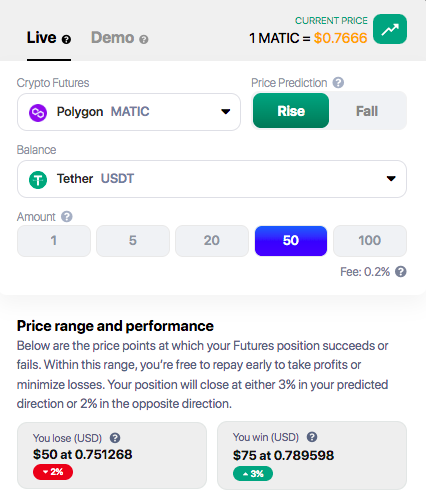

Users of MyConstant have access to prediction markets. A user can choose a rise or fall prediction and then enter an amount of crypto to borrow in USD which is reserved in their balance as collateral. The minimum is 1 USD and Max is 100 USD. MyConstant purchases the crypto and the user borrows it at current market price using 50x leverage. This means they borrow 50x more crypto than their USD collateral. A user can cash out or repay and they profit when the price changes up to 3% in their predicted direction. They can cash out anytime by repaying the borrowed crypto amount in USD. Their position will automatically close at 3% to bank profits or at 2% in the opposite direction in order to minimize losses.

Using MyConstant Futures is straightforward in that the user can quickly learn the basics with their demo/virtual account and then they can go ahead and open a small Futures position to test their prediction skills. MyConstant encourages users to not risk all their funds but to start with as little as $1 up to a maximum of $100 for each position and no more than $5,000 across their account. Since Futures use 50x leverage, a user can earn up to 150% profit when the price changes up to 3% in their predicted direction.

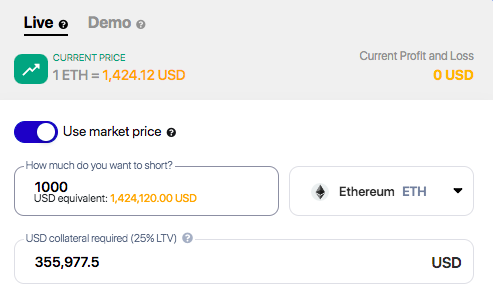

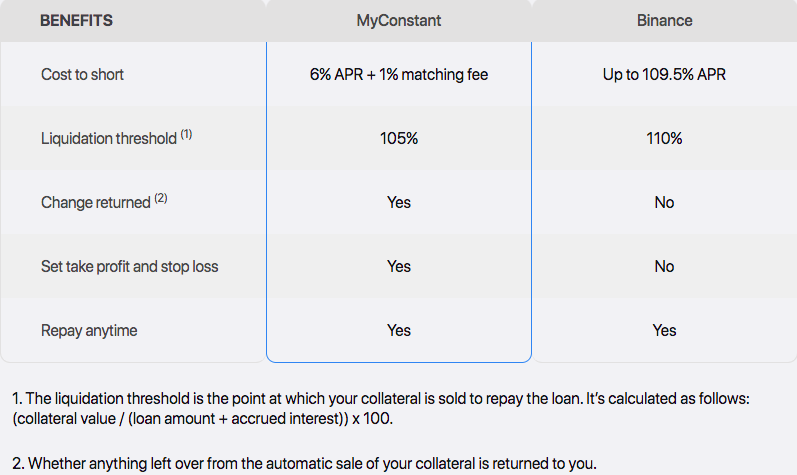

A user can choose the crypto they wish to short. MyConstant supports BTC, ETH, and BNB pairs and a user can effectively transfer USD to their short-selling balance. If they don’t have USD in the account, they’ll need to deposit some first. Following that, a user can then set stop loss and take profit prices. A user can then proceed to select an upper and lower price point to protect their gains and limit losses. MyConstant is able to sell the crypto at market prices and send the proceeds to a user’s USD short-selling balance so that the user can repay the crypto and pocket the difference if their prediction paid off.

Comparative Case Study MyConstant vs Binance

Benefits of using MyConstant

- The platform is compliant with Anti-Money Laundering (AML) regulations and uses KYC guidelines to verify the users.

- There’s no requirement in terms of residency, however, MyConstant only accepts deposits in USD or Crypto via wire transfer or direct transfer via ACH or Zelle.

- As a P2P platform, MyConstant lets users keep all the profits unlike in traditional banking. In addition, users have full control over the term with a choice of anytime withdrawals or 1, 3, and 6-month fixed terms.

- Unlike other P2P lending platforms, all lending on MyConstant is backed by collateral which means that they secure loans with assets that can be sold easily. The platform is effectively a collateral-backed peer-to-peer lending platform where each loan is backed by collateral of up to 200% of the loan amount. The collateral can be easily sold if borrowers default or if its value falls to a threshold, protecting investors.

- MyConstant pools investor funds into a lending pool or reserve which makes it possible to match borrowers and lenders in an instant.

- There are no credit checks and investors can choose instant access investing or one of three fixed terms for best rates.

- MyConstant is available in all US states.

- MyConstant offers a Guarantee which is essentially a mixed-asset fund from which they may, at their discretion, reimburse some or all losses incurred while user funds are in the custody of third parties. However, it is not insurance. The MyConstant guarantee is said to be a fund that is made up of cash and crypto that is stored across hot and cold wallets and is worth $10 million.

- 24/7 customer support – no call centres, no automated messages, but real people ready to help.

- No credit checks.

- No early repayment fees.

- Investing with MyConstant is a straightforward process. A user can simply create an Investment Order that suits their needs and they have three different options to choose from and can invest USD or stablecoins. Additionally, the user can also choose their interest rate. Following this, a user needs to deposit funds from their investment order and they can choose to make a direct deposit or wire the money directly. MyConstant does recommend depositing the funds using Zelle, which is considered to be the fastest, cheapest and easiest way. Fiat deposits take roughly one day to process and they are free of charge. Stablecoin deposits reflect within minutes and are also free. Once the user has been matched to a borrower and completed the investment term, they will be able to withdraw your funds.

MyConstant Pricing and Fees

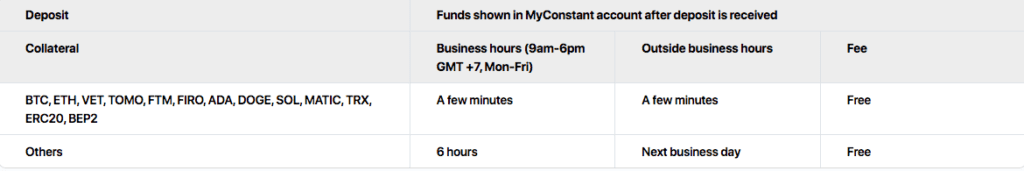

MyConstant charges no deposit fees; however, users may be subject to network fees when dealing with specific cryptocurrencies. Also in the matching process, investors are subject to no fees whereas borrowers are subject to a 3.5% fee.

Collateral Deposits

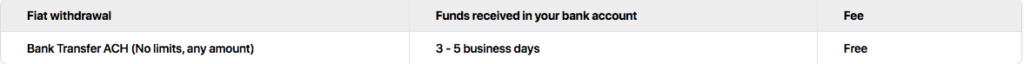

Fiat Withdrawals

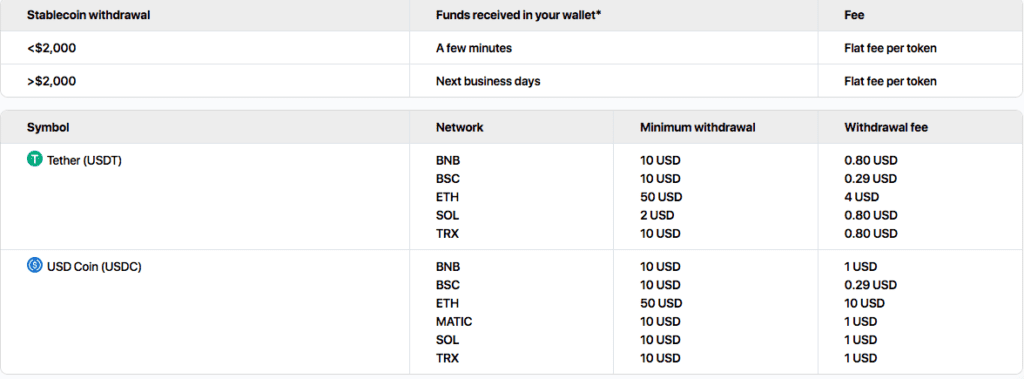

Stablecoin Withdrawals

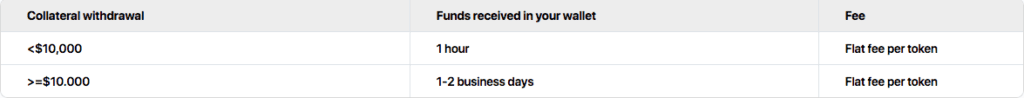

Collateral Withdrawals

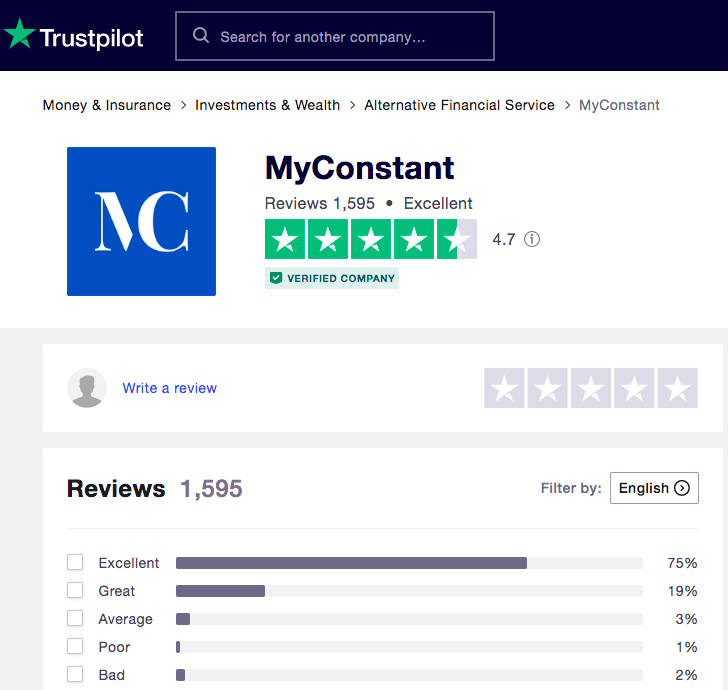

- MyConstant has good reviews on independent review sites.

MyConstant Referral Program

When users of MyConstant refer others to the platform, they stand a chance to earn up to 20 USDT. For each referral that signs up and verifies their ID (KYC) and deposits USD, borrows, or invests in Crypto Lend, they’ll give both of you 10 USDT each. Users can simply sign up, generate their referral link and get rewarded when your friend deposits over $10 or borrows more than $500 in one or more crypto-backed loans. What’s great is that there’s no limit on the number of friends one can refer to the platform.

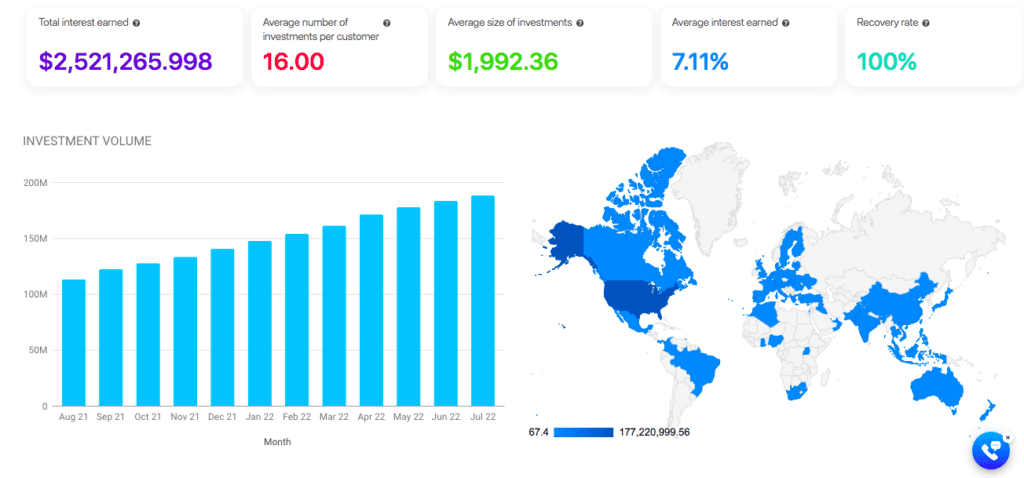

According to MyConstant, the average lender has made ten investments on the platform, per the Statistics page. MyConstant also claims a 100% recovery rate when they have to liquidate a loan for non-payment.

Disadvantages of using MyConstant

- The crypto market is highly volatile.

- MyConstant has sophisticated investment options with several different lending plans which can confuse some customers.

- Limited fiat currency offering.

- Users can only earn APY if they lend their deposits.

- Users are only able to initiate one ACH deposit at a time in most instances.

- There is a $5,000 limit on ACH deposits.

- MyConstant only offers short loan terms of one to six months.

- The Membership Benefit tiers require high investment volumes in order for members to be entitled to the benefits – minimum of $25,000 USD lent or borrowed (or combined).

- The platform relies largely on loan originators for individual loans and there is no secondary market for individual loans that are not in the Flex program.

Conclusion

In the wake of so many centralised lending and borrowing platforms such as BlockFi, Celsius, Voyager and others running into liquidity problems or Nexo which is rumoured to be facing a decline in user deposits and experiencing high withdrawal activity, MyConstant seems to be doing fine. It appears to be a well-run platform that has not yet been plagued by such problems, perhaps due to its p2p business model. It seems to be a transparent platform that facilitates p2p lending and borrowing while protecting both lenders and borrowers as much as possible. The platform also offers a wide range of products and services that could be attractive to crypto enthusiasts. Nonetheless, users of platforms such as MyConstant and others are still advised to conduct proper due diligence and risk management before parting with their assets or using such platforms.